Author: Rebekah Stovall

Daily Comment (March 9, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Global equities suffered a deep slide overnight; equity futures fell to limit down levels, so we are not sure how far they will decline on the open. The 30-year Treasury yield broke 1% and the 10-year T-note has fallen below 50 bps. The JPY is appreciating. Oil prices fell over 20% as it looks like we are in the midst of the market share war. At the same time, there is evidence to suggest some of this event may be about a shake up in the Saudi Royal family. We update COVID-19. Lots to cover; let’s get at it. Here are the details:

COVID-19: The number of reported global infections is now 111,354, with 3,892 fatalities and 62,373 recoveries. Although the raw data suggests some optimism—the growth rate of infections is slowing, while the recovery rate is rising—that news is being lost amid rising fear and government missteps. Governments around the world are moving to contain and cope with the virus.

- In Europe, Italy has moved to lock down its northern provinces, while France has banned gatherings of more than 1,000 people. Germany is considering the same. Helpfully, the French health ministry has warned that cocaine does not protect against the virus. The quarantine in Italy affects 16 million people, which is the most economically vibrant part of the country. We would expect ripple effects for the rest of Europe from the virus.

- In the U.S., the administration is considering further fiscal measures. As we have been noting recently, we remain surprised that the White House hasn’t moved to aggressively stimulate; the chances of inflation are nil, and this is an election year. The desire to avoid panic is understandable, but there is little doubt that upcoming economic data is going to show weakness. There is little point in waiting to act until after the numbers turn lower. Our case for recovery is based on a strong fiscal response; if it fails to develop, the odds of recession are higher than we currently expect. What would we expect to see? Extended and increased unemployment insurance, loan subsidies for small businesses and, perhaps, a payroll tax holiday.

- Meanwhile, reports of infections in the U.S. continue to rise and spread. Seattle has been hard hit, but 35 states have now reported cases. As we have noted, COVID-19 is especially risky for the elderly. With Congress full of old men and women, fear is rising on Capitol Hill. We are in the early stages of U.S. corporate reaction to the virus; look for an increasing number of workers toiling remotely in the coming weeks.

- In the rest of the world, Iran is making a hash of its response, threatening the rest of the region. We are seeing the aftereffect in China; its combined trade data for January and February reported a drop of 17% in exports as supply chains were disrupted by the widespread lockdown. Japan’s Q4 GDP was revised lower, down 7.1% on an annualized basis. Reports suggesting a further retreat in globalization continue as foreign investment is set to decline. The effects on various markets continue as well; besides oil, which we cover below, we are seeing a glut of metals develop on world markets.

Ok, so where are we now? If we think back to where all this started, in China, we started tracking the virus in the second week of January. By late February, we were starting to see signs that the infection rate was slowing. Currently, China is starting to show signs of recovery, although the rise is rather sluggish. In comparison to China, the U.S. is about three weeks into this cycle. The next three weeks will be rough; meeting cancelations will grow, travel will plummet and economic activity will slow. But, by early to mid-April, we should start to see a slowdown in infections and some indication that the worst of this virus is behind us. Due to reporting lags, the economic data will be lousy into June, which will still be reporting data from April and May. Again, policymakers can help here; moving aggressively to funnel money into households remains the best way to support the economy and avoid an official recession. If policymakers remain timid, the drop in growth will be deeper and the recovery slower. We don’t expect a timid response, although at this point that position is more based on faith than evidence.

OPEC: In a surprising development, the Russians refused to participate in OPEC production cuts, citing opposition to losing market share to U.S. shale producers. Perhaps Russia expected the Saudis to maintain production cuts to prevent a sharp decline in prices. If so, that assumption was in error. The Saudis announced sharp price cuts and production increases. Why is Saudi Arabia “going to the mattresses” over Russia’s action?

