Author: Rebekah Stovall

Asset Allocation Weekly (January 29, 2021)

by Asset Allocation Committee | PDF

Although there are always sundry risks to financial markets, a proximate and substantial risk comes from inflation. Of course, there is always risk of some degree of generalized price changes to financial assets. It also is important to realize that there is always some degree of inflation or deflation in an economy. Prices are rarely perfectly stable. The goal of policymakers is not necessarily to rid an economy of inflation but to have a degree of price stability so that economic actors don’t feel compelled to take price changes into account when making decisions. Overall, societies can generally cope with modest changes in prices over a year, which has led central banks to target inflation around 2%. There is nothing particularly special about 2%, other than it seems to work. It is also possible that 3% would work as well.

A price index is a basket of goods and services and their prices are subject to micro changes in a particular market and macro changes that affect prices from policy variables or other markets. For example, the price of crude oil is affected by the supply and demand for the product (the micro). It is also affected by exchange rates, the cost of public transportation, employment, etc. For a basket of goods, weighted by some methodology, the causal factors are not only impossibly large but unstable; in other words, there are lots of inputs that affect an inflation index, and the impact of these inputs can vary over time.

In the face of such complexity, there is a clear desire for simplicity from policymakers, economic actors, and investors. Economic theory has tried to provide simple rules. Monetarists suggested that monitoring the money supply is sufficient. Keynesians offered the Phillips Curve. Supply side economists argued that inflation was generated from excessive regulation. Others suggested that excessive fiscal spending was the culprit. Exchange rates seemed to have an impact. At times, these explanations have worked; in others, they have failed. Our take is that because the factors that trigger inflation are complicated, the conditions surrounding a change in the money supply, a decline in unemployment, an increase in regulation, additional fiscal spending, or a currency depreciation matter greatly.

Another important factor is inflation expectations. Our view is that inflation has an element of a balance sheet decision. Essentially, households and businesses receive liquidity and make a balance sheet decision on how it is held. If there is confidence that inflation will remain low and the return on cash is high enough, it will be held either as cash or in a near equivalent. If inflation expectations remain low but the returns on cash and near-cash instruments are low, financial assets are the likely destination. If inflation fears are elevated, the cash will be converted to real assets. For businesses, this may mean accumulated inventory. For households, this can be accomplished by purchases of consumer durables (cars, houses) or food in the freezer and canned goods in the basement.

Measuring inflation expectations is far from exact. The TIPS market provides a market estimate, but it seems to closely track crude oil, suggesting that market participants are not necessarily in possession of any great insight. Since 2008, the implied inflation rate from the TIPS market and oil prices are correlated at the 76.5% level. There are inflation surveys as well, but our read is that they tend to reflect the recent past. Milton Friedman argued that inflation expectations tend to be built over a lifetime; in our modeling, we use a 15-year average of the yearly change in CPI as a proxy.

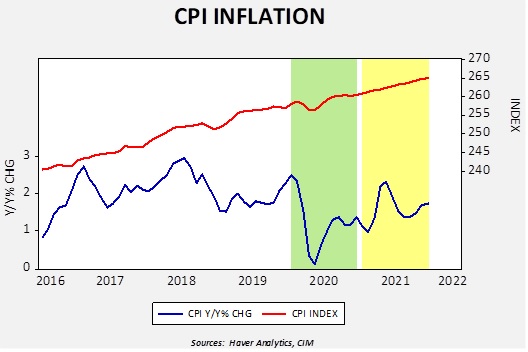

For the next few months, we are likely to see what appears to be a spike in inflation.

This chart shows the CPI Index (upper line) and the year-over-year percentage change (lower line). The area shaded green shows last year. Note that from February through May, the index fell and then rose. This time period represents the first pandemic lockdowns which led to a sharp drop in economic activity and price levels. The lower line shows that the yearly inflation rate fell to 0.1% in May before it began to rise as economic activity restarted.

