Weekly Energy Update (January 7, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices are moving higher on dollar weakness and the recent OPEC+ decision, discussed below.

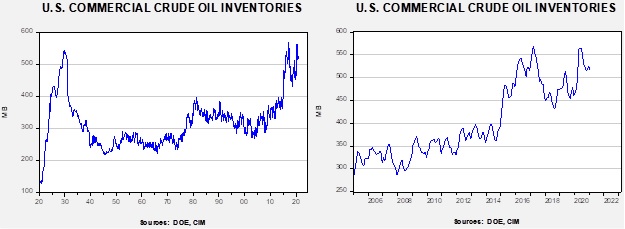

Commercial crude oil inventories fell 8.0 mb, well below the -1.5 mb draw forecast. The SPR was unchanged; there is still 3.1 mb of storage in excess of the 635.0 mb that existed before the pandemic.

In the details, U.S. crude oil production was unchanged at 11.0 mbpd. Exports and imports were also unchanged. Refining activity rose 1.3%.

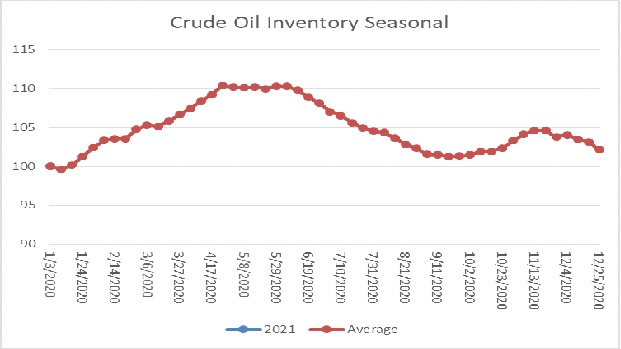

The above chart shows the annual seasonal pattern for crude oil inventories. Since this is the first reporting week of the year, the data overlaps. But it is important to note that inventories usually rise about 10% into mid-April.

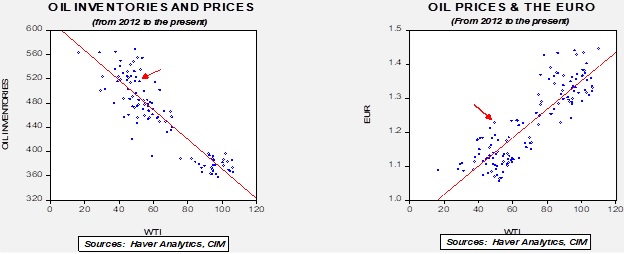

Based on our oil inventory/price model, fair value is $45.18; using the euro/price model, fair value is $75.75. The combined model, a broader analysis of the oil price, generates a fair value of $57.32. The wide divergence continues between the EUR and oil inventory models. Although the inventory issue is a concern, as we note below, if the Saudis are going to play the role of swing producer then the dollar is probably a more important variable.

In geopolitical news, OPEC was in deep negotiations on output policy. The Russians wanted to increase output, while most of the rest of the cartel, including Saudi Arabia, want to hold production steady. Although the group has been able to manage output changes without roiling the market, the underlying problem is that Russia has less production flexibility than the Middle East producers. There are seasonal shut-ins that Russia can execute but closing production in other areas will lead to permanent loss of output. The Saudis resolved the issue, virtually single-handedly, by agreeing to a unilateral cut of 1.0 mbpd. We don’t expect the cartel reduction to be this size as other nations (Russia, Kazakhstan) will fill some of the gap. But, this does show that the Kingdom of Saudi Arabia (KSA) is committed to maintaining price levels at the cost of market share. This action is very bullish, at least for now. At some point, however, the KSA will want its market share back. In effect, the KSA is acting as swing producer as it did from 1973 to 1985. In December 1985, the KSA signaled it was no longer willing to cede market share to prop up prices. The end result was a 66% plunge in oil prices. We doubt the Saudis intend to return to the swing producer role on a permanent basis, but their actions create a precedent that will be hard to undo. One other interesting fact—for the first time in 35 years, the U.S. didn’t import any crude oil from Saudi Arabia.