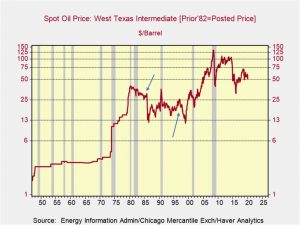

Most of the time, the Saudis opt for a moderate oil price policy, which is a price high enough to bring ample revenue but not so high that it destroys demand. But, if it faces the loss of market share to a key customer, it has, in the past, flooded the market with oil to drive down the price and force its competitor in this key market to surrender. In 1986 and 1999, the Saudis were losing market share in the U.S. At the time, the Kingdom of Saudi Arabia (KSA) was worried that if its share fell permanently, the U.S. might not be interested in its defense. So, in 1986 and 1999, it drove prices to around $10 per barrel until other oil producers agreed to production cutbacks. Once peace emerged, prices recovered.

The KSA is no longer interested in defending U.S. market share. The onset of shale oil and the clear U.S. preference to leave the Middle East means it has other areas to focus upon. That area is China. Last year, its oil exports to China jumped 42% which gave it back the #1 position as foreign oil suppler, with Russia as #2. If the KSA didn’t boost production, it would cede its position to Russia, which it has decided is not in its interest. Therefore, as we saw in the other two episodes, a sharp decline in prices is in the offing. We have noted some analysts have been comparing this event to 2014-15, when the KSA seemed to be taking on shale producers only to retreat. We view this as a faulty comparison. In that event, the Saudis were not defending market share in a key market. This event is more akin to the 1986 and 1999 events. This is going to be a much deeper decline. A $20 handle on oil (meaning falling below $30 per barrel, WTI) is highly likely. One area that might benefit? Natural gas prices may find some support as associated gas production will eventually fall. However, patience is recommended; oil producers are hedged so it will take a few months for U.S. oil production to start falling.

We would expect Russia to take on the KSA in this fight. Look for the RUB to fall sharply as Russia tries to reduce operating costs. The KSA generally doesn’t use exchange rates to boost competitiveness, although it might this time. In the U.S., the already beleaguered energy sector is facing another rout; high yield debt is at risk as well.

Another item of note: Crown Prince Salman arrested Prince Ahmed bin Abdulaziz, the brother of King Salman, and Prince Mohammed bin Nayef, the former crown prince. Prince Abdulaziz is the last remaining “king eligible” son of the KSA founder Ibn Saud, and Prince Nayef was initially the next in line to the throne. Although CP Salman has been consolidating power for some time, these aggressive actions may signal that King Salman, who has been in ill health for some time, may be approaching death and CP Salman wants to eliminate any potential claimants to the throne.

Odds and ends: Lebanon is set to default on its debt as its foreign reserves dwindle. Turkish President Erdogan is visiting Brussels over the current refugee crisis; he wants more money from the EU. Political turmoil is rising in Bolivia as the current government battles with supporters of the exiled former president. In Taiwan, the KMT is dropping its Beijing supportive policy which will exacerbate tension with the PRC.

Asset Allocation Weekly (March 6, 2020)

by Asset Allocation Committee

In the turmoil caused by COVID-19, fixed income has performed remarkably well. Ten-year T-note yields have declined to record lows and, as we will show below, there is no evidence of severe stress in the credit markets.

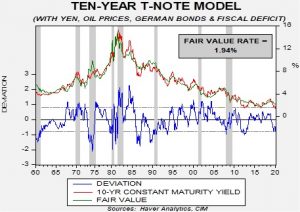

First, here is what we are seeing in Treasuries.

This chart shows our 10-year T-note model. It uses fed funds, the 15-year average of inflation,[1] the yen/dollar exchange rate, oil prices, German bund yields and fiscal deficits as a percentage of GDP. At the end of last year, the fair value was around 2.40%; as the above chart shows, it has declined sharply to 1.94%. Of course, that yield remains well above current yields. The implied three-month LIBOR rate from the two-year deferred Eurodollar futures suggests the financial markets expect another 50 bps of rate cuts over the next two years. Even assuming a 0.75% fed funds target only lowers the fair value to 1.84%. Assuming those rate cuts at a German bund yield of -3.60% (a decline of 300 bps from current levels) would get the model to current yields. A negative yield to that level would be unprecedented. The most likely justification for current yields would be a sharp drop in inflation expectations. If inflation expectations decline to 1% per year along with the assumption of 100 bps of rate cuts, that would justify current yields. This analysis suggests that long-duration Treasuries are richly valued at current levels, and if our base case that COVID-19 won’t trigger a recession is accurate, then a back-up in these yields would be expected.

