Weekly Energy Update (September 22, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices remain under pressure on recession fears.

(Source: Barchart.com)

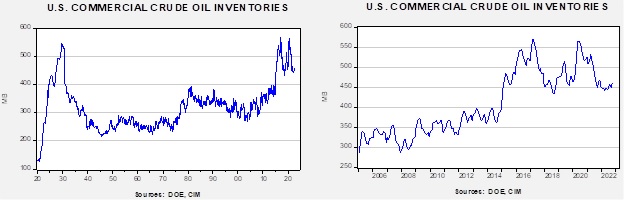

Crude oil inventories rose 1.1 mb compared to a 1.9 mb build forecast. The SPR declined 6.9 mb, meaning the net draw was 5.8 mb.

In the details, U.S. crude oil production was steady at 12.1 mbpd. Exports were unchanged while imports rose 1.2 mbpd. Refining activity rose 2.0% to 93.6% of capacity.

(Sources: DOE, CIM)

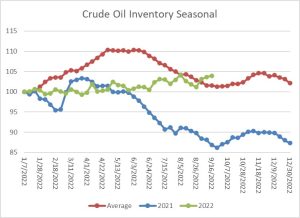

The above chart shows the seasonal pattern for crude oil inventories. The rise in stockpiles over the past two weeks is contra-seasonal. As the chart shows, we are nearing the seasonal trough in inventories. The build seen in October into November is usually due to refinery maintenance. With the SPR withdrawals continuing, the seasonal build could be exaggerated this year.

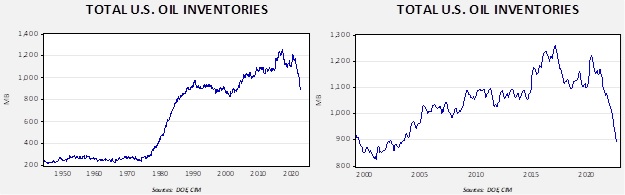

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $106.98.

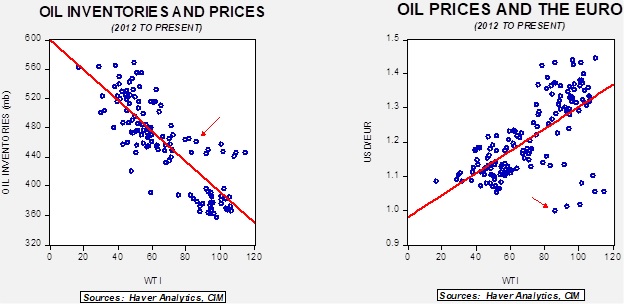

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $66 per barrel, so we are seeing about $20 of risk premium in the market.

The SPR

In our weekly reporting above, we have been updating total U.S. oil inventories, both commercial and the SPR. For years, analysts have tended to treat the two as different entities as commercial inventories are what is available and the SPR was only deployed in emergencies. Price modeling, therefore, tended to focus on commercial storage. The separation of commercial and strategic stocks made sense. However, as our above analysis suggests, we have stopped treating the SPR as an emergency reserve and have begun considering it a buffer stock.

Buffer stocks are sometimes used in commodity markets to dampen price volatility. When prices rise to a level considered “too high,” the buffer stock manager releases inventory, and when prices are “too low” the commodity is purchased. In the 1970s, several commodities had buffer stocks, which were managed by producers. All of them eventually failed because producers set a price well above the market clearing one. Eventually, the buffer stock became too large, and the manager was forced to “dump” the stocks on the market, leading to a price collapse. A buffer stock operated by a consumer would likely have the opposite problem since it would want to set a price well below the market clearing one.

Recently, the Biden administration floated an idea that if WTI fell to $80 per barrel or less, the SPR would buy oil to refill it. We still harbor doubts that oil will ever be purchased by this administration, but this recent “trial balloon” is intriguing. If this idea becomes policy, it will confirm that the SPR has become a buffer stock and the government is comfortable with an $80 per barrel oil price. That is probably a high enough price to maintain current output, but if prices remain steady, the inflationary impact (inflation is a rate of change concept) would diminish over time. In theory, the $80 per barrel becomes a floor, and it is unclear what price would trigger selling (the ceiling price), although one could imagine that a round number like $100 per barrel would be reasonable. There remain numerous uncertainties about this concept, but we will continue to monitor developments.

