Daily Comment (April 27, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning and happy Monday! It’s central bank week; the BOJ has spoken, while the Fed and ECB meet later this week. Equity futures are pointing to another higher opening and there are widespread reports of nations easing social distancing measures. Oil prices are falling. We update the COVID-19 news. Here are the details:

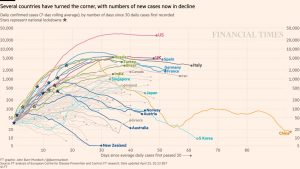

COVID-19: The number of reported cases is 2,982,933 with 206,8111 deaths and 881,635 recoveries. In the U.S., there are 965,933 confirmed cases with 54,877 deaths and 107,045 recoveries. Here is the FT chart:

The virus news:

- The WHO announced over the weekend that there is currently “no evidence” that people who have been infected by COVID-19 have developed antibodies that protect them from reinfection. There has been speculation that once a person is infected by the virus that a degree of immunity would be conferred. That would allow governments to use serological tests to determine the degree of immunity and maybe issue “passports” that would allow those with immunity to return to normal activities. However, that assumes that once infected, a person would be protected. There has been evidence of those who were previously infected having caught the virus again. In that regard, COVID-19 may behave like the common cold or influenza.

- Despite these concerns, there has been a rush to develop tests to determine who has been infected. Sadly, their reliability remains suspect.

- The FT has published a report that argues the death toll from COVID-19 could be 60% higher than reported. The study compares average death rates across 14 countries to normal and assumes increased death rates are likely from the virus. The statistical counts we report each day should be treated as estimates; as an example, the spread between estimated fatality rates from the 1918 Spanish influenza varies widely even more than a century after the event. This article’s methodology clearly has flaws (not all of the deaths above average have come from the virus), but it does act as a check on the official data.

- Although global mortality continues to show that age is a risk factor, doctors in the U.S. are reporting that young people who have been infected with COVID-19 are facing blood clotting issues and are suffering from strokes. Although the number of cases isn’t large, it is occurring with enough frequency that researchers are documenting the phenomena. In what may be a related story, the autopsy of the Santa Clara County woman, who was the earliest confirmed fatality from the virus, concluded that she died of a massive heart attack that led the sack around her heart to fill with blood and “rupture.”

- Another twist to COVID-19 is that it seems to undermine lung capacity well before those infected discover it. Patients infected with the virus will have oxygen saturation readings well below the normal 94% to 100%. Some are reported to have saturation as low as 50% with only mild symptoms. The reaction, known as “silent hypoxia,” means that those infected are quite sick but don’t have the classic symptoms such as shortness of breath. By the time they have noticeable trouble breathing, their oxygen saturation is at dangerously low levels and can progress to critical status quickly.

- Boris Johnson is back to work.

- Nursing homes continue to be an area of concern everywhere; France has been especially hard hit.

The policy news:

- The Fed meets this week. We do not expect any policy action to be announced given the huge actions already taken. So, don’t expect much in the statement. The press conference, on the other hand, could be interesting. We are watching for two things—first, how does the chair handle the negative interest rate question, and second, what about expanding the municipal bond backstop? On the first, expect the Fed to demur; on the second, expect promises to help if necessary.

- The Small Business Administration has moved to not allowing hedge funds or private equity firms to acquire small business rescue loans. It is also limiting the ability of firms owned by private equity to borrow on the payroll protection program. Hospitals purchased by private equity firms are demanding bailouts or they are threatening to close in the midst of a pandemic. Meanwhile, there is a “shaming” underway for larger firms that are taking bailout funds. The popular view is that the bailout money is helping the local bar and grill; in reality, anytime the government offers money, all sorts of people will line up to take it. And, helping larger firms can reduce the impact on unemployment. But this isn’t how the public frames the debate, so larger firms are caught; do they take needed funds and risk the public relations backlash, or forego the money and hurt their companies?

- Another twist is that bankrupt companies can’t get stimulus money. This decision might actually be very bad for energy companies.

- States are starting to reopen, but slowly. To a great extent, governors and mayors are trying to balance public safety with the need for economic growth. Complicating matters, as we noted in the virus news, is that we don’t really know everything about COVID-19. Thus, what may seem like a reasonable decision could look like a terrible mistake in the eyes of historians years from now. The news of reopening is helping equities this morning.

The economic news:

- In our memory, we can’t ever remember government-related entities issuing dire forecasts for the economy. Whether it be the IMF, OECD, World Bank or the Congressional Budget office, we rarely see a forecast of bad news. However, recently, we have seen the IMF and the World Bank issue bearish forecasts. The CBO has just forecast a deep decline in GDP for Q2.

The snapback in Q3 is mostly a function of annualization. The key point to focus on is the level of GDP. Note that the level of GDP remains below the recent peak of $21.7 billion reported in Q4 2019. According to this forecast, nominal GDP won’t reach the peak this year.

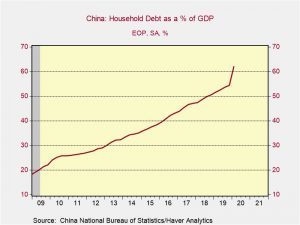

- Chinese households have been increasing their debt in recent years. Although the level remains below that of the U.S., which is around 75% of GDP, the slowdown caused by COVID-19 is increasing pressure on China’s households.

- Banks are preparing for U.S. households to stop paying on credit cards due to the economic slowdown.

- Global trade fell again in February. Growth has been slow since late 2018.

