Tag: economy

Asset Allocation Bi-Weekly – The Inflation Adjustment for Social Security Benefits in 2026 (November 17, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

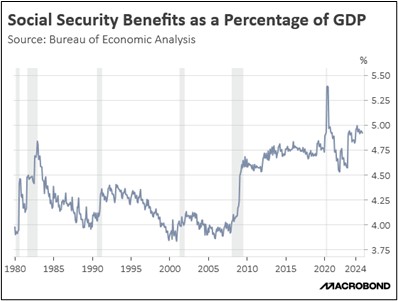

Even for dedicated, successful investors who have built up a substantial nest egg, Social Security retirement and disability benefits can be an important part of their financial security. For many people, Social Security benefits are the only significant source of income in advanced age. On average, these benefits account for about 30% of retired people’s income and more than 5% of all personal income in the US. One aspect of Social Security is especially important in today’s period of elevated price inflation: By law, Social Security benefits are adjusted each year to account for changes in the cost of living. In this report, we discuss the Social Security cost-of-living adjustment (COLA) for 2026 and what it implies for the economy.

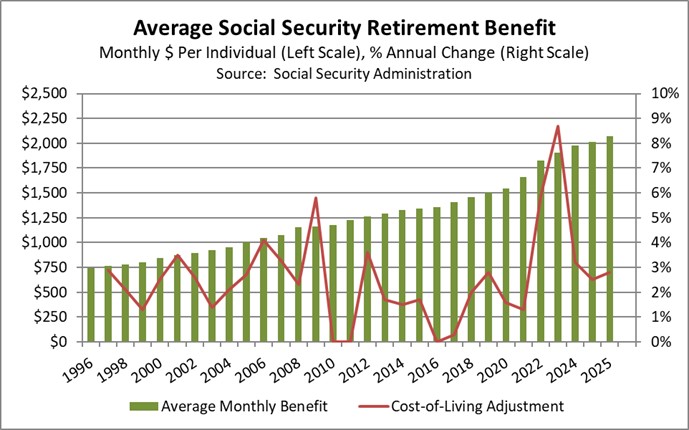

In mid-October, the Social Security Administration announced that Social Security retirement and disability benefits will increase 2.8% in 2026, bringing the average retirement benefit to an estimated $2,071 per month (see chart below). The increase will bump up the average recipient’s monthly benefit by approximately $56. The benefit increase was right in line with expectations, given that it is computed from a special version of the Consumer Price Index (CPI) that is widely available. The COLA process also affected some other aspects of Social Security, although not necessarily by the same 2.8% rate. For example, the maximum amount of earnings subject to the Social Security tax was raised to $184,500, up 4.8% from the maximum of $176,100 in 2025.

Media commentators often fret that the Social Security COLA could be “eaten up” by rising prices in the following year or that the benefit boost could provide a windfall if price increases decelerate. In truth, the COLA merely aims to compensate beneficiaries for price increases over the past year. It is designed to maintain the purchasing power of a recipient’s benefits given past price changes, with price changes in the coming year being reflected in next year’s COLA.

The inflation-adjusted nature of Social Security benefits is also important for the overall economy. Since so many members of the huge baby boomer generation have now retired, and since more people are drawing disability benefits than in the past, Social Security income has become a bigger part of the economy (see chart below). In 2024, Social Security retirement and disability benefits accounted for 4.9% of the US gross domestic product (GDP). Having such a large part of the economy subject to automatic cost-of-living adjustments helps ensure that a big part of demand is insulated from the ravages of inflation, albeit with some lag. If Social Security income were fixed, a large part of the population would see its purchasing power drop more sharply, which might not only reduce demand, but could also spark political instability. The added benefits in 2026 will help buoy demand, although they will also probably keep inflation somewhat higher than it otherwise would be.