Here’s the key point to all this: from the late 1970s until recently, there was great faith placed on markets to solve problems. Government intervention into the economy was normalized during the Great Depression and WWII but the inflation of the 1970s undermined the idea that the government could manage the economy. The infamous gas lines of the 1970s occurred, in part, due to price caps on product. When it became unprofitable to refine gasoline at the cap price, shortages developed. Markets do work, but they are focused on efficiency, not equality. In other words, high gasoline prices did increase available supply and eased demand, but the burden of the policy fell more heavily on lower income households. The government using the SPR as a buffer stock could suggest a return to the pre-Reagan/Thatcher era.

Market News:

- We want to issue a correction to last week’s report; we implied that the permitting element of the Inflation Reduction Act had already been passed. It was not. This part was peeled from the bill to be passed separately. Talks on permitting are currently underway.

- The government has accepted about $190 million of bids for offshore oil development.

- The G-7 price cap idea remains untested, but the IEA notes that when the EU implements its embargo next February, Russian oil demand will fall by 1.9 mbpd.

- As winter approaches, U.S. oil producers warn they will not be able to meet shortfalls as demand rises. Surging LNG exports are pushing U.S. electricity prices higher.

- For reference, this site updates EU natural gas storage.

- One of the factors that has cooled oil prices has been weaker Chinese economic growth. If Beijing becomes serious about stimulating the economy, oil prices will likely rise.

- Over the past several months, we have noted that the data for miles driven by Americans shows a clear reaction to higher gasoline prices. For years, it was a “truism” that driving demand was price insensitive. However, work from home and the expansion of social media appear to have caused gasoline consumption to become more sensitive to price.

- As energy prices rise in the EU, manufacturing firms are being forced to curtail production.

- Smaller U.S. oil firms have been aggressively expanding oil and gas production, but reports suggest that they have exhausted their most promising fields, which may lead to falling output.

- As energy prices rise in Europe, governments are trying to address this issue. There are two policy paths. The first is to increase supply, and although that is the preferred solution, it is hard to execute in the short run because it often takes investment and time to lift production. The other path is to ease the negative impact on consumers by either fixing the price and then allocating the “pain” to either producers or the government, or by subsidizing consumers. The problem is, once this path has been taken, it becomes a political decision about who will bear the cost. The U.K. is a good example of what not to do as the support program is likely too broad, offers too much support, and will be funded by government borrowing. The steady decline in the GBP is evidence that the markets, to quote Queen Victoria, “are not amused.”

- Due to price turmoil, the German government has nationalized the natural gas distributor Uniper (UNPRF, $2.90). Soaring natural gas and oil prices are making it difficult for firms to hedge their exposure, which could either lead to a supply crisis or a financial market crisis.

- The lack of investment in oil and gas production is a key element to the recent rise in prices. A good example of this lack of investment is Nigeria, where oil production is about 1.2 mbpd, down from 2.6 mbpd in 2012. Economic mismanagement and corruption have weakened the incentives to investment, and since oil and gas are depleting assets, the lack of investment means falling output. This investment issue isn’t just a Nigerian problem as OPEC+ now speaks of “production targets” as opposed to “production quotas,” reflecting the lack of productive capacity.

- The recent heatwave in China has spurred coal demand and has lifted imports of coal from Russia and Indonesia.

- Strong coal demand has started to trigger investment in mines that can be tapped quickly.

- As we head into another “La Niña” season, Japan is bracing for a cold winter. If the temperatures stay true to form, it will lift LNG demand.

Geopolitical news:

- Throughout history, Germany and Russia have had periods of economic integration, followed by disengagement. Recent reports that the German government has seized three Russian-owned refineries in Germany suggest disengagement is underway.

