Author: Rebekah Stovall

Daily Comment (January 9, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Financial markets are taking on a clear risk-on bias; equities continue to lift, bonds, gold and oil are struggling. Here are the details:

Ceasefire: As we noted yesterday, Iran launched missiles against U.S. bases in Iraq. The attack was a mere pinprick, with no casualties reported. At the time of our publishing, the White House hadn’t officially responded, but in a press conference President Trump made it clear that he viewed the Iranian action as tolerable and no further military response was necessary. To some extent, the Iranian missile attack almost seemed choreographed. The U.S. knew the action was coming and moved troops out of harm’s way. The Iranian media is claiming numerous casualties, suggesting that Iran felt it had to respond but didn’t want to start a war. The “needle” Iran is trying to thread is to appear strong but avoid a direct military conflict with the U.S. We will be watching to see how successful they are in their quest.

For the time being, equity markets are getting just about everything they could want. A war in the Middle East has been avoided. Monetary policy is accommodative. The Phase One trade deal with China appears to be on its way. All this good news doesn’t mean that there aren’t concerns but in the immediate term, conditions for equities are clearly favorable.

United States-Iran-Canada: Although it looks like the U.S. and Iran are stepping back from any military conflict, it may be important to keep an eye on the airliner crash that killed 176 people in Tehran just hours after Iran’s retaliatory attack on U.S. bases in Iraq yesterday. According to Ali Abedzadeh, the chief of Iran’s aviation agency, the plane was on fire before it hit the ground, and investigators remain open to the possibility that it was hit by a projectile or explosion. That could give Iran an opening to accuse the U.S. of bringing down the plane. Indeed, given that Iran has likely been chastised by the assassination of Gen. Soleimani, we would now expect it to redouble its political pushback against the U.S. in the Mideast. Pressuring Iraq to expel U.S. forces will be a top focus, but it also might be helpful for Iran to create suspicions that the U.S. had reverted to terrorism. Such suspicions could also help drive a wedge between the U.S. and key allies like Canada, since over 60 of those killed in the plane crash were Canadians.

China: Although China’s headline CPI remains elevated at +4.5%, pork price increases finally appear to be slowing. Pork prices rose 97% in December, down from 110% in November. PPI continues negative, but only down 0.5%. Overall, the inflation situation in China remains a concern but the momentum does appear to be heading in a positive direction. Car sales in China fell again, down 7.4% from last year, at 20.7 mm units. The new respiratory virus we mentioned yesterday is apparently a coronavirus. This virus type is best known for causing the common cold. The bad news is that it is a new virus; the good news is that it doesn’t seem to spread via human to human contact.

Taiwan-China: In the run-up to Taiwan’s presidential election on Saturday, Foreign Minister Wu said that if incumbent President Tsai Ing-wen wins as expected, she plans to pursue a “sustainable, predictable and peaceful relationship” with China. The statement is being seen as an olive branch to Beijing, which could help solidify the president’s status as frontrunner in the race and help calm market concerns about future confrontation.

Brexit: The EU and U.K. are starting the process of trade talks. The British stance appears to be attacking trade by individual market rather than by building a grand bargain. By moving piecemeal, negotiators can continue to make progress and can likely go beyond the 2020 deadline if enough progress is made. However, there are a couple of dangers in this plan. First, by not working in a unified fashion, loopholes could develop that will be unforeseen during talks and second, there is the potential to become unexpectedly stuck on an issue that becomes contentious. Still, this looks like the best plan available given the short time frame.

At the same time, Bank of England Governor Carney said central bank officials are considering a new round of monetary stimulus “to reinforce the expected recovery in U.K. growth and inflation.” The threats of a delayed trade deal and looser monetary policy have combined to push the GBP sharply lower.

World Bank: The World Bank issued its global GDP forecast for 2020; it is looking for a modest rise to 2.5%, up from 2.4% in 2019. Trade concerns are a key factor in weakening growth. This forecast represents a downgrade of 0.2% from those made earlier in 2019.

France: Today left-wing trade unions are staging their fourth mass demonstration against President Macron’s proposed pension reform. Several unions have been on strike since early December, and even the moderate Confédération Française Démocratique du Travail is urging its 600,000 members to take part in a protest on Saturday. The strikes and protests come despite a series of government concessions. If Macron can consolidate the pension system and raise the retirement age as planned, the French budget would likely see big savings and the economy would probably get a boost. However, it remains unclear whether Macron will be successful.

Spain: Socialist Party leader Sánchez was finally sworn in as prime minister yesterday, after his coalition with the radical-left Podemos Party gave him a two-vote majority in parliament. That may seem like a fragile hold on power, but the Spanish constitution says a prime minister can’t be brought down by a no-confidence unless an absolute majority of legislators votes for an alternative candidate. Given Spain’s fractured parliament, that is seen as quite difficult. For now, Sánchez will be in a decent position to push his agenda of increased government spending, reforming labor laws to bolster unions and negotiating with Catalonia over its place in the republic. We think that will be positive for Spanish stocks in the near term.

