Author: Rebekah Stovall

Weekly Geopolitical Report – The U.S.-China “Phase One” Trade Deal: Part II (February 3, 2020)

by Bill O’Grady

In Part I of this report, we offered a detailed examination of “Phase One” of the recent trade agreement between the U.S. and China. This week, in Part II, we will examine the ramifications of the deal and conclude the report with market effects.

China appears to be the “loser” in this deal. Our careful reading of the report does support the notion that China gave up more than it got in this arrangement. All leaders of governments try to avoid looking weak; Chinese leaders especially worry about appearing fragile to avoid comparisons to the Opium War era. So, if this take is accurate, what led to this outcome?

Daily Comment (February 3, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Happy Super Monday! There is a lot going on this morning. We have an update on the Wuhan virus. Chinese equity markets reopen and the PBOC eases. Tensions rise on EU/U.K. trade. Iowa caucuses are tonight. We see a turn in Venezuela. Here are the details:

Coronavirus: There is growing speculation that we may be on the verge of a global pandemic. The current confirmed infection count is 17,205, with 361 fatalities, the first death outside of China, and a fatality in the Philippines. Building on its earlier move to reduce travel from China on account of the Wuhan coronavirus, Hong Kong today ordered that 10 of its 13 border crossings with the mainland be totally closed. Separately, the Chinese foreign ministry has blamed the United States for spreading fears about the disease and not helping to stop it. China has completed building a hospital in 10 days. In many respects, the Wuhan virus shows the strengths and weaknesses of China’s authoritarian system. It is amazing that the country can build a facility so quickly; a powerful government can simply override opposition to move fast. On the other hand, there is growing evidence that doctors in Wuhan were dealing with a unique virus in early December but officials there quashed the discussion on social media. A more open society might have been able to use this information to move quickly and contain the disease before it spread. China’s political system is bad at processing and gathering information it doesn’t want to hear, but effective at taking mass action once a crisis occurs.

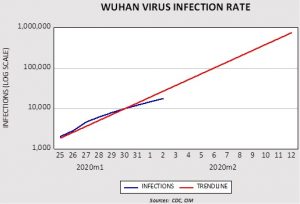

We have enough data on infections to put some charts together.

This is a “good news, bad news” chart. We took the infection rate, log-transformed it and regressed a linear trend through it. The good news is that the rate of infections appears to be falling below the trendline. The bad news is that the trend would suggest 100k infections worldwide by Friday. The disruption from the Wuhan virus will likely be with us for several months, although the impact will lessen over time.

As expected, the reopening of China’s equities led to a sharp selloff, but for the most part it matched other markets in the region. The PBOC took action, cutting repo rates by 10 bps and injecting CNY 1.2 trillion ($173 billion) into the financial system. Although China’s equities were weaker, the Hang Seng was mostly steady and Western equities are rallying. OPEC, facing a plunge in oil prices, is considering further supply cuts to bolster prices. Overall, the Wuhan virus will weaken global growth but the impact is expected to be transitory.

EU/U.K. trade talks: We are now heading into the next phase of Brexit, which is establishing trade relations. The EU wants Britain to remain closely knit to EU rules so as to not create conditions of regulatory arbitrage. The Johnson government wants a looser arrangement; otherwise, leaving the EU was pointless. Why would the U.K. give up representation only to follow EU rules that it can no longer influence? At this point, both sides are bellowing. The EU is staking out a maximalist position; the U.K., a minimalist one. In the end, we expect they will eventually agree on something between these two points, but, in the meantime, the fear that a hard Brexit will occur after all sent the GBP falling today. We doubt that a comprehensive plan can be put together in less than a year and would not be surprised if the two sides follow the arrangement Switzerland has with the EU, which is a series of narrow treaties that cover various areas of trade. Meanwhile, the sniping is escalating; Donald Tusk, the former European Council president, suggested he would favor Scotland rejoining the EU, seeming to support a breakup of the U.K. Such support might end up leading to separatist activity elsewhere in the EU.

