Author: Rebekah Stovall

Asset Allocation Bi-Weekly – #92 “Federal Reserve Policymakers in 2023: Hawks or Doves?” (Posted 2/27/23)

Bi-Weekly Geopolitical Podcast – #23 “Chip War” (Posted 2/21/23)

Asset Allocation Bi-Weekly – #91 “Secular Trends In Bond Yields” (Posted 2/3/23)

Bi-Weekly Geopolitical Podcast – #22 “The New German Problem” (Posted 1/27/23)

Asset Allocation Quarterly (First Quarter 2023)

by the Asset Allocation Committee | PDF

- Our three-year forecast contains a dynamic economic environment comprising both a normal recession and ensuing recovery.

- Upon signs of economic fragility, we expect the Fed to suspend its current assertive drive to quell inflation, with the likelihood that policymakers will cease their balance sheet reduction but will not make cuts to the fed funds rate.

- Bond exposures are in the short-term segment as our forecast calls for a flat yield cur stemming mostly from lower rates in the one- to three-year segment.

- The prospect of an economic recovery encourages an increase in equity exposure from the low levels of last year. U.S. stocks continue to be tilted toward value with lower market caps, and strategies are now overweight in sectors that we believe are well-positioned for the recovery.

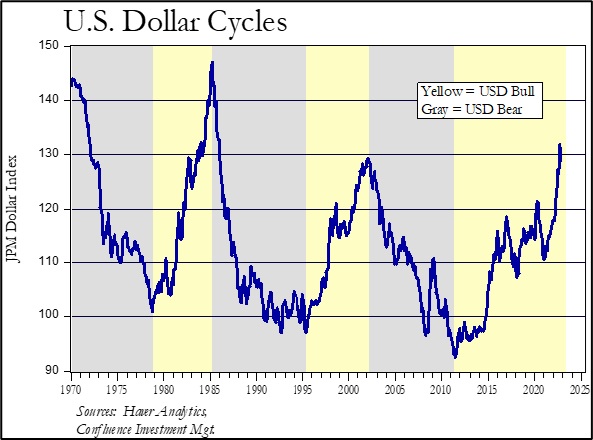

- Compelling valuations of overseas businesses combined with expectations for a weakening U.S. dollar encourage a sizable position in international developed market stocks.

- Broad-based commodities with an emphasis on Energy commodities are retained. The allocation to gold is elevated owing to its appeal as a haven during rapidly changing economic conditions.

ECONOMIC VIEWPOINTS

A broad range of indicators is flashing signs of an impending global contraction and recession in the U.S., the most prominent and oft-cited of which is the inversion of the U.S. Treasury yield curve. The spike in yields across the curve, and particularly in short-term instruments, reflects the surge in inflation over the past year coupled with the efforts of the Fed to harness it. The Fed’s relentless battle against inflation woes have caused it to raise the fed funds rate from its target of 0.25%-0.50% last March to 4.25%-4.50% at its last meeting in December and embark upon quantitative tightening (QT) through the reduction in its balance sheet of $95 billion per month. While many credit these actions with helping to settle inflation in core goods, which was certainly aided by an untangling of supply shortages since the U.S. COVID lockdowns, inflation in core services remains ascendant. The Fed’s pronouncements have been decidedly hawkish as it attempts to slow the economy through dampening demand and targeting the wide gap between job openings and the rate of hiring. The Fed’s latest statements underscore the notion that policymakers will continue to increase the fed funds rate until inflation retrenches to its 2% target.