The Chamber: Tom Donohue, the CEO of the chamber of commerce, will deliver a speech today, where he is expected to support issues like climate change legislation and infrastructure investment. He is also expected to support immigration liberalization. As the GOP becomes increasingly populist, the divergence seen between the party and the chamber reflects the fact that populism isn’t business friendly.

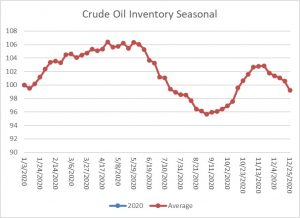

Energy update: Crude oil inventories rose 1.2 mb compared to an expected draw of 3.0 mb.

In the details, U.S. crude oil production was unchanged at 12.9 mbpd. Exports fell 1.4 mbpd while imports rose 0.4 mbpd. The rise in stockpiles was unexpected.

This chart shows the annual seasonal pattern for crude oil inventories. Because this is the first week of the year and the data is indexed to that week, the current reading and average are both equal to 100. As the chart shows, oil inventories usually rise into late spring and then decline significantly into late summer. Last year, this pattern was disrupted to some extent because of exports.

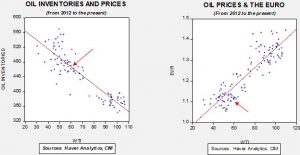

Based on our oil inventory/price model, fair value is $63.59; using the euro/price model, fair value is $51.74. The combined model, a broader analysis of the oil price, generates a fair value of $55.39. We are seeing the divergence between dollar and oil inventories narrow as dollar weakness persists. Given the level of geopolitical risk, prices have not moved significantly above the inventory fair value price, although the combined model would suggest a richly valued market. With inventories poised to rise seasonally and tensions seemly easing, softer prices are more likely in the coming weeks.

Daily Comment (January 8, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

After a wild overnight session, risk assets are rising this morning. Here are the details:

About last night: As we were watching the Blues dispatch the Sharks, Iran launched a series of missile strikes against two bases in Iraq. Market reaction was swift—equity futures plunged, oil and gold prices soared. However, comments from Iran suggest that an “off ramp” might be in place that would allow both sides to de-escalate current tensions. Tweets from Javad Zarif, Iran’s foreign minister, suggested that the attack might be all that Iran intends to do IF the U.S. doesn’t retaliate. Tweets from President Trump seemed to suggest that he might be satisfied with not retaliating, especially since there were no apparent casualties. As these messages of moderation entered into the market, risk assets recovered and safety assets retreated.

There are two unknowns; first, does last night really represent all that Iran plans on doing in retaliation? Second, will President Trump take the off ramp and not react to yesterday’s missile strike? Let’s take the second part first. It would fit the president’s past patterns to not react to the missile attack. No Americans died in the event which appears to be one of his red lines. If a pinprick missile strike is considered to be enough to compensate for the killing of Soleimani, it seems like that outcome is favorable to the U.S. Which leads us to the first question. We have serious doubts that Iran believes it has fully retaliated. However, direct military confrontation is not the usual path Iran takes in projecting power. The missile strikes buy the regime time; it can tell its citizens it acted, and we suspect the Iranian media will play up the attack to make it appear more damaging than it was. Still, we doubt yesterday’s response will be the final retaliation; though, it may take months before we see the next action and, in the meantime, financial markets will likely show less concern over this issue…assuming our assessment of the second question is accurate.

Venezuela: Juan Guaido isn’t done yet. After President Maduro tried to oust Guaido as the head of the National Assembly, Guaido and his supporters stormed the building, pushing past security personnel to give Guaido the opportunity to take the oath of office and return as head of the legislature. So, for now, Venezuela remains divided.

Libya: Forces led by General Khalifa Hifter have taken control of Surt, a city on the central coast of Libya. Hifter is generally considered a secular leader and controls most of eastern Libya. The U.N. backed government, which has Islamist group support, is centered in Tripoli but has been struggling to hold territory against Hifter’s forces. The Libyan civil war is attracting outside influence; Russia and Egypt have generally been supporting Hifter while Turkey recently sent troops to support the Tripoli government.

Taiwan: Voters on the island go to the polls on Saturday in an election that is being framed as a choice between freedom, or dominance by Beijing. Events in Hong Kong loom largely over this election. China has aggressively intervened to swing the vote to the KMT candidate. The incumbent, President Tsai Ing-wen, the DPP candidate, was trailing in the polls in the spring but has seen her fortunes improve while the KMT’s candidate, Han Kuo-yu, has slipped badly in the polls. Hong Kong is the primary reason. Taiwanese politics tend to swing based on attitudes towards China. The KMT, which represents the Nationalists from the mainland who lost to Mao in 1949, tend to favor closer ties to the PRC, whereas the DPP tends to favor looser ties. The crackdown in Hong Kong undermines the “one country, two systems” formula that emerged in the transfer of Hong Kong to PRC control in 1997. If Tsai wins, as it appears she will, tensions between Taipei and Beijing will likely increase.

