Tag: inflation

Asset Allocation Bi-Weekly – The Warsh Doctrine (February 17, 2026)

by Thomas Wash | PDF

When Kevin Warsh, President Trump’s nominee to be the next Federal Reserve chair, last departed the central bank in 2011, it was more than a career move — it was an act of ideological dissent. He cautioned that the Fed’s post-crisis expansion of authority would erode its institutional independence and set the stage for future inflation. Now, nearly 15 years later, he will return with a clear mandate: to unwind those interventions and champion a leaner, less market-intrusive central bank built on a simplified monetary framework.

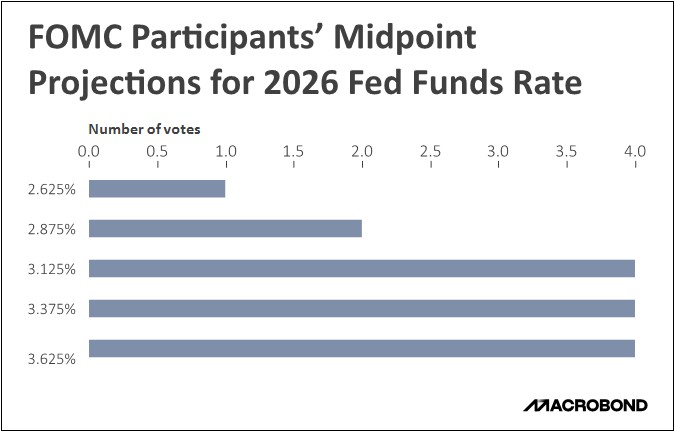

The institution he will rejoin, however, is profoundly transformed. The modern Fed has formalized its once-implicit 2% inflation target and fully embraced aggressive forward guidance. Through more frequent press conferences and the now-institutionalized Summary of Economic Projections, complete with its influential “dots plot,” the central bank has made transparency a core tool of policy. These measures aim to give markets a clearer sense of the Fed’s thinking and its likely policy trajectory.

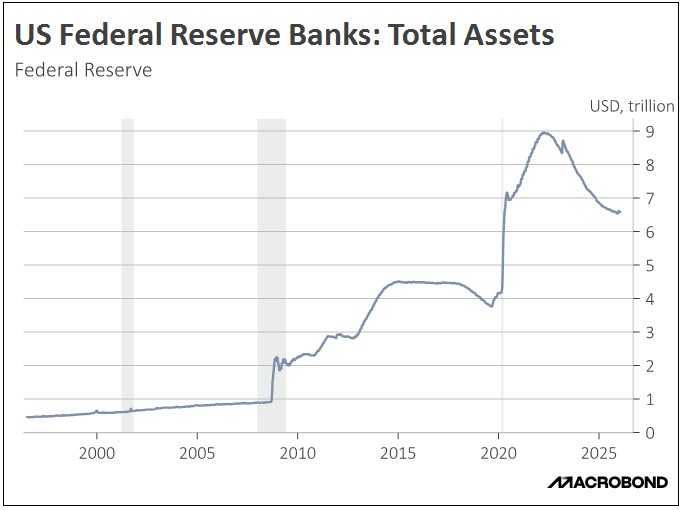

Beyond the expansion of quantitative easing, the Fed has also entrenched its market presence by establishing permanent liquidity backstops. The Standing Repo Facility and the Overnight Reverse Repo Facility were created to reinforce the financial system’s plumbing, ensuring that the central bank can swiftly manage short-term interest rates and ease liquidity strains without resorting to ad hoc crisis measures.