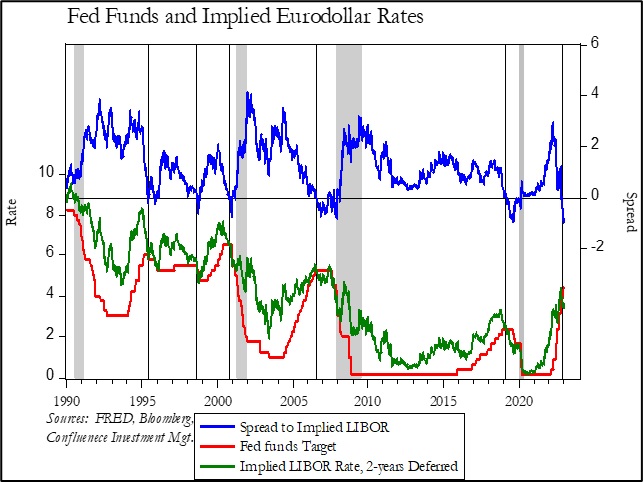

Despite the rhetoric, markets are anticipating a lessening of the Fed’s zeal. As this accompanying chart indicates, the spread between the fed funds target and the implied LIBOR rate, two-years deferred, has been a harbinger of a change in direction for Fed policy. While this has occurred against the backdrop of an overall decline in interest rates over the period since 1990, a negative spread has invariably signaled when the central bank has moved too far, as is now the case to an extreme.

The prospect of a global economic contraction commencing over the next several quarters helped frame our expectations for the overall economy and markets over our full three-year forecast period. Although the Atlanta Fed’s GDPNow estimates for this quarter still exhibit growth, a durably inverted yield curve, elevated inflation, and sentiment point to a recessionary environment in the near term. Confluence’s proprietary Diffusion Index indicates that the probability of a contraction in the U.S. is elevated. Nevertheless, our base case is for a garden-variety recession, as the excesses that were produced in prior severe recessions are absent, owing to the relative brevity of the recent business cycle. Accordingly, our view is that a normal contraction will be followed by a healthy recovery, with the possibility of an expansion toward the end of our forecast period.

STOCK MARKET OUTLOOK

Periods of inflation typically lead to a decline in price/earnings ratios, with both prices and earnings being affected. This is a natural adjustment, as the discount mechanism is elevated for future earnings, especially for longer-duration equities such as certain technology stocks that carry higher earnings expectations further into the future. Moreover, we typically see earnings compression with elevated inflation, not simply due to increased costs of production, but more importantly rises in the cost of labor, which is especially prominent in services. The ability of companies to push rising costs onto consumers has varying degrees of limitation, dependent upon the elasticity of demand for a company’s products or services. Essential products or services obviously have more durable, or inelastic, demand such that costs can be more readily passed onto end users.

With equity markets being anticipatory, we believe the declines experienced in 2022 were handicapping a future recession, to a degree. Although U.S. stocks may dip further, our belief is that most of the negative price movement has largely been already experienced. The Fed’s aggressive battle against inflation has at least indirectly contributed to a relaxation of formerly tight labor markets, as indicated by the recent spate of layoffs from mega-cap technology companies as well as an abrupt slowdown in housing dictated by higher mortgage rates. While it is too early to expect the Fed to pivot on fed funds, our view is that QT will be suspended over the next few quarters. Moreover, the lessons gleaned from March 2020 support our expectation that any relief the Fed may offer in a downturn will be along the lines of the “alphabet soup” type of targeted programs that were offered as support for certain segments at that time as opposed to the blunt instrument of easing fed funds.

The widely anticipated economic slowdown should be normal, by historical standards. Consequently, our three-year forecast is for positive returns for U.S. equities. That expectation extends to and is even magnified for lower capitalization stocks. We expect small cap value stocks with strong free cash flow to perform particularly well, as they typically have when the U.S. has emerged from prior recessions. In addition, we anticipate that an economic recovery within our forecast period will aid the Industrials and Metals/Mining sectors, which are overweight in the strategies, along with the continuation of the overweights to Energy and Aerospace & Defense.

Due to favorable relative valuations of international developed stocks versus U.S. counterparts, combined with the prospect of a weakening U.S. dollar, we are constructive toward international equities. The reconstitution of supply chains and China’s stimulus and emergence from COVID lockdowns further bolster the prospects for developed market stocks, particularly those engaged in the export of commodities. Accordingly, all strategies now hold a sizable position in international stocks, and overweights to Canada and Australia are introduced in the more risk-tolerant strategies of Growth and Aggressive Growth.

