Daily Comment (September 22, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning and buckle up! Today’s Comment will focus exclusively on the central banks. We begin with a broad overview of the latest Federal Open Market Committee (FOMC) meeting followed by an assessment of the future path of policy hikes. Next, we cover the market reaction to the Fed’s rate decision and discuss implications for the global economy. Lastly, the report summarizes how central banks responded to the Federal Reserve’s rate announcement.

It Will Be Enough: The Federal Reserve raised its benchmark interest rate by 75 bps for the third meeting in a row and signaled that it has the tools necessary to corral inflation.

- In a press conference, Fed Chair Jerome Powell reaffirmed that his position is unchanged since giving his Jackson Hole speech three weeks ago. He reiterated the central bank’s will to keep interest rates in restrictive territory until it sees compelling evidence that inflation is coming down. Although his comments were mostly hawkish, Powell signaled the Fed could slow the pace of increases at some point.

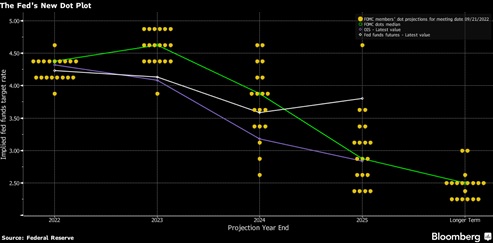

- The Fed’s latest “dot plot” shows the implied year-end fed funds rate above 4.25%. Although Powell mentioned that no decision has been made on the size of the next hike, it is widely believed the Fed will raise rates 75 bps and 50 bps, respectively, at its next two meetings. The plot also shows that policymakers favor a mild hike of 50 bps for all of next year.

-

- Although there were no dissenting votes in the Fed’s rate decision, the dot plot reveals that at least one Fed member on the committee was uncomfortable lifting the fed funds rate above 4.00%. We would guess the outlier was one of the new Fed governors, either Lisa Cook or Philip Jefferson. If that is the case, future hikes could face resistance, especially if the economy falls into recession.

- The Fed’s economic projection showed that the U.S. economy could expand by only 0.2% in 2022. This tepid growth forecast suggests that central bank officials are possibly factoring in a recession later this year. Although the Fed does forecast more robust growth in 2023 and 2024, the sharp increases in the policy rate imply that the central bank does not plan to reverse course if economic growth slows.

The Markets React: Equities whipsawed, major currencies tanked, and long-duration bond prices surged as investors weighed the impact of higher interest rates on financial assets.

- The central bank has been able to raise rates because the unemployment rate remains low, but policymakers will likely not be able to sustain this pace of hikes once the economy contracts. While Powell maintains the bank plans to keep rates high for as long as it takes to bring down inflation, the central bank could face political pressure as the economy weakens and labor markets soften. For example, hours after the rate announcement, Massachusetts Senator Elizabeth Warren (D-MA) slammed the Federal Reserve for its hawkish actions for not looking out for workers. Accordingly, the recent volatility is likely attributable to investors being unsure of whether the Fed will blink when confronted with poor economic data.

- The U.S. dollar rallied against its peers following the Fed’s decision to raise rates. The euro fell further below parity, and the British pound dipped to its lowest level since 1985. The greenback’s strength will exaggerate inflation in other countries as most commodities are priced in dollars. Additionally, the currency’s strength encourages capital outflows, especially from emerging markets, as investors look to move away from risk assets into safe-haven assets. As a result, non-U.S. central banks will be forced to raise rates if they want to prevent their currencies from weakening, thus increasing the likelihood that the global economy will fall into recession.

- The yield curve inversion deepened as recession fears led to a plunge in long-duration yields and a spike in short-end yields. Because financial institutions like to borrow in the short term and lend in the long term, an inverted yield curve can hurt bank profitability. Thus, financial institutions may be less inclined to issue loans to potential borrowers. As a result, the potential decline in lending activity will hinder investment spending and may be already negatively impacting the housing market.

-

- The number of existing home sales plummeted as the Fed’s interest rate hikes pushed up mortgage rates to their highest level since 2008. In his speech, Powell mentioned that he expects the housing market to enter correction territory.

The World Strikes Back: Central banks are altering their monetary policy to prevent a stronger dollar from hurting their respective economies.

- The Bank of Japan intervened in the foreign exchange market for the first time since 1998. The move was aimed at protecting the yen from depreciation, while the central bank maintained its ultra-accommodative monetary policy. The intervention pushed the dollar down 2% to around 140.2 against the yen. However, the BOJ’s action will provide limited relief for the currency as traders will still attempt to offload their yen holdings until the central bank backs away from its loose monetary policy.

- Despite the recent central bank’s action, BOJ Governor Haruhiko Kuroda maintained there would be no change in the bank’s monetary policy.

- In contrast to the BOJ, the Bank of England lifted its benchmark rate by 50 bps to 2.25%, its seventh consecutive rate hike. The bank’s actions were relatively modest compared to the hikes of 75 bps from the Federal Reserve and European Central Bank. The BOE’s moves are likely related to confidence that the U.K. government’s plan to cap energy bills will also lower inflation. Following the hike, the pound briefly rallied above $1.13 before settling back to its 1985 lows. Although the BOE was the first major central bank to raise interest rates, we suspect it could be the first bank to pause its policy tightening as the country battles recession.

- PM Liz Truss’s new administration has advocated for pro-growth policies as she looks to jump-start the British economy. Thus, if the bank tightens policy too much and the economy contracts, the bank will likely be blamed. This dynamic should push the British pound closer to dollar parity over the next few months.

- Several other central banks also tightened their policy to slow the rise in import prices. For example, the Swiss National Bank hiked interest rates by 75 bps, bringing the country out of negative territory for the first time since 2015. Meanwhile, the Philippines and Indonesia raised rates by 50 bps each, and Taiwan hiked interest rates by a modest 12.5 bps. Import goods, especially commodities, are primarily priced in dollars; thus, a surging greenback generally adds to inflationary pressures abroad. As a result, we suspect other central banks will continue to tighten policy until the Fed ends its hiking cycle.