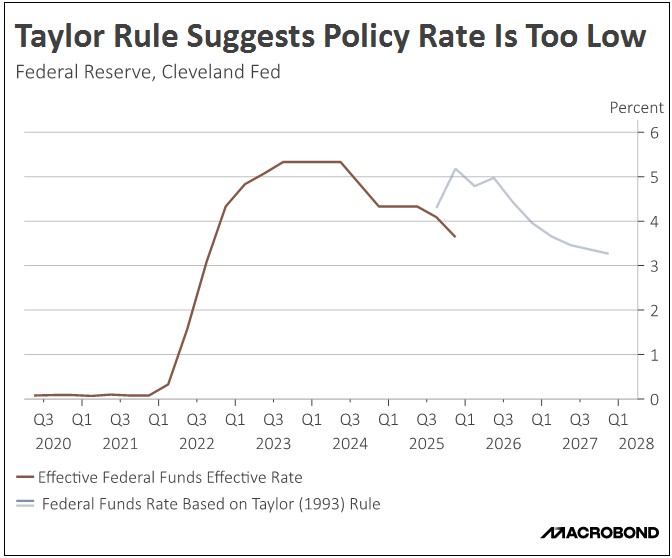

Under a Warsh-led Fed, we are likely to see a pivot toward operational simplicity aimed at reducing market uncertainty, though not without significant caveats. Warsh has historically championed a rules-based framework, where monetary policy is anchored to a transparent set of metrics. This would allow markets to more accurately self-price the direction of rates. However, in recent months, Warsh has moderated this stance, characterizing a “strict adherence” to rules as being more aspirational than absolute.

This evolution hints at a broader philosophical shift. A Warsh-led Fed may bring a chair (like Greenspan before him) willing to look beyond rigid economic models and instead rely on forward-looking judgment. Just as Greenspan saw transformative potential in the internet, Warsh sees it today in artificial intelligence, calling the current productivity surge “the most significant of our lives past, present, and future.”

This conviction clarifies why Warsh has hinted at temporarily overriding rules-based policy prescriptions in favor of lower interest rates, a tactical deviation based on his view of shifting productivity frontiers. His logic is that lower rates will stimulate corporate capital expenditure, thereby boosting investment to expand the economy’s productive capacity. This supply-side expansion could, in turn, help to lower inflationary pressures.

Furthermore, Warsh appears skeptical of a rigid 2% inflation target, having once dismissed it as “arbitrary.” Instead, he has advocated for a flexible inflation target band. Such a framework would grant the central bank greater operational leeway, providing a wider window to assess economic conditions before deciding the optimal course for rate adjustments.

This does not mean Warsh would avoid pursuing a restrictive monetary policy. One area where he seems particularly focused is the normalization of the Fed’s balance sheet. Last May, he stated that if the balance sheet were to grow in line with the broader economy, it would stand at roughly $3.0 trillion. This suggests he might support allowing the current $6.6 trillion balance sheet to continue shrinking until it returns closer to that level.

As Warsh prepares to take the helm of the Fed, we anticipate a decisive but complex pivot. The guiding principle would be a return to a less transparent, more orthodox central bank, likely scaling back forward guidance to force markets toward greater self-reliance. The tension lies in the application. While being openly accommodative toward rate cuts to nurture AI-driven growth, he would almost certainly counterbalance this with a hawkish, determined campaign to shrink the Fed’s balance sheet.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Asset Allocation Bi-Weekly – #152 “The Inflation Adjustment for Social Security Benefits in 2026” (Posted 11/17/25)

Asset Allocation Bi-Weekly – The Inflation Adjustment for Social Security Benefits in 2026 (November 17, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

Even for dedicated, successful investors who have built up a substantial nest egg, Social Security retirement and disability benefits can be an important part of their financial security. For many people, Social Security benefits are the only significant source of income in advanced age. On average, these benefits account for about 30% of retired people’s income and more than 5% of all personal income in the US. One aspect of Social Security is especially important in today’s period of elevated price inflation: By law, Social Security benefits are adjusted each year to account for changes in the cost of living. In this report, we discuss the Social Security cost-of-living adjustment (COLA) for 2026 and what it implies for the economy.

