Author: Rebekah Stovall

Bi-Weekly Geopolitical Podcast – #14 “Political Crises for Top U.S. Allies” (Posted 8/1/22)

Asset Allocation Bi-Weekly – #80 “The Puzzle of the Labor Force” (Posted 7/25/22)

Asset Allocation Quarterly (Third Quarter 2022)

by the Asset Allocation Committee | PDF

- Global growth is clearly slowing and the probability of a recession in the U.S. over the next year is significantly elevated.

- The Fed is continuing its aggressive attack on inflation through rapid increases in the fed funds rate and accelerating its balance sheet reduction.

- Economic data from overseas depicts difficulties, especially in Europe and China.

- The potential exists for defaults of selected emerging market sovereigns beyond Sri Lanka.

- Equity allocations are underweight and bond exposures were increased.

- BB-rated bonds are used as an equity proxy across the array of strategies.

- U.S. stock exposure remains heavily tilted toward value, with overweights to defensive sectors.

ECONOMIC VIEWPOINTS

In June, the World Bank cut its global GDP growth projection for this year from 4.1% to 2.9% owing to a spike in energy and food prices, which in no small part has been influenced by the Ukraine war and the resultant freezing of Russia’s foreign reserves. This has further curtailed supply and trade, which were already constrained by the global pandemic and altered by the general trend toward deglobalization. Deglobalization, coupled with an increase in regulation, could institutionalize a level of inflation above the Fed’s 2% target and lead to shorter business cycles than what we have become accustomed to since 1990.

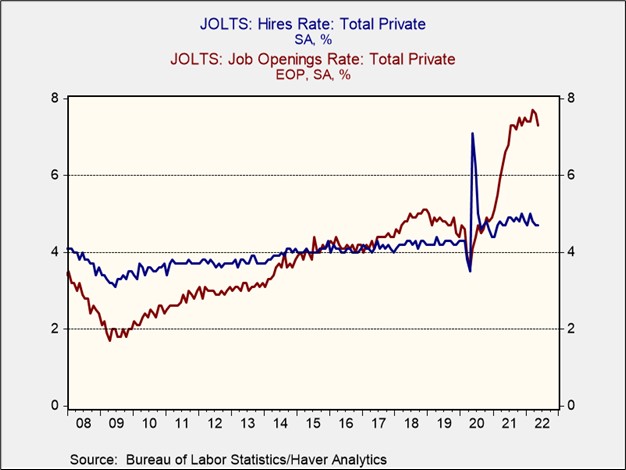

In the U.S., inflation has vaulted higher, with the CPI rising 9.1% year-over-year as of June, the largest annual increase since the end of 1981. At its recent meeting, the U.S. Federal Reserve increased the fed funds rate by 0.75%, the largest single hike since October 1994. In the conference following the meeting, Fed Chair Powell indicated that further rate hikes are in store for the balance of this year and into 2023 with the goal of pulling down inflation to the Fed’s 2% target range. Adding to the dynamic is the Fed’s reduction of its balance sheet, which began in June and is poised to accelerate in September to a monthly rate of $95 billion against the current balance of $8.36 trillion. The Fed’s articulated desire is to quell inflation and reduce the demand for labor without increasing unemployment. As the accompanying chart indicates, the JOLTS openings rate is well in excess of the hires rate. It is this froth that the Fed believes it can remove without aggravating unemployment, thereby accomplishing Powell’s goal of a “softish landing.”

The assertiveness of the Fed, combined with what we find are nascent signs that the spiking inflation is beginning to abate, create fertile ground for a recession in the U.S. The bond market’s inversion of two-year and 10-year Treasury yields underscores the market’s belief that the Fed will pursue its fight too aggressively and stall the economy. It also reflects the dissonance among Fed governors regarding the varying economic consequences of quantitative tightening in the form of balance sheet reduction, increasing the potential for a policy error. We expect inflation to ease within the next few months as the comparative base effects from last year take hold. In addition, we find improvements in supply chains and a satiating of demand from consumers as inventory/sales ratios of merchandise are rising.