In the yellow area, we show how inflation will behave assuming the index grows at 0.015% per month, which is the average monthly rate over the past five years. Using that assumption, due to base effects, we will see a rather sharp rise in yearly inflation in the second quarter where overall CPI will rise to 2.3% in May. If the overall index rises faster, the yearly change will as well. The point of this exercise is to warn investors that there will be a rise in reported inflation coming soon. It doesn’t necessarily mean that the rise will be sustained, but we would expect concerns to be raised which may adversely affect financial markets.

Business Cycle Report (January 28, 2021)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

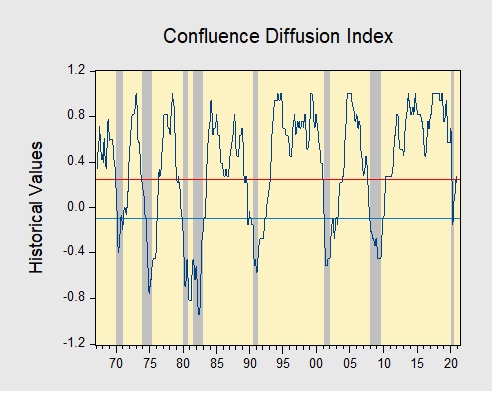

In December, the diffusion index rose further, signaling that the economy remains on track to continue its recovery. Financial markets were mixed; equities strengthened, while the yield curve steepened as vaccine production boosted growth expectations and lifted inflation expectations. Meanwhile, the labor market had a setback as a rise in COVID-19 cases led to new lockdown restrictions. Manufacturing remains strong as a weaker dollar promoted more exports abroad. As a result, four out of the 11 indicators are in contraction territory, unchanged from last month. The reading for December remained unchanged from the previous month at +0.2727, above the recession signal of +0.250.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is headed toward a recovery. On average, the diffusion index is currently providing about six months of lead time for a contraction and five months of lead time for a recovery. Continue reading for a more in-depth understanding of how the indicators are performing and refer to our Glossary of Charts at the back of this report for a description of each chart and what it measures. A chart title listed in red indicates that indicator is signaling recession.

Keller Quarterly (January 2021)

Letter to Investors | PDF

There is an adage I repeat to my colleagues during every election cycle (of which I’m sure they’ve long ago grown tired): “We don’t get to manage money in the world we wish we had, we can only manage money in the world we have.” Every four years approximately half our clients are disappointed about the election results and can’t see how their investments could possibly survive the newly sworn-in administration. And, yet, they do in fact survive and, often, even prosper. These last two election cycles have been particularly emotional for many. After the 2016 election many of our clients thought their investments would plummet in value and leave them penniless. Right now, I’m hearing similar fears from the “opposite side of the aisle.” In both cases, these groups were influenced by “experts” whose opinions had more to do with their political views than with their knowledge of the economy and markets. And in both cases, we believe, they are (and were) wrong.

Why is it that people are so often wrong about the effect of political swings on markets? Half of the population usually gets the election’s impact on the stock market wrong because of a simple factor: emotion. Few activities in American life generate more, and hotter, emotions than politics. Without exception, emotions are the greatest stumbling block to good investment decision-making.

Emotions are one of the elements that make us human. I’m not denigrating them universally. But emotions cloud our powers of reasoning, causing us to overlook evidence to the contrary or to overweight evidence that we like, leading us to the conclusions we want rather than to the conclusions the evidence infers. Emotions can lead us to make poor decisions on individual stocks or on the entire investment climate. During and after major elections, this phenomenon is rampant.

People have often spoken of the twin catastrophic emotions of investing, fear and greed; fear is extreme pessimism regarding investments and greed is optimism run amok. That greed, ironically, generally leads investors to either lose money or make much less than they could have made, while fear usually leads investors to not make the money they should have made. It is fear that tends to afflict investors most during election cycles.

I touched on this subject in my recent October 2020 letter. (In fact, I was tempted to just reissue the same letter after changing the date and changing the future tenses to past tenses.) Fear combines with an important historical tendency to create a big problem for investors. That tendency is to overestimate the impact of presidential elections on investment portfolios, often by a lot. Factors that are generally well beyond the short-term impact of politics, such as economic progress and corporate earnings, have a much bigger impact. This is not to say that politics plays no role in the economy at all, but it is less than one would expect, especially in the short run. The impact of political decisions usually plays out over decades, not years, and even then, it is often swamped by secular trends that politicians can’t control.