Iowa caucuses: Iowa will hold its caucuses to kick off the primary season, and thus the official political season begins today. Usually there is a poll from the Des Moines Register but a glitch led it to be pulled, meaning we are sort of flying blind into tonight’s vote. Axios has an easy-to-follow flow chart of the process involved.

Taiwan-United States: The U.S. government has given its permission for Vice President Elect Lai Ching-te to visit Washington and New York this week for meetings with high-level business and political leaders. The move is likely to provoke strong condemnation from China, which sees Taiwan as a renegade province. It could also further strain China-Taiwan ties, though it will be interesting to see what will happen with China distracted by the coronavirus crisis.

Japan-South Korea: The Japanese government has filed a fresh complaint with the WTO over South Korean shipbuilding subsidies. The move points to a possible new round of bilateral trade tensions between the countries, following a period when their World War II-era dispute seemed to be cooling. If tensions do rise again, it would be negative for Japanese and Korean stocks.

Eurozone: In an interview with the Financial Times, ECB Chief Economist Philip Lane said the EU’s consumer price index is undercounting inflation because it doesn’t take into account the cost of owner-occupied housing and only assigns a weight of 6.2% to rental costs. He said he has started presenting policymakers with adjusted inflation figures that give extra weight to housing. Those figures are currently 0.2% to 0.3% higher than the official data. As central banks around the world keep falling short of their inflation goals, Lane’s action is a signal that they may start “moving the goalposts” to suggest they’re being more successful and fend off pressure for even lower interest rates. Such a move would be negative for bonds.

United Kingdom: The final Markit/CIPS purchasing managers’ index for manufacturing was revised upward to a nine-month high of 50, beating expectations that it would be unchanged from the initial estimate of 49.8. The reading provides further evidence that the British economy has regained some strength after the divisive election over Brexit in December.

Turkey-Syria-Russia: After Syrian troops shelled Turkish observation posts in northwest Syria over the weekend, President Erdogan said Turkish forces have launched massive retaliatory attacks on Syrian positions in the Idlib province. Erdogan also accused Russia of not supporting efforts to de-escalate the civil war between Syrian government forces and the remaining rebels.

Odds and ends: We are seeing the Maduro administration in Venezuela back away from its interference in markets and, lo and behold, conditions appear to be improving somewhat (arguably from a low base). However, the benefits of the thaw appear to be mostly falling to the rich, which is in opposition to the goals Hugo Chavez established during his presidency. Those benefiting from the boom should be cautious; Cuba has a history of easing up on market interference during downturns only to return to controls when the recovery develops.

In Ireland, Sinn Fein is surging in the polls in front of this weekend’s election; although it isn’t running enough candidates to govern alone, it may do well enough to force the centrist parties into a coalition or lead to a minority government. U.S. farm bankruptcies hit an eight-year high in 2019.

Asset Allocation Weekly (January 31, 2020)

by Asset Allocation Committee

Last week, we updated our thoughts about a melt-up in equity markets. We observed that retail flows had diverged from equity market performance and noted that if sentiment shifts and retail investors come into equities, the market could rise rapidly to levels that may not be sustainable. This week, we are dealing with the opposite problem—a potential “black swan” from the Wuhan virus and the subsequent decline in risk assets.

The Wuhan virus is a coronavirus that recently emerged in the Chinese city of Wuhan in the Hubei province. It likely originated in wild animals and “jumped” the species barrier to become a human infection. Since the virus is evolving rapidly, we won’t cover the details of the disease in this report.[1] In this report, we will discuss how the virus could affect financial markets and how investors should handle it.

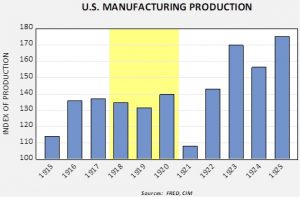

Pandemics[2] can have lasting and significant effects. The Black Death, transmitted by a flea-borne bacterium, killed about 25% of the world’s population. The subsequent population reduction led to a 3.5x jump in real wages in Britain from 1310 to 1450.[3] However, modern medicine has tended to reduce the economic impact of pandemics. The worst influenza pandemic, the Spanish Influenza of 1918, infected 500 million and killed up to 100 million globally. The economic impact was notable but rather short; within a couple of years, the U.S. economy had recovered.

