by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment begins with coverage of Fed Chair Jerome Powell’s testimony to the Senate Banking Committee. Next, we review the latest updates on the Russia-Ukraine war. We continue the report with a discussion about U.S. gas prices, China’s crackdown on tech, and a potential slowdown in the European economy. Lastly, we end the report with our daily COVID-19 coverage.

Note: Because COVID-19 has become more endemic and in most countries isn’t disrupting the economy or politics as much as it did previously, we will drop our dedicated COVID-19 section beginning July 1. We will continue to cover pandemic news as needed within our main text.

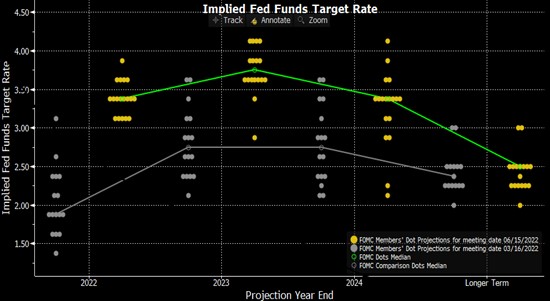

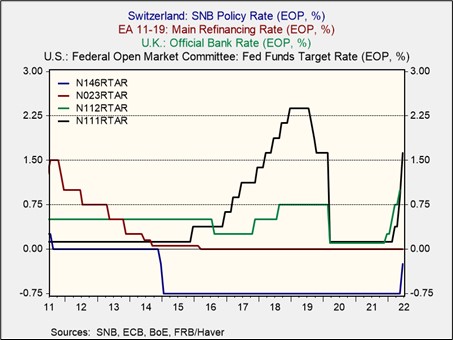

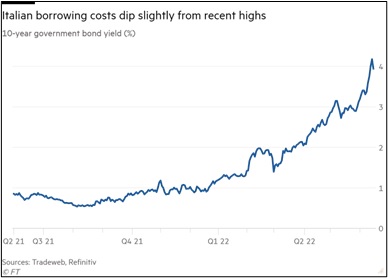

Jerome Speaks to the Senate: Federal Reserve Chair Jerome Powell acknowledged that a recession might be possible. This acknowledgment was the first time the central bank head conceded that rate hikes could lead to an economic downturn. He explained that although the economy can withstand monetary tightening, outside factors such as the war in Ukraine and China’s Zero-COVID policy make it more difficult for the central bank to achieve a soft landing. Despite the negative outlook, the Fed chair’s comment was less hawkish than investors feared. Powell neglected to mention anything about the size of future hikes leading investors to believe that in future meetings, the Fed will consider the impact that hikes will have on the economy. His comments led to an initial rally in equities and bond prices that was later pared back before the market closed on Wednesday. Jerome Powell is set to return to Capitol Hill on Thursday for the second day of testimony, where he will likely face more questions about the direction of Fed policy.

- Chicago and Philadelphia Fed Presidents Charles Evans and Patrick Harker signaled they would be open to supporting a 75bps rate hike in July if inflation remains elevated. Their comments suggest the central bank could have another big hike in July. However, both Fed officials also expressed the possibility of a pause in rate hikes by 2023. Evans stated the Fed should raise rates above three percent by the end of the year, then reassess, while Harker noted the use of quantitative tightening could make raising past three percent unnecessary. Their comments could be favorable to risk assets that have been negatively impacted by rate uncertainty.

- The job market may be cooling. Data collected by Indeed shows that job listings are starting to stagnate. Nevertheless, there are still more vacancies than the number of workers available, suggesting that the Federal Reserve may be achieving some success in relieving the demand pressures for firms.