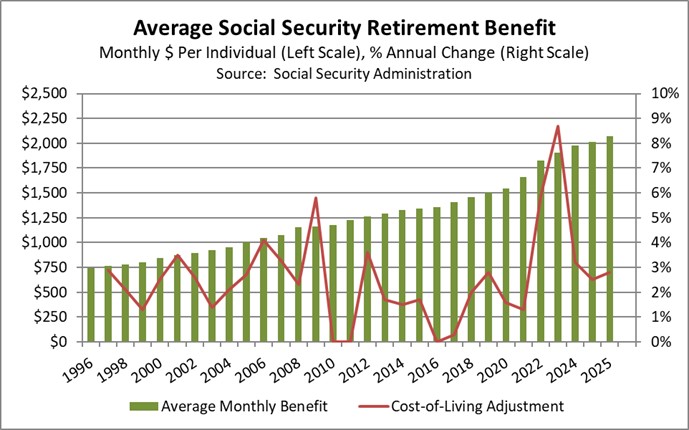

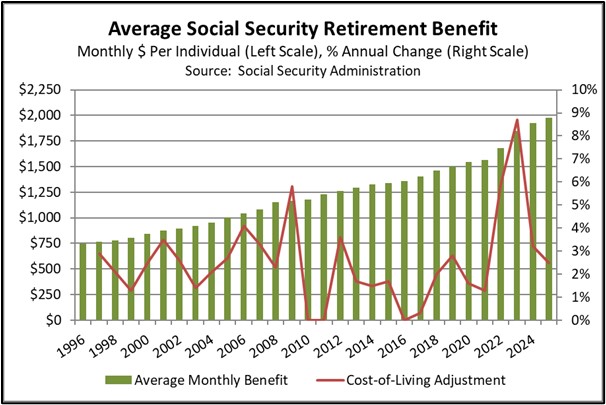

In mid-October, the Social Security Administration announced that Social Security retirement and disability benefits will increase 2.8% in 2026, bringing the average retirement benefit to an estimated $2,071 per month (see chart below). The increase will bump up the average recipient’s monthly benefit by approximately $56. The benefit increase was right in line with expectations, given that it is computed from a special version of the Consumer Price Index (CPI) that is widely available. The COLA process also affected some other aspects of Social Security, although not necessarily by the same 2.8% rate. For example, the maximum amount of earnings subject to the Social Security tax was raised to $184,500, up 4.8% from the maximum of $176,100 in 2025.

Media commentators often fret that the Social Security COLA could be “eaten up” by rising prices in the following year or that the benefit boost could provide a windfall if price increases decelerate. In truth, the COLA merely aims to compensate beneficiaries for price increases over the past year. It is designed to maintain the purchasing power of a recipient’s benefits given past price changes, with price changes in the coming year being reflected in next year’s COLA.

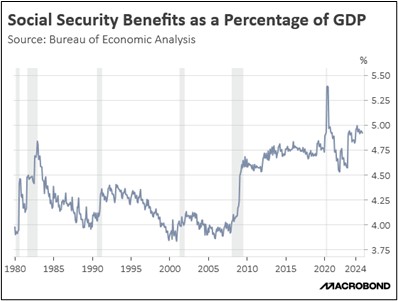

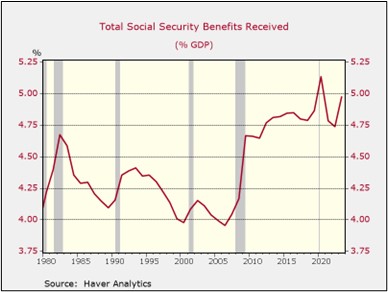

The inflation-adjusted nature of Social Security benefits is also important for the overall economy. Since so many members of the huge baby boomer generation have now retired, and since more people are drawing disability benefits than in the past, Social Security income has become a bigger part of the economy (see chart below). In 2024, Social Security retirement and disability benefits accounted for 4.9% of the US gross domestic product (GDP). Having such a large part of the economy subject to automatic cost-of-living adjustments helps ensure that a big part of demand is insulated from the ravages of inflation, albeit with some lag. If Social Security income were fixed, a large part of the population would see its purchasing power drop more sharply, which might not only reduce demand, but could also spark political instability. The added benefits in 2026 will help buoy demand, although they will also probably keep inflation somewhat higher than it otherwise would be.