As I noted in that previous letter, the economic recovery currently underway, the Fed’s extraordinarily favorable monetary policy, and the likelihood that COVID-19 will recede over the next two years should lead to higher stock prices, regardless of the political landscape. Those reasons for optimism still hold, in my view. In fact, the positive results of vaccines were unknown three months ago. Thus, my optimism is higher still.

If the outlook, independent of the election, was dire, I would tell you as much. But that is not the case today. As I noted three months ago, the outlook was (and is) positive, regardless of the election’s outcome.

President Franklin Roosevelt began his first inaugural address (March 4, 1933, in the depths of the Great Depression) by asserting that “the only thing we have to fear is fear itself.” When I first heard that phrase, I thought it was non-sensical; then I got into the investment business. We observe that phenomenon almost daily. Do not let fear debilitate your investment goals.

We appreciate your confidence in us.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer

Weekly Energy Update (January 28, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

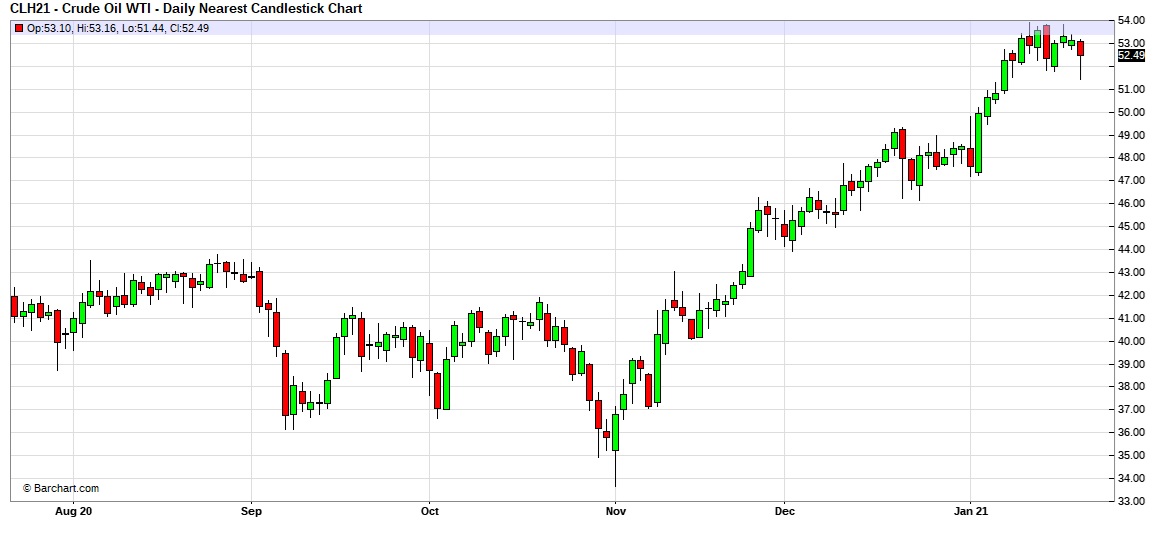

Here is an updated crude oil price chart. Prices are consolidating between $54 to $52 dollars per barrel after a strong rally from early November into late January.

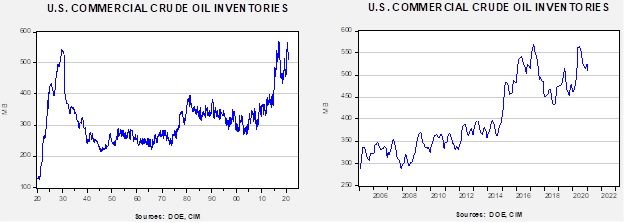

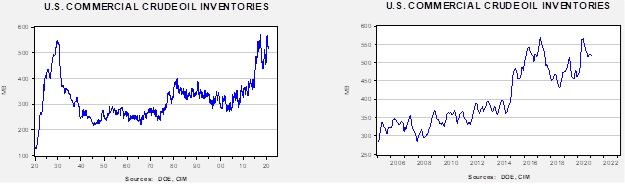

Commercial crude oil inventories unexpectedly fell 9.9 mb when a build of 1.5 mb was forecast.