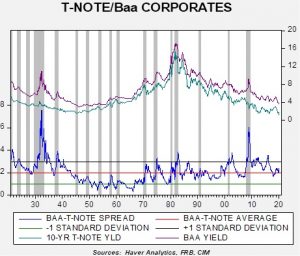

What is perhaps most interesting is that there has not been a strong reaction in credit. Comparing the 10-year to Baa yields shows that spreads have not moved significantly, only around 30 bps.

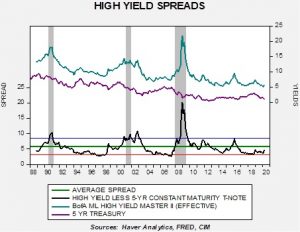

In high yield, spreads have widened as well, but the increase is not notable so far.

Yields have increased by 80 bps but remain 120 bps below average.

The lack of pressure in the credit markets, at least to this point, suggests the current situation probably won’t evolve into deep financial crisis or a recession. We will continue to monitor the credit markets closely in the coming weeks, but financial stress appears quite manageable for now.

[1] Which is a proxy for inflation expectations.

Daily Comment (March 6, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

It’s Friday employment day, although the data is mostly irrelevant. This report covers February, before COVID-19 hit the U.S. economy. We detail the data below, but the quick read is that the data was very strong. As has been our practice, we update COVID-19 news. Risk markets are under pressure globally as the virus spreads and policymakers appear to be caught off guard. Russia and Turkey declare a ceasefire. Here are the details:

COVID-19: The number of reported cases is now 100,278, breaking the 100k level for the first time; fatalities are 3,406 and recoveries are 55,694.

- We are seeing a massive risk-off trade in the financial markets. World equity markets are under pressure; U.S. equity futures, at the time of this writing, are down in the neighborhood of 3%. Gold prices are higher and Treasury yields continue to march lower. Mortgage yields are falling to record lows; it isn’t clear how much stimulus this development will generate.

- The news from the world outside of China remains grim. Seattle closed its schools. In France, a deputy in the National Assembly is in intensive care, afflicted with the virus. Islamic holy sites are being closed. The economic costs continue to mount. Credit spreads are starting to widen around the world as default fears rise. Food prices are showing signs of rising again in China. Under normal circumstances, that would be good news for U.S. agriculture. However, global shipping has been disrupted and, at least for now, it isn’t likely that U.S. grain and meat will make its way to China. Oil demand has been hit hard by the virus. Maryland has declared a state of emergency; its proximity to Washington, D.C. will increase fears. The airline industry has been hit hard; a British airline has failed. The European Parliament has canceled over 100 events.

- There is an old saying that the first victim of war is the truth. Similar sentiments can be expressed about pandemics. Fact checkers have been hard at work debunking reports that the U.S. created the virus (it should be noted that a similar rumor that it originated in a Chinese biological weapons factory circulated a couple of weeks ago). Other reports offered novel ways of protecting oneself from the virus; all have been found to be false. Reports out of China are suggesting that a second, more virulent strain of COVID-19 has emerged. Geneticists warn against concluding that the virus is becoming more deadly. The work of Adam Kucharski puts the disease in context.

- Another developing trend is that countries and businesses are being accused of hoarding. Italy is complaining that other EU nations won’t share medical supplies (so much for European solidarity). Globalization has moved from a virtue to a vice.

- Our expectation of this event is that it would be significant in impact but short in duration. Part of this expectation is built on the idea that we would see aggressive fiscal and monetary policy stimulus. So far, we have to say the results have been mixed at best. The Fed did act aggressively, but the bond market is making it clear they didn’t move nearly enough. The ECB hasn’t moved at all. However, what has really surprised us is the lack of fiscal action. This is an election year; history shows a pattern where incumbents use all sorts of tactics to boost growth to improve either re-election or the election of a new president from the incumbent party. Rahm Emmanuel had a famous quote, made during the financial crisis, that “one should never let a crisis go to waste.” And yet, so far, the White House has pushed back on suggestions of fiscal actions. As the airlines have swooned, the president has indicated no aid will be forthcoming. The attitude seems to be that COVID-19 isn’t a big deal and that nothing—no tariff rollbacks, payroll tax holidays, credit support or even cash distributions—is necessary. We find this attitude a bit surprising; the economic data will start to deteriorate soon but, due to delays in reporting, the worst won’t be seen until April and May. In terms of the November elections, this is the most critical time because most voters’ view of the economy is based on what was happening two quarters ago. If the stimulus isn’t forthcoming, the rebound could be much less robust than we expected and the odds of recession are rising.