Finally, it’s important to remember that an individual’s own Social Security retirement benefit isn’t just determined by inflation. The formula for computing an individual’s starting benefit is driven in part by a person’s wage and salary history. Higher compensation will boost a retiree’s initial retirement benefit, which will then be adjusted by the COLA over time. As average worker productivity increases, average wages and salaries have tended to grow faster than inflation. The average Social Security benefit has therefore grown much faster than the CPI. Over the last two decades, the average Social Security retirement benefit has grown at an average annual rate of 3.8%, while the CPI has risen at an average rate of just 2.6%. In sum, Social Security benefits provide an important source of growing purchasing power that helps buoy demand and corporate profits in the economy.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Asset Allocation Bi-Weekly – American Exceptionalism and the Markets (February 3, 2025)

by the Asset Allocation Committee | PDF

We suspect many investors today think the “American Exceptionalism” they studied in high school or college no longer applies to the United States, given the challenges it faces from the rise of China, the country’s own enormous debt load, or its sharp political divisions. However, as we survey the global landscape in these still-early days of 2025, we are struck by the unusually positive trends we see in the US. Below, we lay out the US’s current economic growth, relatively smooth political transition, and outstanding stock market performance compared with other key countries. The US certainly has near-term challenges, but we think investors should understand how positively the US compares with many other investment regions today.

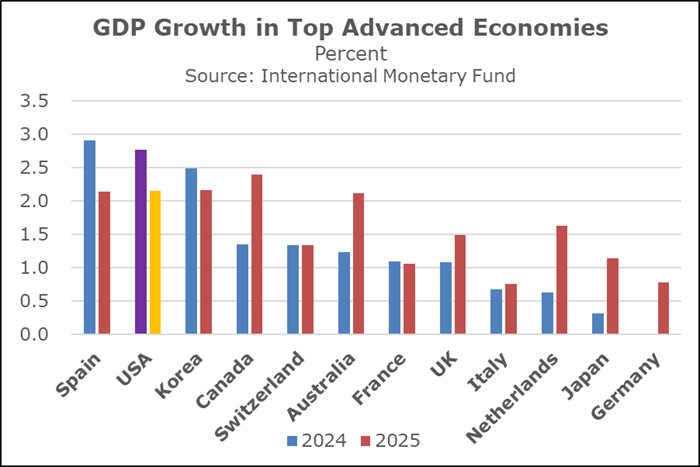

Based on initial estimates, US gross domestic product in 2024 was up an inflation-adjusted 2.8% from the previous year, modestly beating the average growth rate of 2.1% over the last 20 years. As we’ve noted previously, some US economic sectors are struggling, especially those that are sensitive to high interest rates or depend on lower-income consumers. Still, data from the International Monetary Fund (IMF) shows that the US was one of only three major advanced countries to grow faster than their 20-year average last year (the others were Italy and Spain). Moreover, the IMF estimates the US economy will grow 2.2% in 2025, again a bit above its 20-year average and better than all major advanced countries except for Canada.

Based on initial estimates, US gross domestic product in 2024 was up an inflation-adjusted 2.8% from the previous year, modestly beating the average growth rate of 2.1% over the last 20 years. As we’ve noted previously, some US economic sectors are struggling, especially those that are sensitive to high interest rates or depend on lower-income consumers. Still, data from the International Monetary Fund (IMF) shows that the US was one of only three major advanced countries to grow faster than their 20-year average last year (the others were Italy and Spain). Moreover, the IMF estimates the US economy will grow 2.2% in 2025, again a bit above its 20-year average and better than all major advanced countries except for Canada.