In the details, U.S. crude oil production declined 0.1 mbpd to 10.9 mbpd. Exports rose 1.1 mbpd, while imports declined 1.0 mbpd. Refining activity fell 0.8%.

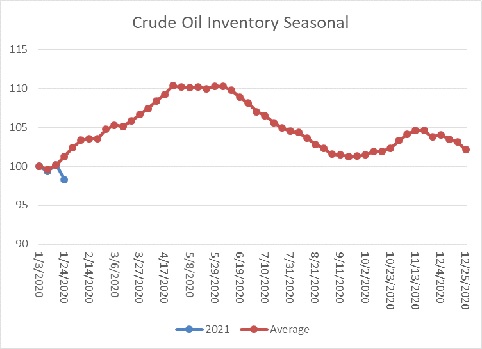

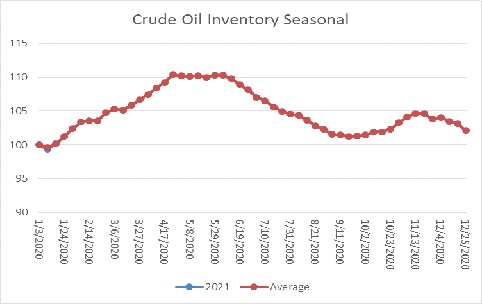

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline is abnormal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. Of course, one week doesn’t constitute a trend, but the decline was notable.

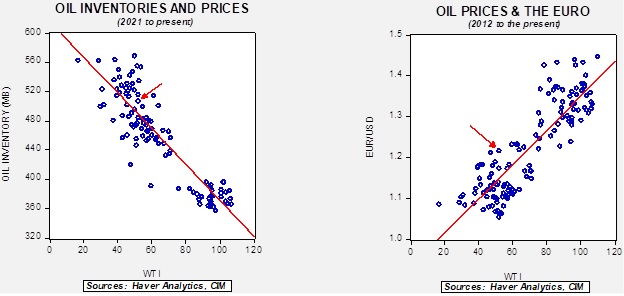

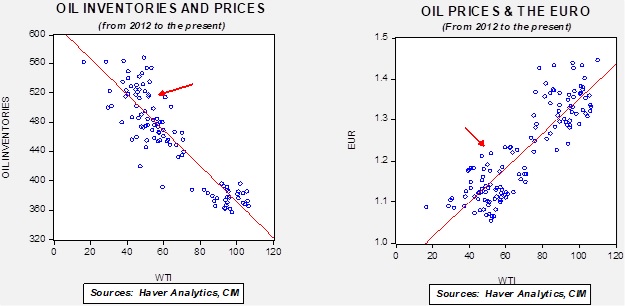

Based on our oil inventory/price model, fair value is $48.05; using the euro/price model, fair value is $70.80. The combined model, a broader analysis of the oil price, generates a fair value of $58.18. The wide divergence continues between the EUR and oil inventory models.

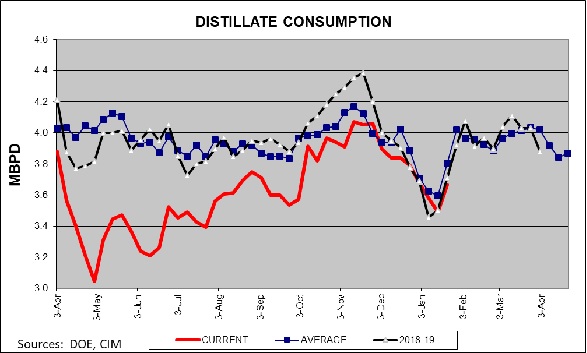

Distillate consumption has returned to normal and should continue to rise on a seasonal basis.

We continue to see evidence of market and policy measures causing a divergence between oil and gas prices compared to related equities.