Turkey and Russia: The two have set a ceasefire. The refugee threat to Europe remains. We will be watching to see if the agreement holds but clearly neither Ankara nor Moscow want a broader war.

Odds and ends: There was an OPEC agreement but it doesn’t appear Russia will participate. The remaining members offered to cut production by 1.0 mbpd, but without a 0.5 mbpd cut from Russia oil prices have plunged this morning. On Thursday night, the Reserve Bank of India (RBI) seized control of its fourth largest lender, Yes Bank (YESBANK, 16.60). The takeover was to prevent a loss in confidence of the Indian financial system due to Yes Bank’s inability to raise capital to improve its financials. The president’s national security team has advised that he block Infineon Technologies’ (IFNNY, 20.20) proposed acquisition of the American chipmaker Cypress Semiconductor Corp. (CY, 19.18) due to its links to China. In order to stimulate the U.K. economy, Prime Minister Boris Johnson appears to be looking into eliminating tax breaks that benefit the “staggeringly rich.” In Tunisia, two militants on a motorbike blew themselves up outside the U.S. Embassy.

Daily Comment (March 5, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Happy Thursday! After a strong equity market rally yesterday, which lifted stocks in Asia overnight, Europe turned lower and U.S. equity futures are also falling. We update COVID-19 news. The U.S. won a battle with China over global regulation. Turkey and Russia meet; Europe frets over another refugee crisis. Here are the details:

N.B. On Thursdays, we usually update the DOE weekly energy data as part of the Daily Comment report. We have decided to make the weekly data recap its own report, which you can access here. Going forward, a link will be provided every week after the data is released.

COVID-19: There are now 95,748 reported cases of COVID-19, with 3,286 fatalities and 53,423 recoveries. Although the news flow surrounding the virus remains grim, since February 19, the number of recoveries have outpaced the number of new cases. This is good news.

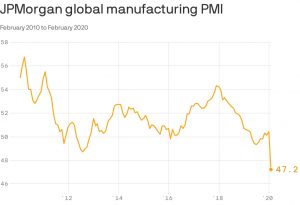

- The economic impact: The economic impact of the virus continues to ripple through the global economy. The JP Morgan world PMI report shows a sharp decline.

Anecdotal evidence of economic fallout continues to build. The Fed’s Beige Book painted a picture of widening negative effects; in part, the report is probably one of the factors that prompted the emergency rate cut this week. Italy has closed its schools for two weeks. France has put price controls on hand sanitizer. The London Book Fair has been canceled; so was the Geneva Auto Show. European football[1] games are being played before empty stadiums. So far, the Olympics are still a go, but there are growing concerns they might be canceled as well. California has declared a state of emergency after the first fatality of one of its citizens was reported; the U.S. death toll has reached 11. Companies are preparing their workers to perform their tasks remotely. India solar groups are considering force majeure declarations due to supply problems emanating from China. China’s auto sales fell 80%. Japan announced that a state visit by China’s President Xi Jinping has been postponed. Reports from the Chinese small business community remain grim. Companies in China are being forced to offer bounties to find workers.

- Iran: The situation in Iran continues to deteriorate and may have geopolitical ramifications. At least two dozen MPs and 15 other senior members of the government have all been afflicted by the virus. It appears the virus is spreading rapidly in Iran and overwhelming its public health capacity.

