by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the expected surge in COVID-19 infections in China after it relaxed its pandemic regulations. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the latest in the Russia-Ukraine war and the beginnings of a wave of strikes in the U.K. We discuss today’s U.S. inflation data in the “U.S. Economic Releases” section below.

China: Following the government’s recent relaxation of its COVID testing and quarantine policies, a range of indicators suggests the disease is now ripping through the country. Hospitals and clinics are reportedly facing a surge in cases, although it is still a bit too early for deaths to be rising dramatically.

- Experts predict the new wave will peak in one to three months, with some 60% of the population infected—probably enough to ensure significant economic disruptions as people self-quarantine and businesses face mass absenteeism.

- Those trends are likely to weigh heavily on China’s economy and financial markets, which in turn is likely to present headwinds for the global economy and financial markets.

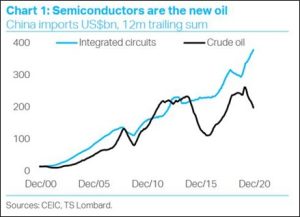

China-United States: The Chinese Commerce Ministry yesterday filed a complaint with the World Trade Organization against the massive new U.S. restrictions on selling advanced computer chips, chipmaking equipment, and related components and services to China. The filing comes just days after the WTO ruled against the Trump administration’s imposition of steel and aluminum tariffs against China and other countries based on national security concerns.

- The Biden administration’s restrictions, issued in October, essentially amount to a blockade of advanced information technology going to China in order to suppress the country’s military and economic development.

- In each case, however, the WTO ruling is unlikely to have legal effects because its Appellate Body has been suspended over disagreements among the WTO’s member states. The new U.S. restrictions will likely remain a key source of friction between the U.S. and China and will probably limit China’s technological development going forward.

China-India: Chinese and Indian troops have once again skirmished along the China-India frontier high in the Himalaya mountains. In contrast with the big 2020 skirmish that killed approximately two dozen, the latest fight only produced minor injuries and was apparently very short-lived. Nevertheless, the incident serves as a reminder of the geopolitical risks involved as the two countries jockey to maintain control over their frontiers in the Himalaya region.

European Union: Ambassadors from the EU’s member states last night reached a deal with Hungary that will allow the EU to implement a new minimum corporate income tax of 12% and provide some €18 billion in support for Ukraine. In return, the EU committed to approve Hungary’s €5.8 billion COVID-19 recovery plan, which has been held up since last year because of EU concerns about rule-of-law policies in Hungary.

- In a separate deal today between EU national governments and the European Parliament, officials agreed to impose a tax on imports based on the greenhouse gases emitted to make them, inserting climate regulation for the first time into the rules of global trade.

- The “carbon border adjustment mechanism” has angered a number of EU trading partners, especially some emerging markets that emit relatively large amounts of greenhouse gases when producing goods for the EU market.

Russia-Ukraine War: Heavy fighting continues along the frontlines in eastern and southern Ukraine, with the Russians continuing to mount air, missile, and drone strikes against Ukrainian civilian energy infrastructure throughout the country. Meanwhile, the Ukrainians launched yet another attack on a key bridge in the Russian-occupied city of Melitopol and put it out of action. That attack demonstrates Ukraine’s ability to strike Russian forces deep inside occupied territory. It also shows their intention to keep attacking throughout the winter to prevent the Russians from regrouping.

- President Putin has signed a law allocating over nine trillion rubles (about $143 billion) to defense, security, and law enforcement for Russia’s federal budget in 2023.

- That amount is about 8% of Russia’s 2021 gross domestic product, and probably an even greater proportion of Russia’s 2022 and 2023 GDP. It also implies that Russia’s defense burden is now more than twice that of the U.S., and several times more than the defense burden in many European countries.

- The U.K. Ministry of Defense has also assessed that as Russia’s defense spending has significantly increased, it will now represent over 30% of Russia’s entire 2023 budget. This suggests that in order to pay for the war, Putin will have to defund many civilian budget accounts, thereby further undermining the economy.

- Illustrating President Putin’s worsening domestic political position, the Kremlin announced that his annual marathon news conference, in which he takes questions from the public, has been cancelled for the first time in a decade.

