Weekly Energy Update (September 15, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices remain under pressure on recession fears.

(Source: Barchart.com)

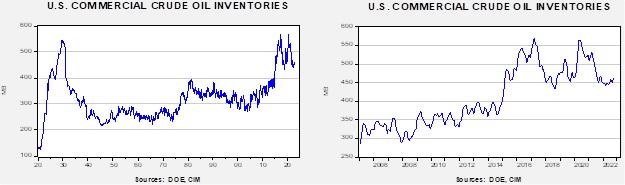

Crude oil inventories rose 2.4 mb compared to a 2.5 mb build forecast. The SPR declined 8.4 mb, meaning the net draw was 6.0 mb.

In the details, U.S. crude oil production was steady at 12.1 mbpd. Exports rose 0.1 mbpd, while imports declined 1.0 mbpd. Refining activity rose 0.6% to 91.5% of capacity.

(Sources: DOE, CIM)

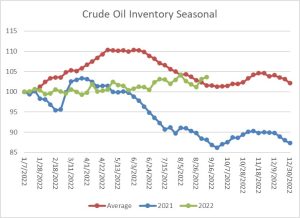

The above chart shows the seasonal pattern for crude oil inventories. The rise in stockpiles over the past two weeks is contra-seasonal. As the chart shows, we are nearing the seasonal trough in inventories. The build seen in October into November is usually due to refinery maintenance. With the SPR withdrawals continuing, the seasonal build could be exaggerated this year.

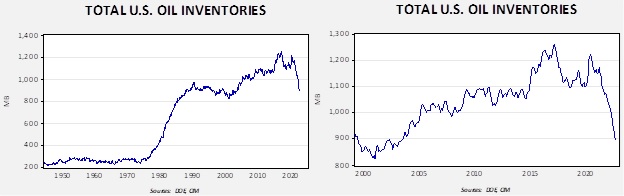

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $106.07.

The SPR has been falling rapidly.

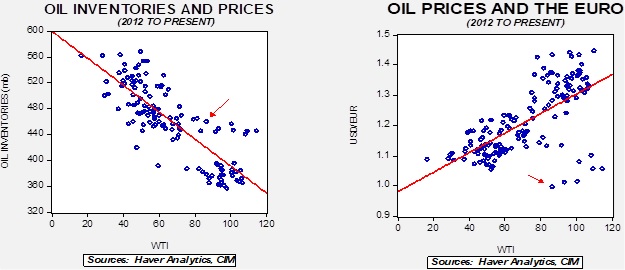

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $66 per barrel, so we are seeing about $20 of risk premium in the market.

Natural Gas Update

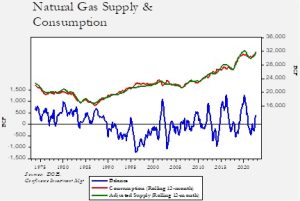

Now that summer is behind us, it’s time to examine the state of the natural gas market as winter approaches. Currently, on a rolling 12-month basis, supply is exceeding consumption.

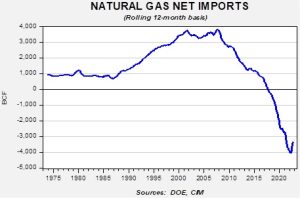

Some of the supply improvement has come from rising net imports. As the chart below shows, the U.S. was a net importer of natural gas until late 2017 (again, on a rolling 12-month basis). Since then, the U.S. is a net exporter, hence the negative net import reading. The recent rise in net imports appears to be tied to the Freeport LNG disruption, as LNG exports have fallen. By next spring, that facility is expected to be at full production, which will reduce American supplies, assuming steady production.

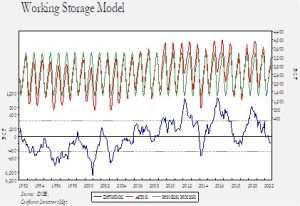

Although supply has been ample, hot summer weather has lifted consumption and puts the U.S. at a modest storage deficit going into autumn.

This model seasonally adjusts storage levels, and the deviation line shows the difference between current and normal storage.

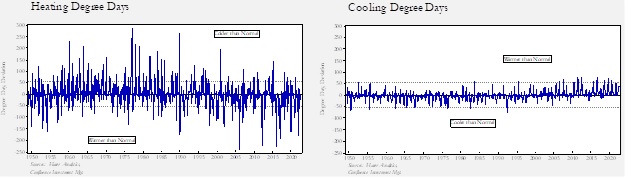

Expectations of rising LNG exports have pushed U.S. natural gas prices well above seasonal norms. As always, the key to prices in the winter is temperature. One way to measure the impact of temperature on energy demand is using the concept of the degree day. The degree day measures the average temperature (high + low/2) compared to 65o with the idea that no climate control is necessary at that temperature. If above 65o, cooling is required while if below, heating is required. The temperature deviation is then adjusted by population. Below are the deviations from normal.