In other geopolitical news:

- Tensions with Iran remain elevated. The U.S. initially moved the U.S.S. Nimitz out of the region then sent it back; B-52s have been located into the area. Iran announced it will increase uranium enrichment, which will complicate the incoming Biden administration’s attempt to return to the Obama-era nuclear deal. It will complicate regional tensions as well.

- Iraq has announced that China is prepaying a year’s worth of imports. This will relieve fiscal pressure on Baghdad and, at the same time, enhance China’s influence in the Middle East.

- Qatar and Saudi Arabia are ending their feud that led to the border being sealed. Although we don’t think the issues have been fully resolved, it appears that the Saudis have concluded it isn’t in their interest to maintain hostile relations. The blockade simply allowed Turkey to increase its influence in the region and thus has to be seen as a foreign policy error.

- Venezuelan President Maduro has solidified his power in the country by regaining control of the legislature. Although not a pressing problem, the regime in Caracas remains an unresolved problem. The UAE, usually an ally of the U.S., has become a key link in Venezuela’s sanction avoidance.

- The World Bank reduced its GDP growth forecast for 2021; weaker growth is a negative factor for oil demand, and if the expected rebound fails to materialize this year then oil prices will face bearish pressure.

Here is what we are following in alternative energy news:

- Carbon sequester has been part of climate policy for some time. There are two primary areas; the first is through biological methods, e.g., planting trees and carbon-absorbing crops. The second uses physical methods to pull carbon dioxide out of the air. On the former, we are seeing a surge in interest from the farm sector. In Europe, planting grasses in peat bogs is being considered. Peat tends to hold large amounts of CO2; drying it out tends to release it into the atmosphere. Farmers are considering rewetting dried out peat bogs and planting new grasses for harvest. In the U.S., paying farmers to change practices to capture carbon is being discussed. Providing money to farmers for changes in agricultural practices will be politically popular and thus we would expect policy momentum to develop on this issue.

- For the first time since 1885, the U.S. consumed more green energy last year than coal.

- We continue to monitor developments on the hydrogen front.

- Geopolitically, the end of oil could be disastrous for Middle East oil producers. However, that is only true if they fail to adapt. There are discussions in the region about using solar energy to produce hydrogen and convert it to ammonia for cheap shipping.

- Using hydrogen for a shipping fuel is being investigated.

- Although hydrogen, by itself, is quite green, making it can be anything but environmentally friendly. Using coal-fired electricity to make hydrogen is hardly worth the effort. But, as we have discussed recently, turning to nuclear power for making hydrogen could create a fuel free of fossil fuels. Instead of the large reactors used for electricity, the industry is moving toward modular reactors than can be mass produced and moved to production areas. Improving the efficiency of catalysts to extract hydrogen from water is also being researched.

- Oil majors are starting to make larger investments in this area. Expanding scale is important to achieve the goal of lower cost.

- On auto-electrification, the next “new thing” is the solid-state battery. Such a device would make the cars safer and allow for rapid recharging. Here is an update. Another area to watch is recycling. As more electric cars are produced, the need to recycle old batteries will become more important. If the recycling industry expands, it should reduce the need for metals mining.

Here is what we are following in energy policy:

- As President Biden slowly moves toward the Oval Office, the energy industry braces for policy changes. Clearly, there will be more focus on reducing carbon emissions, which is not good news for the oil and gas industry. At the same time, Biden is a centrist and lacks the power to make sweeping changes to the industry. We would expect less direct intervention from the president compared to the Trump administration, but there will be changes that will likely help alternative energy and larger oil companies.

- Another area we are watching is the impact of central banks on climate change policy. Although we are not seeing anything direct, it is clearly on the radar screen. One area where we could see intervention is in central bank buying of “green bonds.”