Finally, it’s important to remember that an individual’s own Social Security retirement benefit isn’t just determined by inflation. The formula for computing an individual’s starting benefit is driven in part by a person’s wage and salary history. Higher compensation will boost a retiree’s initial retirement benefit, which will then be adjusted by the COLA over time. As average worker productivity increases, average wages and salaries have tended to grow faster than inflation. The average Social Security benefit has therefore grown much faster than the CPI. Over the last two decades, the average Social Security retirement benefit has grown at an average annual rate of 3.8%, while the CPI has risen at an average rate of just 2.6%. In sum, Social Security benefits provide an important source of growing purchasing power that helps buoy demand and corporate profits in the economy.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Asset Allocation Bi-Weekly – Equities as an Inflation Hedge? (March 17, 2025)

by Daniel Ortwerth, CFA | PDF

A time-honored belief holds that inflation is bad for stocks, but recent developments may be challenging this view. In this report, we step through the traditional narrative, review certain recent developments, and consider what might have changed in the relationship between inflation and stocks. Ultimately, we might be entering a world in which investors are increasingly turning to stocks as a hedge against inflation and a store of value in uncertain times.

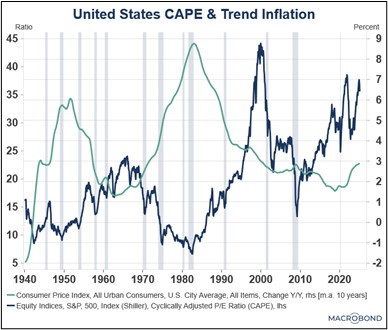

The traditional narrative centers around the idea that inflation suppresses stock price multiples. The chart below shows the inverse relationship that has usually prevailed between inflation and the broad-market price/earnings ratio. Businesses experience inflation in their input costs, which squeezes profits, and lends support to this narrative. As inflation rises, interest rates also rise, drawing money away from stocks and into short-duration fixed income, while simultaneously raising borrowing costs for businesses. Rising inflation also reduces consumer confidence, suppressing investor appetites for relatively risky investments such as stocks.

Figure 1

Recent events have challenged this principle, begging the questions of how it arose in the first place and whether inflation really is bad for stocks in today’s world. The narrative originally gained prominence in the 1970s, a time when inflation in the United States was persistently high and stocks suffered (see Figure 2 below); however, several other factors impacted the economy, inflation, and markets during that period.

- The period began with the United States’ retreat from Vietnam, which caused the wind down of associated expenditures that were primarily in the defense sector but would eventually ripple throughout the broader economy.

- In August 1971, President Nixon closed the gold window, upsetting financial markets. The effects of this move were further exacerbated by loose Federal Reserve policy later in the decade, which undermined faith in the value of the dollar.

- In 1973 and 1974, OPEC placed an embargo on oil exports to the countries supporting Israel — principally the US and UK — heavily impacting prices throughout the US economy and causing a severe recession.

- The five years leading up to the oil crisis had witnessed a strong bull market for US stocks, with valuations for the most-favored stocks of the day (known as the “Nifty Fifty”) reaching more than double the S&P 500 as a whole.

Figure 2

Challenges to the narrative in recent years have taken the form of domestic and foreign stock markets performing well in high-inflation environments.

