Daily Comment (February 13, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

After a steady rise, equities are lower this morning following a jump in reported infections; we update news on COVID-19. The nominating process for the remaining two vacant governor positions begins today. PM Johnson shakes up his cabinet. The CDU/CSU begins the process of selecting a new party leader. We update the energy data; the IEA warns of weakening oil demand. French unemployment falls (see foreign economic data below). Here are the details:

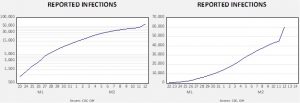

COVID-19: Due to new reporting standards, there was a massive jump in reported infections in China. The new count is 60,407 with 1,370 fatalities. Health authorities in Hubei province started counting clinically diagnosed cases as infections. Previously, only a positive laboratory test would trigger a diagnosis. There have been serious concerns about undercounting; testing kits were seen to be inaccurate, or worse, because they had a tendency to produce false negatives. The new reporting does show a noticeable bump in the data.

Both charts show the same data but the chart on the left uses a logarithmic scale, which shows the rate of change in the data; the chart on the right uses a linear scale and has been used by some media outlets to highlight the “hockey stick” nature of the increase. Although the jump in the data is clearly noticeable, even using the more legitimate log scale, it should be treated as a one-off event. In a sense, the new reporting should be treated as a data revision. The good news is that the increase in the number of cases highlights that most of those infected are suffering a mild case of the disease. So, today’s equity weakness is probably not a proper reaction to this news; on the other hand, the rally we have seen over the past several days was ignoring the likelihood of under-reporting so today’s drop could also be seen as a correction to previous overconfidence.

In related news, China continues to fire province-level officials over the handling of this crisis. And, proving the universality of Rahm Emmanuel’s dictum that a political leader should never let a crisis go to waste, Chairman Xi has installed his close ally, Xia Baolong, as leader of the Hong Kong and Macau Affairs Office. Xi is clearly working to extend his control over the restive Hong Kong. The banking system is showing some signs of stress as the virus weakens the economy. Global tourism is weakening as well. China’s car sales plunged 22% in January.

PM Johnson’s shakeup: The most notable firing is Sajid Javid, who was Chancellor of the Exchequer. However, there were numerous other sackings. The government is expected to announce replacements throughout the day. It is still uncertain what these replacements will bring. The GBP did move higher on the news.

The Fed nominating process: At long last, Christopher Waller and Judy Shelton go before the Senate Banking Committee at 9:00 EST today. To some extent, Waller may be the most fortunate candidate in recent memory; he is a conventional candidate and, most likely, Shelton will take a grilling. She is a very unconventional candidate. She has supported the gold standard and has expressed doubts about the very wisdom of having a central bank. For GOP senators, this nomination may prove to be yet another loyalty test to the White House. Our view? We have been expecting doves to be nominated to the vacant seats and both these candidates will be reliable advocates for rate cuts. It will make the composition of the Fed more dovish. At the same time, as we move from an efficiency to an equality cycle, central bank independence will be undermined. What we are concerned about with Shelton is that she may not be a dove or hawk in the traditional sense but may instead represent a “new bird.” She may be a political bird who will support easier policy when a Republican controls the White House but call for tight policy when a Democrat is in the Oval Office.

Odds and ends: As AKK leaves the leadership of the CDU/CSU, new candidates for the job are circling. The vetting process is beginning with familiar names emerging for a second chance at the position. And, here’s one to ponder—Greek 10-year bond yields have fallen below 1% to 0.98%.

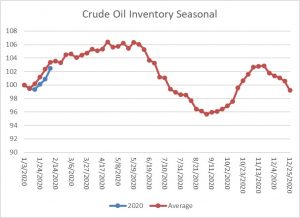

Energy update: Crude oil inventories rose 7.5 mb compared to a forecast rise to 3.2 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 13.0 mbpd. Exports fell 0.4 mbpd, while imports rose 0.4 mbpd. The rise in stockpiles was more than 2x what was forecast. The rise in imports coupled with the decline in exports prompted the large rise.

This chart shows the annual seasonal pattern for crude oil inventories. This week’s rise was consistent with seasonal patterns, and the gap between the normal pace of inventory accumulation and the actual has narrowed significantly. The next two weeks are usually steady so continued accumulation will put the current year above normal.

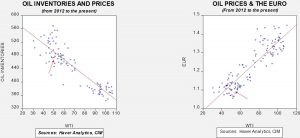

Based on our oil inventory/price model, fair value is $59.72; using the euro/price model, fair value is $47.58. The combined model, a broader analysis of the oil price, generates a fair value of $51.04. We are seeing a steady decline in all of the fair value calculations as the dollar strengthens and oil inventories rise. However, the combined model is within range of fair value so we may see some consolidation in the coming weeks. The IEA, citing the impact of the COVID-19 virus, has cut its global oil demand forecast by 365 kbpd.