- The steady supply of oil relies, in part, on continued exploration and field development. Last year, there was a notable decline in acreage acquisition by the largest oil companies in part due to low oil prices. Because virgin oil fields require investment well before they begin producing, there is a risk that future declining demand will strand the investment. We are already seeing declines in exploration budgets.

- We expect that pipeline growth will be further restricted. This is bullish for oil and gas prices, and bullish for existing pipelines, but determining the impact on individual companies is hard to generalize.

- As expected, the Biden administration is restricting drilling on federal lands. The oil industry will likely engage the courts to overturn this ruling, but, for now, it looks like this area won’t be available for production. It represents about 9% of onshore production.

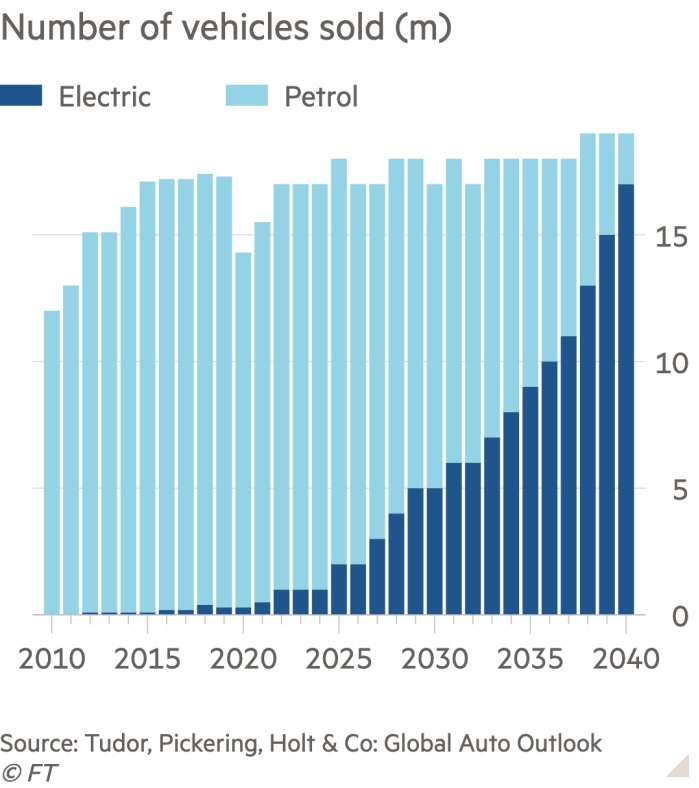

- By early in the next decade, it is estimated that 50% of new car sales will be EVs.

Here is the geopolitical news:

- In a bid to diversify its economy, the Kingdom of Saudi Arabia (KSA) is using its sovereign wealth fund to encourage health and tech companies to set up operations in the country.

- Also in the KSA, the U.S. is engaging in a quiet buildup of forces to counteract Iranian actions.

- As the Biden administration takes power, Israel is starting to saber-rattle, warning it may attack Iran. Such comments dwindled under the last administration but were common during the Obama government. Our take is that Israel probably won’t take unilateral action, but there is a chance that a coordinated action may be more likely as relations improve with the Arab Gulf states.

- Indonesia has detained Chinese and Iranian oil tanker crews who were engaged in illegal oil transfers in Indonesian waters. We suspect this was done to evade sanctions.

- China is expanding its investment in green projects as part of the “belt and road” program.

On the alternative energy front, here is what we saw this week:

- Lenders are offering lower interest rates to commodity firms and traders who lower their carbon output. This allows the banks to package these as “green” loans to investors to meet ESG goals.

- Blackrock (BLK, USD, 709.76) CEO Larry Fink warned companies that if they lag in achieving the goal of net zero emissions by 2050, the asset manager may exclude them from active portfolios. Blackrock is using its power as a large owner of company equities to press for climate change action.

- Exxon (XOM, USD, 46.38) has partially succumbed to activist pressure, announcing it will make changes to its board and take measures to reduce its carbon output.

- Large battery arrays are becoming more common as utilities use them to smooth out the variable flows from wind and solar power.

- We are seeing a buildup of U.S. battery production.

- Recent studies suggest the costs of solar power will continue to decline and replace conventional energy.