Beyond the U.S., the European Central Bank (ECB) is similarly attempting to battle inflation but also trying to maintain tight spreads for rates among its member states. In combatting inflation, which reached a record 8.6% last month, the ECB is expected to raise its deposit rate at its July meeting and perhaps elevate it from negative rates for the first time in over a decade. However, it is simultaneously dealing with fragmentation risk, which is the possibility that yields on debt of some peripheral countries will spike versus German bunds. The ECB is wrestling with these items, while manufacturing data is indicating slower growth and economic sentiment is waning. On the other side of the globe, economic growth in China has slowed dramatically. The world’s second largest economy produced its lowest growth since data was first recorded in 1992 as lockdowns in major cities contributed to the stagnation. Though it is widely believed that the People’s Bank of China will enact stimulus measures to spur the economy, worries abound regarding capital outflows as the U.S. Fed aggressively raises short-term rates. Among other emerging market economies, the risk of default is garnering attention after the government of Sri Lanka defaulted for the first time. Credit default swap spreads across a number of smaller sovereigns that issue debt in hard currencies, such as the U.S. dollar or euro, have spiked significantly, indicating the potential for a contagion effect. As noted in connection with China, capital flows to emerging market economies are at risk under these circumstances.

STOCK MARKET OUTLOOK

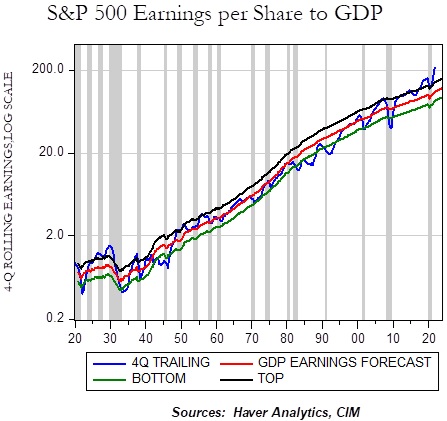

Equity markets have been in retreat for much of the year as investors have been struck by an array of worries including the Ukraine war, supply shortages, an aggressive Fed battle against inflation, and waning consumer and business confidence, among other concerns. Further pressure on U.S. stocks may come from a compression in earnings. As the chart indicates, four-quarter rolling EPS on the S&P 500 as compared to the earnings forecast based upon GDP is well above its historical standard error band. While the trailing figure relative to the GDP earnings forecast has been on a significant upswing recently, we expect this to decrease as financial conditions continue to deteriorate, the cost of labor increases, and prior inflation becomes fully incorporated. Relative to the cost of labor, larger companies may disproportionately contribute as they engage in elevated efforts to retain employees in a tight labor market. The escalating cost of hiring is encouraging firms to retain employees, despite growing wage levels. The result will likely be increased labor costs and lower margins, especially in service-oriented sectors that lack the ability to fully pass on increased costs to consumers. Beyond the effects of fragile global economies on corporate earnings, higher levels of inflation typically portend lower P/E ratios. Persistent inflation could continue to maintain pressure upon equity prices.

Although our base case is a troubled outlook for the stock market over the next several quarters, various fundamental forces could aid prices over our three-year forecast period. A satisfactory resolution of the Ukraine war would be a significant positive for global equities. In addition, a staggering amount of cash remains on the sidelines, both individual and institutional. If the Fed is able to engineer a softish landing or decides that it has fought the inflation battle too aggressively and/or too late and becomes more accommodative, a modest deployment of cash available for investment could prove to be a propellant for equity prices. Finally, a bottoming in the economy followed by a solid uptick created by full digestion of supply imbalances and improving consumer and business sentiment could buoy equity prices. While we acknowledge the potential advantages for U.S. stocks over our forecast period, we don’t necessarily share the sentiment for some international developed or emerging market stocks. Difficulties faced by some European companies as the ECB practices its version of inflation therapy, and the likelihood of reduced foreign direct investment in emerging economies during a period of elevated sovereign risk, may crimp the shorter-term advantages for international equities in these strategies, especially with a surging U.S. dollar.

