Daily Comment (May 24, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning. After a strong rally off the lows on Friday and impressive follow-through yesterday, risk assets are lower this morning. However, one pattern emerging in the past couple of weeks is that the correlation between stocks and bonds has again become inverse. Since about May 6, we have seen the inverse pattern that has mainly been in place since the mid-1990s and is the backbone of the 60/40 portfolio. We remain cautious about the long-term path of this relationship. If inflation becomes persistent, higher bond yields are probably unavoidable. The fact the pattern has returned suggests that (a) the market thinks the current yield on longer duration Treasuries is “about right,” and (b) the debt markets believe the Fed will defend bond values against inflation.

In today’s Comment, we open with China news, focusing on the aftermath of President Biden’s statements on Taiwan. From there, we take a look at economic news. The Ukraine update follows. International news comes next, and we close with the pandemic update.

China news: Was it a gaffe, or not? As we reported yesterday, President Biden seemed to end the U.S. policy of strategic ambiguity regarding Taiwan. Within 24 hours, the White House tried to walk the comments back, suggesting “nothing has changed.” To be fair to the president, strategic ambiguity has been fraying for some time. We note that SoS Blinken once referred to Taiwan as a “country,” and it isn’t the first time the president has suggested the U.S. would defend the island militarily.

So, has anything changed? In some ways, yes, but in others, no. What has changed? Japan seems much more committed to the defense of Taiwan. As we have noted before, Taiwan in the hands of Beijing is an existential threat to Tokyo. What remains the same? We seriously doubt anyone in China’s leadership believes the U.S. would not come to the aid of Taipei if China tried to invade Taiwan. That isn’t anything new. The rhetoric surrounding the president’s remarks in Beijing will escalate; if the PLA hasn’t been pondering how to thwart American defense efforts in its invasion plans, they should be relieved of duty. We note that within the international relations community, the end of strategic ambiguity is being widely cheered. The primary benefit of ending strategic ambiguity is that China won’t be as likely to miscalculate, assuming the U.S. won’t act; that was, in part, why the Korean War occurred. However, as noted above, the odds of such a miscalculation were small anyway. The most serious risk of ending the policy is that it reduces American optionality and might lead to less cautious behavior on the part of Taiwan. We still view Taiwan as a chief point of geopolitical risk; the president’s “gaffe” doesn’t change that.

- Airbnb (ABNB, USD, 1113.28) is closing its domestic business in China, although it will maintain an office for outbound travelers. It appears the company simply could not compete against Chinese incumbents.

- The incoming Australian PM has indicated that he doesn’t expect relations with China to improve anytime soon.

Economics and policy: It’s day two of Davos. Some softening in monetary policy may be coming.

- The attitude of Davos appears downbeat. A big part of this mood is that this crowd really benefited from globalization. Although we have been suggesting for some time that globalization was under threat, the tensions with China, the rise of populism, and the Ukraine war have pretty much confirmed that it’s over. Among the attendees, the general consensus is that recession is coming.

- Weakening globalization further is the realization that data is being constrained within borders.

- On the FOMC, St. Louis FRB President Bullard is considered a hawk, while Atlanta FRB President Bostic is more dovish. Yet, both made statements suggesting they may relent on policy. Bullard suggested the Fed might cut rates next year. Such a shift is what the Fed did in the mid-1990s when it executed a rare soft landing. Bostic indicated a “pause” in the fall might make sense to see how the market deals with rate hikes. In the near term, we expect nothing other than tightening. These comments suggest the FOMC is looking past the tightening cycle.

- Congress has approved two new governors along with Jay Powell’s renomination. In addition, Michael Barr is likely to be approved for the Vice-Chair of Supervision.

- Whether we have a recession or not in the next 18 months will likely depend on the consumer. A Fed survey conducted last fall showed that the consumer was doing quite well; of course, that was before inflation jumped. However, JP Morgan (JPM, USD, 124.60) said yesterday that the bank’s read on the consumer is that things are just fine.

- One interesting indicator—birth rates showed a modest improvement last year.

- As diesel prices soar, the administration is considering a release from the Strategic Heating oil reserve.

Larry Summers has been a problem for the administration. He criticized the fiscal stimulus in 2021, saying it would likely lead to higher inflation. Although fiscal spending wasn’t the only reason for inflation, it certainly contributed. He is now attacking the idea that industry concentration leads to higher prices. The basic issue is that industry concentration can improve efficiencies but also gives market power to firms. Firms can decide how to allocate the gains to efficiency because they have market power. Since the mid-1980s, when the Bork Standard for antitrust emerged, firms have mostly allocated these efficiencies to profits and consumers by keeping price hikes contained. Labor has generally been excluded from benefiting from any efficiencies.

This chart shows the share of output going to labor. The trend was mainly declining but clearly accelerated this century. So, back to Summers’s argument. He contends that antitrust action might actually lead to higher inflation if it undermines the efficiencies from concentration. But, that is true only if two conditions are met. First, increased competition should make it more difficult to pass along high costs. Second, it appears that Summers believes current profit margins will be maintained. With S&P 500 earnings nearly 8% of GDP, an all-time record, it seems reasonable that a return to trend could allow for antitrust to at least not contribute to higher inflation. At the same time, we think the administration is overstating the case for antitrust to bring down inflation. It’s easier to blame industry concentration for inflation than to cool the economy by cutting spending and raising taxes.