- Globalization: We continue to watch the impact of COVID-19 on globalization. In our analysis, globalization has been in retreat for some time; we would peg the U.S. withdrawal from TPP and TTIP as the events that historians will someday use to mark the end of the post-WWII globalization era. The virus is contributing to the trend. Reports indicate foreign firms in labor intensive industries are starting to exit. Editorials are pointing out that the virus has exposed the risk of far-flung supply chains. India has announced curbs on drug exports which could lead to shortages in the U.S. China had an aggressive response to COVID-19 and was angered by other nations applying travel bans; now it must deal with Chinese nationals returning from overseas visits from areas affected by the virus. The U.S. is not considering lifting tariffs on China due to COVID-19.

- The good news: Amid all this negative news, there were some positive items as well. Recruitment efforts have started for testing an experimental vaccine. The House passed an $8.3 billion fiscal package to counter the impact of COVID-19. One underlying positive factor from the Fed’s emergency rate cut is that it has given political cover for foreign policymakers to take aggressive steps of their own. We expect the policy response to bring a strong recovery later this year.

China v. U.S. on regulation: China has been making a concerted effort to gain more power and representation in international bodies. Where it is being blocked, it is creating new bodies to expand its soft power. Meanwhile, the U.S. and the rest of the West are pushing back. The World Intellectual Property Organization’s leadership position was open and China was pushing its candidate, Wang Binying, for the role. The U.S. fought back and won; its candidate, Daren Tang, the head of Singapore’s intellectual property office, was nominated. On the one hand, as China’s importance in the world rises, it makes sense it would want, and may deserve, more representation. On the other hand, if the U.S. has deemed China a strategic competitor, every office it controls becomes a threat. These sorts of events are further evidence that the world is evolving into at least a bipolar world.

About yesterday: The strong rally in equity markets was supported by a massive jump in health care stocks, a reflection of Super Tuesday.

Europe, Turkey and Russia: Turkish President Erdogan and Russian President Putin are meeting to defuse an escalating conflict in Idlib. Meanwhile, Turkey is allowing refugees to stream toward its borders with Europe, raising the potential for a political crisis during the COVID-19 outbreak.

Afghanistan: The U.S. launched airstrikes against Taliban positions after the latter continued to attack Afghan army positions. Although we expect the NATO troop withdrawal to continue, the lack of stability does show that Afghanistan is likely to spiral into civil conflict as we leave.

Odds and ends: Uber (UBER, 34.53) lost a case in France; French courts ruled that its workers were employees. If the ruling stands and becomes the new standard, the whole “gig” business model will become much less attractive. A new study by the Economic Policy Institute confirms our suspicions about last year’s stronger wage growth for non-supervisory workers—it was all about state and local minimum wage increases, and not due to tightening labor supply. The U.S. has finalized rules that will require the largest banks to further increase their capital buffers.

[1] Soccer for Americans.

Weekly Energy Update (March 5, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

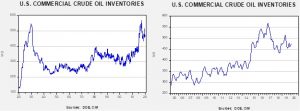

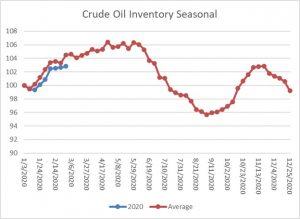

Crude oil inventories rose 0.8 mb compared to the forecast rise of 3.0 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to a new record of 13.1 mbpd. Exports rose 0.5 mbpd, while imports were unchanged. The inventory build was less than forecast due to rising exports and steady imports.

This chart shows the annual seasonal pattern for crude oil inventories. This week’s report was less than the usual seasonal patterns, and the gap between the normal pace of inventory accumulation and the actual widened modestly.

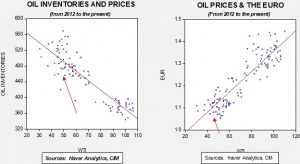

Based on our oil inventory/price model, fair value is $59.19; using the euro/price model, fair value is $46.44. The combined model, a broader analysis of the oil price, generates a fair value of $50.08. Oil prices have stabilized this week. OPEC has reportedly agreed to a 1.5 mbpd production cut; it is unclear if Russia is participating. This decision comes not a moment too soon as we are hearing reports that tankers are being used for floating storage, a clear sign of oversupply.

Daily Comment (March 4, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

After yesterday’s wild rollercoaster ride in the markets, we’re looking for a happier Wednesday. We provide an update to the COVID-19 panic and the confusing policy responses, as well as a recap of yesterday’s Super Tuesday primaries. On a less positive note, it seems the U.S.-Taliban peace deal is already at risk, while a new migrant crisis continues to threaten the EU.