BOND MARKET OUTLOOK

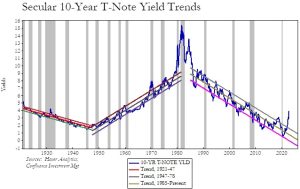

As noted earlier, while we anticipate an end to the Fed’s current QT balance sheet reduction of $95 billion per month, in our view a decrease in the fed funds rate to the former ultra-low levels is very unlikely, even in the face of a recession. While we expect the steep inversion of the U.S. Treasury yield curve to evaporate over our three-year forecast period, it is likely that the curve will flatten through a decrease in yields in the one- to three- year segment in combination with a secular increase in long-term rates, as illustrated in the accompanying chart. Accordingly, the positions in extended duration Treasuries via zero-coupon instruments were liquidated to positive effect after their initiation last quarter as we believe their continued utility has evaporated. All bond exposures in the strategies are now short-term, with the sole exception of the Income strategy, which continues to use a 10-year laddered maturity core, an inviolate part of this strategy’s construction. The short-duration posture among the other strategies also reflects our recognition of the small potential that, in the extreme, a bond market panic could lead to a form of yield curve control.

Within corporates, the brevity of the current economic cycle has not seemed to wreak the excesses experienced during longer expansions, except in the low-rated floating rate instruments. Therefore, we expect only modest widening of spreads among investment-grade and BB-rated corporate bonds, the latter of which are employed moderately as equity surrogates in the more conservative strategies in order to provide a degree of risk control over the next several quarters.

OTHER MARKETS

Despite valuations seeming compelling in REITs with their weak performance in 2022 compared to other sectors of the U.S. equity market, the strategies remain devoid of REIT exposure. The fragmentation of the REIT market and the lack of conviction surrounding the prospects of certain segments encourage our avoidance of the sector over the near-term. On the other side of the spectrum, commodities appear well-poised for a recovery following a normal recession. We retain an exposure to broad-based commodities with an emphasis on Energy commodities across all strategies. In addition, we increase the weighting to gold for its appeal as a haven during dynamic economic environments.

Bi-Weekly Geopolitical Podcast – #21 “How China Will Manage Its Evolving Geopolitical Bloc” (Posted 1/17/23)

Confluence of Ideas – #28 “The 2023 Geopolitical Outlook” (Posted 12/19/22)

Daily Comment (December 14, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the continuing troubles in the global cryptocurrency markets, as well as welcome signs that inflation is continuing to slow even outside of the United States. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the latest on the COVID-19 wave ripping through China and the worsening U.S.-China geopolitical frictions. We also note that the Federal Reserve will release its latest interest-rate decision and economic projections today at 2:00 pm ET.

Global Cryptocurrencies: Investors pulled $1.1 billion out of top cryptocurrency exchange Binance yesterday, bringing the seven-day total of withdrawals to $3.6 billion. Binance CEO Changpeng Zhao played down the withdrawals, which are the firm’s biggest since June, but we still believe they reflect growing investor jitters regarding cryptocurrencies as investors see more revelations of fraud and operational issues at now-bankrupt crypto firms like FTX. Such jitters could lead to further volatility and falling values for crypto assets in the near term.

United Kingdom: Following on yesterday’s report showing cooler U.S. inflation, the U.K. today said its November consumer price index was up 10.7% from the same month one year earlier, marking a modest slowdown from the 11.1% rise in the year to October. Excluding the volatile food and energy components, the November “core CPI” was up 6.3% year-over-year, compared with 6.5% in October.

- The slowdown in British inflation partly reflects the government’s decision to cap energy prices beginning in October. As a result, the October inflation rate was likely the peak for the U.K.

- All the same, cooling inflation readings around the world would likely help encourage the major central banks to slow their interest-rate hikes, beginning with the U.S. today (see discussion below).

European Union-Qatar: Investigators now believe that Qatar’s apparent bribery of European Parliament members, revealed this week, may have been directed toward securing last year’s EU-Qatar “open skies” agreement. That deal gave Qatar Airways (Qatar’s state-owned flag carrier and one of the world’s largest airlines) essentially unlimited access to the European market. European legislators are now looking for ways to scale back the deal.

Denmark: After failing to win an outright majority for her center-left Social Democratic Party in the November elections, Prime Minister Frederiksen said she has agreed to form a left-right coalition government with the center-right Liberal Party and the Moderate Party. This would mark Denmark’s first left-right alliance in decades.