Given our expectations for the economy and outlook for stocks, we are further constraining our exposure to risk-based assets. Accordingly, the stock allocations in our strategies are lower, and in some cases the lowest since inception. Within these reduced equity exposures, we maintain a significant bias of 65% to value stocks as they tend to outperform as economic growth retreats. There is also less concentration among the top names, where the top five companies in the S&P 500 Growth Index account for 45.2% versus 11.7% in the S&P 500 Value Index. To complement the value skew, we continue the overweight to defensive segments of Health Care and Consumer Staples, as well as Energy. In addition, we believe the Ukraine war has advanced an increase in defense expenditures among developed countries, thus we retain a position in the aerospace and defense industry. Our efforts to reduce risk also apply to international allocations, where the only exposure is in a Japanese equity position that carries a currency hedge back to the U.S. dollar. The thesis leading to this overweight included the relative pricing advantage of Japanese stocks compared to U.S. counterparts complemented by continued policies from the Bank of Japan that are contributing to a depreciating yen. Emerging markets remain absent from all strategies.

BOND MARKET OUTLOOK

Rampant inflation and a motivated Fed would normally imply caution regarding the bond market. Typically, as the Fed is raising rates and emptying its balance sheet, the fundamental forces it unleashes would cause yields to increase and thereby prices on bonds to retreat. Based upon the impact on bond prices thus far in 2022, we believe much of the punishment to bond investors has already been wrought this year. Moreover, the inversion of the yield curve for two-year/10-year Treasuries indicates market participants are becoming convinced that fed funds increases are going to be limited to this year. Accordingly, we hold a positive outlook for the short- and intermediate-term segments of the Treasury curve. However, the sanguine outlook does not completely extend to credit. With the increasing prospect for a recessionary environment in the U.S., we expect spreads to widen for investment-grade corporate bonds closer to historic averages. While we expect these instruments to produce positive returns over our three-year forecast period, the returns will be restrained by the spread widening. We expect a similar dynamic to unfold in the BB-rated space within high yields. However, in lower rated speculative bonds we find the inherent risks outweigh any advantage at this point in the economic cycle. Consequently, the exposure to speculative-grade bonds in all strategies are confined to bonds rated BB, which are used as a lower volatility equity proxy.

OTHER MARKETS

Due to the Fed’s aggressive fight against inflation and the increased potential for a recession, REITs are absent from the strategies. We retain exposure to commodities in all strategies given the utility they offer as portfolio stabilizers as the potential for risk increases. Gold is utilized given its appeal as a haven from heightened geopolitical risk, and a broad basket of commodities, with an emphasis on energy, is also employed across all strategies. The global thirst for energy, especially in Europe as they adjust to sanctions on Russian exports, produces certain advantages for this positioning.

Bi-Weekly Geopolitical Podcast – #13 “The Pandemic’s Impact on Inequality” (Posted 7/18/22)

2022 Outlook: Update #2 – The Tails Become Fatter (July 12, 2022)

by Bill O’Grady, Patrick Fearon-Hernandez, CFA, and Mark Keller, CFA | PDF

In our 2022 Outlook: The Year of Fat Tails, we outlined a forecast with a higher likelihood of events outside the norm. To compensate for the unusual level of uncertainty, we promised to provide frequent updates to the forecast. This report is the second of the year. In the most recent update, we offered four scenarios for the path of monetary policy. Since we published that report in February, the world has seen even bigger changes. The war in Ukraine and the subsequent freezing of Russia’s foreign reserve assets have changed the world in a profound manner that will take years to fully determine. Nevertheless, one change we think is permanent is that globalization as we have practiced it since 1990 is over.[1] That change will have serious ramifications on financial markets.

In the past few weeks, market conditions have changed rapidly. It has become nearly impossible to construct a detailed outlook simply because the details are in flux. In order to offer some structure to our current thinking, this will be a short report with price/yield in an effort to at least provide directional guidance.

