Weekly Energy Update (June 9, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices continue to rise in an orderly fashion.

(Source: Barchart.com)

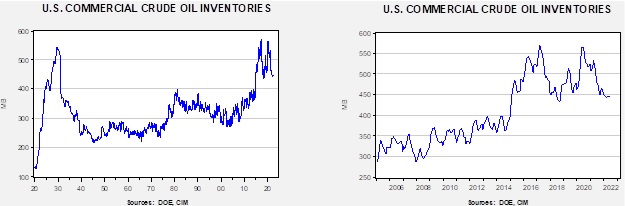

Crude oil inventories rose 2.0 mb compared to a 3.3 mb draw forecast. The SPR declined 7.3 mb, meaning the net draw was 5.2 mb.

In the details, U.S. crude oil production was unchanged at 11.9 mbpd. Exports fell 1.8 mbpd, while imports fell 0.1 mbpd. Refining activity rose 1.6% to 94.2% of capacity.

(Sources: DOE, CIM)

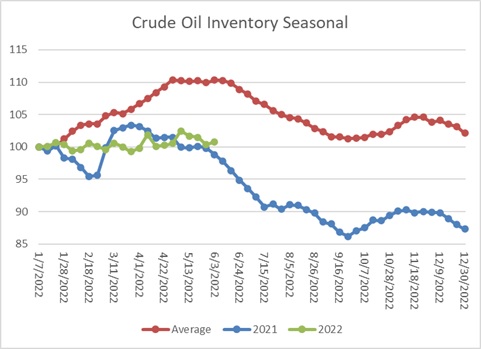

The above chart shows the seasonal pattern for crude oil inventories. This week’s report is consistent with the average pattern. However, we note that this week we had a decline in crude oil exports, which probably won’t be repeated. Thus, we would expect a larger decline in stocks next week.

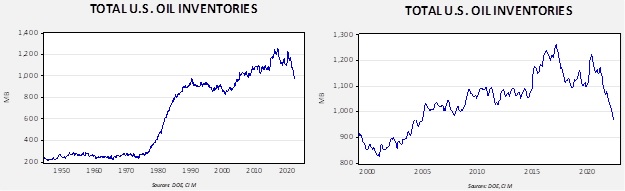

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in 2005. Using total stocks since 2015, fair value is $96.41.

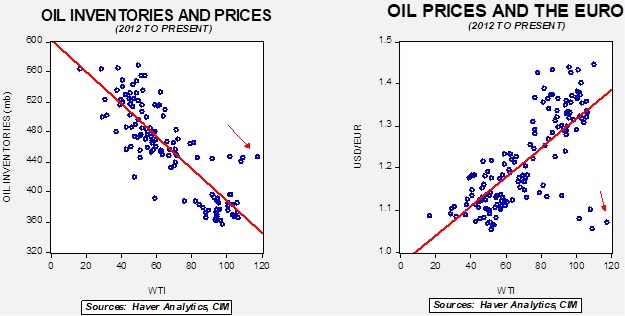

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $65 per barrel, so we are seeing about $50 of risk premium in the market.

Market news:

- Although it has been well documented that the energy industry is suffering from a lack of investment, it appears the LNG industry is enjoying a rise in investment. LNG will be critical for the EU to wean itself off Russian natural gas supplies. Germany, for example, is aggressively building LNG regasification facilities that will aid in the transition.

- As LNG exports expand, tanker rates are starting to rise.

- Tight natural gas supplies have led the natural gas industry to take another look at natural gas flaring. Flaring occurs when oil producers find natural gas in the oil drilling process. If the well doesn’t have access to pipelines, it is prohibitively expensive to liquify it on site. However, as prices rise, interest in somehow finding a use for this gas is expected to increase. One potential use is to hook the gas up to mobile generators to mine bitcoin.

- Due to supply disruptions and geopolitical tensions, there is a natural tendency for nations to hoard supplies. It appears China is maintaining quotas on product exports despite rising Asian demand.

- The only oil company that bid on a lease in the Arctic National Wildlife Refuge has canceled the agreement.

- At the same time, high oil prices are encouraging investment in high-cost projects. The Vaca Muerta (dead cow) shale deposit in Argentina is getting a second look.

- As temperatures rise in the U.S., there are growing warnings of electricity blackouts. The DOE suggests the Midwest may be especially vulnerable.

- Between the abandonment of Russia by Western oil firms and the lack of storage, Russia has increasingly been forced to shut in production in highly complex fields. This development is raising concerns that some Russian oil and gas production will be permanently lost, leading to lasting shortages.

Geopolitical news:

- Although President Biden has pushed off his Middle East trip until July, elevated oil prices are forcing the president to improve relations with the KSA. As we noted last week, OPEC+ agreed to lift output above its announced intentions. However, the market is highly skeptical OPEC+ can make a difference, as most cartel producers are at capacity.

- The political optics of going to Riyadh for oil and not reducing regulations to foster domestic production are unfavorable. But, in reality, given the president’s political coalition, there are no good outcomes here.

- After promising more oil production, the KSA raised contract oil prices to Asia.

- As the world splits apart, the global oil trade is rapidly becoming regional. This development will lead to regional price differences and increase the potential for spot shortages. We could see a return to the 1970s, where various designations of the source of different hydrocarbons carried different prices, taxes, and restrictions. Running afoul of these laws led to Marc Rich fleeing the U.S.

- As we have discussed recently, the U.S. and Venezuela have been opening a dialogue. At the Summit of the Americas meeting this week, Cuba, Nicaragua, and Venezuela have not been invited. Venezuelan opposition leader Juan Guaidó will attend but only as an observer. If the Biden administration moves to normalize relations with Venezuela, it is likely Guaidó will be sidelined.

Alternative energy/policy news:

- At long last, the Biden administration has clarified its position on imported solar panels. The U.S. will waive tariffs on solar panels from Southeast Asia for two years. The U.S. has implemented tariffs on China, which is the world’s largest producer. Domestic producers of the panels wanted tariff protection widened because they feared Chinese manufacturers were shipping panels to non-tariffed states, giving them access to the U.S. market without the import tax. Installers feared that widening the tax would discourage demand. Although the situation isn’t fully resolved, at least for now, imports from Southeast Asia should continue.

- The administration is also invoking the Defense Production Act to boost the production of various clean energy products.

- CO2 levels measured at the Mauna Loa observatory have reached a new record level, more than 50% higher than pre-industrial levels.

- As the world scrambles to adjust to the disruption caused by the Ukraine war, environmentalists fear that climate goals are being ignored.