The Spanish Influenza is shown in yellow. The pandemic did have an impact on output but was dwarfed by the post-WWI recession of 1921.

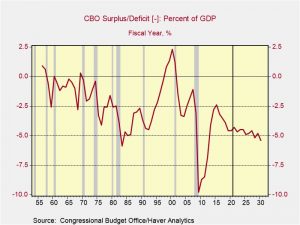

The current situation is being compared to the SARS epidemic of 2003, which mostly affected China. Using data from Capital Economics,[4] the disease clearly had an adverse effect on the Chinese economy.

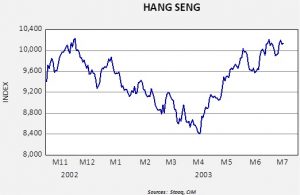

What did financial markets tell us about SARS? This is a chart of the Hang Sang Index from November 2, 2002, to July 31, 2003.

If this event follows roughly the same pattern as SARS, then Chinese equities could see a 15% decline. It should be noted that SARS was first detected in November 2002 but was not reported to the WHO until February. Beijing is acting much faster this time around so the timing could be compressed. It is also important to note that by June the Hang Seng had recovered most of its losses. Such recoveries are typical from these events.

What should investors take from this analysis? First, these sorts of events usually have a three- to five-month period during which they have a significant impact on financial markets. There is always fear that this one will be different and it is possible that it will be. But, more than likely, the Wuhan virus will peak in the next six weeks and the recovery will start. Second, it’s important to note that the operative factor affecting financial markets from this virus is fear. The CDC estimates that between 291k to 646k die each year from influenza. If the world has 8k cases of the Wuhan virus and a 10% lethality rate (which would be roughly in line with SARS), then we are looking at about 800 fatalities worldwide, with the majority in China. That is notable but far less than the number of likely fatalities from influenza this year. Still, the element of the unknown will tend to lead markets to overshoot to the downside which may open opportunities for a recovery in the spring.

[1] Interested readers can follow the evolving details in our Daily Comment.

[2] Pandemic is an epidemic with global proportions.

[3] Scheidel, W. (2017). The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century. Princeton, NJ: Princeton University Press, p. 303.

Daily Comment (January 31, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Happy Super Bowl Friday! It’s also Brexit Day. We update the latest on the Coronavirus. Eurozone GDP comes in weak. Global equities continue to lose ground. Abe appoints a new member to the BOJ. More movement on global tech taxes. Here are the details:

Coronavirus: Yesterday, the WHO officially declared an international emergency, but then went on to say that it shouldn’t affect travel, or border security. Equities actually rallied on the news, but the optimism didn’t stick. We are approaching 10k in confirmed infections and the death toll has now exceeded 200. New cases are being reported in Europe. Despite WHO recommendations, Singapore and Mongolia have closed their borders to anyone coming from China. The U.S. has implemented a Level 4 travel ban to China, a simple “do not travel” warning. Countries outside of China are trying to isolate the spread. Reports say even North Korea(!) is suspending trade with China and has stopped issuing visas to Chinese citizens. China is extending the New Year’s holiday; reports from contacts indicate that most businesses will remain closed and are telling their employees to work from home. Airlines are bearing the brunt of the weakness, although the turmoil in China will almost certainly affect global manufacturing supply chains. Since mainland Chinese markets remain closed, we have been paying close attention to the Hang Seng; it closed down again today, but the pace of the decline is moderating. Overall, we are looking at probably two to three weeks of volatility.

