by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy productivity day! Lots of news this morning; here is what we are watching:

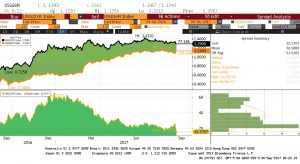

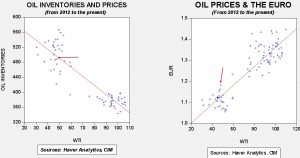

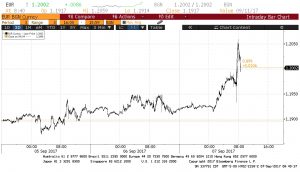

The ECB: The ECB’s statement was a repeat of the one from a few weeks ago. In the press conference, the reporters focused most of their questions on the exchange rate. President Draghi deftly fended off these questions by not commenting on any particular level and by discussing the exchange rate outside the parameters of broader policy goals. In response to the lack of direct opposition to the recent rise in the EUR, the currency rose rather sharply, shown in the chart below.

The fact that policy didn’t change and there is no indication that policy will markedly tighten anytime soon, the EUR’s rise suggests that (a) the financial markets realize the EUR is still undervalued (we put fair value around $1.300), and (b) the dollar’s weakness is originating from the U.S. and not from abroad.

The Trump Shuffle: President Trump stunned the GOP leadership (and probably much of the party) by cutting a deal with the Democrat Party leadership to pass a short-term debt ceiling bill. House Minority Leader Pelosi and Senate Minority Leader Schumer engineered a deal that will raise the debt ceiling but only until December. The media is full of reports from GOP activists apoplectic about this turn of events. Although the degree of anger is understandable, we are somewhat surprised by the shock. Our position has been that our two-party system is a program of enforced coalitions; history shows that these coalitions change over time. The GOP houses a number of different factions. The GOP establishment is mostly center-right; supportive of markets, deregulation and moderately conservative on social matters. This group is generally resigned to large government and thus wants to shape that government to its own ends. There is a small government faction, often called the “Tea Party” and includes the Freedom Caucus in the House, that wants to return government to the pre-Roosevelt period; Grover Norquist is the key leader of this group. Social conservatives have also gravitated to the GOP. The key to Trump’s victory was wooing the disaffected white working class voters; traditionally Democrats, this group has discovered that the Democrats are focused more on identity rather than class. In other words, the Democrat Party leadership will celebrate differences in culture while purposely ignoring economic issues. This explains why the Democrat leadership was caught flat-footed by the rise of Bernie Sanders. Trump promised to restrict globalization (in both trade and immigration) and increase government support (he wanted a bigger health care program and infrastructure spending).

After the election, the GOP leadership wanted to accommodate the goals of the Tea Party and the establishment through tax cuts and spending reductions. Although Trump wasn’t necessarily opposed to these measures, his focus was on the white working class. When the Freedom Caucus wanted to tie spending cuts to the debt ceiling increase and was willing to risk hurricane aid to get what it wanted, Trump decided to get a better deal from the opposition party. Although the media is suggesting Trump has no ideology,[1] we would suggest otherwise; he wants to help the working class who have been harmed by a nearly four-decade bipartisan policy of deregulation and globalization. Note that he characterized the GOP health care plan as harsh and is ok with tax cuts, but has no worries about the deficit. In other words, he sees no need to cut spending.

Although other presidents have “triangulated” between their own party and the opposition (Bill Clinton was a master at this), we see Trump as doing something different. He is creating conditions that will lead to a realignment of party coalitions. We don’t know how that will evolve; third parties might emerge for a time. It’s important to remember that the Whig Party existed from 1834 to 1854 but was unable to hold together (slavery led to the dissolution). A multi-ethnic (or, perhaps, multi-identity) working class party and a market-oriented party of globalization and deregulation could emerge.

In the short run, although the debt ceiling issue is probably off the table for now, it will return soon enough. For the opposition party, making the majority vote to raise the ceiling multiple times before the midterm elections is a favorable outcome. However, Democrats should be careful in how they embrace the president. If Trump can craft a protectionist policy and raise infrastructure spending, he could woo some Berniecrats and widen the divisions within the Democrat Party as well. In our opinion, the key point here is that the party coalitions are shifting; instead of thinking about party, investors should focus on factions. Conditions will likely become increasingly confusing if one’s thinking remains in the framework of traditional GOP/Democrat characteristics.

Fed Drama: Vice Chair Fischer dropped a blockbuster yesterday by unexpectedly resigning, effective Oct. 13, for “personal reasons.” We have no insight into what those might be, but we note he is 73 years old and the grind of central banking is probably a lot for anyone. Although we expected Fischer to be out early next year, this removes a mainstream voter and a sage central banker from the FOMC. At the same time, Gary Cohn, who was thought to be a lock for the Fed chair job, is apparently unlikely to get the position. The president doesn’t handle criticism well; the very public criticism that Cohn expressed over the Charlottesville issue appears to have changed the president’s mind. The combination of these two events probably means the odds that Yellen gets extended have increased markedly. It is also worth noting that virtually all the candidates for governor positions reported in the media are hawks. We suspect that Trump is figuring this out and has no interest in appointing a hard money person to the Fed. Thus, we would not be shocked if none of the names mentioned are actually nominated and more dovish candidates are recommended by the White House. As noted in the above discussion, the president really isn’t a small government, low inflation person. He is ok with deficits and inflation and it would make more sense for him to choose Fed governors who share those positions. And, we would not be surprised to see Cohn leave soon.

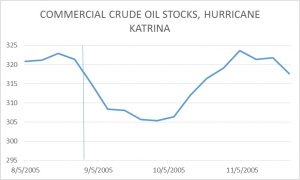

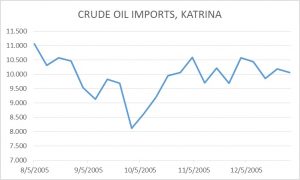

The Tropical Situation: We have three active hurricanes; one will likely hit Mexico, Jose will probably go out to sea, but Irma is another matter. Its forecast path is to hit Florida and then move into the Atlantic Seaboard. Next week, we could see weather disruptions in this region.

[1] https://www.washingtonpost.com/opinions/trump-offers-us-a-glimpse-behind-the-curtain-theres-nothing-there/2017/09/06/c0b30556-933b-11e7-aace-04b862b2b3f3_story.html?stream=top-stories&utm_campaign=newsletter_axiosam&utm_medium=email&utm_source=newsletter&utm_term=.e46d8ed77cf2