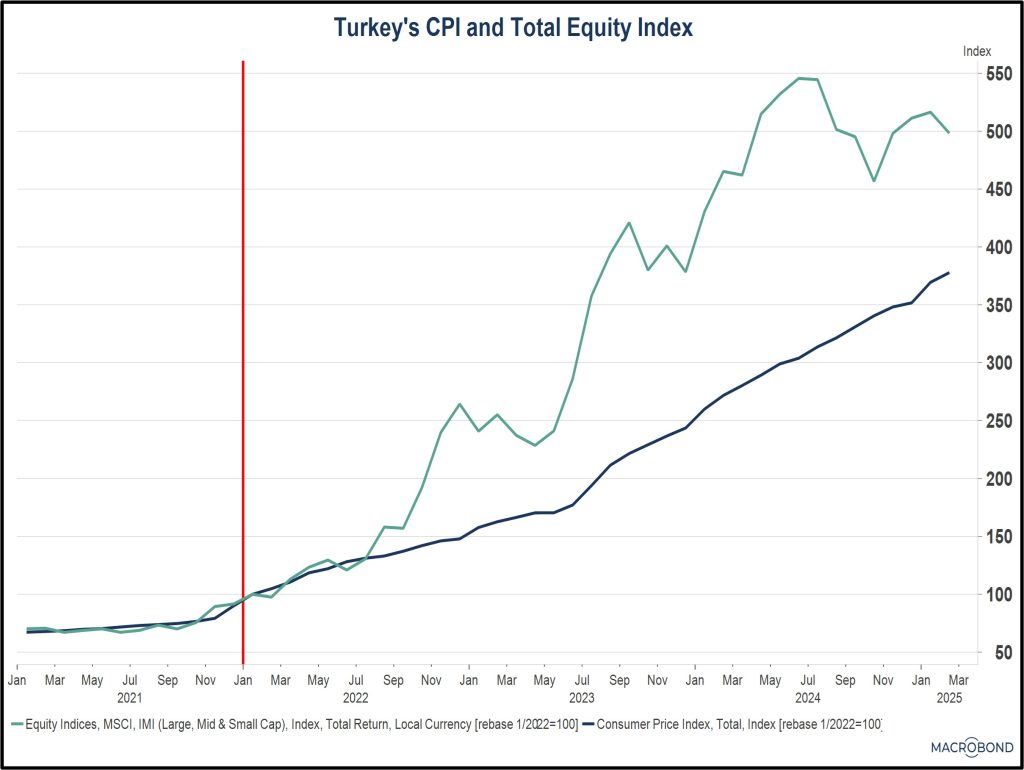

- Turkey provides the first example (see Figure 3 below). Despite inflation rates between 40% and 75% for most of this decade, its stock market has performed impressively and has solidly exceeded the country’s inflation rate.

- Iran appears to have experienced the same phenomenon as Turkey. Data from Iran has been highly questionable due to concerns of government manipulation, but our recent report on Middle Eastern stock markets provides some details on how its market has posted its impressive performance.

- While nowhere near the extreme levels of Turkey and Iran, this decade has witnessed the highest level of inflation in the US since the early 1980s. Despite this, since the beginning of 2020, the S&P 500 has risen 81%, while the CPI during that same period has risen only 23% (see Figure 4).

Figure 3

Figure 4

Any number of factors could explain the disparity between the 1970s scenario and these recent examples; however, we are confident that several changes over the last 40 years have likely played a role. Stock market participation has become far more accessible, inexpensive, rapid, and liquid than ever before. A few examples of these changes include:

- Since the 1970s, transaction costs have plummeted. Before 1975, commissions on stock trades were fixed by law at levels that often resulted in fees of hundreds of dollars. By using progressive steps over the decades, commissions today are essentially zero.

- Fifty years ago, settlement time, meaning the number of days from the order to purchase or sell shares until the payment and securities actually change hands, was five days (referred to as “T+5”). Gradually, as trading technology has improved, security regulations began requiring shorter settlement times to the point that, in 2024, the standard became T+1, and there is talk that it may eventually get to T+0.

- Previously, stocks were quoted, bought, and sold in increments of 1/8 of a share. That means the smallest amount a price could change was 12.5 cents. This had a negative effect on trading volumes and liquidity. Starting in the late 1990s, computerizing the process led to decimalization of quotes and trading, which increased liquidity and made the entire process of buying and selling easier.

- Internet technology may have done more than anything to make participation in the stock market easy, accessible, and affordable to virtually the entire adult population. Stock trades used to require relatively exclusive brokerage accounts and telephone communication between broker and client. Now, we trade via cellphone.

- Index ETFs, which did not exist decades ago but are now as broadly available and investable as stocks themselves, give individual investors with modest amounts of money the ability to own broad baskets of stocks and achieve diversification as never before.

Taken together, these regulatory and technological changes have made access to and participation in the stock market almost as easy as using a common bank account.