Silicon Valley strikes back: Once staunch opponents of trade protectionism, U.S. tech giants are now backing tariffs against French goods. The reversal comes on the heels of a controversial French digital services tax that hit firms such as Facebook (FB,213.06), Amazon (AMZN,1906.86) and Alphabet (GOOG, 1393.34). As the world moves away from global free-trade toward more regional free-trade, it is likely that Big Tech will come under pressure from other countries due to an increase in both scrutiny and competition. Therefore, we are not confident that the signing of the “phase one” trade deal with China will lower global trade tensions as much as the financial markets expect. That said, it is also becoming more likely that the traditionally left-leaning Silicon Valley are becoming more open to forming an alliance with moderate leaning conservatives.

Brussels vs UK: On Wednesday, European Commission President Ursula von der Leyen warned the UK that it must adhere to a “level playing field” of rules to protect European companies from unfair competition. The warning comes as both sides prepare to restart negotiations on a Brexit agreement, following PM Boris Johnson’s decisive victory in December. The posturing by the European Union, highlights the growing uneasiness that the bloc has about the UK’s departure. On Tuesday, PM Johnson revealed his “fast-track” trade deal, in which he stated that the UK should have the right to diverge from certain EU rules. Officials from the EU fear that the condition laid out by PM Johnson, could lead to a creation of a hard border, which could potentially disrupt supply chains. Given ongoing geopolitical risks, we are not confident that the bickering between the UK and the EU will have much of an impact on equities in the short-term, however, there may be long-term ramifications if a deal is not reached by the end of the month.

Cyber-attacks in Texas: On Tuesday, Texas Governor Greg Abbott announced that the state saw a surge in infiltration attempts by foreign operatives; 10,000 attempts per minute in the last two days. Although Iran was implicated, it is believed that other countries have also attempted to gain access to the Texas network. At this time, the state reports that is has been able to block all attempts to gain entry, but has not elaborated on where the attacks are targeting. Despite Texas’s success in preventing attacks, hackers were able to successfully hack into the U.S. Depository Library Program earlier this week. As we have mentioned in prior comments, warfare is much more likely to happen with computer viruses than with bombs. Hence, we do not expect Texas to be the only state affected going forward.

Daily Comment (January 7, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Financial and commodity markets are rather quiet this morning as we await Iran’s response. Investor sentiment is starting to recover as risk assets are recovering. China reported its foreign reserves. We are watching a new pneumonia emerging from China. As a side note, Kenny Loggins is 72 today. Here are the details:

Iran: Other than confusion over the U.S. troop presence in Iraq, there wasn’t much news overnight. The U.S. is further bolstering its presence in the region, adding B-52s and more troops. We suspect this action is designed to give the U.S. tools to respond to any Iranian response. Oil prices have started to retreat after initially rising. As we noted yesterday, the key to a sustained rise in oil prices is the triggering of hoarding. If that fails to occur, it is unlikely that oil prices can move significantly higher. Global demand is modest at best and supply, including what OPEC has in excess capacity, is ample. Obviously, all that changes if Iran does something that seriously disrupts oil flows. Still, in the absence of any sort of attack, it will be difficult to hold prices at current levels. However, that doesn’t mean other effects aren’t starting to show up; farmers are worried that wheat sales to the region could be affected.

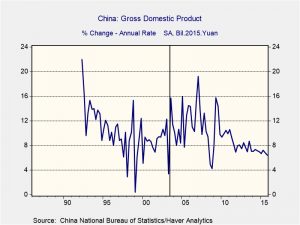

China: There were a few items of note. First, China is grappling with an outbreak of a new respiratory illness. So far, nearly 60 people in the city of Wuhan have been officially diagnosed with this disease. The worry is that this event could resemble the SARS virus in 2003; medical officials in Hong Kong and Singapore have issued health alerts. SARS had a noticeable, but short term, effect on China’s economic growth.

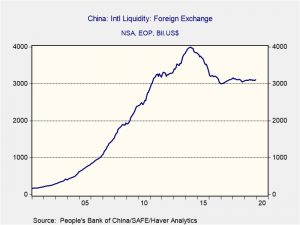

We have placed a vertical line representing the SARS outbreak. Second, foreign reserves rose in December, to $3.108 bn, up $12 bn and mostly on forecast.

Third, China has indicated it won’t increase its grain quotas, raising questions about how the country will meet the requirements of the Phase One deal. It is possible that the U.S. will get the bulk of the quotas and other suppliers will lose market share, but it also could mean that China has no intention to meet the terms of the upcoming agreement.

Fourth, Indonesia is standing up to the China’s incursions into South China Sea. China considers all the waters in the “first island chain” as under its control. Although we doubt Indonesia can withstand China’s efforts alone, with allies, the country may be able to help contain China’s behavior in the region.

Fifth, Chinese financial regulators are moving to direct household saving into the Chinese equity market. Although Chinese investors can certainly invest now, the directive, which didn’t have any details, could be similar to a forced program to change household saving patterns. Chinese households have tended to prefer real estate for excess saving; this program could force diversification on that saving. It could also cool a real estate market that has been prone to overheating and support the conversion of corporate debt to equity (firms could issue stock to pay down debt). This may be a plan to address China’s debt overhang (with the risk being born by households). This action could be bullish for Chinese equities.

