by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with reports of new mass protests in Iran that could potentially help spur the US to launch its expected attack on the country. We next review several other international and US developments that could affect the financial markets today, including the nomination of two dovish academics to the Bank of Japan’s policy board and growing concerns in Germany and Canada that their new defense budget hikes will disproportionately benefit large, incumbent defense suppliers.

Iran: Anti-regime protestors and pro-government militias clashed on college campuses across the nation yesterday for a fourth consecutive day. The protests haven’t spread beyond campuses so far, but if they do, there would be a heightened risk of a violent crackdown by the government like the one in early January that killed some 7,000 civilians. In turn, such a crackdown could spur the US administration to launch its long-awaited attack against Iran, potentially sparking political disintegration or an economically disruptive war across the region.

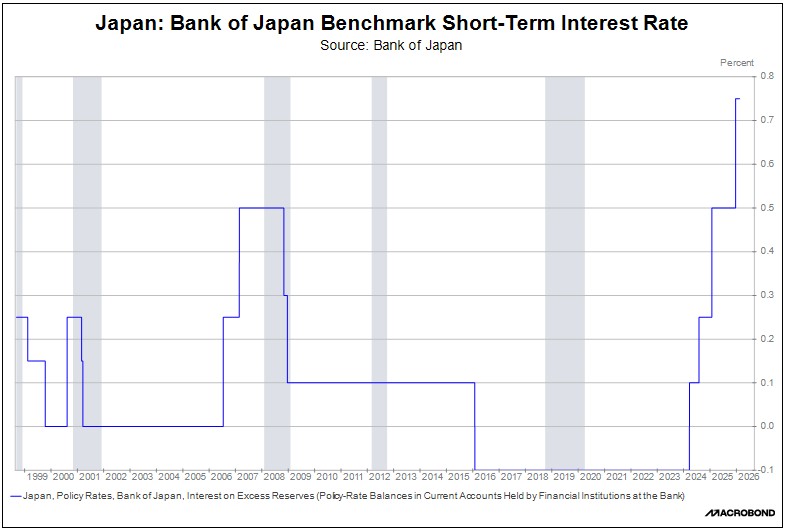

Japan: Prime Minister Takaichi today nominated two dovish academics for positions on the Bank of Japan’s nine-member monetary policy committee, following through with her intention to push through more stimulative monetary and fiscal policies. In response, the yen has weakened some 0.5% to 156.61 per dollar ($0.00639). If concerns about overly dovish monetary policy take hold in Japan, the yen could weaken further, potentially boosting consumer price inflation and drawing the ire of the US.

Thailand: Today, the Bank of Thailand unexpectedly cut its benchmark short-term interest rate from 1.25% to 1.00%, reflecting the country’s persistently weak economic growth and low price inflation. Since the pandemic, the Thai economy has been weighed down by high household debt, weak consumption, and a slow tourism recovery. While the central bank has cut rates to help address those issues, it has also called on the government to take more proactive steps in fiscal, regulatory, and industrial policy to address the problem.

Germany: According to the Financial Times, Chancellor Merz and his government are probing the way major defense firms such as Rheinmetall benefit disproportionately from Germany’s increased military budget. The government reportedly wants to ensure that the hundreds of billions of euros in new defense funds also reach start-ups focused on unmanned systems and military applications for AI and quantum technology.

- We have long believed that changing geopolitics will give a boost to European defense stocks, and that has been borne out over the last few years.

- If the Merz government’s initiative leads to major procurement policy changes, it could remove some of the opportunity for big, incumbent defense firms in Germany and the broader European Union. Over time, however, it could also help spawn a new class of smaller, more agile, and more innovative firms that could eventually list shares.

Canada: The German-style concern about concentrated military spending is also now playing out in Canada. While the government intends to boost its defense budget to 5.0% of gross domestic product by 2035 and channel at least 70% of the total into Canadian defense firms, smaller companies are warning that a risk-averse Ottawa might channel the bulk of increased defense funding to well-established players such as Bombardier or continue with legacy US military providers such as Lockheed Martin.

US Politics: In his State of the Union speech last night, President Trump focused on painting a positive picture of the US economy, while offering several initiatives to address the cost of living. For example, he reiterated his intention to impose limits on investors buying large numbers of homes, and he announced a plan to shield consumers from electricity price hikes caused by AI data centers. He also floated a plan to give citizens without access to a retirement savings plan at work the opportunity to invest in the retirement plan for federal workers.

- Of course, a major goal of the speech would have been to bolster Republican chances ahead of the mid-term Congressional elections in November.

- With public opinion polls showing widespread dissatisfaction with the current economy, it is not yet clear whether the rosy picture painted by the president will do much to help Republican prospects when it is time to vote. As of right now, the polls continue to suggest the Republicans will at least lose their majority in the House of Representatives.

US Artificial Intelligence Industry: AI firm Anthropic, which has touted its strict guardrails on its models, yesterday said it will relax its core safety policy to stay competitive with other AI labs. The move may mean the firm will cave to the Pentagon’s demand for free rein to use Anthropic’s well-regarded Claude model. More broadly, it also signals that competitive pressures may also push other AI firms to loosen their safety standards, increasing the risk of dangerous results from the use of their models.