Does ease of use change or broaden the reasons why people might choose to invest in stocks? Traditionally, we have always associated stocks with long-term investing for the accumulation of wealth. Meanwhile, we have associated other investments, such as Treasury securities, with the preservation of wealth and protection against inflation. Might that be changing? Might the improved liquidity, cost, and accessibility of the stock market, combined with the ability to easily diversify and reduce risk, inspire investors to use stocks as a store of value and an inflation hedge? We have seen evidence of this in certain foreign markets, and we recognize the possibility that this could happen in the US as well. We see this as one more potential reason why stocks might perform better than expected, even in an inflationary environment.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Asset Allocation Bi-Weekly – #136 “Equities as a Inflation Hedge?” (Posted 3/17/25)

Asset Allocation Bi-Weekly – #128 “The Inflation Adjustment for Social Security Benefits in 2025” (Posted 10/28/24)

Asset Allocation Bi-Weekly – The Inflation Adjustment for Social Security Benefits in 2025 (October 28, 2024)

by the Asset Allocation Committee | PDF

Even for dedicated, successful investors who have built up a substantial nest egg, Social Security retirement and disability investments can be an important part of their financial security. For many Americans, Social Security benefits may be the only significant source of income in advanced age. On average, Social Security benefits account for approximately 30% of elderly people’s income and more than 5% of all personal income in the US. There is one aspect of Social Security that is especially important in the current period of higher price inflation: By law, Social Security benefits are adjusted annually to account for changes in the cost of living. In this report, we discuss the Social Security cost-of-living adjustment (COLA) for 2025 and what it implies for the economy.

In mid-October, the Social Security Administration announced that Social Security retirement and disability benefits will increase 2.5% in 2025, bringing the average retirement benefit to an estimated $1,976 per month (see chart below). The increase, much smaller than those during the last couple years of high inflation, will bump up the average recipient’s monthly benefit by approximately $49. The benefit increase was right in line with expectations, given that it is computed from a special version of the Consumer Price Index (CPI) that is widely available. The COLA process also affected some other aspects of Social Security, although not necessarily by the same 2.5% rate. For example, the maximum amount of earnings subject to the Social Security tax was raised to $176,100, up 4.4% from the maximum of $168,600 in 2024.

Media commentators often fret that the Social Security COLA could be “eaten up” by rising prices in the following year, or that the benefit boost could provide a windfall if price increases decelerate. In truth, COLA merely aims to compensate beneficiaries for price increases over the past year. It is designed to maintain the purchasing power of a recipient’s benefits given past price changes with price changes in the coming year being reflected in next year’s COLA.

For the overall economy, the inflation-adjusted nature of Social Security benefits is particularly important. Since so many members of the huge baby boomer generation have now retired, and since more and more people are drawing disability benefits than in the past, Social Security income has become a bigger part of the economy (see chart below). In 2023, Social Security retirement and disability benefits accounted for 4.9% of the US gross domestic product (GDP). Having such a large part of the economy subject to automatic cost-of-living adjustments helps ensure that a big part of demand is insulated from the ravages of inflation, albeit with some lag. In contrast, if Social Security income were fixed, a large part of the population would be seeing its purchasing power drop sharply, which might not only reduce demand, but could also spark political instability. Of course, the additional benefits in 2025 will help buoy demand and keep inflation somewhat higher than it otherwise would be.

Finally, it’s important to remember that an individual’s own Social Security retirement benefit isn’t just determined by inflation. The formula for computing an individual’s starting benefit is driven in part by a person’s wage and salary history. Higher compensation will boost a retiree’s initial retirement benefit, which will then be adjusted via the COLA process over time. As average worker productivity increases, average wages and salaries have tended to grow faster than inflation, and as a result, the average Social Security benefit has grown much faster than the CPI. Over the last two decades, the average Social Security retirement benefit has grown at an average annual rate of 3.5%, while the CPI has risen at an average rate of just 2.6%. In sum, Social Security benefits provide an important source of growing purchasing power that helps buoy demand and corporate profits in the economy.

On the bottom line in our view, this year’s COLA announcement will prove to be market neutral. Although recipients may experience initial disappointment with this adjustment relative to those of recent years, the adjustment is actually more in line with those that came before the recent period of heightened inflation.