View PDF

Weekly Geopolitical Report – The U.S.-China Balance of Power: Part II (January 25, 2021)

by Patrick Fearon-Hernandez, CFA | PDF

In Part I of this report, we provided a comprehensive overview of how China and the U.S. see their key interests and goals. We believe those understandings will have a big impact on how the two sides compete with each other in the coming decades. In Part II this week, we provide a head-to-head comparison of U.S. and Chinese military power. In the following weeks, Part III will examine the relative economic power of the two sides. Part IV will describe their diplomatic positions around the world. Finally, Part V will dive into the opportunities and threats for U.S. investors.

To compare two military powers, you need to resolve many issues. For example, should you compare only the two countries’ own forces? Or should you also count the forces of any allies that might fight with them? If so, should you discount the allies’ forces because of problems like limited joint training or domestic political concerns that might make them reluctant to fight? Our method will focus on the two sides’ total national forces, on the assumption that even though a U.S.-China conflict would probably be fought in the waters off China’s coast, assets currently deployed in theaters such as Europe or northwestern China could theoretically be brought to bear on the fight if needed. For each country, we first discuss the overall resource base available to support military forces. We then discuss the quantity and quality of each country’s land, sea, air, space, and cyber forces.

Weekly Energy Update (January 25, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

The report was delayed due to the Martin Luther King Jr. holiday. Here is an updated crude oil price chart.

Commercial crude oil inventories unexpectedly rose 4.4 mb, when a decline of 1.3 mb was forecast.

In the details, U.S. crude oil production was unchanged at 11.0 mbpd. Exports fell 0.8 mbpd, while imports declined 0.2 mbpd. Refining activity rose 0.5%.

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s rise is normal (although it seemed to surprise most analysts). If we follow the seasonal pattern, inventories will rise about 10% into mid-April. That situation should be factored into the current price but the anticipated rise in stockpiles isn’t a positive for the market.

Based on our oil inventory/price model, fair value is $44.83; using the euro/price model, fair value is $70.97. The combined model, a broader analysis of the oil price, generates a fair value of $56.43. The wide divergence continues between the EUR and oil inventory models.

In geopolitics, we continue to watch with great interest the situation with Iran. The U.S. withdrawal from the JCPOA led Iran to violate its restrictions on enriching uranium. It has also moved further toward acquiring a domestic nuclear weapon. The incoming Biden administration has signaled it would like Iran to return to the constraints of the JCPOA; we have doubts Iran will accept this program, fearing that a future administration will withdraw again. We note the U.S. has shifted Israel from the European command to Central command. For years, the U.S. put Israel under the supervision of the European command to avoid upsetting the Arab states. From an operational standpoint, it makes more sense for Israel to be in Central command and now that several of its Arab neighbors have normalized relations with Israel, the emerging alliance structure in the region should benefit from the switch.

- Islamic State is returning. It claimed responsibility for two suicide bombings in Baghdad. This group has shown remarkable resilience. Although the U.S. and other allies seemingly eliminated the group a couple of years ago, if efforts are not maintained, it has the habit of re-emerging.

- Venezuelan oil is under sanction by the U.S. China is putting additives in Venezuelan oil to mask its origin and transferring cargos at sea to avoid sanctions and acquire Venezuelan crude, “laundering” the shipping documents through Swiss shipping companies. According to reports, Venezuela accounts for 50% of China’s oil imports.

On the policy front, we are seeing the following developments:

- The OCC has ruled that banks cannot exclude the Energy sector as a class without offering specific reasons why services won’t be provided. This won’t preclude a bank from refusing to lend to an oil company if the risk is considered too excessive, but it means the bank cannot refuse to make the loan just because it’s an energy company.

- Although this is the current ruling, we expect the incoming administration to provide cover for financial services to reduce lending and other services to the sector under the aegis of combating climate change.

- The French oil company Total (TOT, USD, 45.06) has ended its membership with the American Petroleum Institute, the oil lobbying group. The decision highlights the differences between U.S. and European supermajors.