Key Forecasts:

- 10-Year Treasury: 3.60% to 3.75%, with caveats about the business cycle (see below)

- S&P 500: Range of 4200 to 3400

- Dollar: Bullish for the rest of the year

- Commodities: Very vulnerable to cyclical factors, but secular trend is favorable

[1] For details, see our Bi-Weekly Geopolitical Reports from March 14, March 28, April 25, and May 9. We also recommend our podcast episodes associated with these reports.

Asset Allocation Bi-Weekly – #79 “The ECB Dilemma” (Posted 7/11/22)

Business Cycle Report (June 30, 2022)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

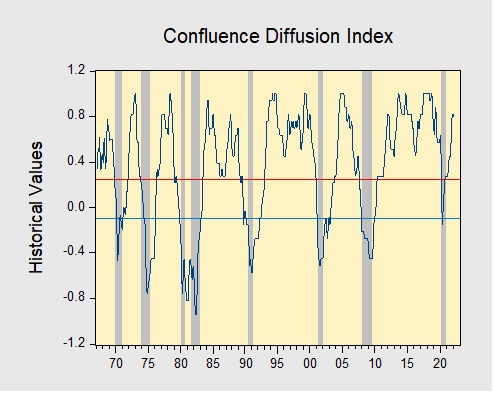

The Confluence Diffusion Index fell for the first time in the expansion. The latest report showed that nine out of 11 benchmarks are in expansion territory. The diffusion index declined from +0.9394 to +0.8789 but remains well above the recession signal of +0.2500.

- Financial indicators were negatively impacted by tighter monetary policy.

- Indicators tied to the goods-producing sector were inconclusive.

- Employment indicators suggests that the labor market remains tight.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the index is signaling recession.

Daily Comment (June 30, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will start with a discussion about remarks made by central bank officials during the ECB forum. Next, the reports will provide the latest update on the Russia-Ukraine war. Afterward, we provide a summary of international news from China, Israel, and OPEC+, and briefly summarize the latest developments in the Democrats’ spending bill. The report concludes with our daily COVID coverage.

Note: Because COVID-19 has become more endemic and in most countries isn’t disrupting the economy or politics as much as it did previously, we will drop our dedicated COVID-19 section beginning July 1. We will continue to cover pandemic news as needed within our main text.

Central Bank News: Several central bank leaders met in Sintra, Portugal, for an annual conference to discuss the difficulties of containing rising inflation. Fed Reserve Chair Jerome Powell and ECB President Christine Lagarde warned that the low inflation era was likely not coming back soon. Powell explained that “different forces” prevent globalization, aging demographics, and technological advancement from bringing down inflation. Lagarde added that the war in Ukraine has also created a massive geopolitical shock, making it difficult to contain inflation in Europe. Despite their concerns, Powell and Lagarde maintained that they were ready to tighten monetary policy to restore price stability. Initially, equities were little changed following the comments from central bank officials; however, this morning stocks sold off and bond prices rose over renewed recession fears.

- BOE Governor Andrew Bailey also attended the conference and warned that the U.K. will have elevated inflation longer than other developed countries. He added that the bank expects inflation to rise as high as 11% in the fall. His comments suggest that the bank may prepare to take more aggressive action to contain inflation. In May, inflation hit 9.1%.

- Sweden’s central bank is set to take more aggressive monetary action to combat soaring inflation. The bank announced that it plans to hike rates by an additional 50 bps and wind down its balance quicker than it signaled in April.

Russia-Ukraine: Russian forces continue to make incremental advances in eastern Ukraine; however, there are doubts whether it will sustain this momentum. Despite its military superiority, Russia still lacks the modern precision weapons to maintain a sophisticated campaign. As a result, Russia has been willing to launch attacks even if it killed innocent civilians. There is speculation that the missile strike that hit a mall was intended to hit a nearby infrastructure target. So far, Russia has taken over about 20% of Ukraine and is now looking to annex certain areas into its territory. Reports from Ukraine show that Moscow is preparing to set up a pseudo-referendum under the template of “Tavriia Gubernia.” Under this scenario, the left bank of Kherson Oblast and part of Zaporizhia Oblast would likely be combined and join the Russian Federation as a single territory. The move to acquire parts of Ukraine reinforces the notion that Russia is looking to control the entire country.