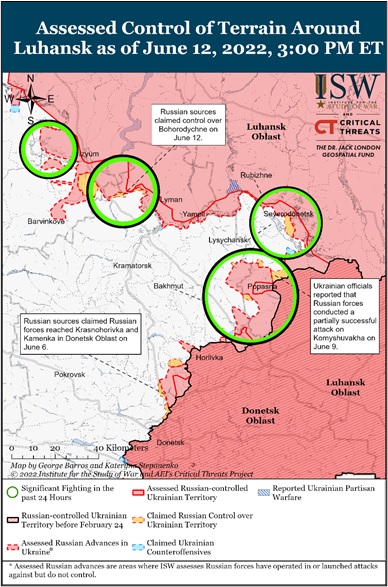

Russia-Ukraine: Moscow continues to succeed in eastern Ukraine as Russian forces look to take over Donetsk and Luhansk oblasts. Russian troops are closing in on Lysychansk, the last major Ukrainian-controlled city in Luhansk. Ukrainian troops are prepared to defend the city, as the country remains committed to fighting a war of attrition. Meanwhile, Russia’s anti-defense missile systems have decreased the effectiveness of Ukrainian drones. Using Turkish drones was a key to Ukraine’s early military success. However, recent failures have forced Ukrainian forces to switch tactics. Despite Russia’s advances, there is growing speculation that its momentum could slow because of a lack of resources and troops.

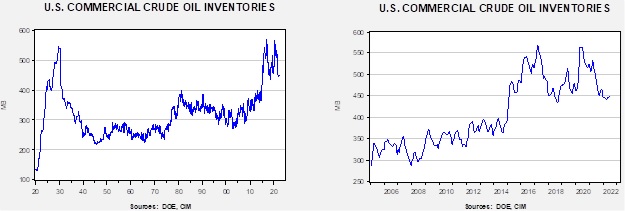

- Russian oil cargoes are becoming hard to track in the Atlantic Ocean. Over the last few days, at least three tankers have disappeared from the vessel-tracking system as they enter the Azores. Although it is not clear why the ships have vanished, it is suspected that the vessels went dark to conceal the prospective buyers of the oil, keeping them private to avoid sanction penalties. Other countries hit with sanctions, such as Venezuela and Iran, have also gone dark for similar reasons. The sale of Russian oil on these vessels will probably relieve some demand pressure but could also extend the war in Ukraine.

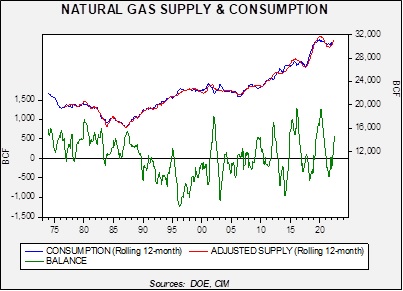

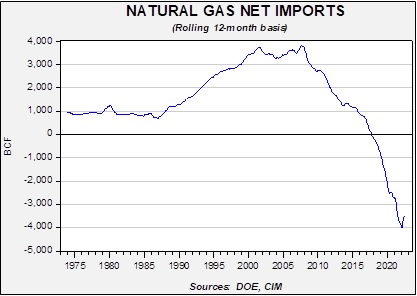

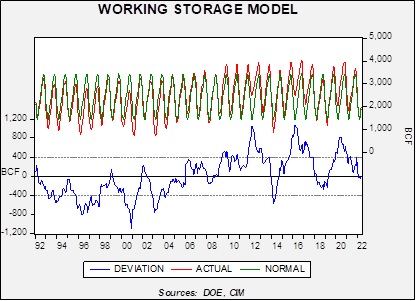

- Moscow could cut gas from Europe altogether, the head of the International Energy Agency warned. He stated Russia could make up excuses about technical difficulties to justify not supplying gas to Europe. Germany is already considering rationing its gas to consumers and businesses to rebuild its inventory for the winter months. Europe has growing concerns that the gas crisis could lead to a collapse in energy markets. Energy suppliers have been forced to take huge losses. As a result, there is a possibility that the effects could spill over to local utilities. Germany is the most vulnerable to the rise in costs, and we suspect it will become bolder in its push for Ukraine to agree to a ceasefire. European power prices surged to their highest level since December, and prices will likely get worse.

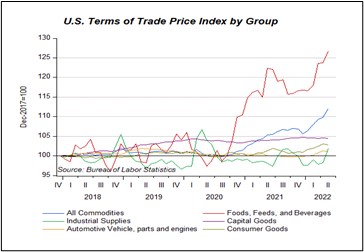

- Russian forces have targeted wheat terminals as Moscow looks to hurt Ukraine’s ability to export food. On Wednesday, it hit two North American-owned terminals with missile strikes. Russia’s targeting of Ukraine wheat exports adds to concern that there could be a global food crisis this year.

