by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

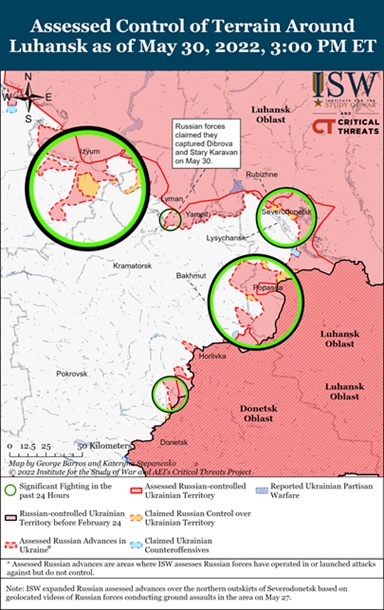

Today, our Comment opens with an update on the Russia-Ukraine war; Russian forces continue to seize some territory in Ukraine’s eastern Donbas region, and Ukrainian forces continue staging what appears to be a tactical retreat. We next review a range of international and U.S. developments with the potential to affect the financial markets. We close with the latest news on the coronavirus pandemic.

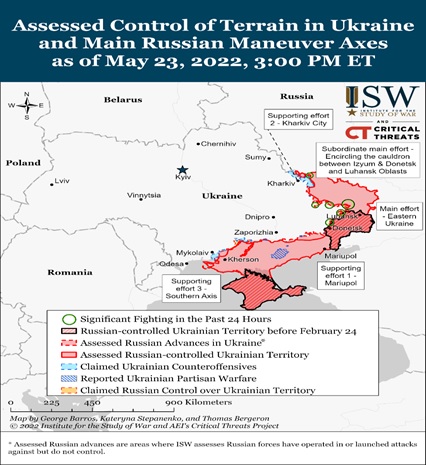

Russia-Ukraine: Russian forces continue to focus on consolidating their control over the Donbas region of eastern Ukraine. Their superiority in equipment and troop levels allows them to make slow but steady gains. In addition, it appears Ukraine has made a strategic decision to offer only limited resistance to that effort. It is probably a measure to preserve its military resources for future counteroffensives against the Russians if, and when, the balance of forces shifts more toward Ukraine’s favor, perhaps after the delivery of more powerful weapons from the West. Today, the Biden administration plans to announce a new tranche of weapons shipments to Ukraine, including long-range rocket launchers and precision ammunition with a range of up to 80 kilometers. The announcement of that shipment comes after Ukraine provided the U.S. with assurances it would not use the missiles to attack Russian territory.

- In recent days, alarmist press articles have again highlighted growing “cracks” in the alliance against Russia’s invasion, this time centered on the fact that some countries (such as Germany and France) have misgivings about providing ever more powerful weapons to Ukraine that could prolong the war without guaranteeing a Ukrainian victory, while other countries (such as the U.S., the U.K., and Poland) want to provide such weapons to inflict as much damage as possible on Russia’s military and discourage President Putin from further territorial aggression. However, despite the alarmist tone of the reporting, it’s probably too early to assume the alliance is in danger of fracturing.

- Military conflicts are so destructive and dangerous that wartime alliances always generate sharp internal disagreements as leaders ponder the opportunities and risks at hand for their own countries. From World War II to the Gulf War, the U.S. has successfully managed such differences within its alliances and coalitions.

- The risk of destruction in wartime is, at the same time, a glue that can help keep alliances together as leaders ultimately realize they are safer in a coalition than they are striking out on their own.

- Beyond that, NATO has been singularly successful in cultivating its fundamental unity over the decades, even in peacetime. That can be lost on some national leaders, press pundits, and armchair generals who don’t know what it is to eat lunch every day with colleagues from a dozen different NATO countries in the headquarters cafeteria in Brussels or who have never taken part in a NATO military exercise. Persistent, intensive, large-scale NATO alliance-building activities have produced a coalition that is probably more resilient than many observers realize (President Putin, for example). The best proof of that may be that after the end of the Cold War, the NATO alliance merely softened and got flabby rather than disintegrating. Differences of opinion within the alliance bear watching, but they are still just arguments at this point. They are probably still far from endangering the allied effort against Russia.