Spain: It appears that PM Sanchez has been able to form a government with the populist left Pademos Party, making Spain one of the rare left-wing governments in Europe. However, the coalition doesn’t have a majority and will depend on support from several small parties to govern. We doubt this arrangement will hold for very long.

United States-France: U.S. Treasury Secretary Mnuchin and French Finance Minister Le Maire have agreed to work on a compromise over France’s new tax on digital services offered by big U.S. technology firms. The attempt at compromise aims to avert the prospect of new U.S. retaliatory tariffs of 100% on certain French goods.

United States-North Korea: Reports indicate the U.S. may have recently deployed MQ-9 Reaper attack drones, like the one that killed Gen. Soleimani in Iraq, to South Korea. The U.S. forces in South Korea already have the Gray Eagle attack drone, but the addition of the Reaper is seen as a powerful additional deterrent to North Korea.

Venezuela: A day after police barred opposition leader Juan Guaidó from entering the National Assembly and legislators voted to replace him as their leader, Vice President Pence reiterated the U.S. position that Guaidó is Venezuela’s “only legitimate” leader. However, it is still unclear how much political support Guaido retains after his effort last year to oust President Maduro petered out.

Daily Comment (January 6, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Happy Monday! It’s another risk off morning, as issues surrounding Iran dominate the news and the markets. We update the situation in the Middle East this morning. In other news, Hong Kong has a new administrator and Phase One of the U.S./China trade deal should be signed by the 15th. Here are the details:

Iran: The funeral of Qassem Soleimani continues in Iran to massive crowds. In the wake of the operation that killed Soleimani, here are the items we are watching most closely:

- Iran’s retaliation—we expect Iran’s retaliation to the event to be potentially broad. We list some of the potential areas of risk below:

- Iran announced it is essentially ending the Joint Comprehensive Plan of Action, commonly known as the Iran Nuclear deal. This is no huge shock; Iran had been slowly violating the terms of the agreement in response to U.S. sanctions. However, officially ending it does have ramifications. If Iran “sprints” toward developing a deliverable nuclear weapon it will likely force Israel to at least consider direct air strikes on suspected nuclear sites. In the past, an Israeli attack was difficult to coordinate as the raid would have to use airspace of unfriendly nations. However, under the current situation, we would expect Saudi Arabia to be more than open to allowing overflights. We should also note that “deliverable” doesn’t necessarily mean a warhead on a missile; Iran might have a device it could detonate at ground level, carried by a proxy. This plan would have its own complications but can’t be completely ruled out. A “dirty bomb” could be used as a terror weapon against targets in the region.

- Gulf shipping could be at risk. Although we believe that Iran can’t permanently close the Persian Gulf, it could reduce oil flow for a few months and push oil prices much higher.

- There could be a more serious attack on Saudi oil facilities. Although the last attack was serious, it could have been much worse, and it is possible Iran “pulled its punch” on this attack to avoid escalation. Escalation now may be the watchword.

- We would expect a cyberattack against the U.S. and allies. Although historical analogies are never perfect, the divergent interests and interlocking relations in the Middle East is somewhat similar to Europe prior to WWI. The trigger for that war was the assassination of the Austrian archduke and his wife, caused, in part, by complicated Balkan politics. What turned a regional issue into a massive war was outside power involvement. We don’t expect outside powers to come to Iran’s aid. Although China and Russia have somewhat friendly relations with Iran, they probably won’t risk war with the U.S. to support Iran. However, we would not be shocked to see Russia, China, and maybe even North Korea support Iran in a cyberattack on the U.S. This support is possible because attribution of cyberattacks can be very difficult. Thus, these outside powers could “cover their tracks” behind an Iranian effort and act as a force multiplier. There is already evidence that Iran is taking action in the cyber theater. Researchers at cybersecurity firm FireEye and the think tank Atlantic Council say they have already found evidence that Iran has stepped up its use of social media accounts to spread pro-Iran propaganda following Soleimani’s killing.

- We would expect Israel to become a target for Iranian proxies. Hezbollah has been cautiously avoiding triggering a war with Israel; but this event may remove that caution.

- We would also expect a global assassination effort against American military, business and political officials. Historically, Iran and its proxies have been very effective in the Middle East in these efforts. They also had success in South America, some in Europe, but little in the U.S. Thus, Americans overseas are likely now targets.

- What we don’t expect is a conventional military response. Iran’s conventional military power is limited and not all that effective. Although it can’t be completely ruled out, an invasion of Iran is highly unlikely as is conventional warfare by Iran against its neighbors, excepting naval action in the Persian Gulf.

- Iraq is at the crossroads—Iraq’s underlying problem is that it was never a normal nation, but a colonial construct. For most of its history it was ruled by a Sunni minority and doesn’t have a natural basis for nationhood. The more Iran pressures Shiites in Iraq to participate in actions against the U.S., the more Sunnis and Kurds will be open to separation from Baghdad. The decision over the weekend by the Iraqi Parliament to demand the U.S. troops leave Iraq was not binding and only occurred because Sunni and Kurdish lawmakers didn’t participate in the voting. It is important to remember that the rise of Islamic State was supported by Sunnis in eastern Syria and Western Iraq and another Sunni state could emerge there if Iranian pressure becomes overbearing.