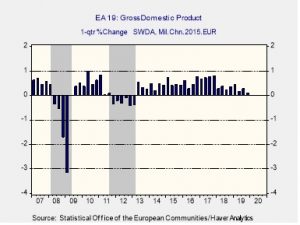

Eurozone: In an initial estimate, fourth-quarter GDP grew by a seasonally-adjusted 0.1% from the previous quarter, short of the expected rise of 0.2% and much slower than the third-quarter increase of 0.3%. GDP in the fourth quarter was up just 1.0% from the same period in 2018, and full-year GDP in 2019 was up just 1.2% from 2018 its weakest annual gain in six years. Not only is Eurozone growth being dragged down by global trade tensions and a struggling auto industry, but the data shows fourth-quarter GDP unexpectedly contracted in both France and Italy. The disappointing numbers are weighing on global equities today. Since the figures suggest the ECB may have to loosen monetary policy further in the coming months, bonds are reacting positively to the news.

Brexit: At 6:00 EST, the U.K. will leave the EU. In reality, nothing changes all that much immediately. The U.K. will remain under EU rules for the next 11 months while a trade deal is worked out. The most immediate impact will be on the EU; the European Parliament will shift rightward as center-right parties will capture most of the exiting U.K. seats. The EU will be more dominated by Paris and Berlin after losing British influence. For the most part, the Brexit seems to be a bit anti-climactic after all.

BOJ: PM Abe has appointed Seiji Adachi to the BOJ, replacing Yutaka Harada on the nine-member board. Adachi is considered an extreme dove, but the composition of the board won’t really change because Harada was dovish too. The current composition of the board is three reflationists and six moderates. In June, Yukitoshi Funo’s term will end; he is a moderate; if Abe adds another reflationist, we could see a weaker JPY.

Global Tech Taxes: The 137 countries working with the OECD to develop new, global rules for taxing multinational companies has issued a statement reaffirming their goal to reach a deal by the end of 2020. The statement suggests the participants have had a fire lit under them by the recent dustup between the U.S. and France over France’s proposal for an interim tax on global tech firms’ digital revenues. A new tax regime like the one being discussed could have a big impact on corporate earnings for years into the future, so we’ll be watching how things develop over the course of the year.

United States-South Korea: The Pentagon has warned its South Korean employees they could be furloughed on April 1 because of insufficient funds to pay them. The warning is being taken as a sign that the U.S. and South Korea are still deadlocked over a new cost-sharing deal for the 28,500 U.S. troops stationed in South Korea.

Business Cycle Report (January 30, 2020)

by Thomas Wash

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. We have created this report to keep our readers apprised of the potential for recession, which we plan to update on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

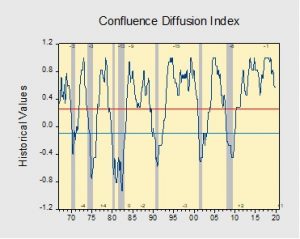

December brought a wave of positive news about the economy. U.S. large and mid-cap equities ended the year at record highs largely due to strong performance in the Technology sector.[1] Moreover, the U.S. and China announced an agreement for the “Phase One” trade deal. Additionally, strong retail sales around the holiday break offered reassurance that U.S. consumption, which is the largest contributor to GDP, remains strong. However, not all was positive. The manufacturing sector continued to show signs of weakness that will likely persist into 2020. Last month, Boeing (BA, 323.89), arguably the largest U.S. manufacturing exporter, announced that it will suspend production of its Boeing 737 Max starting in January. It is estimated that the production cut will reduce annualized GDP by 30 to 50 bps. That being said, our diffusion index has remained unchanged from the previous month with nine out of 11 indicators in expansion territory. The reading for this month came in at +0.575.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is headed toward a recovery. On average, the diffusion index is currently providing about six months of lead time for a contraction and five months of lead time for a recovery. Continue reading for a more in-depth understanding of how the indicators are performing and refer to our Glossary of Charts at the back of this report for a description of each chart and what it measures. A chart title listed in red indicates that indicator is signaling recession.

[1] The basis used is the S&P 500 and S&P 400.

