Daily Comment (June 15, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where both sides continue to face resource constraints and are struggling to make significant new territory gains. We next review other international and U.S. developments with the potential to affect the financial markets today, including an emergency meeting called by the European Central Bank to address a sell-off in the government bonds of Italy and other economically weak members of the Eurozone. We close with the latest news on the coronavirus pandemic.

Russia-Ukraine: The Russian and Ukrainian militaries remain essentially deadlocked in their struggle to control eastern and southeastern Ukraine, with each side finding it difficult to generate the force needed to make significant gains. In a desperate attempt to increase manpower, the Russian military is reportedly preparing to raise the age limit for military service from 40 to 49 and drop an existing requirement for past military service to assist in the tank and motorized infantry units. The Russians are also reportedly accelerating their efforts to integrate occupied Ukrainian territory into Russia proper, using methods as diverse as introducing the ruble as legal tender and changing the international calling prefix for cell phones to the Russian code instead of the Ukrainian one.

- Partly reflecting the West’s war-related sanctions on Russia, which will force it to shut in some oil wells, the International Energy Agency today said it would be hard for global oil supply to meet rising demand next year.

- In its first forecast for 2023, the IEA predicts global demand next year will grow to 101.6 million barrels per day, up 2.2 mbpd from 2022.

- The agency predicts U.S. production will grow at a robust pace, but Russian output will fall, and total OPEC+ output will decline by 520,000 bpd in 2023.

- Meanwhile, defense ministers from NATO and other countries providing weapons to Ukraine are meeting today in Brussels to discuss what additional aid they can provide. It’s important to remember that some countries have already sent virtually all the weapons they can spare without endangering their own defense. Even the U.S. has used up some critical stores and will need months or even years to replenish them (although doing so will likely be a positive for defense contractors, as we have repeatedly noted).

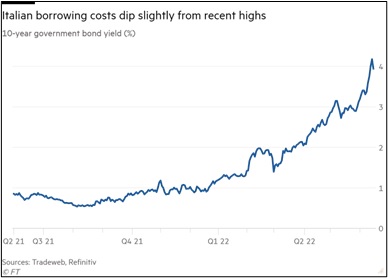

Eurozone Monetary Policy: The ECB said it will hold an emergency meeting today to discuss a recent sell-off in the bonds of economically weaker countries in the bloc’s south. In a process referred to as “fragmentation,” investors had dumped those bonds in recent days after the ECB said it would conduct a series of interest-rate hikes but didn’t unveil a new tool to shield highly indebted economies in southern Europe from the effect of the rate rises.

- The announcement has given a boost to European stock markets, the euro, and European sovereign debt.

- The yield spread between German and Italian 10-year government bonds narrowed from 2.5% on Tuesday to 2.2% so far today, indicating expectations that the ECB will adopt preferential policies to maintain the demand for southern countries’ debt even as the bank hikes interest rates and sells down its balance sheet holdings.

- Expectations are high that the ECB will have to announce a large, dramatic program to curtail the risks to Italy, Greece, and other weaker countries. ECB board member Isabel Schnabel further raised expectations in a speech last night when she said, “Our commitment to the euro is our anti-fragmentation tool. This commitment has no limits. And our track record of stepping in when needed backs up this commitment.”

- However, because expectations are now running high, an unexpectedly timid decision at the end of the meeting would likely spark a sell-off in European assets.

European Union Tax Policy: Poland is reportedly ready to accept an EU plan to adopt the OECD’s global deal on minimum corporate taxes agreed to last year. If Poland drops its veto and no other members come up with last-minute objections, the EU will implement a minimum effective tax rate of 15% on corporations.

European Union-United Kingdom: The European Commission announced it would resume a previously paused legal action against the U.K. for failing to implement full border checks in Northern Ireland. The move is in retaliation for the British government’s announcement yesterday of a proposed law that would allow it to abrogate the Northern Ireland protocol contained in the post-Brexit EU-U.K. trade deal.

- The EU infringement procedure can last several months before a case is referred to the EU’s top court, which can impose fines on the UK.

- The EU also has other means of pressure, such as increased customs checks on goods coming from Britain into countries such as France, Belgium, and the Netherlands.

- As we’ve written before, the increasing tensions over the Northern Ireland protocol threaten to touch off growing trade restrictions between the U.K. and the EU. Such restrictions could be especially painful for the U.K. economy and U.K. stocks.

