Weekly Energy Update (December 17, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

A note to readers: The Weekly Energy Update will go on holiday hiatus following today’s report and will return on January 7, 2021. From all of us at Confluence Investment Management, we want to wish you a Merry Christmas and Happy New Year! See you in 2021!

Here is an updated crude oil price chart. Prices are taking another leg higher on hopes of stronger demand.

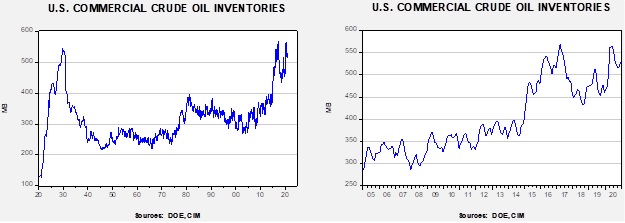

Commercial crude oil inventories fell 3.1 mb, in line with the 3.0 mb draw forecast. The SPR was unchanged; there is still 3.1 mb of storage in excess of the 635.0 mb that existed before the pandemic.

In the details, U.S. crude oil production fell 0.1 mbpd to 11.0 mbpd. Exports rose 0.8 mbpd, while imports declined 1.1 mbpd. Refining activity fell 0.8%.

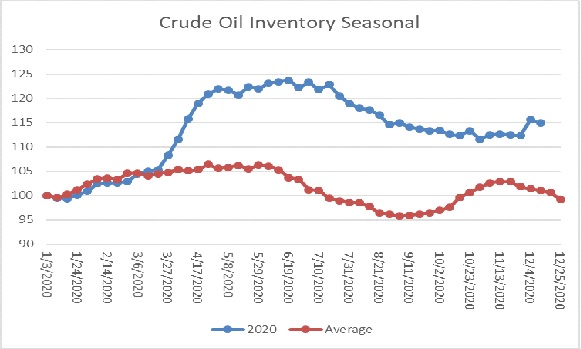

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s data showed a decline in crude oil stockpiles, which is normal. Inventories usually decline into year-end.

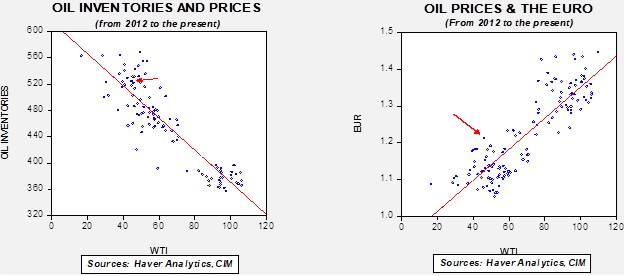

Based on our oil inventory/price model, fair value is $40.30; using the euro/price model, fair value is $69.70. The combined model, a broader analysis of the oil price, generates a fair value of $53.42. The wide divergence continues between the EUR and oil inventory models. This week’s jump in oil inventories led to a large decline in the oil model forecast, while the weaker dollar boosted the EUR model forecast. Overall, the dollar probably has a greater impact on oil prices and thus should keep the market elevated despite high levels of supply.

The IEA report for December continued to paint a bleak outlook for oil as demand remains weak. For 2021, the group projects demand at 96.9 mbpd, still below the 100.1 mbpd seen pre-pandemic. At the same time, supply is creeping higher as U.S. production recovers, Libya comes back on-line, and OPEC begins retaking market share. Still, as we note above, the weaker dollar is a strong catalyst for higher prices and may overcome otherwise soft fundamentals.

Natural gas producers are becoming increasingly adept at adjusting production to market conditions. If this practice becomes widespread, it could lead to stable natural gas prices. Simply put, instead of prices adjusting, supply adjusts.

In geopolitical news:

- There was an attack on an oil tanker in the Red Sea near the port Jiddah. It is suspected that a vessel controlled by Yemeni Houthis was likely behind the attack. A drone boat probably was deployed by the rebels. The U.S. added additional sanctions on Iran for the abduction and likely death of former FBI agent Robert Levinson. He was abducted in 2007 but this is the first formal action against Iran for the event.

- Iran has been exporting more oil despite sanctions, with most of the oil going to China. Iran’s exports remain well below normal levels due to American sanctions.

- Meanwhile, as Arab states normalize relations with Israel (likely creating a potent coalition to oppose Iran), Iran is moving some of its nuclear production to underground facilities to protect against attack.