- The shutdown has wreaked havoc for perishable food supply chains. There were lots of stories over the weekend about farmers ploughing under crops, while food bank demand remains elevated. The problem is mostly logistical. The food service system is designed to supply various groups—some retail, some commercial. The latter has mostly been shut-down restaurants. And, in related news, all that beer sent to stadiums for Opening Day and to bars for St. Patrick’s Day is now languishing and at risk of going stale.

- Although COVID-19 continues to dominate the news, companies are rethinking supply chains for the world after the virus. Deglobalization is the likely trend and firms are looking to adjust. This action will also bring government involvement; the Pentagon has invested in the only U.S. rare earths mine in California. Deglobalization will likely have a large impact on the profitability of technology hardware firms, which depend on China for their supply chains.

- There is baseball! But, only in Taiwan. This report shows what baseball in the time of coronavirus looks like.

The market news:

- As fear recedes, investors are returning to the markets in search of yield. Asset-backed securities and structured notes are making a comeback. Emerging market bonds are also finding flows.

- S&P has declined to downgrade Italian sovereign debt. There were fears the credit rating agency would reduce Italy to below-investment grade, which would have made it difficult for the ECB to buy Italian bonds.

The foreign policy news:

- Under pressure from Beijing, the EU has apparently made deep revisions to a report critical of China’s disinformation surrounding COVID-19. It appears European countries were worried the criticism would lead Beijing to punish European companies operating in China. According to reports, China warned the EU three times to soften its criticism of China’s handling of COVID-19.

- The BOJ left rates unchanged but has removed caps on buying JGBs and is also planning to buy corporate debt. Thus, the bank is relying on QE rather than rate cuts for stimulus. The JPY didn’t budge, so the actions were likely anticipated. Meanwhile, the ECB is expected to start buying bonds below investment grade. And, the PBOC promises to support the Chinese economy, although its actions thus far have been modest, at best. As an aside, China’s major macroeconomic problem is the lack of demand caused by income and wealth inequality. The long-term solution is to rebalance the economy toward domestic household consumption and away from exports and investment.

- It’s not just U.S. states and cities that are reopening; Europe is, too. Italy is allowing some activities to return but is also planning methods to encourage citizens to stay within the bounds of the new rules.

North Korea: As promised, we continue to monitor developments tied to the disappearance of Kim Jong Un. South Korean Defense Minister Jeong Kyeong-doo indicated that North Korea has increased inspections of its artillery’s readiness and has been increasing air force operations. The most threatening part of North Korea’s military is its artillery. Massed along the border, it could cause serious damage to Seoul and would take a major air campaign to suppress. The fact that it is holding inspections and increasing combat readiness could be indicating preparations. We also note that China has suspended some rail traffic in Dalian. Although this move is probably in response to COVID-19 infections, Dalian is close enough to North Korea that if the PLA needed to move troops to the border, it would probably use trains from this major port city.

The site 38o North is reporting that a train known to be used by the Kim family has been at the Wonsan compound since April 21. This merely shows that the train is in place but doesn’t indicate anything about Kim’s condition. Media accounts continue to conflict. Sources in Hong Kong and Japan have reported that he is in a vegetative state. South Korean media continues to report that Kim is “alive and well.” Reuters reported that China has sent a team of doctors to advise on Kim’s condition; if this story is accurate, it lends credence to the idea that the “young general” is suffering a serious medical problem. So, what do we think? First, it is really hard to know what is going on in North Korea; it isn’t called the Hermit Kingdom for nothing. Second, we find it a bit odd that a young man could have such terrible heart disease. It’s not unprecedented, but unusual. Third, it is quite possible that COVID-19 is running rampant through North Korea and Kim has decided to evade the public in order to avoid infection. Kim has disappeared before, sparking rumors, only to return later. Simply put, we don’t know and neither does anyone else outside of the Kim family.

As we reported last week, if Kim is indeed dead or incapacitated, it isn’t clear who would be next in line to the “throne.” North Korea is a dynastic kingdom acting as if it is Marxist. Although Kim has a sister who plays a prominent role in the government, we have doubts that the Korean people are ready for a “queen” to rule. Both China and South Korea fear a breakdown of the regime, worried that it might trigger a refugee crisis.

Turkey: Ankara riled the U.S. and NATO when it purchased the S-400 missile system from Moscow. The system has been delivered but President Erdogan has decided to “leave it in the box” for now. The U.S. is prepared to invoke the Countering America’s Adversaries Through Sanctions Act (CAATSA) against Turkey for buying the S-400. Turkey’s collapsing economy is likely leading Ankara to avoid deploying the missile system and triggering the CAATSA sanctions. Turkey has also approached the Fed about a currency swap line. Given the turmoil in the region, Erdogan has apparently concluded that angering the U.S. is a bad idea and decided that the benefits of the missile system do not outweigh maintaining relations with Washington.

China: The U.S. has pulled its heavy bombers from Guam. The Air Force has had nuclear weapons-capable bombers on Guam since 2004. The DoD argues that both North Korea and China have missiles that can reach Guam, putting the bombers at risk. In addition, they can still attack both targets from North Dakota and Missouri and not be at risk from the same type of missile attack. At the same time, the symbolism of the U.S. removing these assets will not be lost on U.S. allies in the region.

China has arrested five former employees of Huawei (002502, CNY 3.31) who claimed on social media that the company did, indeed, sell products to Iran, violating U.S. sanctions. This news comes at a time when public opinion of China is falling rapidly.

Iran: In a twist, the U.S. is arguing that it remains a participant in the Iran nuclear deal. This is being done to press the U.N. Security Council to extend the arms embargo or increase sanctions. The current ban expires in October and Washington is likely worried that trade with Tehran will rise after the expiration. The U.S. is using this ploy to trigger the “snapback” provisions of the agreement. This situation will become more important as summer ends. Stay tuned…