- Last week, we discussed how environmentalists were focusing on constraining pipeline growth as a way to restrict the expansion of fossil fuels. This tactic looks like it will find support from the incoming Biden administration as one of his initial executive orders was to cancel the XL pipeline. The state of Michigan has ordered the closure of the Great Lakes Pipeline, a line that carries oil and natural gas liquids from Alberta to U.S. and Canadian refineries. Part of the line runs on the lakebed from the Upper Peninsula to Michigan and environmentalists argue that a rupture would create catastrophic conditions. Rising oil imports from Canada are straining the existing pipeline infrastructure and the inability to build more capacity will create bottlenecks and price distortions. We expect this trend to continue under the new administration.

- The state of New York is planning to build miles of new power lines to tap electricity from wind and solar farms that are usually situated in rural areas. This plan will pit environmentalists and landowners against each other.

- Courts have struck down a Trump era regulation that allowed for greater coal use by electric utilities. Despite this action, higher natural gas prices will likely boost coal demand this year and create a problem for the new administration. Adding to this pressure are signs that the new administration will crack down on methane emissions from natural gas wells and pipelines. We also note that Vale (VALE, USD, 17.03) is divesting itself from its coal mining operations in Mozambique.

- As countries begin to use carbon taxes to address climate change, the prospect for using carbon pricing tariffs to prevent free-riding carbon emissions will become a bigger issue. Trade officials have taken a dim view of such regulations in the past, fearing they could be used as an excuse for protectionism. Look for ideas like a “carbon border tax” to start circulating. We also note that the U.S. Chamber of Commerce appears to be supporting the idea of a carbon tax instead of regulation. And, a recent executive order recreates the Obama era working group on establishing carbon prices. The entire backbone of carbon reduction will need a workable carbon price so markets can be created to allocate carbon more efficiently.

- The Senate under Democratic Party control may allow for more climate legislation.

- The U.K. is considering a ban on new gasoline and diesel vehicles by 2030. If this plan is adopted on a more widespread basis, the oil and gas industry is in serious trouble as it will clearly show peak demand is on the horizon.

In alternative energy, we continue to see investment flows and batteries dominating the news.

- Hydropower has also been a mixed bag for environmentalists. On the positive side, the facilities create reliable electric power with no carbon emissions. On the negative side, dams change the environmental characteristics of the rivers where dams are built. Some dams were built long ago for flood control or navigation. Investors are looking at these old, smaller dams as offering the potential for hydropower, installing generators and using the existing facilities to create clean power.

- Batteries remain the key bottleneck in expanding alternative energy. Wind and solar, by their very nature, create intermittent flows of electricity. Electricity is difficult to store; conventional flow management usually relies on flexible excess capacity (peaking power) fueled by natural gas or stored water systems. This report offers some parameters on how cheap battery storage would have to be to replace conventional energy sources. To fully replace conventional, storage would need to cost $20 kWh. Current storage is around $175 kWh. However, if the target is 95%, the report suggests $150 kWh will suffice.

- Meanwhile, the race to build a better battery for EVs continues. The concept of a solid state battery that would allow for multiple recharges, longer range, and rapid recharging is the current rage.

- Of course, the mini nuclear reactor remains an interesting alternative. Researchers in the U.K. are making the case that fossil fuel use will continue without an expansion of nuclear power. (An aside: a smart lobbyist for the oil and gas industry would fund anti-nuclear groups.)

- Clean-tech firms’ equities continue to outpace oil and gas stocks.

View PDF

Asset Allocation Weekly – #24 (Posted 1/22/21)

Asset Allocation Weekly (January 22, 2021)

by Asset Allocation Committee | PDF

In Charles Dickens’s novel A Tale of Two Cities, he writes, “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair…” The paradox was designed to illustrate the different experiences of people living prior to the French Revolution. In this week’s report, we discuss the paradoxical nature of this recovery. Specifically, we focus on how consumer behavior may not be indicative of consumer sentiment. We conclude by discussing how the Biden administration might structure policy to accelerate the recovery and how this direction could affect financial markets.

