by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Investors today continue to focus on pandemic lockdowns being eased around the world, including the reopening of schools in much of Europe, but a bit of caution is rising as some countries and localities are seeing a rebound in cases. As always, we review the key pandemic and related news below.

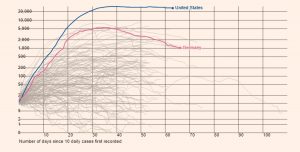

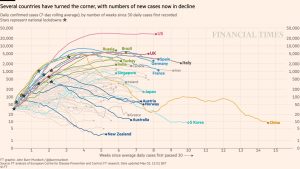

COVID-19: Official data show confirmed cases have risen to 4,201,921 worldwide with 286,835 deaths and 1,467,412 recoveries. In the United States, confirmed cases rose to 1,347,936 with 80,634 deaths and 232,733 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- In Wuhan, China, where the coronavirus first began to spread, the municipal government has launched a 10-day push to test all residents for the virus, following the discovery of a cluster of infections a full month after its lockdown ended. The discovery ended a 35-day stretch of zero new locally transmitted cases in the city.

- The new infections in Wuhan come as other places around the world, including South Korea and India, have also seen a rebound in cases after easing their lockdowns.

- The rebound in cases highlights the risk of asymptomatic carriers sparking a resurgence of infections after lockdowns are eased. That danger has taken some of the air out of risk assets in recent days. However, it remains a question whether that risk will outweigh the impatience for easing felt by many individuals and businesses around the world.

- Russia reported its tenth straight day of more than 10,000 new coronavirus cases and a record number of daily deaths from the virus, making it the world’s second-most affected country after the U.S. Even as President Putin announced federal lockdown orders would be eased, Moscow and many local authorities tightened their quarantine rules yesterday, including making face masks and gloves mandatory on public transport and in shops.

- Comparing actual total deaths to normal rates in March through May, a study by the CDC estimated the virus has killed thousands more people in New York City than the number officially listed as confirmed or probable. The study’s methodology would likely capture not just those who died directly from the virus, but also those who died of health problems that were exacerbated by it or the epidemic, including those who died because they couldn’t get admitted to an overwhelmed hospital.

- Japan has become the second country to grant emergency approval of the antiviral drug remdesivir to treat critically ill patients with COVID-19. Prime Minister Abe also said a drug known as avigan, from Fujifilm Holdings (FUJIY, 48.68), is in line for clearance by the end of the month.

Real Economy

- Elon Musk, CEO of Tesla (TSLA, 811.29), yesterday said his company is resuming car production at its sole U.S. plant in California in defiance of a county order that the facility be limited to “minimum basic operations” until it gets approval of an operating plan that would protect its workers from the coronavirus.

- In spite of Musk’s bravura in announcing the production start, it may not be quite the act of defiance it seems. Over the weekend, Tesla filed suit in federal court to be allowed to resume operations, and that court could potentially block the county order at any time. Besides, the company was reportedly planning to submit its plan for review as early as Monday, and it could be approved quickly. Finally, California Governor Newsome noted that Tesla would likely be allowed to restart production next week anyway.

- All the same, Tesla’s production restart escalates the pushback against state lockdown measures, which until now had been largely confined to relatively limited groups of individuals and small businesses rather than publicly traded companies. It could therefore help accelerate the ongoing moves to gradually lift restrictions, although it could also open Tesla to expensive lawsuits, especially if workers feel forced back to the assembly line or if an employee becomes sick and dies.

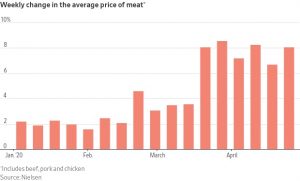

- Touching on the emerging debate about whether the pandemic will lead to higher or lower inflation, China’s April producer price index was down 3.1% year-over-year compared with a decline of just 1.5% in the year to March (see tables below in Foreign Economic News). The April CPI was up 3.3% on year compared with 4.3% in the previous month. The cooldown in inflation came mostly from a collapse in commodity prices and weakening demand. In the U.S., the latest CPI data also show weakening inflation. However, the question is whether inflation in the longer term will remain lower, or whether problems like supply restrictions will lead to less efficiency and higher prices. The long-term outlook for inflation will have a significant impact on monetary policy and bond prices going forward.

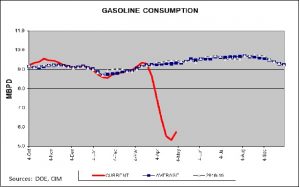

- Bernard Looney, the new CEO of British oil giant BP (BP, 23.50), warned that the hit to crude oil consumption was likely to endure beyond the pandemic, and that the world therefore may have already passed “peak oil” demand.

Financial Market Impact

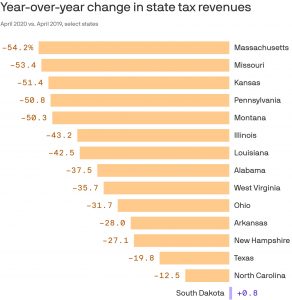

- Data from the Wilshire Trust Universe Comparison Service shows public pension plans in the U.S. lost a median 13.2% in the three months ended March 31, slightly worse than the previous record decline in the fourth quarter of 2008. Despite a partial rebound in performance since the beginning of April, the loss will likely make pension costs even more burdensome for states, counties, and cities going forward, which will probably impact their creditworthiness for years.

U.S. Policy Response

- The next round of federal fiscal support for the economy, which Democrats in Congress hope to introduce as early as this week, may allow local news outlets to participate in the Payroll Protection Program of small business loans being run by the SBA.

- According to a survey conducted by the Global Business Alliance, which represents U.S. subsidiaries of groups including BMW, Nestlé, and HSBC in Washington, 77% of its members said they thought the U.S. would become more protectionist on trade, cross-border mergers and acquisitions, and government procurement because of the pandemic.

Foreign Policy Response

- Germany’s main business organization has signed on to a call for more “fiscal solidarity” in Europe, in a sign of widening support in Berlin for a bigger German contribution to the EU’s post-coronavirus recovery.

- Germany, like several other high-saving countries in Europe, fear that grants or other aid to debtor countries in southern Europe will be squandered, but they are probably also beginning to fear a prolonged loss of markets if the southern countries can’t recover soon.

- That trade-off was brought into stark relief last week, when Germany’s constitutional court challenged the European Court of Justice over its approval of the ECB’s massive bond-buying program. Even many conservative Germans have said the German court’s move went too far in challenging the Euro system and the primacy of EU law over member states’ law.