Turkey-Greece: As the latest spat in a decades-long series of bilateral disputes, Turkish President Erdogan warned that his country has developed a new medium-range missile that could be fired at Athens if Greece continues to build up its military forces on the Aegean Sea islands close to Turkey. Although disputes like this have gone on for decades, Erdogan’s assertiveness has raised the risk of a destabilizing conflict between two key NATO members.

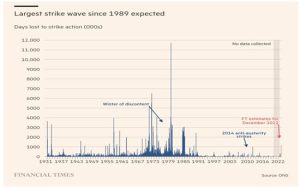

United Kingdom: Railroad workers have begun the first of four days of strikes this week in their dispute over pay levels, job security, and working conditions. The strikes are already snarling transportation throughout the country, but that’s just the first blow for the government as a range of public employees are also set to strike in the coming weeks, including nurses, ambulance drivers, postal workers, border and customs officers, and highway workers. The wide range of strikes will likely be an additional headwind for the British economy and stocks as the country struggles to deal with its winter energy crisis.

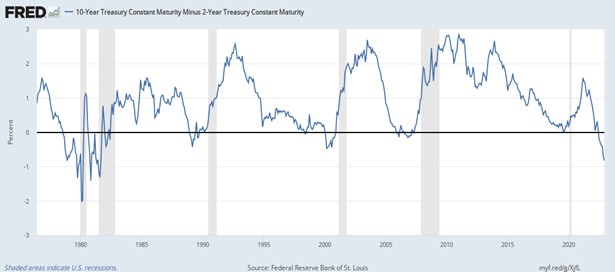

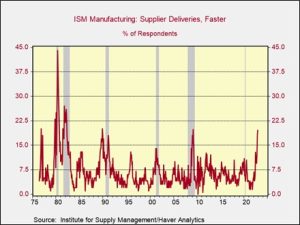

U.S. Monetary Policy: The Fed today begins its latest two-day policy meeting, with the decision due to be released on Wednesday afternoon. Policymakers are widely expected to hike their benchmark fed funds interest rate by just 0.5%, to a range of 4.25% to 4.50%, after four straight hikes of 0.75%. They will also release their updated forecasts for key economic indicators and the path of interest rates going forward.

U.S. Fiscal Policy: As congressional leaders scramble to avoid a partial government shutdown when the current funding law expires on Friday night, Senate Majority Leader Schumer said negotiations over the weekend were successful enough to warrant a one-week extension in order to finalize a funding deal for the rest of the fiscal year. Senate Minority Leader McConnell also signaled that an omnibus spending bill remained a viable option, but he said that Democrats needed to meet Republican conditions. In any case, the statements suggest Congress will avoid the threat of a government shutdown, which would probably push down financial markets.

U.S. Stock Market: The SEC will vote tomorrow on four proposals aimed at lowering costs for small investors. The new rules would effectively curtail “payment for order flow” and force brokers and market-making firms to execute deals at the best price available. For example, the new rules would require brokers to auction customers’ orders and publish detailed data showing how orders were carried out.

U.S. Cryptocurrency Market: Sam Bankman-Fried, founder and CEO of now-bankrupt crypto exchange FTX, was arrested yesterday in the Bahamas after the U.S. Justice Department filed criminal charges against him related to the exchange’s collapse. The indictment against Bankman-Fried is due to be unsealed this morning. Also this morning, the U.S. Securities and Exchange Commission sued Bankman-Fried for securities fraud.

- Bankman-Fried had been expected to testify before Congress today regarding the collapse of FTX, but now that will not happen. However, current FTX chief executive and workout specialist John Ray III will testify.

- Ray will likely unveil even more damning evidence of how poorly FTX was run as he already has during his short tenure at the company.

- In his prepared testimony for today, Ray will say that FTX’s collapse “appears to stem from the absolute concentration of control in the hands of a very small group of grossly inexperienced and unsophisticated individuals” who failed to implement the controls “that are necessary for a company that is entrusted with other people’s money or assets.”

- The latest developments in the FTX saga, in conjunction with the many other crypto bankruptcies this year, will likely continue to be a black eye on the industry and make it even harder for crypto assets to regain their previous high valuations, at least in the near term.