Heating degree day values tend to be higher than cooling because extreme cold is more common than extreme heat. A temperature of 0o generates a heating degree day where the equivalent would be 130o for a cooling degree day. Thus, on the above charts, we have scaled the degree days equally. Casual observation would suggest that winters have become milder as the last extreme cold month, December 2000, was a heating degree day of 200 which has not been exceeded since. Such readings were far more common in the 1970s. On the cooling side, there is a clear upward drift in deviations. It is quite possible that rising greenhouse gas levels are a factor in both warmer winters and hotter summers, but one cannot rule out longer cycle factors, such as sunspots. What this means for natural gas markets is that colder winters may not be as bullish a factor as it once was, but summers pay a larger role in demand.

Market news:

- As autumn approaches, natural gas demand tends to decline. Moderate temperatures ease electric demand. There is always a risk of hurricane disruption in the Gulf of Mexico, but so far this year, the region has been spared from storms. Hurricane season peaks, on average, by September 10, so there is a growing chance that we will avoid a serious disruption from tropical activity. Although EU natural gas inventories have increased, it is important to remember that inventory is a supplement to production and imports. Thus, to ensure ample supplies, barring a mild winter, U.S. LNG flows, which have been critical to the inventory build, will need to continue. This means that U.S. natural gas prices will remain elevated, unless the U.S. decides to curtail exports.

- A follow-on effect of high natural gas prices is high fertilizer prices as natural gas is an important feedstock for fertilizers, and tight supplies are hammering the European fertilizer industry. In response, Germany has been increasing chemical imports.

- In addition to fertilizer, vegetable growers often use greenhouses in Europe, and high natural gas prices are leading to production declines.

- One of the surprises over the past 18 months has been the lack of supply response from the oil industry in the face of elevated prices. A key reason is the worry about policy changes leading to stranded assets. We expect this fear to cap the supply response and keep oil prices high.

- Although the supply situation for crude oil remains bullish, demand is cyclical and as the odds of a recession rise, the potential for demand destruction is increased as well.

- One of the key elements of recent legislation was permitting reforms. Environmentalists and other groups have been using the courts to prevent pipeline construction, for example. The Inflation Reduction Act is designed to reduce the time of objections to construction. Interestingly enough, it could work the other way. Although intermittency is a hinderance to using solar and wind power, long-range electricity distribution could, in theory, counter intermittency by allowing solar or wind power to be sent long distances when it might be dark and calm. This bill should help that process as well, as often proposals for electricity lines face local objections.

Geopolitical news:

- It is looking increasingly like a return to the Iran nuclear deal isn’t going to occur. To some extent, it appears that Iran won’t take “yes” for an answer. The White House has generally accepted Iran’s demands, only to see new ones emerge. We suspect the Iranian leadership needs an enemy much like the Castros do in Cuba; it is hard to repress one’s population without an ever-present enemy. We have been skeptical of a deal and despite continued negotiations, it doesn’t look like one is coming.

- Part of managing sanctions is the use of GPS and vessel transponders. Increasingly, software is spoofing this system, reducing the effectiveness of sanctions. Actual interdiction is still possible but would require a much larger military effort.

- Lebanon has been in a financial crisis for some time. Things have gotten worse as the central bank has stopped supplying dollars to energy importers, leading to soaring product prices.

Alternative energy/policy news:

- Uranium prices have been strong as interest in nuclear power continues to rise. Although nuclear electrical power has been an environmental pariah for a long time, the sources don’t create greenhouse gases. Unfortunately, Russia is a significant source of uranium.

- Although the logic is questionable, the EU has promoted biomass, mostly wood burning, as a “green” alternative. The EU is now considering tightening the rules on wood burning (mostly pellets) due to the controversy surrounding its impact on the environment.

- Solar power is a popular renewable energy source; however, California is finding that disposing of the panels once their useful life has expired (around 15-20 years) is becoming a problem. The panels contain heavy metals which if dumped in a leaky landfill, could contaminate groundwater.

- Disruptions in the solar panel supply chain are leading to greater coal consumption.

- Some critical rare earths are mined in Myanmar and lax environmental practices are raising concerns about environmental damage to the country.

- Renewable energy is facing a constraint due to the lack of skilled workers.