COVID-19: Official data show confirmed cases have risen to 94,250 worldwide, with 3,214 deaths and 51,026 recoveries. In the United States, confirmed cases rose to 128, with nine deaths and eight recoveries. Those figures still pale in comparison with the typical impact from influenza every year, but the COVID-19 virus is still a novel, unknown threat, and world markets have been buffeted by waves of fear and worry that even powerful policymakers may be ineffective in their fight against it.

- Federal Reserve. Over the last 24 hours, the key event in the COVID-19 panic was the Fed’s decision to slash its benchmark fed funds interest rate to a range of 1.00% to 1.25%. Not only was the cut unusually large (50 basis points), but it also came sooner than expected. In fact, it was the first cut outside a regular policy meeting since 2008. The aggressive action initially prompted strong stock buying, but the aggressiveness itself seemed incongruous with the Fed’s recent signaling that the economy is in good shape. Even worse, Fed Chair Powell warned in a post-decision press conference that the virus and measures to contain it will still weigh on the global economy in the future, and Cleveland Fed President Mester later reiterated that idea. This begs the question as to why policymakers felt the need to move so soon, undercutting the “coordinated” action that global officials had been hinting at. Does the Fed know something that we don’t know, perhaps from the business contacts that contribute to the Beige Book? Did policymakers cave to political pressure from the White House? Or, after years of monetary policy coming to the rescue of the economy and markets, did the bungled messaging finally wake up investors to the fact that low interest rates and central bank asset purchases can’t cure all ills. Sometimes, they’re merely anesthesia. In any case, the market’s judgement turned negative quickly, pushing stock prices down sharply.

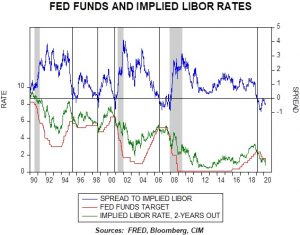

- Bond Market Action. Amidst the drop in stocks, safe-haven Treasuries surged, pushing the yield on the benchmark 10-year note down to a record intraday low of 0.91% and a record closing low of 1.01%. Strong buying during a stock rout is no surprise, but there was probably more to it than that. We note that the Fed’s big cut still wasn’t enough for the fed funds rate to catch up with one of our favorite indicators: the implied LIBOR rate two years out. That figure suggests the Fed would have to cut rates by about 50 more bps soon. Just as important, multiple structural issues ranging from slower population growth and population aging to deregulation and globalization still seem likely to hold down inflation in the near term. At this point, it’s hard to see a need for serious rate hikes in the foreseeable future. Some snap-back in longer yields wouldn’t be a surprise, but a dramatic and sustained rebound may not be in the cards.

- Other Central Banks. Like the Fed, other major central banks have been signaling their willingness to loosen policy to cushion the impact of COVID-19, but they may wait a bit longer. The ECB may be the next move, with markets pricing in a cut of 10 bps when it meets on March 12. The Fed holds its next regular policy meeting March 17-18, at which point it could cut again, while the Bank of Japan holds its next meeting on March 18-19 and Bank of England policymakers meet on March 26.

- Economic Impact. Even though public health officials’ draconian measures to stem the epidemic have so far proven much more economically disruptive than the disease itself, a new IPSOS poll shows people around the world are comfortable with quarantining whole cities. In the U.S., the poll found fully 70% of respondents comfortable with citywide quarantines. That support is probably one reason why public officials and private firms alike continue to take dramatic steps that can seem excessive compared with the risk of the disease. Conferences and business travel plans are being cut at a historic rate. The NCAA even says it’s open to banning fans from attending the men’s basketball championship tournament. Such cancellations could increase if a well-known personality is sickened or dies from the virus; rumors are already swirling that Pope Francis has been infected with COVID-19. With global manufacturing still nursing its wounds from last year’s trade war, the hit to the service sector is a key risk. As shown below, data today showed a big drop in the PMI for services in both China and Japan. Of course, manufacturing workers in China and elsewhere have borne much of the brunt of the epidemic’s disruptions, but the generally lower pay, lower skill level, and lack of unionization among service-sector workers in industries like air travel and lodging mean their income and spending could quickly come to a hard stop as the disruptions continue.