- Here are some random facts we found interesting:

- Walmart (WMT, USD, 122.60) is expanding drone delivery in six states. Items up to 10 pounds can be delivered for $3.99.

- The last payphones in New York City have been removed.

- The average age of a U.S. vehicle is 12.2 years, a new record.

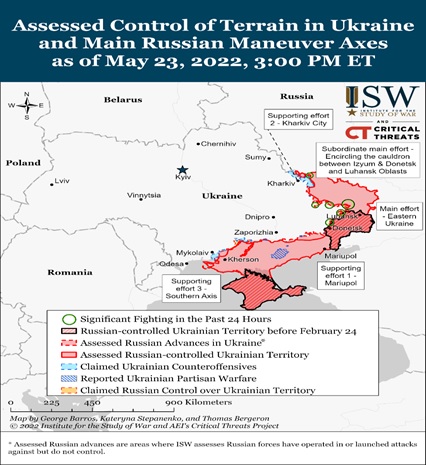

The Ukraine War: The conflict appears to be evolving into a trench war, with both sides building fortifications to thwart offensive actions. Here is the latest map:

- The most active fighting continues in Severodonetsk as Russia attempts to solidify gains in the territory it holds.

- We see increasing criticism of the war effort from Russian nationalist figures, who are pressuring the Kremlin to at least make a partial mobilization to rebuild troop strength. Mobilization would be a significant escalation, and if Moscow is going to continue the conflict, it will need, at some point, to mobilize. Yesterday, we noted growing comments on a ceasefire. If Russia announces a mobilization, we doubt a ceasefire is possible. Thus, for now, the Russian war effort is to continue in the current pattern despite heavy losses to maintain gains in eastern Ukraine.

- It’s not just nationalists attacking the Kremlin. A Russian diplomat attached to the nation’s U.N. mission in Geneva has resigned because of the war.

- The EU is accusing Russia of purposely attacking Ukrainian agriculture in a bid to worsen the global food shortage.

- NATO continues to send heavier weapons into Ukraine as the war develops into an artillery battle. The U.S. has sent the M777 howitzer, a weapon with significant firepower that is easily transportable. The Czech Republic has sent attack helicopters and is acting as a repair depot for Ukraine armor.

- Ukraine has convicted a Russian soldier for war crimes.

International roundup: A big deal is in the works and more from the president’s trip.

- The U.S. is reportedly working on a deal between Israel, Egypt, and the KSA over two small islands near the Gulf of Aqaba. The islands, Tiran Island and Sanafir Island, were said to be “given” to Egypt by the KSA in 1950. In the aftermath of the 1973 Yom Kippur War, the islands were demilitarized and currently occupied by a multinational U.N. force. Legally, they remain Egypt’s. The deal being struck is ostensibly between the KSA and Egypt, but Israel would have to approve. The negotiation might lead to a normalization of relations between the KSA and Israel, further extending the Abraham Accords.

- Although the economic deal offered by the administration is underwhelming, 12 Asian nations have been invited. Essentially, it will set up a talking shop for various issues that would have been part of TPP. Since multilateral trade deals are no longer politically possible, such arrangements are about the only thing the U.S. can offer. Interestingly enough, the reception was better than we expected.

- The OECD has been working on a minimum corporate tax program that would prevent companies from shifting to jurisdictions that offer lower taxes. Poland, likely to gain leverage in EU negotiations over COVID-19 relief funds, is opposing the tax measure.

- Turkey continues to oppose Sweden’s entry into NATO, demanding that Kurds operating in Sweden and Finland be extradited to Turkey. We still expect a deal to be struck, but Ankara’s actions are slowing the process.

- Turkey also says it no longer recognizes the existence of the Greek leader. Greek PM Kyriakos Mitsotakis is lobbying Congress and the administration to deny Turkey F-16s.

- Starbucks (SBUX, USD, 73.42) announced its exiting Russia.

- U.K. professional services firms are finding that restrictions on providing services to Russians are making it impossible to avoid breaking the law. They want relief.

- As we have been reporting for some time, Egypt is at high risk of political unrest due to rising grain prices.

- Conditions in Venezuela have become so dire that the national output of vehicles was eight last year. Maintaining old cars has become a necessity, much like in Cuba.

COVID-19: The number of reported cases is 526,196,860 with 6,278,868 fatalities. In the U.S., there are 83,393,876 confirmed cases with 1,002,385 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 741,676,155 doses of the vaccine have been distributed, with 584,449,398 doses injected. The number receiving at least one dose is 258,174,992, while the number fully vaccinated, which would grant the highest level of immunity, is 220,933,970. For the population older than 18, 76.5% of the population has been fully vaccinated, with 61.1% of the entire population fully vaccinated. For those over 65, 90.9% have been fully vaccinated. The FT has a page on global vaccine distribution.

- Pfizer (PFE, USD, 52.88) says studies show its vaccine triggers a strong immune response in young children.