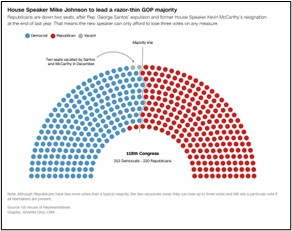

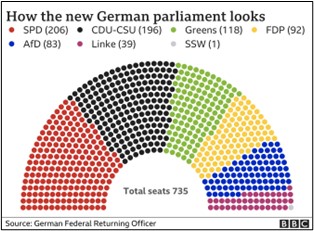

Another underappreciated development in the US has been the smooth transition of political power since the November election. Of course, nearly half of US voters were disappointed by the Republican Party’s broad victory. All the same, US citizens of all persuasions have benefited from the fact that the election and transfer of power were completed without the widespread political violence many feared. The US’s overall political stability has been confirmed, and President Trump’s apparently clear mandate to effectuate change may well be better than the fractious, unstable coalitions and paralyzed minority governments that plague Europe and Asia today. For example, the charts below show the current party breakdowns of the US House of Representatives and the German Bundestag.

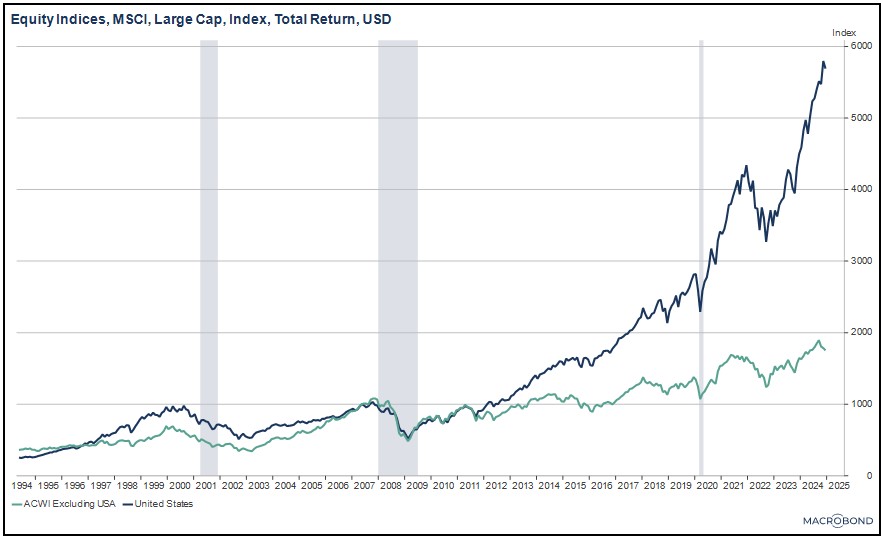

Finally, because of the US’s continued strong economic momentum and the clear runway for Trump to implement his program of supporting business and cutting regulation, it should be no surprise that US stocks have outperformed most other key markets. As shown in the chart below, the MSCI USA total return stock index rose 25.1% in 2024, while the MSCI ACWI ex-USA All Cap Index provided a total return of just 5.7%. Taking a somewhat longer view, the USA index provided an average annual total return of 14.6% over the last five years, handily beating the average total return of 4.6% for the ACWI ex-USA index. Of course, past performance doesn’t necessarily show what will happen in the future, especially since US stocks on average are very highly valued when compared with foreign stocks. Nevertheless, we think the relatively strong political and economic environment of the US should help support the country’s stock values in the near term. This environment has helped US firms dominate some of the world’s most important, innovative, high-growth stock sectors, such as Information Technology and Communication Services. US stock market capitalization is now heavily concentrated in those sectors. Of course, this creates the risk of a US correction or rotation to value stocks, small cap stocks, or other sectors. For now, however, it positions the US stock market to continue performing well as long as investors continue pouring funds into large, innovative, high-growth companies.

In sum, as we noted in our 2025 Outlook: A Year of Political and Policy Change, we expect US stocks to continue providing good returns in the coming months, albeit with the potential for volatility stemming from geopolitical events, policy changes, and the potential for stock market leadership to rotate between size, style, and sectors. This isn’t to say that there won’t be opportunities in foreign stocks or other asset classes. There certainly will be, and keen-eyed investors will likely be able to identify them. Many investors will also want to maintain exposure to foreign stocks and other asset classes for diversification purposes. All the same, this big-picture analysis suggests that US stocks should have the most wind at their backs in 2025.