- Oil is the key risk—since the early 1980s, geopolitical oil disruptions have become relatively short term in nature. Even the Gulf War didn’t keep oil prices high for more than a few months. The memories and historic gasoline price hikes and the notorious gas station lines are fading from the collective memory as baby boomers age. We have seen a steady stream of pundits in the financial media telling us that oil is nothing to worry about. If there is going to be a problem, it will come from hoarding. Under conditions of supply uncertainty, consumers will hold oil for precautionary purposes, driving up demand and prices. If the uncertainty is high enough, it can lead to excessive price increases, well beyond what inventory levels would suggest.

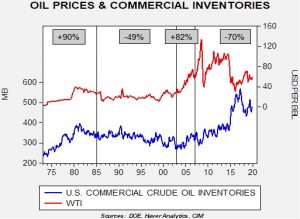

This chart shows the price of West Texas Intermediate with U.S. commercial crude oil stocks. Under normal circumstances, inventory represents the difference between supply and demand, and so there should be an inverse correlation between stockpiles and price. In other words, rising inventories should bring lower prices and vice versa. However, under conditions of hoarding, some of the inventory build represents precautionary demand and the correlation can turn positive. The chart above shows the relationship of these two variables since 1973, when OPEC became the global swing producer. Although the majority of the time the correlation is inverse, there have been significant periods of positive correlation, especially in the 1970s into the mid-1980s. In this period, unrest in the Middle East (two wars, the Yom Kippur War and the Iran-Iraq War, the Iran Revolution) led to constant fears of supply shortages and hoarding behavior. We also saw a short period of positive correlation from 2003-07, on “peak oil” fears and the rapid rise of Chinese oil demand.

The West has several tools available to dampen hoarding activity. First, the OECD nations and China have strategic reserves which, in theory, can be used to distribute supply globally to dampen hoarding. Second, the rise of U.S. shale production has created an important supply buffer outside the Middle East, where the vast majority of OPEC’s excess oil capacity resides. These may be enough to prevent hoarding. However, there is potential that these two factors may fail to prevent the hoarding instinct. First, the strategic reserves work because in a crisis, the OECD, through the IEA, would take control of national strategic reserves; in other words, the IEA could demand the U.S. sell oil to Panama from the U.S. SPR. This program has never actually been executed, but in the current nationalist environment, we think the odds of U.S. taxpayer provided oil being sold outside the U.S. to prevent hoarding in Central America is extremely unlikely. Second, the shale oil supply only dampens hoarding if it is available for export. In the case of a supply emergency, the temptation to close off American oil exports will be very high. Thus, WTI prices might stay low relative to world prices, but global prices, represented by Brent, might soar. The potential for oil prices disrupting global economic growth is probably as high now as it was in the 1970s. And so, the “playbook” of assuming that geopolitical events in the Middle East only have a short-term impact on oil prices, the pattern seen since 1985, may not be as operative as the parade of analysts on the financial media seem to think.

- S. is going mostly alone–British Prime Minister Johnson, German Chancellor Merkel and French President Macron issued a joint statement calling for de-escalation of the U.S.-Iran conflict. After U.S. Secretary of State Pompeo complained that the Europeans weren’t being supportive enough following the assassination of Iranian Revolutionary Guards General Soleimani, British officials offered tacit approval of the U.S. action. All the same, reports indicate the British were given no advance warning of the assassination. We suspect they found that perturbing, as it meant they couldn’t move their hundreds of troops and contractors in Iraq out of harm’s way beforehand.

China-Hong Kong: The Chinese government replaced its top representative in Hong Kong with Luo Huining, a former provincial leader who is expected to be tougher on the city’s continuing anti-China protests. Even though Beijing’s many similar baby steps haven’t led to a bloody confrontation, or clampdown yet, such a move is likely to keep alive the risk of such an outcome, so it will probably be negative for Hong Kong stocks.

Trade: It appears that Phase One of the U.S./China trade deal will be signed in Washington on January 15. Boris Johnson wants to “fast track” a deal with the EU to get a trade deal done before 2021.[1] France is warning the U.S. not to retaliate against its digital tax.

Venezuela: Opposition leader Juan Guaidó, who as head of the National Assembly declared himself interim leader of the country last year, was voted out of his legislative role and replaced by opposition deputy Luis Eduardo Parra. Ahead of the vote, police prevented Guaidó and his supporters from entering the legislative building, prompting U.S. Secretary of State Pompeo to accuse President Maduro of orchestrating the vote through an “undemocratic campaign of bribery and intimidation.” Guaidó’s supporters then held an impromptu vote to re-elect him, but it is not clear whether he will retain the confidence of the country’s anti-Maduro forces. We would score this as at least a short-term win for Maduro that will prolong Venezuela’s misery.

Turkey-Lebanon: President Erdogan said Turkey has already started sending soldiers to Libya to help its UN-backed government fend off rebel attacks, in defiance of President Trump’s call last week for Turkey to stay out of the conflict. Erdogan insisted the Turkish troops would have no direct combat role, suggesting their Syrian militia allies would lead the fighting.