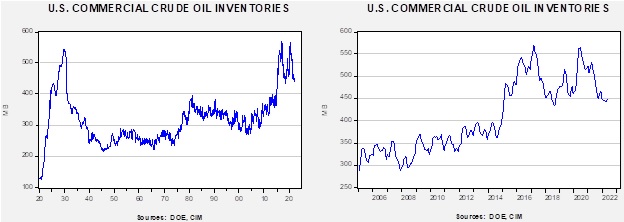

- With Western sanctions pushing down Russia’s oil production, some OPEC members are exploring the idea of exempting the country from its output targets under the OPEC+ deal. Exempting Russia from its targets could potentially pave the way for Saudi Arabia, the United Arab Emirates, and other OPEC producers to pump significantly more crude, something that the U.S. and European nations have pressed them to do in order to help bring down inflation.

- Additional details on yesterday’s sanctions package from the EU indicate the bloc will not only ban most seaborne imports of Russian oil by the end of the year, but it and the U.K. will also ban their insurance companies from covering ships carrying Russian oil anywhere in the world. The move threatens to further complicate Russia’s efforts to bring its crude to market, contributing to a further jump in oil prices so far today.

- Senior insurance executives have stressed to British and EU officials how hard it is to establish the provenance of oil cargoes on ships.

- The executives have warned that insurers, fearing they might violate the sanctions, could pull back from covering any ships coming out of a particular port. For example, they might refuse to cover ships coming out of a Russian port, even if it appears to be carrying oil from Kazakhstan. Such a development could further crimp global oil supplies and drive prices even higher.

- Other Western sanctions on Russia are also increasingly complicating global trade in food commodities. In a summit with EU leaders yesterday, the president of the African Union complained that cutting Russian banks from the SWIFT system for international funds transfers has made it difficult for poor African countries to buy needed food supplies from Russia. We continue to believe that rising food costs because of the war and other factors could spark widespread hunger or political instability worldwide in the coming months.

Germany: Police, public prosecutors, and financial regulators yesterday raided the offices of DWS and its majority owner Deutsche Bank (DB, $11.18). It is part of a probe into whether the asset manager has been engaging in “greenwashing,” i.e., making misleading statements that its assets were invested using environmental, social and governance criteria.

- The Germans launched their probe following a similar action by the U.S. Securities and Exchange Commission, prompted by allegations from a former DWS staffer.

- The probes may signal intensifying scrutiny of asset managers going forward. In an environment where ESG criteria can be vague, fluid, and inconsistently applied, those who have gotten out too far over their skis in making ESG claims could face high regulatory and reputational risk.

United Kingdom: Britons today are prepping for a four-day celebration of Queen Elizabeth II’s platinum jubilee. The holiday will mark the queen’s 70 years on the throne, a record in a royal dynasty that stretches back over a thousand years.

- The celebration will include all the pomp and ceremony associated with a British royal event.

- There will be a military parade, street parties, a pop concert outside Buckingham Palace, and a religious service at St. Paul’s Cathedral.

Mexico: After years of racking up debts to its suppliers, state-owned oil giant Pemex said it would offer to pay back about $2 billion it owes to big-ticket suppliers using new debt. The notes would pay a coupon of 8.75% and mature in 2029, potentially benefitting major service providers like Schlumberger (SLB, $45.96) and Halliburton (HAL, $40.50).

Sri Lanka: Illustrating the country’s worsening economic and political crisis, the government has begun applying for food donations from a regional food bank that supplies rice and other staples to member states during food crises. Severe shortages of essential goods have wracked the country, which defaulted on international debts of more than $50 billion last month since it effectively ran out of foreign reserves.