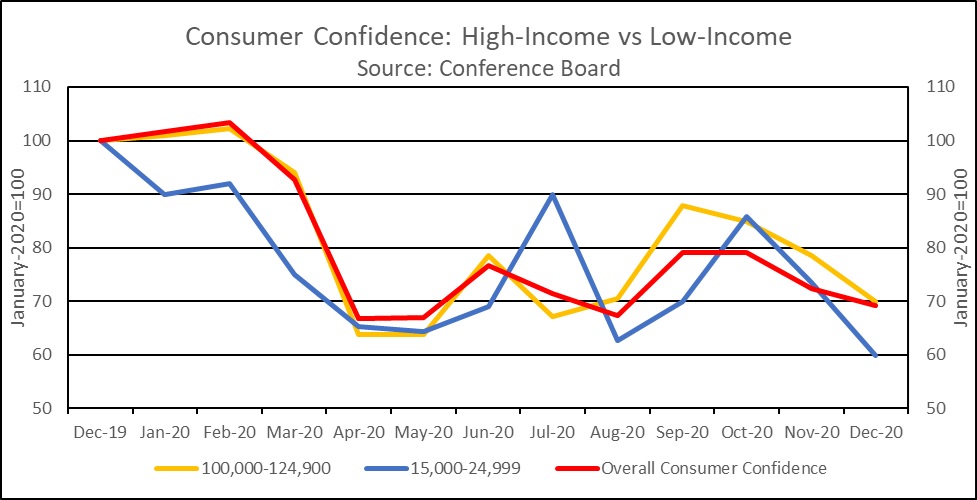

Even though this recession may have had a different origin than previous ones, this recovery appears to be telling a similar story. With few exceptions, the higher income classes have consistently outperformed the bottom income classes. For example, employment for high-income individuals has returned to pre-pandemic levels, while employment for low-income individuals is not only below pre-pandemic levels but has fallen in recent weeks. It is highly likely that this discrepancy has contributed to the confidence gap between low- and high-income households.

The chart above shows the level of consumer confidence for high-income and low-income groups and the overall consumer confidence index since the start of the pandemic. According to this chart, confidence among low-income groups has routinely lagged high-income groups. This lag may be due to high-income groups having better information. For example, the sharp increase in July may be related to the previous month’s hiring. This notion is further supported by the steep decline in the following month as rising cases in July resulted in a slowdown in hiring. It is also worth noting that this lag isn’t typically picked up in the overall index. Hence, the overall index seems to mask pessimism of the low-income group. This phenomenon is consistent with previous cycles as low-income individuals are typically the last to benefit when the economy enters into expansion territory.

That being said, there appears to be a mismatch between current sentiment and the present situation. The share of low-income households reporting an improvement in their financial situation from a year ago was elevated throughout 2020, while the share of high-income households sunk. This is likely due to a combination of high-income workers being forced to take pay cuts and low-income households receiving generous benefits in unemployment. This trend is also mirrored in the flow of funds data in which the top 1% of households has seen a larger increase in checking deposits compared to the bottom 40% of households. The boost in income for low-income individuals has likely supported domestic consumption as they are the only group spending more now than before the pandemic.

In a post-COVID-19 recovery, President Biden and his economic agenda should be aware that low-income households will likely suffer during the initial months of the economic expansion and refrain from fiscal tightening. One of the biggest mistakes the Obama administration made was prematurely declaring that the economy had recovered. In fact, the austerity that occurred during Obama’s second term likely created conditions for the GOP sweep in 2016. To prevent a repeat of this mistake, the new administration will likely need to focus on those the economy has left behind, specifically low-income workers. This likely means there will be more focus on jobs and less on tax reform.

Going forward, we expect that additional stimulus will be able to support consumption growth as the recovery gathers momentum. The low-income households that receive the money will likely be able to find immediate use for the funds, which will benefit consumption and related companies. Meanwhile, as the economy moves from recovery to expansion, it is likely that the top 1% will begin moving their savings into equities and other assets. Nevertheless, it generally takes a year after an economy enters expansion before employment returns to pre-recession levels. Hence, a great recovery for some people may still be a stressful recovery for others, so policymakers should keep that in mind when deciding whether to withdraw stimulus.