India: In a sign that Prime Minister Modi’s Hindu nationalist movement is gathering force, a mob of Hindu rightwing activists stormed India’s most prestigious secular academic institution, Jawaharlal Nehru University, and commenced beating students and faculty members they accused of being insufficiently nationalist. It’s not clear whether the storming was sanctioned, or organized by Modi’s Hindu nationalist government, or whether it was spontaneous. In either case, accumulating incidents like this point to a potentially destabilized social situation that could eventually be negative for Indian stocks.

Global Cocoa Market: In devastating news for the world’s chocolate lovers, the West African countries of Ivory Coast and Ghana have agreed to form a cocoa cartel and will try to boost the price of the main ingredient of chocolate to $2,900 per ton from the current $2,500 per ton. Together, the two countries produce almost two-thirds of the world’s cocoa, so market participants are anticipating prices will rise substantially.

[1] See what we did there?!

Daily Comment (January 3, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

The fifth episode of the Confluence of Ideas podcast has been posted. “Arriving at Decisions” examines the issues that surround making decisions under conditions of uncertainty.

Happy Friday! With the world still in New Year’s holiday mode, there’s little interesting news in most countries, but that doesn’t include Iran and Iraq. In what’s likely to be a watershed moment for the whole Middle East, yesterday the United States assassinated one of Iran’s most important and influential military leaders as he traveled to the airport in Baghdad. As discussed below, that’s likely to produce an ongoing risk of retaliation, escalation and miscalculation. Here’s our take on what’s happening:

United States-Iran: Overnight, a U.S. airstrike ordered by President Trump killed Qassem Soleimani, the chief of the Iranian Revolutionary Guards’ foreign forces. Also killed was Abu Mahdi al-Mohandes, the deputy commander of an important Iran-allied militia force in Iraq. The action took place in Baghdad as the two were driving to the city’s airport. Justifying the strike as defensive, the Pentagon said Soleimani was actively developing plans to attack U.S. diplomats and service members in Iraq. Meanwhile, Al-Mohandes’ militia had been harassing U.S. forces in Iraq, including this week’s attempt to storm the U.S. Embassy in Baghdad. With Iran already suffering mightily from the U.S. sanctions against it and its nuclear program, and with many Middle Easterners starting to push back against Iran’s interference in their countries, the blatant assassination of such an important, high-level Iranian official is certain to invite retaliation. Supreme leader Ayatollah Ali Khamenei has already vowed “tough revenge.” A key question for the future is what that revenge will look like: A military strike on Saudi Arabia, or Israel? Assassination of a CIA station chief, or U.S. military officer? Disruptive computer hacking? The increase in tensions and the risk of escalation, or miscalculation have already driven up oil prices and sparked heavy buying of safe-haven assets like gold and government bonds, while global equities are falling so far today. However, it’s important to remember that any Iranian revenge attack may come with a lag. If that happens, investors could soon be lulled into a false sense of security. This might allow risk assets to recover and safe-haven assets to sell off again, but the reality is that Iranian mischief could come out of the blue at any moment, just like the missile that killed Soleimani and Al Mohandes.

United States-Turkey-Libya: In a call yesterday, President Trump warned Turkish President Erdogan against sending troops to Libya to support its UN-backed government. Official U.S. policy is to support the government, but Trump has expressed sympathy for warlord Khalifa Haftar, who is trying to overthrow it with the help of Egypt, Saudi Arabia and Russia.

United States: Despite the euphoria in the financial markets as the New Year trading began yesterday, it’s important to remember there are not just geopolitical risks, but also some lingering economic risks to keep in mind. For example, it’s still possible that the Fed’s interest-rate cuts last year may have come too late. Separately, the Philadelphia Federal Reserve has issued a report noting that nine states are expected to be in recession in 2020, including Pennsylvania, New Jersey, Delaware, West Virginia, and Iowa.

Australia: The nation’s massive wildfires are intensifying again as hot, windy conditions return. Today the Australian navy began evacuating thousands of people stranded in tourist towns along the country’s eastern coast, and Victoria’s territorial government has declared a state of emergency. Importantly, Prime Minister Morrison continues to take blame for heading off to Hawaii for a vacation in the midst of the crisis. During his visit to New South Wales after his return, residents reportedly refused to shake his hand and forced him to retreat to a car amid strong heckling and swearing. It’s too early to know exactly how much the disaster will impact Australia’s economy, or political stability but there does appear to be a significant risk to Australian assets.

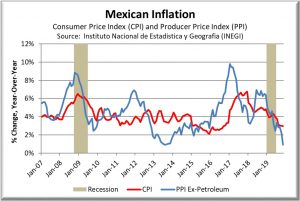

Mexico: Banco de Mexico yesterday released the minutes from its December policy meeting, with the document showing officials were concerned that a 20% hike in Mexico’s minimum wage scheduled for January 1 would increase price pressures, even though last year’s 16% hike of the minimum wage didn’t prevent a steep drop in inflation. The policymakers did decide to cut their benchmark short-term interest rate to 7.25%, compared with 7.50% previously, but the cut was seen as timid considering the way Mexican inflation has recently been cooling.