Russia-Ukraine War: Heavy fighting continues along the frontlines in eastern and southern Ukraine, with the Russians continuing to mount air, missile, and drone strikes against Ukrainian civilian energy infrastructure throughout the country. Using their current air-defense weapons, the Ukrainians continue to destroy many of the incoming missiles and drones, reportedly including an entire wave of 13 drones directed at Kyiv yesterday. Nevertheless, the Biden administration is finalizing plans to provide Patriot air-defense missile systems to Ukraine. If the systems are given to Ukraine, they would be the most sophisticated weapons that the U.S. has provided since the war began.

- One issue with the Patriots is that they are in high demand globally, so sending some units to Ukraine would likely mean less units for other locations, at least until more can be produced.

- As with the rest of the money and weapons systems that the U.S. has provided, the benefit would be to shore up Ukraine, a budding ally, and to weaken Russia, a key threat to the U.S., without having to send U.S. troops. Nevertheless, the decision would likely generate pushback from isolationists on the left and right of the U.S. political spectrum.

China: Now that the government has relaxed its strict requirements on COVID-19 testing and quarantines, leading to a massive waves of new infections, it has also admitted that its official infection data is no longer reliable. With so many people no longer being tested, it also announced that it will no longer publish data on asymptomatic cases. Now that the government has essentially decided to let the disease rip through the country, we expect the resulting sickness, self-isolations, and business disruptions to negatively affect the Chinese economy and financial markets, with negative implications for the global economy and markets.

U.S.-China Technology Trade: The U.S. government is reportedly preparing to place more Chinese technology companies on one of its key “entity lists,” which will prohibit U.S. tech firms from selling to them. The firms to be targeted include memory chip firm Yangtze Memory Technologies, also known as YMTC, and surveillance camera producer Tiandy Technologies.

- While the Chinese government had recently begun cooperating with the U.S. in order to confirm that some of its technology firms were meeting the tough new technology transfer rules imposed by the U.S. on October 7, it appears YMTC and Tiandy were not cooperating.

- In any case, the new U.S. action will further exacerbate bilateral relations. It also underscores how much momentum there is in the bipartisan U.S. clampdown on China’s technology sector. That clampdown increasingly appears to be effective and will likely have a noticeable slowing effect on Chinese economic growth.

U.S.-China Military Competition: Although China and Russia continue to lead in the new class of maneuverable, super-fast “hypersonic” missiles, late last week the U.S. Air Force finally scored its first successful test of its own fully operational version, which it has designated as the “Air-launched Rapid Response Weapon.” That test, following a successful test of the weapon’s booster earlier this year, has helped make up for a disastrous 2021, when three straight tests had ended in failure.

- Now that China has built up a conventional military that could potentially prevent the U.S. Navy from entering the waters around China in time of conflict, the competition between the Great Powers is increasingly focused on high technologies like artificial intelligence, supercomputing, hypersonic missiles, and autonomous weapons.

- However, even though the U.S. hypersonic program now appears to be on track, officials at the Pentagon are still debating whether and how it should fit into the U.S. arsenal in the coming years.

U.S. Monetary Policy: The Federal Reserve today wraps up its latest two-day policy meeting, with the decision due to be released at 2:00 pm ET. The policymakers are widely expected to hike their benchmark fed funds interest rate by just 0.5%, to a range of 4.25% to 4.50%, after four straight hikes of 0.75%. They will also release their updated forecasts for key economic indicators and the path of interest rates going forward.

U.S. Fiscal Policy: As Congressional leaders scramble to avoid a partial government shutdown when the current funding law expires on Friday night, top Democrats and Republicans said they have reached a bipartisan framework that should allow for enactment next week of an omnibus spending bill covering the remainder of the fiscal year. Today, the House will vote on an extension of the current funding until next week, and the Senate is expected to vote on the extension shortly thereafter. If implemented, the deal will eliminate the threat of a government shutdown that would likely be negative for the U.S. economy and financial markets.

U.S. Politics: According to a new Wall Street Journal poll, prospective Republican primary voters would favor Florida Governor Ron DeSantis over former President Donald Trump by a margin of 52% to 38%. Among all voters, the poll also found that DeSantis is viewed favorably by a much higher number than Trump, suggesting DeSantis is currently in the driver’s seat for the Republican presidential nomination in 2024.