Daily Comment (January 30, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

It’s GDP Thursday! We cover the data in detail below but the report came in at 2.0% which was close to forecast. Risk-off returns as global equity markets slump. We update the latest on the Coronavirus. The BOE surprises; the Fed does not. The EU officially accepts Brexit; the U.K. does tomorrow. We cover yesterday’s DOE data. Here are the details:

Coronavirus: We now have more than 7,711 cases confirmed along with 170 fatalities. The World Health Organization (WHO) will meet today; they may decide to declare the virus as a world public health emergency after declining to do so last week. Russia has partially closed its border with China. Some interesting research has emerged on the virus. First, the New England Journal of Medicine has calculated that the average incubation period is just over five days, not the 14 that was estimated earlier. That shorter period will likely reduce the dispersion as people get sicker sooner than thought and thus are not “out and about.” Second, the report suggests the R0 is more like 2.2 instead of the 2.5 that has been earlier estimated. That reduction means that the actual spread should be less than some earlier estimates. SARS, for example, had a R0 of 3.0, meaning that every case meant that three others were also infected. Third, the disease is primarily affecting older people; in reported cases (those sick enough to notice), over 50% were aged 60 or older, and there are very few reported cases among children of 15 years or less.

The CNY weakened and briefly breached the 7.0 CNY/USD level. The U.S. is planning another evacuation flight from China. A cruise vessel with 6,000 on board is being held in an Italian port after a guest reported flu-like symptoms. There is increasing worry about disruptions of global supply chains; if this continues to develop, it will clearly hurt global economic growth. It will certainly affect China’s growth. Mainland China markets continue to be closed, but Hong Kong is open. The Hang Seng weakened for the second day, falling 2.6%. So far, U.S. officials are treating this situation as if it won’t be a problem; however, we would expect some increase in preparedness in the coming days. Overall, our position remains the same; the virus will have a negative impact on global economic data and markets that will likely continue for another 3-4 weeks. However, we don’t anticipate a lasting effect.

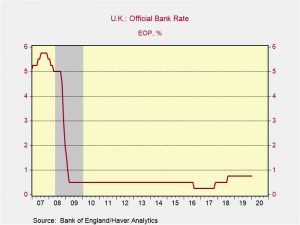

The BOE: The Bank of England held its benchmark short-term interest rate unchanged at 0.75%, as expected, based on the policymakers’ view that improved business sentiment since the December election has pushed off the need for stimulus. However, the policymakers also cut their economic forecast to the weakest since World War II. They now see the British GDP growing just 1.1% per year in the coming three years, compared with the government’s forecast of 2.8%.

U.K. equities and debt prices fell, while the GBP rallied.

The Fed: In some respects the FOMC did exactly what we expected. The changes in the statement were minimal. In fact, only three words were changed in the body of the statement and one of those referred to the month of the year. Housing spending was downgraded a bit, from “strong” to “moderate,” and inflation was changed from “near” to “returning to” the 2% target. The Fed did raise the Interest on Excess Reserves (IOER) by 5 bps, so one might be able to argue there was a modest tightening, but even this would be a stretch. However, despite the lack of change, financial markets took the response with a bearish tone. Equities fell off their highs and bonds rallied. Perhaps the moderate position on future growth dampened investor optimism.

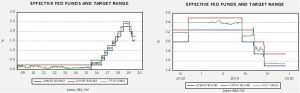

Here is our take. First, the increase on IOER is designed to push the effective fed funds rate (the actual rate banks borrow) towards the middle of the target range.

These charts show effective fed funds and the target range. The left-hand chart shows the data from 2008 to the present, while the right-hand chart shows the data from Q4 2018. On the right-hand chart, there are two issues we want to highlight. First, the Fed has tried to keep the effective rate near the midpoint of the range; because it has been running near the low end, it is lifting the IOER to push the effective fed funds rate to the midrange. Thus, it is technically a tightening but clearly not much of one. Second, note the spike in fed funds in late Q3. That was spawned by the repo crisis.