Daily Comment (January 2, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

The fifth episode of the Confluence of Ideas podcast has been posted. “Arriving at Decisions” examines the issues that surround making decisions under conditions of uncertainty.

Happy New Year everyone! Global equities began 2020 with a bang, as markets responded favorably to news that the People’s Bank of China will increase the supply of cheap funding to banks. In addition, the euro weakened against the dollar after weak manufacturing PMI data from Italy and Germany elevated fears that the Eurozone is heading for another year of anemic growth. Here is what we will be watching today:

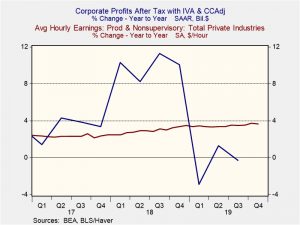

S&P 500: In 2019, S&P 500 had its highest annual return since 2013, rising 28.9% from the prior year. A reversal of Federal Reserve policy, abated fears of an earnings recession as well as a thaw in trade tensions were likely the biggest contributors to the rise in returns. Furthermore, it is also worth noting that the index likely benefited from a time period bias due to a series of negative market events taking place toward the end of 2018. These events included: A Fed rate hike, a government shutdown and rising tariffs on Chinese and U.S. goods. To say that investors were pessimistic in the beginning of 2019 would be an understatement. That said, we believe that despite the rise in optimism there are still some reasons to be a bit cautious going into 2020.

Here are our concerns:

- Rising wages and the resumption of tariffs will likely weigh on corporate profits in 2020. Therefore, it will likely be very difficult for the market to avoid an earnings recession if firms don’t start raising prices.

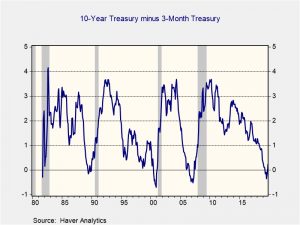

- It will be a while before we know whether the Federal Reserve lowered rates in time to avoid a recession. As we have mentioned in prior reports, a common misconception is that a yield curve inversion signals a recession. In reality, it is the reversal of the inversion that signals a recession is imminent as shown in the graph below. In fact, a recent survey from the Conference Board showed that U.S. chief executives are concerned about a recession taking place in 2020.

- Lastly, if a series of negative market events toward the end of 2018 led to a surge in 2019, it is logical to assume that a positive market event such as the Phase one trade deal toward the end of 2019 will make it unlikely that a rise of similar magnitude will take place toward the end of 2020. In fact, given the volatile nature of this trade war, we wouldn’t be surprised if there is a snapback in trade tensions sometime this year.

People’s Bank of China: On Wednesday, China’s central bank reduced its reserve requirements for banks and signaled that it will continue to lower borrowing costs for businesses. This move by China is designed to bolster its economy after several years of slower growth by boosting investment. Recently, China has encouraged banks to lend to more small businesses. In March 2019, the Chinese government set out a goal to boost small business financing by 30 percent. In order to reach these goals Chinese banks have increased lending to subprime borrowers, as many of the credit-worthy businesses have been reluctant to borrow. Although default rates have skyrocketed over the past three years, it is not a huge market concern at this time. That said, it is something that we are monitoring closely.

Odds and ends: Tensions between the U.S. and Iran have escalated after protesters sieged the U.S. Embassy in Baghdad. North Korean leader Kim Jong-un announced that his country will abandon a self-imposed moratorium on testing nuclear weapons and long-range ballistic missiles. Israeli Prime Minister Benjamin Netanyahu is seeking immunity from corruption charges as the country prepares for another round of elections.

Asset Allocation Weekly (December 20, 2019)

by Asset Allocation Committee

(N.B. This is our last Asset Allocation Weekly for 2019. The next edition will be published January 10, 2020.)

Did the Fed engineer a soft landing? That is the critical question for 2020. If the Fed, through its rate cuts last year,[1] has rescued the economy, it would be one of the most remarkable episodes of deft central bank practice.

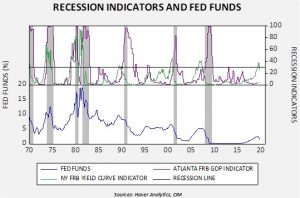

This chart shows fed funds along with recession indicators from the New York and Atlanta Federal Reserve Banks. The former uses the yield curve in its forecast and the latter uses GDP. The New York indicator gives a 12-month forward read on the economy. Since 1970, any reading over 30 for the New York indicator has led to an eventual recession. Nevertheless, even though its track record is impressive, we like to wait for confirmation from the Atlanta indicator before declaring a downturn. The chart shows that risks of recession are elevated.

What if recession is avoided? Because retail money market levels are elevated, we could see a strong rally in equities.

This chart looks at retail money market funds (RMMK) compared to the S&P 500. When RMMK fell from 2008 into 2011, the equity index more than doubled. The high level of RMMK may not necessarily all flow to equities, but avoiding recession (and a reduction in trade conflicts) could lead to this liquidity finding its way into asset markets.