Super Tuesday: In yesterday’s Democratic primaries, former Vice President Joe Biden did much better than anticipated, winning multiple states outright and surging past Vermont Sen. Bernie Sanders in committed delegates to the party’s summer convention. Biden showed particular strength in the South, Midwest, and New England, while Sanders won California, Utah, Colorado, and Vermont. Former New York Mayor Bloomberg and Massachusetts Sen. Warren walked away with little to show for their efforts. With the moderate Biden now leading what has become a two-man race, and with Bloomberg promising to richly fund whichever Democrat wins the nomination, the results are likely to be a positive for equities today.

Turkey-Syria-EU: Rushing to take advantage of President Erdogan opening Turkey’s border with Greece, thousands of Middle Eastern refugees are streaming across Turkey to cross into the EU. However, Greek officials continue to block the migrants, and EU leaders are demanding that Turkey comply with its 2016 agreement to keep them bottled up in return for aid. While Erdogan hopes to use the EU’s fear of a new migrant crisis as leverage for additional aid and help in Turkey’s fight against Syrian troops, EU officials are showing no sign of caving to his demands just yet.

United Kingdom: Home Secretary Priti Patel’s position in the government appears to be hanging by a thread after multiple senior civil servants have accused her of using an abusive, bullying management style. Given the Home Secretary’s high profile in British government, a Patel resignation would be politically damaging to Prime Minister Johnson.

United States-Afghanistan: Just days after the U.S. and the Taliban signed a deal to end U.S. involvement in Afghanistan, yesterday Taliban fighters carried out dozens of attacks on Afghan security checkpoints in Helmand province alone, prompting a U.S. airstrike against the Taliban. The violence suggests the U.S.-Taliban deal is already at risk. If the deal fails, it could leave the U.S. with no good option to withdraw from the country and cause a significant political liability for President Trump in the run-up to the November election.

Iran: The International Atomic Energy Agency said yesterday that Iran has tripled its stockpile of enriched uranium and is barring international inspectors from two undeclared nuclear sites. The moves follow Iran’s announcement last year that it will stop adhering to aspects of the international nuclear agreement in response to the U.S. re-imposing sanctions. This news will further ratchet up tensions with the West and potentially bring Israel closer to taking unilateral military action.

Daily Comment (March 3, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

It’s Super Tuesday! By late this evening, we should have a better sense of who is really competitive in the Democrats’ race for a presidential candidate. In the meantime, the COVID-19 virus remains in the spotlight. We provide our usual update and discuss the evolving regulatory, fiscal, and monetary policy responses. We also provide an update on the Turkish-Syrian military conflict.

COVID-19: Official data show confirmed cases have risen to 91,320 worldwide, with 3,118 deaths and 48,166 recoveries. In the United States, there have been 105 confirmed cases, six deaths, and seven recoveries. A hotspot of cases centered on a nursing home in Washington State is of particular concern. However, despite the continuing spread of the virus, investors have begun to get more encouraged by signs of concrete government action to tackle the epidemic.

- FDA Commissioner Stephen Hahn said last night that up to a million U.S. citizens could be screened for the virus by the end of this week. In the U.K., Prime Minister Johnson said the “vast majority” of Britons should go about their business as usual, but he also unveiled a response plan focused on containing the virus, delaying its spread, researching its origins, and mitigating its impact.

- In the realm of fiscal policy, countries are also marching forward. Most notable so far is Italy, which has launched a $4 billion stimulus program including deploying tax credits, support for exporters, and increased liquidity to businesses.

- In monetary policy, Bank of England Governor Carney told a parliamentary committee that the central bank would try to help businesses and households manage through the crisis, echoing hints of looser monetary policy from the U.S. Federal Reserve, the European Central Bank, and the Bank of Japan. The Reserve Bank of Australia today became the first central bank to lower interest rates in an effort to bolster demand in the face of the crisis. The bank cut its benchmark short-term interest rate to a record low of 0.50% from 0.75% previously. The Malaysian central bank also cut rates, and the Bank of Japan injected liquidity into the financial system for a second straight day.

