by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] Here’s a recap of the weekend news:

Italy bails out two banks: Veneto Banca and Banca Popolare di Vicenza were declared failed by the ECB on Friday. Over the weekend, the Italian government bailed out the banks, shielding senior bondholders from losses. EU rules are designed to force private investors to bear the first losses and so shareholders, junior bondholders and senior bondholders bear losses in that order. Italy was able to inject public (taxpayer) money into the two banks before the bondholders faced losses by invoking the “public interest” loophole in the regulation—essentially, if a Eurozone government decides that following the normal liquidation procedure would lead to undue economic stress. The Italian government sold the two banks to Intesa Sanpaolo, another Italian bank. To transact the deal, the buying bank received €4.8 bn and also received €12.0 bn in additional guarantees. It should be noted that these two banks are rather small—they only hold 2% of Italian bank deposits. Of course, if the Italian government is willing to go to the mat for two small banks, it suggests that larger banks will almost certainly be bailed out, too. The EU did approve the bailout but to not do so would have created a political crisis between the EU and Italy, and the fear was that it might trigger a broader run if the two banks failed. The real takeaway from this bailout is that the EU is rather powerless to stop a national authority from bailing out a bank, short of the ECB refusing to act as lender of last resort. The bigger risk for the EU is that other nations will flout the bailout rules too and further weaken the Eurozone banking system.

Qatar rejects ultimatum: Qatar, faced with a set of demands from the GCC to end the blockade, rejected the ultimatum. It is not clear what the “or else” will be from the GCC. Qatar still has a strong ally in Turkey, which could be using the dispute to undermine Saudi Arabia’s push to dominate the Sunni world. Although President Trump has supported the GCC against Qatar, Secretary of State Tillerson has been much more critical of the GCC and has been pushing for reconciliation. In fact, Tillerson has canceled a trip to Mexico this week to work on this situation from Washington.

Saudi security forces thwart an attack on Mecca: The NYT reports that Saudi security forces have prevented an attack on Mecca. The sponsor of the attack wasn’t announced but apparently there were three militants. Two were met in Jidda and one near the Grand Mosque. The latter was a suicide bomber who detonated his weapon, wounding 11 people. A successful attack on one of Islam’s most holy places would be a “black eye” for the kingdom, which gains part of its legitimacy from protecting the holy sites.

Crackdown on the crocodiles: Chairman Xi is going after a number of the large conglomerates in China, sometimes called “crocodiles.” The official reason seems to be that these companies are rather leveraged and there are concerns that they could trigger a financial crisis if lending isn’t curbed. However, it should be noted that all these firms are aggressive foreign investors and Xi may be going after them in order to contain capital flight. And, like any purge in China, there is likely an element of political control as well. This may be akin to Putin’s aggression against the oligarchs in Russia.

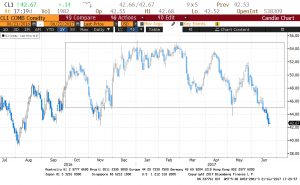

A rogue order hits gold: Gold prices are sharply lower this morning, much weaker than the action in the dollar would support. Bloomberg[1] reports that at 9:00 am London time (4:00 am EDT), a massive 1.8 mm ounce order hit the Comex, leading to an 18,149 contract order. An hour later, the trade was 2,334 contracts. This has the classic look of a “fat finger” order, a mistake. However, in a world of trading algorithms, this order could have been triggered by a computer with little human oversight. Although these algorithms make the markets more efficient, they do create vulnerabilities to large market moves that may be unrelated to news or market conditions.

____________________________________________

[1] https://www.bloomberg.com/news/articles/2017-06-26/gold-plunges-as-1-8-million-ounces-traded-in-a-new-york-minute?cmpid=socialflow-twitter-business&utm_content=business&utm_campaign=socialflow-organic&utm_source=twitter&utm_medium=social