by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

It’s “red Monday” – global equities are taking a hit as the COVID-19 virus is starting to look like a global pandemic. Risk assets are down around the world while most risk-off assets, gold and Treasuries, are rallying. We cover three elections – Iran, Germany and Nevada. The president is in India. Here are the details:

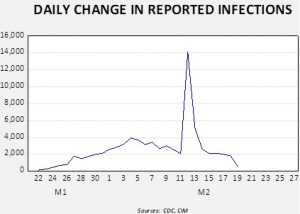

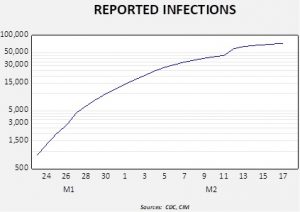

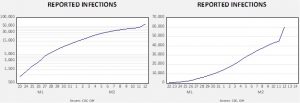

COVID-19: Worldwide cases are now 79,524 with 2,626 fatalities. Up to this weekend, the virus was mostly a Chinese problem. That has now changed. South Korea has seen its cases rise to 833, Italy is up to 215 and Iran has reported 61. South Korea is facing a crisis as cases rise and quarantines go into effect. Italy has seen a jump in cases as well. The famous Carnival in Venice closed early due to the virus. Italian authorities are putting towns under quarantine; EU nations are considering border blockades. In China, it appears that victims of the COVID-19 who have recovered can still spread the disease, leading authorities to put recovered patients back into quarantine. If this characteristic is confirmed, it would be most disturbing as it would become almost impossible to stop its spread because carriers would be asymptomatic. Iran is seeing a rise in cases and is shutting down schools in response. Neighboring nations are closing borders with Iran. There is a dispute over the number of fatalities in Iran. Chinese leaders confirmed that the National People’s Congress will be postponed due to COVID-19.

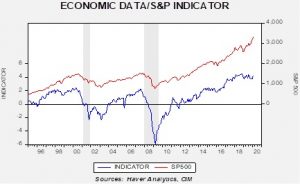

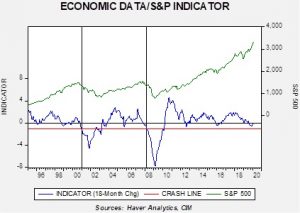

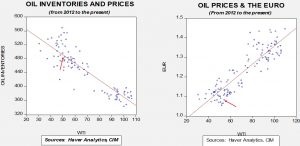

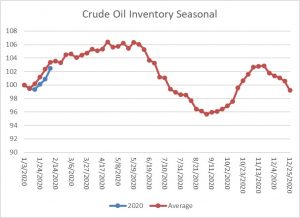

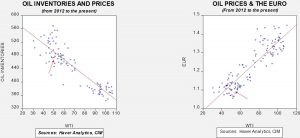

We would have to say that the perception of the virus has changed. Financial markets have been looking through the initial wave of infections and expecting conditions to improve by the end of March. If the virus prompted policy stimulus, risk-on assets would do even better. That attitude appears to have changed over the weekend, although signs of caution were emerging last week. As the virus spreads, it does appear that the global economic impact will be larger than first thought. Clearly, China will be hurt but it does have policy space to react to the problem. Unfortunately, most policy measures boost demand, but if the problem is supply, the impact of lowering interest rates or distributing cash will merely bring higher prices. Reports suggest that Chinese firms are facing severe liquidity constraints and supplying credit will raise already elevated debt levels. Low levels of global inventories are intensifying the impact of outages. Further disruptions of global supply chains appear inevitable. The G-20 warns that COVID-19 will threaten global growth. At the same time, U.S. officials continue to believe that the virus will not be an impediment to China’s purchases as mandated by the Phase One agreement. We suspect that position will change.

Our overall view of the virus remains the same; we expect it to be mostly a three-month event and look for the virus to dissipate. However, this is a probabilistic statement; there is a chance that COVID-19 becomes a global pandemic that becomes impossible to control and has an impact similar to influenza pandemics of the past. We continue to think the odds of this outcome are rather low but the spread we are observing is a concern. But, for now, we still see this problem mostly over by spring.

Elections: There were three elections of note over the weekend. In Hamburg, Germany, local elections gave the beleaguered SDP a rare win. The state will likely be governed by a Green/SDP coalition. In Iran, as we noted last week, the leadership had restricted candidates that could run, ensuring that conservatives would triumph. They did, but the turnout was so low that the mandate from the election was certainly weakened. In Nevada, Sen Sanders (I-VT) won easily, putting together a surprisingly broad coalition. As the schedule of primaries intensifies, Sanders has a chance to create an insurmountable lead. Although we would put most of the blame for equity market weakness on the COVID-19, the rise of Sanders is likely contributing to market pressure as well. The Left-Wing Establishment is in a tizzy over Sanders. The complaints sound remarkably similar to 2016 among the Right-Wing Establishment.

Passage to India: President Trump is in India for a two-day tour. So far, things appear to be going well, although there are noteworthy policy differences between the two nations.

Odds and ends: A rising CHF versus the EUR is causing problems for the Swiss National Bank. In the past, the SNB has aggressively intervened to fix the CHF/EUR rate. However, intervention to prevent the rise of the CHF would likely anger the U.S. and is complicating policy. The booming tech sector in northern California is starting to look like a bust. The impact on the broader economy might be next.