- The G-7 is preparing to implement its price cap on Russian oil. The reason for the cap is that the U.S. is afraid that when the EU’s ban on insurance for tankers goes into effect this December, Russian oil flows will slow to a trickle, leading to a spike in prices. The U.S. has proposed the price-cap idea, where Russia could still export oil that would be granted tanker insurance but at or below a mandated price. The trick is to establish a price high enough to encourage continued production but low enough to reduce revenues. We remain skeptical that this plan will work, but if the EU insurance ban goes forward, we could see a drop in available oil supplies and a rise in price.

- EU leaders are watching growing protests over the war and high energy prices.

- Meanwhile, ties between Russia and Saudi Arabia appear to be tightening.

- Protests against the beating death of a woman in Iran who refused to wear a head covering have become widespread, leading the government to reduce internet connectivity as a way to prevent organizing. According to reports, five protestors have died as security forces attempt to quell unrest.

- In recent interviews, President Raisi of Iran has made it clear that his country won’t rejoin the nuclear deal without guarantees that a future administration won’t exit it again. Since the deal is not a treaty, the Biden administration cannot bind future governments to it. If this position is maintained, there is little chance that the U.S. will rejoin the pact. Although the market may take this as bullish, in reality, we harbor doubts that the current sanctions are keeping Iranian oil from global markets. Thus, the impact of failed negotiations may be minor.

Alternative energy/policy news:

- There is an old adage in commodities that “nothing cures high prices like high prices.” The idea is that high prices lead consumers to reduce demand and suppliers to boost output. In the current high-price environment, most of the adjustment has come from consumers. However, one area often overlooked is increasing efficiency. A recent report indicated that data centers, server farms that do the calculating that fosters AI and the internet, tend to generate massive levels of heat that is usually vented. However, with prices for energy high, there are efforts to capture this energy and use it for the production of steam.

- As EVs expand, lithium, a key mineral in batteries, is in high demand. It tends to be found from two sources: ‘hard rock’ mining and evaporating brine at high altitudes from waters containing lithium. The latter source is mostly found in South America, primarily Chile. The former source is distributed around the world, with several mining sites in Canada. A major, yet undeveloped, mine exists in Quebec. Despite high demand and high prices, the mine remains uncompleted due to various obstacles.

- Hertz (HTZ, $18.15) announced plans to purchase 175,000 EVs from General Motors (GM, $39.17) over the next five years.

- Modular nuclear reactors hold the promise of expanding nuclear power quickly to less populated regions. Despite their promise, industry expansion has been slow. There are several reasons. First, most of the research and development of these reactors are still in the concept and design phases. This situation is still favorable, because is suggests this product will become increasingly available. But for now, electricity from small modular nuclear reactors remains in the future. Second, connecting to the grid remains an issue in some markets. One possibility would be to site these reactors where current coal-fired plants reside, allowing for rapid connectivity. And finally, even with modularity, nuclear power remains controversial, which tends to slow development.

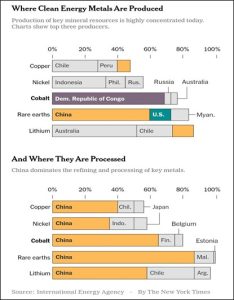

- Although key metals for clean energy are found in various places around the world, processing is concentrated in China.

- A leak at a German nuclear power plant has led to its temporary closure.

- One of the benefits of offshore wind energy is that, unlike on land, offshore wind is more constant. Despite this benefit, getting projects completed has been remarkably slow.

- As the West builds out LNG infrastructure, there is a concern that these assets, which have long lives, could become stranded.

- Policies are sold. As governments try to sell clean energy to their citizens, leaders are touting the prosperity the change will bring. Even in China, with an authoritarian government, there are concerns about whether clean energy will bring economic benefits. A related element of this goal is that governments are taking steps to favor domestic firms to build out the clean energy industry. Such actions will likely run afoul of WTO rules. Our take is that the trade rules will be broken, lending additional evidence that we are ending the current phase of globalization.