Daily Comment (February 21, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

It’s Friday! Virus worries lead to mixed equity markets but a distinct element of worry—gold—continues to move higher despite dollar strength. Treasury yields continue to fall. However, the other flight-to-safety asset, the JPY, has failed to rally this time on fears of recession in Japan. We update the virus news. There are reports of a peace deal with the Taliban. Iranians go to the polls today. The EU is struggling with budget negotiations. Japan restricts foreign investment. We recap the DOE report. Here are the details:

COVID-19: The total number of reported cases is 76,778 with 2,247 fatalities. China is continuing to adjust its reporting parameters, raising concerns about an undercount. There has been a surge in cases in South Korea, with many tied to a church in Daegu. The country also recorded its first fatality. We note that U.S. equity markets slumped at mid-morning yesterday, likely on reports of a large rise in reported cases in Beijing. Up until now, the vast majority of cases (62,662 out of 76, 778) were in Hubei province, where the city of Wuhan sits. If case reports begin to show a rapid rise in infections beyond Hubei, it would suggest that the trajectory of the disease may not be lessening over time. There is evidence to suggest COVID-19 has a similar physiological effect as SARS.

Meanwhile, the economic impact of the virus is becoming clear. Airlines have been hurt. Energy demand has declined. There are increasing reports of manufacturing disruptions. Although today’s PMI data shows improvement, the virus may be distorting the reports. One element of the report, supply deliveries, may be giving a false reading. In the construction of PMIs, slower deliveries are considered bullish because they signal rising demand. However, in this case, slower deliveries caused by COVID-19 are actually a reflection of weakness. It appears that equity markets are taking a more cautious reading on the impact of the virus.

A deal with the Taliban? There are early reports from the SoS that a plan to reduce violence in Afghanistan may be in the offing. If true, it would be a signal that plans for a peace accord, set to be signed on February 29, may be closer to reality.

Iranian elections: Iranians go to the polls today to vote on a reduced slate of parliamentary candidates. The choice in most districts is either a hardliner or an extreme hardliner. The Council of Guardians, who decides which candidates can run, has severely restricted choices. The vote will generate a conservative parliament; however, the legitimacy of the vote is clearly weakened. In other Iranian news, the Financial Action Task Force, a Paris-based organization that monitors terrorist financing, is planning to put Iran on its blacklist. This action will further isolate Iran and undermine relations with Europe.

The EU budget: The EU is in the process of creating a seven-year budget. One of the major parts of this process is the transfer payments that move from the wealthy EU nations to the poorer ones. The latter want a bigger budget with high transfers; the former want less spending. A rebellion of sorts from Germany and the “frugal four,” trying to contain spending, is making it very difficult for negotiators to make a deal. Overhanging the problem is Brexit. The U.K. leaving the EU has left a €60 to €75 billion “hole” in available funds; the northern European nations are loath to fill that gap. In effect, the southern nations want the northern nations to offset the loss of Britain, while the northern nations want to offset the loss by reducing available funds.

Japan: The government is finalizing a plan to tighten scrutiny of foreign investment in 12 economic sectors, including defense, nuclear power, aerospace, telecom, utilities and others. Signaling a further rollback of globalization, the plan says any foreign investor buying 1% or more of certain firms in those sectors would be subject to prescreening, up from 10% currently.

Odds and ends: Despite the Phase One trade deal, financial conditions in the farm belt continue to deteriorate. Farm bankruptcies are forecast to remain high this year. The poor financial situation for farmers may be behind a shift in recommendations by Agriculture Secretary Perdue. He has come out in favor of a carbon tax, a significant break from the stance of the administration. It appears he is angling for farmers to receive payments for carbon sequestering. When farmers plant corn or soybeans, carbon is pulled from the atmosphere into the soil. After harvest, if the silage rots, some of this carbon is released back into the atmosphere. However, various techniques may prevent this from occurring and, if so, we suspect Perdue would push for farmers to receive payments for containing the carbon that was captured in the growing process.

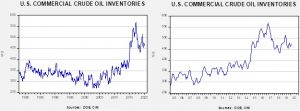

Energy update: Crude oil inventories rose 0.4 mb compared to the forecast rise of 3.2 mb.

In the details, U.S. crude oil production was unchanged at 13.0 mbpd. Exports rose 0.4 mbpd, while imports fell 0.2 mbpd. The inventory build was less than forecast due to rising exports, falling imports and a rise in refining activity.

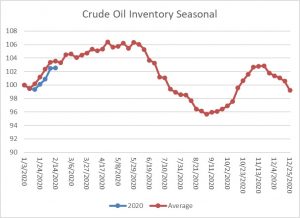

This chart shows the annual seasonal pattern for crude oil inventories. This week’s report was consistent with seasonal patterns and the gap remains narrow between the normal pace of inventory accumulation and the actual. Seasonally, next week should be steady too, but further builds would be expected into May.

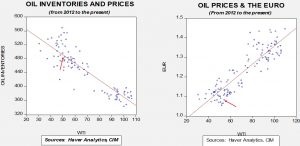

Based on our oil inventory/price model, fair value is $59.59; using the euro/price model, fair value is $46.28. The combined model, a broader analysis of the oil price, generates a fair value of $50.13. The wide deviation in model forecasts is due to the weakness in the dollar. Although we have seen a rebound in oil prices on hopes that the COVID-19 virus will be contained soon, dollar strength remains a bearish risk factor for oil prices.