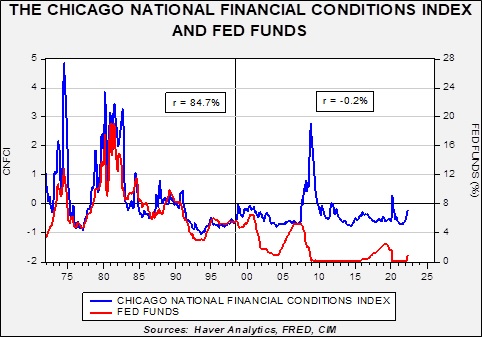

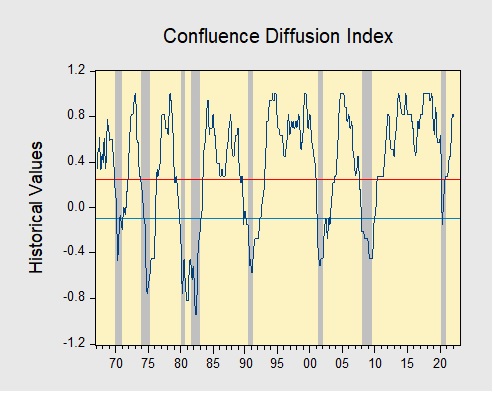

U.S. Monetary Policy: Neither the White House nor the Federal Reserve provided any details on yesterday’s meeting between President Biden and Fed Chair Powell, other than National Economic Council Director Deese’s statement that it was “a very constructive meeting focused on the outlook for the U.S. and the global economy.” If anything, reports prior to the meeting underscored that both Biden and Powell remain intent on bringing down consumer price inflation rapidly.

- With the Fed driving up bond yields and stocks sliding, individual investors poured a net $20 billion into mutual and exchange-traded funds that focus on U.S. Treasury securities over the four-week period ended May 25. It marked the largest such infusion in records going back 29 years.

- At the same time, some investors are starting to buy heavily beaten down small-cap stocks, although that could well prove to be premature given the way rising inflation and higher interest rates have increased the risk of recession in the coming quarters.

U.S. Cryptocurrency Markets: Amid the latest pullback in digital currency values, lawsuits over investment losses are picking up around the country.

- Many of the cases have been fueled by investors who allege some digital coins were hyped and sold under false pretenses. Some proposed class-action suits allege pump-and-dump schemes involving celebrity promoters.

- Others allege that some digital tokens are unregistered securities or that cryptocurrency issuers were deceitful in their marketing.

COVID-19: Official data show confirmed cases have risen to 530,184,304 worldwide, with 6,292,981 deaths. The countries currently reporting the highest rates of new infections include the U.S., Taiwan, Germany, and Australia. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases have risen to 84,215,080, with 1,007,047 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 221,292,360, equal to 66.7% of the total population.

- In the U.S., the latest wave of infections already appears to be topping out, although hospitalizations are still accelerating with their usual lag. The seven-day average of newly reported cases has now reached 98,688, down 2% from two weeks ago. The seven-day average of people hospitalized with confirmed or suspected COVID-19 in the U.S. came in at 26,512 yesterday, up 16% from two weeks earlier. New COVID-19 deaths are now averaging 298 per day, down 6% from two weeks earlier.

- Although the CDC only recommends self-isolating for five days after the first appearance of COVID-19 symptoms or a positive result from an at-home test, many people find they continue to test positive for as many as ten days. In other words, they may still be contagious even after the recommended five-day isolation period.

- In China, authorities in Shanghai today lifted most pandemic restrictions as planned. Along with dozens of government stimulus programs launched around the country to offset draconian lockdowns, the end of the restrictions in Shanghai offers some hope that the Chinese economy can start growing again, helping buoy Chinese stocks and global commodity prices in recent days.

- In Japan, the government further eased travel restrictions today by allowing people arriving from 98 countries where the coronavirus risk is deemed to be low to be exempt from testing at airports and quarantine.

- In contrast, authorities in Hong Kong said a planned late-June easing of social-distancing rules on pubs and restaurants might be delayed because of recent infections tied to two bar clusters.