Hong Kong: Monetary authorities in Hong Kong said they sold more foreign-exchange reserves to maintain the Hong Kong dollar’s longstanding peg to the greenback, taking its total outlay this year to $5.48 billion. The move comes as the continuing surge in the greenback threatened to push Hong Kong’s dollar out of its permitted exchange rate band of 7.75 to 7.85 per U.S. dollar.

Laos: Today, Moody’s (MCO, $257.68) downgraded Laotian sovereign debt one notch further into “junk” territory, to Caa3 from Caa2. The cut in Laos’s bond rating reflects the risks involved for less-developed countries as global interest rates rise, global energy and food prices rocket higher, and the dollar continues to strengthen.

Chile: New reporting suggests that a splinter group of Mapuche indigenous people has been increasing its attacks on logging companies, other businesses, and police in central Chile. The attacks are putting increased pressure on the country’s new leftist president, Gabriel Boric, to reimpose order. With Chileans also set to vote on a new, leftist constitution later this year, any failure by Boric to get control over the situation would further undermine Chile’s attractiveness to investors.

U.S. Monetary Policy: Today, Federal Reserve officials wrap up their latest policy meeting, with surging inflation readings leading some observers to think they could hike interest rates by a very aggressive 75 basis point when they release their decision at 2:00 pm ET. We have even heard chatter about a possible 100-basis-point hike. The policymakers will also release their latest “dot plot” projections for the economy and the path of future interest rates.

- A hike of 75 basis points would be the biggest increase since 1994 and would leave the benchmark fed funds rate in a range between 1.50% and 1.75%.

- While an aggressive hike could well push asset values down farther, investors should keep in mind that an unusually aggressive hike, like 100 basis points, could be taken as a sign that the Fed is getting ahead of the inflation problem and spark a market rebound.

U.S. Gasoline Market: Faced with political doom because of soaring inflation and gasoline prices, President Biden has sent a letter to several major U.S. refiners, warning them against price gouging and asking them to take immediate action to increase the supply of gasoline, diesel, and other refined products. He said his administration was prepared to use its emergency authorities to increase capacity in the near term, if necessary. The letter signals an increased risk that politicians may try to intervene in the market to bring prices down, perhaps even including a windfall profits tax.

U.S. Natural Gas Market: U.S. natural gas prices fell some 16% yesterday after an LNG shipping facility in Texas said a fire last week would knock it offline until late this year, greatly reducing export capacity but boosting the supply of gas in the U.S. Gas for delivery in July ended at just $7.189 per million British thermal units. Futures prices for deliveries through February shed at least 10% on the day, suggesting markedly diminished fears about shortages this coming winter.

U.S. Cryptocurrency Market: Bitcoin (BTC-USD, 22,166.98) fell another 5.4% yesterday, marking a decline of about 68% from its all-time high in November last year of $67,802. So far this morning, it is down another 8% to approximately $20,100, and other digital currencies are even weaker. The continuing decline in Bitcoin and other digital assets largely reflects the impact of the Fed’s increasingly aggressive monetary tightening.

COVID-19: Official data show confirmed cases have risen to 536,720,870 worldwide, with 6,312,601 deaths. The countries currently reporting the highest rates of new infections include the U.S., Taiwan, Germany, and Australia. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases have risen to 85,762,625, with 1,011,925 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 221,768,203, equal to 66.8% of the total population.

- In the U.S., the latest wave of infections appears to be topping out, but hospitalizations are still accelerating with their usual lag. The seven-day average of newly reported cases stands at 105,605, up 7% from two weeks ago. The seven-day average of people hospitalized with confirmed or suspected COVID-19 came in at 29,728 yesterday, up 8% from two weeks earlier. New COVID-19 deaths are now averaging 322 per day, up 8% from two weeks earlier.

- Illustrating how easily China can slip back into mass lockdowns under President Xi’s “zero-COVID” policy, Beijing is already reimposing sweeping lockdowns after an outbreak traced to a single bar produced hundreds of new infections.

- Following our report yesterday that China’s strict testing protocols are progressively alienating everyday citizens, new reports point to increasing anger that authorities have manipulated the health codes assigned to people on their cell phones to limit protests.

- Since late May, hundreds of people have taken to the streets in China’s central Henan province, calling for authorities to ensure the return of their deposits that were frozen in four rural banks in the province.

- To keep outsiders from traveling to Henan to join in the protests or press for their deposits, authorities evidently changed their health codes to indicate they were infected with COVID-19 and were therefore ineligible to travel to the province.