Daily Comment (March 5, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Happy Thursday! After a strong equity market rally yesterday, which lifted stocks in Asia overnight, Europe turned lower and U.S. equity futures are also falling. We update COVID-19 news. The U.S. won a battle with China over global regulation. Turkey and Russia meet; Europe frets over another refugee crisis. Here are the details:

N.B. On Thursdays, we usually update the DOE weekly energy data as part of the Daily Comment report. We have decided to make the weekly data recap its own report, which you can access here. Going forward, a link will be provided every week after the data is released.

COVID-19: There are now 95,748 reported cases of COVID-19, with 3,286 fatalities and 53,423 recoveries. Although the news flow surrounding the virus remains grim, since February 19, the number of recoveries have outpaced the number of new cases. This is good news.

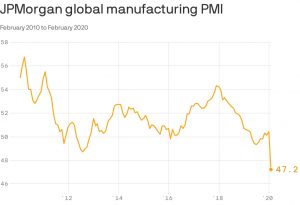

- The economic impact: The economic impact of the virus continues to ripple through the global economy. The JP Morgan world PMI report shows a sharp decline.

Anecdotal evidence of economic fallout continues to build. The Fed’s Beige Book painted a picture of widening negative effects; in part, the report is probably one of the factors that prompted the emergency rate cut this week. Italy has closed its schools for two weeks. France has put price controls on hand sanitizer. The London Book Fair has been canceled; so was the Geneva Auto Show. European football[1] games are being played before empty stadiums. So far, the Olympics are still a go, but there are growing concerns they might be canceled as well. California has declared a state of emergency after the first fatality of one of its citizens was reported; the U.S. death toll has reached 11. Companies are preparing their workers to perform their tasks remotely. India solar groups are considering force majeure declarations due to supply problems emanating from China. China’s auto sales fell 80%. Japan announced that a state visit by China’s President Xi Jinping has been postponed. Reports from the Chinese small business community remain grim. Companies in China are being forced to offer bounties to find workers.

- Iran: The situation in Iran continues to deteriorate and may have geopolitical ramifications. At least two dozen MPs and 15 other senior members of the government have all been afflicted by the virus. It appears the virus is spreading rapidly in Iran and overwhelming its public health capacity.

- Globalization: We continue to watch the impact of COVID-19 on globalization. In our analysis, globalization has been in retreat for some time; we would peg the U.S. withdrawal from TPP and TTIP as the events that historians will someday use to mark the end of the post-WWII globalization era. The virus is contributing to the trend. Reports indicate foreign firms in labor intensive industries are starting to exit. Editorials are pointing out that the virus has exposed the risk of far-flung supply chains. India has announced curbs on drug exports which could lead to shortages in the U.S. China had an aggressive response to COVID-19 and was angered by other nations applying travel bans; now it must deal with Chinese nationals returning from overseas visits from areas affected by the virus. The U.S. is not considering lifting tariffs on China due to COVID-19.

- The good news: Amid all this negative news, there were some positive items as well. Recruitment efforts have started for testing an experimental vaccine. The House passed an $8.3 billion fiscal package to counter the impact of COVID-19. One underlying positive factor from the Fed’s emergency rate cut is that it has given political cover for foreign policymakers to take aggressive steps of their own. We expect the policy response to bring a strong recovery later this year.

China v. U.S. on regulation: China has been making a concerted effort to gain more power and representation in international bodies. Where it is being blocked, it is creating new bodies to expand its soft power. Meanwhile, the U.S. and the rest of the West are pushing back. The World Intellectual Property Organization’s leadership position was open and China was pushing its candidate, Wang Binying, for the role. The U.S. fought back and won; its candidate, Daren Tang, the head of Singapore’s intellectual property office, was nominated. On the one hand, as China’s importance in the world rises, it makes sense it would want, and may deserve, more representation. On the other hand, if the U.S. has deemed China a strategic competitor, every office it controls becomes a threat. These sorts of events are further evidence that the world is evolving into at least a bipolar world.

About yesterday: The strong rally in equity markets was supported by a massive jump in health care stocks, a reflection of Super Tuesday.

Europe, Turkey and Russia: Turkish President Erdogan and Russian President Putin are meeting to defuse an escalating conflict in Idlib. Meanwhile, Turkey is allowing refugees to stream toward its borders with Europe, raising the potential for a political crisis during the COVID-19 outbreak.

Afghanistan: The U.S. launched airstrikes against Taliban positions after the latter continued to attack Afghan army positions. Although we expect the NATO troop withdrawal to continue, the lack of stability does show that Afghanistan is likely to spiral into civil conflict as we leave.

Odds and ends: Uber (UBER, 34.53) lost a case in France; French courts ruled that its workers were employees. If the ruling stands and becomes the new standard, the whole “gig” business model will become much less attractive. A new study by the Economic Policy Institute confirms our suspicions about last year’s stronger wage growth for non-supervisory workers—it was all about state and local minimum wage increases, and not due to tightening labor supply. The U.S. has finalized rules that will require the largest banks to further increase their capital buffers.

[1] Soccer for Americans.