by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Equities futures are trading lower this morning after the CPI report was hotter than expected. Today’s Comment starts with a brief update on the Russia-Ukraine war. Next, we review the latest international news, focusing on the ECB’s hawkish shift. We examine some U.S. economic and policy news and conclude with our COVID-19 coverage.

Russia-Ukraine: There are no major breakthroughs in Ukraine. The most intense fighting is taking place in Severodonetsk. Ukrainian forces have claimed to have made progress but are still waiting for new artillery to overcome Russia’s massive firepower. Moscow has made taking over the city a key objective in its war. That being said, Russia is having less success in the South, where troops are fighting over territory stretching from Kherson and Zaporizhzhia provinces.

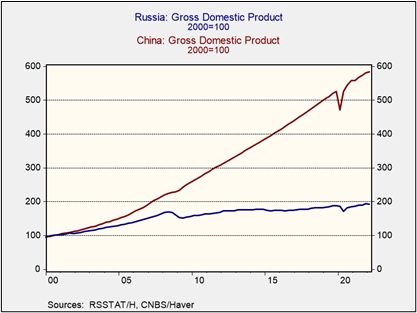

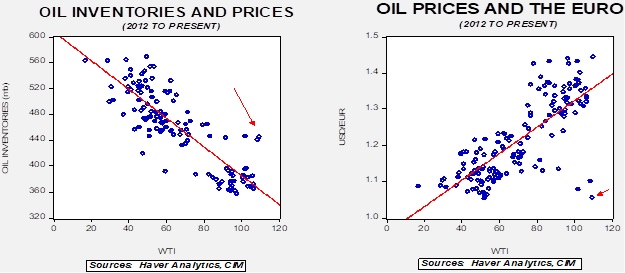

- Russian President Vladimir Putin compared himself to Russian Tsar Peter the Great, who led a conquest of the Baltic coast in a war against Sweden in the 18th He stated that Peter the Great did not take land from Sweden but reclaimed the regions that belonged to Russia. The nationalistic tone of Putin’s speech suggests that he believes the Ukraine war is a way for Russia to restore its glory. As a result, it is unlikely that Putin will accept anything less than victory in its war against Ukraine. This outcome could mean that commodities will remain elevated for the foreseeable future, and global growth will probably slow. If we are correct, safe-haven, fixed-income securities will likely be attractive as they should provide some protection from the adverse outcomes of the war and a slowing global economy.

- The U.S. has requested that India not purchase too much oil from Russia. India has taken advantage of discounted oil prices caused by Western sanctions by drastically ramping up its purchase of Russian crude. The ability to buy cheap oil from Russia has allowed India to avoid the same energy price shocks seen in Europe. The U.S. has tolerated India’s oil purchases for two reasons: 1) India’s purchases of Russian oil relieve the demand for petrol in other parts of the world, and 2) the U.S. views India as a strategic ally in its goal to offset Chinese influence in the Indo-Pacific. Moreover, it is becoming clear that Washington’s patience may be wearing thin. The U.S. wants to reduce Russia’s ability to finance its war in Ukraine. As it looks into possible price caps, there is growing talk of hitting potential violators with secondary sanctions. This outcome may create a situation where India is forced to choose between supporting the U.S. and Russia. As we have mentioned in previous reports, the war in Ukraine is putting loyalty among allies to the test. Countries trying to play both sides of this war have benefitted so far, but as the war grows longer, that could change. India ran a trade surplus of nearly $12 billion with the U.S. in 2021, three times the total value of goods and services India exported to Russia in the same year. Hence, India’s economic interests suggest it could side with the U.S if forced to choose.

- Russia warned of direct military confrontation with the West if cyberattacks continue to target the country’s infrastructure. The warning comes after the Russian housing ministry website was hacked over the weekend. An internet search of the site led to a “Glory to Ukraine” sign written in Ukrainian. Moscow alleged the attacks were coming from the United States. Both sides are using cyber warfare to disrupt information. However, Russia’s response suggests that Moscow increasingly views the attacks as hostile, especially as the war continues. We do not consider the remarks from Moscow to lead to imminent military conflict with the West. Instead, the comment signals that Russia is frustrated with the level of success the U.S. has gained with its cyberattacks. Regarding markets, it is a signal that the U.S. government has demonstrated the capability of not only launching an attack but also having a great defense. This bodes well for U.S. businesses. Last year’s Colonial Pipeline hack may have given the U.S. government a wake-up call to make a much-needed upgrade to defensive capabilities, which we assume is the reason we have not had such disruptions since.

International news:

- Chinese ride-hailing app Didi ($2.36) will be delisted from the NYSE on Friday. The ride-hailing company is being forced to delist as a condition by Chinese regulators to lift a ban on new customers. The removal of Didi from the NYSE suggests regulators are still trying to maintain a tight grip over its tech sector.

- The European Union’s executive arm is expected to recommend Ukraine for candidate status for joining the bloc. Ukraine has been pushing for immediate admission into the European Union since Russia started its invasion. The recommendation will not lead to an expedited admission process, but it does put the country on the path to joining. Ukraine’s entrance into the EU depends on member countries’ unanimous approval. Ukraine’s acceptance will likely be challenging given that many countries within the bloc have close ties with Russia and are therefore unlikely to approve its admission.

- The European Central Bank’s hawkish shift has led to concerns that high-debt countries may struggle to repay. Following the announcement of the ECB’s policy change, the spread between Italian and German 10-year bonds increased by the most in over two years. The increased rates and rising inflation will make it harder for the European Union to avoid contraction. Financial services companies, particularly in Germany, may be attractive in this environment as higher rates generally make it easier for banks to increase their net interest margins.

U.S. Economic and policy News:

- The Biden administration is exploring setting standards for federally financed EV charging stations. The measure is part of the bipartisan infrastructure bill.

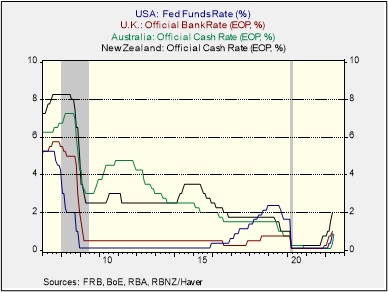

- The latest CPI report rose to a 40-year high in May, leading to doubts about whether the Fed will pause interest rate hikes late this year. The Fed is in a tough spot. Much of the inflation is driven by outside factors beyond its control (the war in Ukraine, lack of home inventories, and ongoing supply chain issues). However, it must maintain the perception that it can rein in inflation using its available tools. As a result, the Federal Reserve may be forced to raise rates to cool demand, even if it slows the economy.

COVID-19: Official data show confirmed cases have risen to 534,295,684 worldwide, with 6,306,726 deaths. The countries currently reporting the highest rates of new infections include the U.S., Taiwan, Germany, and Australia. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases have risen to 85,329,812, with 1,010,805 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 221,601,089, equal to 66.7% of the total population.

- Shanghai resumed large-scale testing of COVID-19 just 10 days after the city ended its lockdown. The increase in testing is due to an unexpected rise in cases, sparking concerns of a new outbreak.