- Saudi Aramco (2222, SAR, 35.60) has a long reputation for being a good work environment for expat workers. However, a recent report from the FT suggests that may no longer be the case as financial pressures rise on the company. The report suggests the company is cutting corners on safety, likely to meet financial goals.

- The kingdom is also introducing austerity to reduce its fiscal deficit; usually, such actions are reversed due to fears of civil unrest.

Here is the roundup of climate and alternative energy news:

- Exxon (XOM, USD, 43.04) announced a series of carbon reduction measures. The company is promising to reduce emissions intensity (carbon per unit of production) rather than a full cut. In other words, if intensity falls but production rises, the overall output of carbon will continue to rise. Exxon is facing growing pressure from the investor community to reduce its carbon emissions. This is a factor affecting the energy sector; although we have seen a rise in equity values recently, it may be a mere recovery bounce.

- This brings us to a broader issue. How should investors treat the oil and gas sector? A case can be made that the future for oil and gas is in peril. Oil and gas are being hit from all sides between technology that reduces the need for travel, the electrification of transportation, the growing likelihood of a carbon tax, and investor pressure to reduce carbon. And yet, in the here and now, it is clear that we still need oil and gas. The last three months have seen a strong recovery; the question now is how long will this last?

- A key point to remember is that equity markets are anticipatory markets, whereas commodity markets are not. In other words, the value of a stock is ultimately based on future cash flows; if the future is “cloudy,” investors tend to reduce the value of cash flows into that unclear future. On the other hand, commodities don’t really pay a future stream of cash (despite academic studies that suggest one can generate cash from futures roll yield, it can just as easily turn into a cost depending on the shape of the futures curve) and the value of commodities is (a) the value of processing it into a product, and (b) changes in price between now and the future. In this situation, we could very easily see oil and gas equities underperform the commodity; in fact, this has been a feature of the market for the past few years.

- Industries in decline can still be investible. Tobacco proves that one can make money in a pariah group. On the other hand, coal has been a destroyer of capital. The difference is complicated, but industry concentration plays a role as does the ability to shape regulation. Tobacco did a masterful job, e.g., eventually turning the states into supporters of smoking. Coal did not. If the oil and gas sector takes steps to address climate change and carbon mitigation (e.g., support a carbon tax,[1] invest heavily in carbon capture, branch into alternative energy), the sector might do fine. If it fails to manage the situation, oil and gas could resemble the path of coal equities.

- China is promising to reduce its carbon intensity (see above) by 65% by the end of the decade. We take these promises with a grain of salt. China is still the world’s largest consumer of coal, a fuel with a high carbon content, and the country is continually expanding its coal-fired electricity capacity. We view this as mostly a public relations move.

- At the same time, as we have noted in recent Daily Comments, China has been seeing a spate of corporate defaults, especially in the SOE sector. However, we note that the Xi government did rescue Tianqi Lithium (002466, CNY, 31.38) when it was facing a deadline on a bank loan. The company is the world’s largest lithium producer, and this move by the state suggests it is being treated as a national champion. The recent plunge in lithium prices has undermined the company’s ability to manage the default.

- One of the emerging themes is that the energy world is moving from oil and gas to metals. In other words, alternative energies and electrification of transportation will require lots more metal (e.g., lithium, cobalt, nickel, aluminum, copper) and much less oil and gas. Since the turn of the last century, oil has been a primary factor in geopolitics. That may not be the case in the future; instead, the pivot will be mines.

- Although electric cars are still in the forefront, fuel cell vehicles, powered by hydrogen, may end up being the winner. Hydrogen can be produced from fossil fuels (gray), natural gas (blue), or electricity (green). Green hydrogen comes from generating electricity from a non-fossil fuel source (hydro, solar, wind, nuclear) and splitting water to get the hydrogen. A fuel cell takes the hydrogen, and its waste product is water.

- This is where nuclear comes in. Since the Three-Mile Island/Chernobyl/Fukushima disasters, nuclear power has been considered a pariah by environmentalists. However, we are starting to see a reassessment among this group that reducing carbon emissions is probably impossible without nuclear power. Like everything, the decision to use nuclear is a tradeoff; as the above referenced events show, nuclear power can be dangerous. At the same time, rising levels of carbon dioxide in the atmosphere is also considered a danger.

- The nuclear industry has been building smaller modular reactors that could be used to make green hydrogen. Modular technology could make permitting easier (once the model is approved, it can be replicated without another permit) and established where needed. If these reactors become commonplace, it could bring a renaissance to the nuclear industry.

View PDF

[1] And the level of the tax.