- Moscow is positioning itself to become India’s largest supplier of oil. Meanwhile, Indian firms have explored setting up operations in Russia. India risks drawing the ire of the U.S. as it seeks to build closer ties with Russia. As mentioned in previous reports, the U.S. has refrained from clamping down on India; however, we don’t expect this to last. Although India has consistently maintained that it would like to remain neutral in its position on the Ukraine conflict, the Biden administration is slowly signaling that India will eventually be forced to choose a side.

- Russia has withdrawn its troops from Snake Island, a strategic outpost in the Black Sea. The retreat of Russian forces could make it easier for Ukraine to deliver commodities such as wheat to other countries.

- After being hit with another round of sanctions on Wednesday, the Kremlin rebuked the West. Russia’s Deputy Security Council Chairman Dmitry Medvedev warned that international sanctions could justify war.

- The German government is mulling a bailout for Uniper (UPKF, $16.50), one of Europe’s largest utilities companies. Russia has reduced its deliveries of natural gas to Germany making it more difficult for firms to meet demand. To help deal with the rising costs, energy companies are asking the government to help pass on rising prices to consumers. As Germany struggles to secure alternative sources of fuel to help wean itself from Russian energy, there will be a greater push to delay some of the climate change initiatives; as a result, this could be bullish for hard commodities like coal.

China: To boost economic growth and consumer sentiment, China has implemented measures to help stimulate the economy. Beijing has offered subsidies to oil refiners for as long as two months if crude prices surge above $130 billion a barrel. Meanwhile, the PBOC has pledged to provide more financial support for smaller firms. Growing the economy by 5.5% remains a core objective of Beijing. However, this target will be hard to achieve after the restrictions from the Zero Covid policy have weighed on consumer sentiment. The latest survey from the PBOC showed that confidence has fallen to its lowest level since 2009, with most households stating that they are more inclined to save rather than spend or invest.

- The FCC has urged Apple (AAPL, $139.91) and Google (GOOGL, $2,234.03) to remove TikTok from their platforms because the app poses a national security risk. Regulators suspect that the Chinese government could use the app to collect user data.

Israel: Prime Minister Naftali Bennett has decided not to stand for reelection. Instead, Bennet will stay on as an alternate PM until elections are held in late October or early November. Foreign Minister Yair Lapid will take over as head of government in the meantime. Current polling suggests new elections will probably end in a stalemate, creating more political uncertainty within the region.

Spending Bill: Senate Democrats are prepared to reduce the proposed tax hike to secure Joe Manchin’s (D-WV) support for the bill. The new spending bill will cost $1 trillion, with half going to deficit reduction and the other half going to new spending. If passed, the legislation will likely provide a boost to the economy and potentially to equities. The Democrats have until the end of September to push the bill through Congress before the budget resolution that allows them to enact legislation with a simple majority expires.

Commodities: OPEC+ is set to expand output production by 648,000 barrels a day in August, restoring its production target to pre-pandemic levels. Although the group has increased its output target, there are still concerns that countries still lack the capacity to meet demand. As a result, lifting the group’s production cap will likely not lead to a steep decline in oil prices.

COVID-19: Official data show confirmed cases have risen to 546,133,495 worldwide, with 6,334,004 deaths. The countries currently reporting the highest rates of new infections include the U.S., Germany, Taiwan, and France. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases have risen to 87,383,429 with 1,017,386 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 222,123,223 equal to 66.9% of the total population.

- Pfizer is seeking approval for its COVID-19 pill, and if granted, the pharmaceutical company will be able to sell the drug commercially. The medication Paxlovid will likely be needed to fight further variations of COVID-19 as the virus becomes more endemic.