- With the emergence of more concrete government action to tackle the epidemic and hints of coordinated fiscal and monetary policy to counter any damage to demand, investors are clearly regaining their wits. A statement by G7 finance ministers after their emergency meeting this morning was a bit disappointing as it stopped short of announcing new actions. There is some disagreement about the best ways to counter the epidemic. There is also some silliness, like the NBA directive that players should avoid high-fives with fans or strangers. All the same, the short-term trend still seems to be for improved sentiment toward risk assets. That view is consistent with our continuing assessment that the crisis will likely be limited to three or four months, even if the economic impact might be greater than we earlier expected.

- Even though investors are looking hopefully toward policy response against the coronavirus, not all governments are being given the benefit of the doubt. In Iran, officials will send 300,000 “medical” teams to screen the population for the coronavirus and offer assistance, but the move is getting pushback based on the risk that door-to-door visits could actually spread the virus further and the fact that the teams will include members of the Revolutionary Guards and paramilitary basij enforcers.

Super Tuesday: Primary elections will be held in 14 states today. The main focus will be on the Democratic races, which will pick about one-third of the delegates to its national convention in the summer. Over the last two days, several moderate candidates have dropped out and/or endorsed former Vice President Joe Biden, but it’s still not clear whether he can overtake Vermont Sen. Bernie Sanders when the counting is done. We expect to have greater clarity on the results in our Daily Comment tomorrow.

Turkey-Syria-Russia: The Turkish military claims it has decimated the Syrian forces trying to crush the last pockets of rebel resistance in Idlib province. According to the sources, Turkey’s high-tech F-16s and drones have destroyed some 135 tanks, 77 armored personnel carriers, eight helicopters, and two jet fighters, not to mention killing 2,500 Syrian troops. The officials claim Turkey has already rendered Syria unable to defend its front-line armor and artillery units. To date, Russia has been unwilling to come to the aid of its Syrian allies, perhaps demonstrating the limits of Russian aggressiveness when faced with superior technology and firepower. If Turkey can quickly stop Syria’s advance against the remaining rebels in the area, it could obviate any need for assistance from NATO or the EU. It might then close its border again to Syrian refugees trying to cross into Europe (state media has claimed the opening is temporary; tens of thousands of refugees have massed on Turkey’s border with Greece, and several thousand have already entered). However, as long as the fighting continues, there is always a chance of miscalculation, escalation, and further destabilizing refugee flows into the EU.

Israel: With more than 90% of the vote in yesterday’s parliamentary elections now counted, it appears Prime Minister Netanyahu and his center-right Likud Party won 59 seats in the 120-member Knesset, while challenger Benny Gantz and his coalition won no more than 54. Netanyahu would still have to ally with another party to win control of the government. Making matters even more fluid, he will go on trial for corruption in two weeks. All the same, the prospect for continued rule by Netanyahu is probably positive for Israeli assets.

United States-China: Following on the Trump administration’s decision last month to designate Chinese state media companies as foreign government representatives, the State Department yesterday ordered the firms to cut their employees in the U.S. to 100 in total from 160 currently. The move should dispel any notion that the U.S.-China Phase One trade deal will necessarily put an end to tensions between the countries.

Weekly Geopolitical Report – Investment Implications of Changing Demographics: Part III (March 2, 2020)

by Patrick Fearon-Hernandez, CFA

In Part I of this report, we looked at current key global population trends. The report discussed how plunging birth rates have been weighing on population growth and boosting average ages all over the world, with a potentially huge impact on the distribution of geopolitical power, economic prospects and future investment returns. In Part II, we showed how these demographic trends are playing out for the world’s sole superpower and most important economy: the United States.

This week, in the final segment of this report, we’ll dive deeper into the economic implications of slowing population growth and an aging population. Our analysis will show that these demographic trends are likely to weigh heavily on future economic growth and inflation. The trends may well impact standards of living and constrain monetary and fiscal policy in important ways. We’ll conclude with a discussion of the long-term ramifications for investors, although it’s important to remember that many other forces can have a greater impact on investment returns in the short term.