by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with our thoughts on the recent disagreement between Anthropic and the Department of Defense. We then turn to the UK by-election, examining the broader populist wave sweeping across the West. Following that, we discuss the ongoing global chip shortage, provide an update on the Iran nuclear talks, and highlight recent solar funding advocacy within the White House. We also include a summary of key economic data from the United States and developments in global markets.

Pentagon Anthropic: Tensions between the US government and Anthropic escalated this week after the company said it cannot, in good conscience, agree to the Pentagon’s demand that its AI models be available for “all lawful purposes.” The stance puts Anthropic at risk of losing a Defense Department contract worth up to $200 million and of being labeled a “supply chain risk,” potentially barring its technology from Pentagon programs and key contractors. It also leaves the company vulnerable to the risk of being compelled to comply under the Defense Production Act.

- The two sides have spent weeks negotiating over the Defense Department’s use of Anthropic’s systems for military and intelligence applications. Anthropic has insisted on explicit limits barring domestic mass surveillance and fully autonomous weapons that make targeting decisions without human oversight, while the Pentagon argues that existing law and internal policy already constrain such uses and that its contractors should not be able to veto lawful military operations.

- AI is becoming increasingly integrated across the broader economy, and Anthropic has played a particularly prominent role. Its powerful AI tools have been a major catalyst for the so‑called “SaaS collapse,” reshaping how businesses use and value traditional software. As a result, the company is widely regarded as one of the leading players in the technology sector and is becoming strategically important to the country.

- While there has been no official announcement on the government’s next steps, we see a meaningful risk that it could invoke its authority to assume control of Anthropic technology. If so, this would likely mark another step in a longer‑term shift toward a more activist state role in the economy and a further blurring of lines between the public and private sectors.

- This shift in the global economy is unlikely to have a meaningful short‑term impact on markets as companies will, for now, continue to operate in a relatively market‑friendly environment. However, this could change over the longer term, perhaps over the next decade, with firms increasingly prioritizing government demands over shareholder interests. As a result, investors might consider greater international diversification to avoid excessive concentration in any single region.

Populist Wave: A strong performance by a left‑wing party in the UK highlights the growing appeal of populist movements across the West. On Friday, the Green Party won a key parliamentary by‑election in southeast Manchester, a seat long considered safe for the incumbent Labour Party. Labour not only lost to the Greens but also finished behind the right‑wing populist Reform UK party. The result is likely to fuel concerns that Labour is losing support just a year after taking power and may also signal the emergence of a new populist wave.

- The Green Party’s election victory underscores the growing appeal of populist movements across the Western world. During its campaign, the party emphasized tackling the poverty crisis, arguing that poverty is a political choice that can be addressed through changes in tax policy. This approach mirrors that of the Reform UK Party, which similarly seeks to raise workers’ wages, though it frames the issue around curbing immigration rather than fiscal reform.

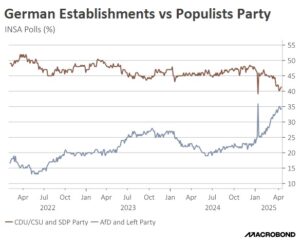

- This growing populist trend is also evident in Europe and the United States. In Germany, the CDU/CSU has come under pressure as the far-right AfD has at times overtaken it in the polls, while some disaffected centrist voters have drifted toward parties on the left. Meanwhile, in the United States, populist figures have risen to prominence in major cities; local leaders such as New York Mayor Zohran Mamdani have cultivated high-profile relationships with populist President Donald Trump.

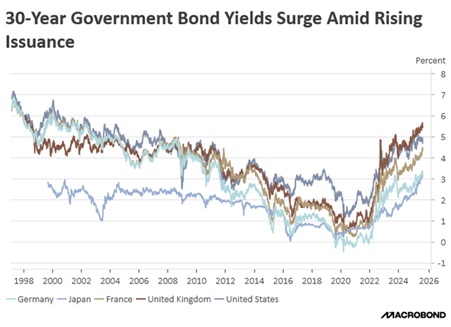

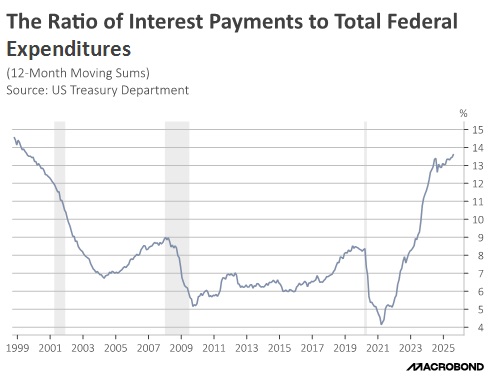

- The ascendancy of populist movements appears to be a structural shift rather than a fleeting trend, driven by a public mandate for intervention in the face of rising cost of living. Should establishment parties continue to lose ground, we anticipate a tangible shift toward higher social spending and more accommodative monetary policies.

- From a purely market perspective, right-wing populism is often regarded as the “lesser of two evils” compared to its left-wing counterpart. This preference stems from a right-wing lean toward deregulation and decentralization, which typically lowers the cost of doing business. However, investor sentiment is not strictly partisan; as demonstrated by Spain’s Socialist Party, markets are willing to tolerate left-wing administrations provided they maintain rigorous fiscal discipline.

Chip Shortage: According to IDC, the smartphone market is expected to shrink by 12.9% in 2026 due to a shortage of memory chips. This shortage is driven by a drop in the global supply of chips needed to power new technology. The report highlights how the rise of AI is starting to have a crowding-out effect, in which the sector’s enormous demand is beginning to price out other industries. As a result, we believe the surge in demand for chips could lead to either higher inflation or lower margins for certain goods.

Iran Progress: Momentum appears to be building toward a potential US-Iran deal. On Thursday, the two sides held intensive talks on Iran’s uranium enrichment program. Tehran rejected a US proposal to transfer its enriched uranium abroad but left the issue open for further negotiation. The White House continues to favor diplomacy. Vice President Vance stressed that the US has no intention of entering a prolonged war with Iran. The parties are expected to meet again next week in Vienna.

MAGA Goes Solar: The solar lobby has partnered with conservative influencer Katie Miller and former Trump adviser Kellyanne Conway to promote solar power among right‑leaning voters. The move comes as the White House has signaled skepticism toward renewable energy, reflecting concerns about its impact on traditional fuel industries. However, growing recognition of solar as a diversified source of power, with the potential to ease pressure on the electricity grid and improve energy security, appears to have softened that stance somewhat.