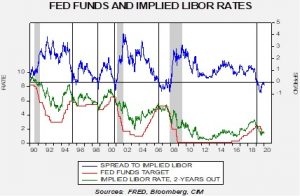

The second item of interest is that the financial markets are starting to signal further easing might be in order.

The implied LIBOR rate from the two-year deferred Eurodollar futures contract has been a good guide to policy easing. In general, when the implied rate falls below the fed funds target, easing usually follows. Last summer the spread widened out to excessive levels; the FOMC responded with rate cuts which narrowed the spread back to zero. However, in the past two weeks, the spread has widened to near 30 bps. Although the Fed will almost certainly wait, this data would suggest the next move by the central bank will be to ease. It is possible that the recent behavior of the financial markets raised hopes that the chair would have taken a more obvious dovish stance. Perhaps the lack of action is what led to the hawkish market response.

Mexico: Preliminary figures show Mexican GDP contracted by a seasonally-adjusted 0.3% in the fourth quarter of 2019. Not only was the decline worse than expected, but it also marked the third straight quarterly contraction and confirmed that the Mexican economy remains in recession. Since the three straight quarters of decline were just enough to offset a growth in the first quarter, GDP in the fourth quarter was unchanged from the same period one year earlier.

Brexit: The EU has officially accepted Brexit; the U.K. does so tomorrow. Now the focus turns to trade. The U.K. will be talking first to the EU but there is also attention being paid to the U.S. We expect Washington to be very tough on the U.K., especially in light of the Huawei (002502, CNY 2.99) decision. The EU appears to be following the lead of Westminster on this issue, which will further anger the U.S.

Odds and ends: There is an oil tanker on fire in the Persian Gulf; however, it appears to be empty and this may be a case of mutiny. According the reports, the crew has been stuck on board the vessel for more than a year due to an ownership dispute. The fire many have been set by the crew to get off the ship. Since they were evacuated, we would have to say it appears to have worked. USCMA is official. And, some good news…U.S. life expectancy has reversed a four-year decline and rose in 2019.

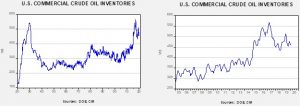

Energy update: Crude oil inventories rose 3.5 mb compared to a forecast rise to 0.1 mb.

In the details, U.S. crude oil production was unchanged at 13.0 mbpd. Exports rose 0.1 mbpd while imports rose 0.2 mbpd. The rise in stockpiles exceeded forecasts.

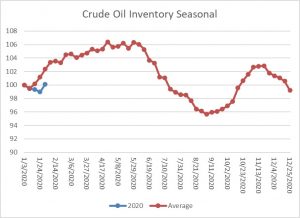

This chart shows the annual seasonal pattern for crude oil inventories. This week’s rise was consistent with seasonal patterns, although the level of inventory accumulation continues to lag historical norms. As the chart shows, oil inventories usually rise into late spring and then decline significantly into late summer. Last year, this pattern was disrupted to some extent because of exports.

The biggest surprise in the data was the sharp drop in refinery operations, which plunged 3.3% relative to expectations of a 0.7% drop.

The seasonal trough usually occurs in mid-February. Refinery demand will likely remain soft until early May, which is a bearish factor for oil prices.

Based on our oil inventory/price model, fair value is $63.37; using the euro/price model, fair value is $50.47. The combined model, a broader analysis of the oil price, generates a fair value of $54.41. We are seeing a steady fall in all of the fair value calculations, as the dollar strengthens and oil inventories rise. However, the combined model is now in line with current prices so we may see some consolidation in the coming weeks.

Daily Comment (January 29, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

BREAKING: Houthi rebels claim they launched a drone and missile attack on Saudi oil facilities; oil prices have rallied on the news.