In conclusion, the odds of recession are elevated but we don’t see a downturn as imminent. The FOMC has moved aggressively to cut the policy rate and is at a level we would consider neutral. If a recession is avoided, risk assets could appreciate significantly in 2020. However, the risks of a downturn are probably high enough to keep asset prices contained at least for the first few months of the new year.

[1] And the expansion of the balance sheet as well.

Daily Comment (December 20, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

N.B. A couple of items. First, the Daily Comment will go on hiatus from Dec. 23, 2019, to Jan. 1, 2020. Publication will resume on Jan. 2, 2020. Second, the fifth episode of the Confluence of Ideas podcast has been posted. “Arriving at Decisions” examines the issues that surround making decisions under conditions of uncertainty.

Happy Friday! In fact, it should be an especially happy day, as several important uncertainties are formally being removed. The House has given its OK to the U.S.-Mexico-Canada trade deal, and the Senate has approved funding for the federal government for this fiscal year. In the U.K., parliament is formally debating Brexit and is expected to pass the deal easily. Here’s what we’re watching today:

United States-Mexico-Canada: The House of Representatives yesterday voted 385-41 to approve the “USMCA” trade agreement. The update to NAFTA will now need to be approved by the Senate, most likely early next year. The Canadian parliament also still needs to approve the deal, but as of yet there is no set schedule for a vote in either of its chambers. Only Mexico has approved the deal so far, but since the United States and Canada are both expected to follow suit, it appears that the uncertainty regarding North American trade is dissipating, which is probably one key reason for the ongoing rally in stocks.

U.S. Federal Budget: The Senate has approved the two appropriations bills necessary to fund the federal government through the fiscal year ending September 30. If President Trump signs the bills before the end of today, as expected, there will be no new government shutdown. The news is likely to be positive for stocks as it removes yet another potential source of uncertainty.

United Kingdom: Parliament today began debating Prime Minister Johnson’s Brexit withdrawal deal with the EU. The bill is widely expected to pass with a comfortable majority, helping to remove a bit more uncertainty regarding Brexit. That’s likely a positive for European stocks, although it’s important to remember that there is growing concern that Britain may not be able to secure attractive trade deals with the EU, or the United States in the coming year or so. Separately, the government announced that the new head of the Bank of England will be Andrew Bailey, a longstanding official at the central bank who is currently the head of its regulatory office. The well-respected Bailey is considered a “safe pair of hands,” so the decision is likely to be positive for British assets. All the same, it is still not clear where he will take British monetary policy when he officially assumes his post on March 15.

U.S.-China Trade: Chinese leader Xi Jinping reportedly doesn’t plan to attend January’s World Economic Forum meetings in Davos, Switzerland. That eliminates one potential venue for him to meet President Trump for a formal signing of the “phase one” U.S.-China trade deal. However, China still plans to send its top trade negotiator to Washington in January so he can sign the deal.

European Union-China: The new president of the European Council, Charles Michel, said he will push the EU to prioritize deeper economic ties with China while also protecting its own markets. In doing so, he vowed that the EU’s international trade policies would not be dictated by the United States. The statement amounts to pushback against U.S. efforts to re-set relations with China, but it also reflects the slow-growing EU’s reliance on exports.

India: Thousands of Muslims and social activists today staged another round of protests against Prime Minister Modi’s new, Hindu-friendly citizenship law, in defiance of the government’s ban on public gatherings. It still seems Modi will eventually get control over the protests (especially because of his clampdown on the internet and communication services yesterday). That helps explain why Indian stocks have been able to push to new record highs this week. However, today’s defiance against the public-meeting ban suggests he still has his work cut out for him.

Lebanon: Christian, Sunni and Shiite political leaders (including Hezbollah) have agreed that the country’s new prime minister will be Hassan Diab, a former education minister who is now the vice president of Lebanon’s top university. As described in our WGR from December 2, Lebanon’s “confessionalist” power-sharing system requires the prime minister to be a Sunni Muslim, but many parliamentary Sunnis refused to vote for Diab, suggesting the real winners in the negotiations were Hezbollah, the Maronite Christians and maybe even the youthful demonstrators that brought down the former prime minister two months ago. Since the move helps reduce uncertainty regarding Lebanon, there is still no firm news on what Diab will do to address the country’s financial and debt crisis.

North Korea: Thousands of North Korean laborers are streaming out of Russia ahead of a Sunday deadline to avoid UN sanctions. The exodus will end one of North Korea’s last remaining sources of foreign funds. It may therefore help stoke the country’s recent new provocations aimed at the United States. Reports indicate U.S. intelligence is closely monitoring North Korea for a potential Christmas Day missile launch.

U.S. Junk Bond Market: Moody has issued a report warning that this year’s rally in low-rated bonds has left them vulnerable to a significant fall in value next year. As shown in the charts near the end of this article, U.S. high-yield bonds have provided a total return of 13.97% for the year through yesterday. With the Fed’s 2019 interest-rate cuts, the recent improvement in some economic indicators and the new easing of global trade tensions, some of that strong return may well be justified. However, according to Moody, “If the anticipated improvement in fundamentals governing corporate credit do not materialize, a significant widening of high-yield bond spreads is likely.”