- Lithuania is preparing for Russia to cut it off from the regional power grid. Moscow threatened retaliation after Lithuania blocked shipments of Russian goods to Kaliningrad. Unlike other European countries, Lithuania does not depend on Russia for its energy needs; thus, it has more flexibility to stand up to Moscow.

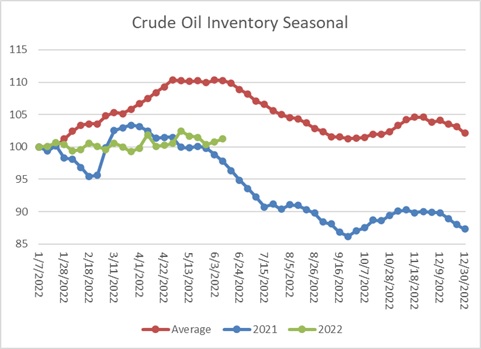

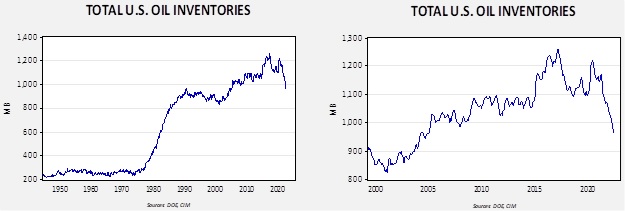

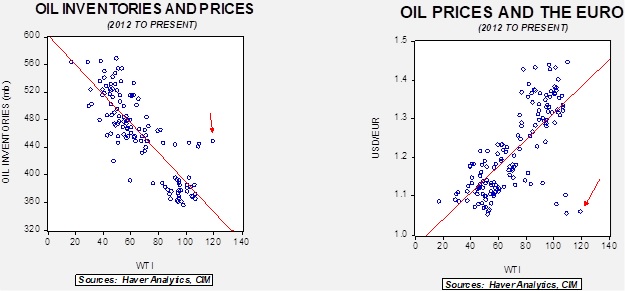

U.S. Gas Prices: Rising gas prices have weighed on demand as drivers have changed their consumption habits. According to energy-data provider OPIS, gas stations have declined annual sales for the 14th consecutive week. Consumers likely need this demand destruction to bring prices back into equilibrium with the supply level. Meanwhile, oil refiners are expected to meet with President Biden to discourage him from placing restrictions on exports. The Biden administration is looking at limiting the overseas sales of domestically produced oil to bring down gas prices. If the administration does ban exported oil, it will bring down fuel prices domestically but increase prices abroad.

- The rate to deliver fuel by sea has more than doubled this year to the highest level since April 2020, according to the Baltic Exchange. The increase in price is due to the war in Ukraine forcing some shippers to alter their trade routes. The rise in shipping costs might lead to an increase in inflation, as firms will look to push those costs onto consumers.

China Crackdown: Authorities in China appear to be shifting their focus away from fintech and toward online pharmaceuticals. On Thursday, Beijing approved a plan to allow online financial platforms’ “healthy” development. This change indicates the investigation into financial firms like ANT could end soon, and regulators are considering banning third-party platforms from selling medication online.

- China expects to miss its growth target of 5.5% for the year. A weakening property market and the Zero-COVID policy have made it difficult for the country to expand.

European Economy: Higher energy and food prices have started to slow economic activity in Europe as consumers have reduced their demand for other goods and services. The latest index from S&P Global shows that purchasing managers are reporting a decline in manufacturing output for the first time in two years. Additionally, the S&P Global composite PMI index, which tracks manufacturing and service activity, decreased from 54.8 in May to 51.9 in June. The reduction in output highlights the challenges Europe faces due to the war in Ukraine and raises the likelihood of a possible downturn.

COVID-19: Official data show confirmed cases have risen to 541,441,499 worldwide, with 6,324,412 deaths. The countries currently reporting the highest rates of new infections include the U.S., Taiwan, Australia, and Germany. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases have risen to 86,636,306, with 1,014,835 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 221,924,152, equal to 66.8% of the total population.

- New variants of omicron have proven to be resistant to antibodies from vaccinated and previously affected individuals. The mutation in the virus will likely increase infections; however, there is no evidence that suggests that it could lead to economic disruptions.