It’s FOMC Day! As we noted yesterday, we don’t expect much from the statement, but the press conference could be interesting. Developed equity markets continue to recover. We update on the coronavirus. More on the U.K. The CBO projects the deficit. We are also monitoring some reports out of Afghanistan. An update on Spain. Here are the details:

The Fed: To recap, we don’t expect any change in policy. In fact, in the statement, we shouldn’t see any reference to balance sheet expansion, since the Fed continues to insist that it isn’t QE. However, we could see some hard questioning on the balance sheet in the press conference. One potentially bearish factor would be if the Chair signals that the expansion will be taken away anytime soon. There should also be some discussion of the coronavirus and the potential impact on monetary policy. We expect Powell to suggest that the FOMC is watching developments and will move to lower rates if the virus negatively affects growth. Overall, this one should be a snoozer, but if a surprise is going to happen it will be in the press conference.

Coronavirus: Hong Kong reopened today and the Hang Seng fell a bit less than 3%. To date, nearly 6,000 cases have been confirmed and more than 130 have died. Thus far, there have been no fatalities outside of China. The U.S. has offered to send CDC officials to assist the Chinese government; so far, Beijing has not responded. Countries are steadily restricting travel to China; British Airways (IAG, GBP, 5.918) has suspended flights to China. The U.S. is considering a total ban on air traffic to China. The U.S. and Japan have removed its nationals from Wuhan; the Americans have flown to Anchorage where they will be tested for the virus in a secure terminal. They will eventually arrive at March Air Reserve Base in Riverside, CA. In general, this virus appears to be more easily transmitted compared to SARS, but much less deadly. SARS killed about 10% of those affected; this virus appears to be fatal to 2% to 3%, so far. China has confirmed cases of foreigners infected within China. Markets are still dealing with the potential economic impact of this virus, but there are three areas that are clearly affected—travel, tourism and movies.

U.K.: We continue to monitor for fallout from the Johnson government’s decision to accept Huawei (002502, CNY 2.99), defying a U.S. ban. The fear is that if the U.S. doesn’t retaliate strongly, the EU will likely follow the same path. Germany is considering accepting equipment from the Chinese firm under threat from Beijing that it will face auto tariffs if it complies with U.S. demands. In some respects, Europe is in a very difficult spot. The Eurozone has essentially become a “greater Germany” in economic terms. In other words, as Germany has become dependent on exports, so has the rest of the Eurozone. That means other nations can affect the Eurozone economy by reducing the amount of goods they buy from the region. At the same time, its defense capabilities are modest at best, so the EU still depends on the U.S. for security. Europe seems to be betting that the U.S. won’t inflict costs high enough compared to the loss of future 5G.

Bolivia: Last October, Evo Morales, the former president of the country, fled into exile in Mexico after he was denied the right to run again for office. Jeanine Anez took over as interim president with promises to step down once elections occurred. Apparently, she has developed a fondness of the office as she has announced her candidacy. This decision will be controversial, as she is seen as a divisive figure. Elections are not due until Oct. 20.

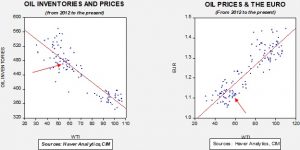

The deficit: The Congressional Budget Office has updated its forecast for the deficit. The numbers are large.

In general, deficits around 5% of the GDP are usually associated with recessions. To have deficits at this level late in an expansion suggests the deficit will expand even further when the inevitable recession occurs. Still, it’s important to remember that the impact of deficits is dependent upon the level of unused resources in the economy. The fact that we can run deficits of this magnitude without serious inflation ramifications suggests that there is still ample slack in the economy. The dollar’s strength in the face of these deficits suggests there are no concerns about capacity to service the debt. So, for now, this situation isn’t a problem.

A situation we are monitoring: The U.S. has confirmed that an E-11A crashed in Afghanistan on Monday. The aircraft is used by the Air Force for communications. The Taliban has claimed it shot the aircraft down; the U.S. has denied the claim. According to reports, SEALS recovered two bodies and the black box and destroyed sensitive equipment. Iranian and Russian media are reporting that the senior CIA officer that was responsible for the operation that killed Qassim Soleimani died in the crash. The U.S. has not confirmed these rumors. We have doubts over the veracity of these reports. Misinformation is rather normal with these sorts of things. However, we will continue to watch to see if there are further developments.

Troubles in Catalonia: Unity among pro-Catalan independence parties suffered a blow on Wednesday, after Catalan President Quim Torra called for new regional elections. The move is in response to the President being stripped of his voting rights after the Spanish Court and Central Electoral board found him guilty of disobeying electoral rules. In December, President Torra was found guilty of disobedience for his refusal to remove banners in support of jailed pro-independence leaders. New elections highlight the growing fractions between separatist parties, the Republican Left of Catalonia (ERC) and Junts Per Catalonia (JxCAT). Although the two sides agree on Catalan independence, the groups represent opposite sides of the political spectrum. The political storm has yet to cause uncertainty within Spain, but highlights the growing differences between the two sides.

Keller Quarterly (January 2020)

Letter to Investors

You don’t need me to tell you this, but 2019 was an unusually good year for the public financial markets. Virtually every market rebounded nicely from the sharp sell-offs that occurred in late 2018. How broad was the advance? Confluence Investment Management’s Asset Allocation team tracks 12 major asset classes globally, consisting generally of domestic and foreign stocks, domestic bonds, real estate, commodities, and cash. In 2018 only two of these asset classes had positive total returns: U.S. Treasury bonds and cash.[1] 2019 was a different story entirely: all 12 asset classes had positive returns in the calendar year. In fact, only three of the 12 asset classes failed to provide a total return of at least 10% (U.S. Treasury bonds, commodities, and cash). Yes, 2019 was truly an unusual year.

Such a year raises expectations for the following year, inasmuch as most investors seem to peg their expectations to the market. So, what’s ahead for 2020? If you read my October 2019 letter, you know I can’t answer that question. We cannot predict the future. As I noted in that last quarterly letter, it seems odd to have to say that, but so many people seem to believe that investing is all about making accurate forecasts of future events. We believe that to invest according to a prediction of the future is pure speculation. Rather, we hold that investing in an uncertain world does not depend upon a prediction, but upon a process. It is our view that a successful investment process is one that enhances the probability of favorable outcomes.

Confluence has recently begun producing podcasts, which are available on our website. I would particularly encourage you to listen to podcast episodes #5 and #6, which discuss the importance of utilizing a repeatable investment process in order to enhance the probability of success in an uncertain investment world. At Confluence, we have worked hard over the years to create processes that we believe improve the probabilities of good investment returns. We work equally hard to consistently apply those processes day after day, year after year.

In episode #6, I liken a good investment process to that of a good batter in baseball. Good batting form and approach improve the odds of success, but don’t guarantee it. (Indeed, an excellent batsman still fails in about 70% of his at-bats!) Likewise, in investing, a good process improves the odds of success, but doesn’t guarantee it.

The reason there are no guarantees in investing is that randomness is always with us. (Statisticians say randomness for what most of us call luck.) A good batter may put a good swing on a pitch and hit the “daylights” out of the ball yet hit it right at a fielder. But, often, a good batting approach will result in a hit. We seek to do the same in investing. A good investment process may still result in a less-than-good outcome due to the vagaries inherent in the world of investing, but we believe the probabilities of good outcomes are enhanced by a consistently applied process.

Thus, even though we don’t know what will happen in 2020, we feel confident that consistent adherence to good processes will improve the probabilities of good outcomes. We don’t know whether the economy will fall into a recession this year or who will be elected president in November, but we must manage client assets regardless of how these events unfold. Success, or the lack thereof, will not depend on whether we “guessed right,” but on whether we stuck to our processes. That’s how we look at the coming year. It may not be as exciting as a newsworthy forecast, but, unlike predicting the future, it is something we can do.

We appreciate your confidence in us.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer

[1] This and all other references to asset class performance in this letter are based on total returns of generally accepted market indices for each asset class.