Daily Comment (September 15, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with an overview of the implications of a more aggressive Federal Reserve. Next, we discuss the latest developments in the EU and U.S. fight against inflation, which includes an update on rail worker negotiations. The report concludes with a discussion on how sanctions are affecting Russia’s relationships with its allies.

Go Big or Go Home: Higher than expected inflation numbers have added to speculation that the Federal Reserve could be more aggressive in its tightening cycle. However, this does not mean it won’t cut rates.

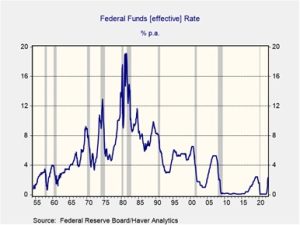

- The market expects the Federal Reserve to go big at its next meeting. The CME FedWatch Tool shows that the Federal Reserve will raise rates by at least 75 bps in September and potentially push its benchmark policy rate up 100 bps. This change in the policy-rate forecast was related to disappointing CPI and PPI reports. In August core CPI accelerated unexpectedly, while core PPI failed to drop as much as the market anticipated. Higher fed funds expectations could lead to a choppy market over the next few days as the FOMC meeting approaches.

- The Fed’s next rate hike will be historic even if it raises the policy rate by only 25 bps. This next rate decision should lift the policy rate above the previous cycle’s peak for the first time since 1981. The milestone possibly reflects the central bank’s confidence in financial market conditions. The previous two economic downturns exposed the weaknesses in the financial system and forced the Fed to develop policy tools designed to prevent a crisis. Therefore, we may be heading into a new finance regime in which the Federal Reserve raises interest rates, but also maintains those rates for much longer. If we are correct, the tech sector’s dominance in the S&P 500 is likely over. However, the financial services industry could be on the ascent.

- The Fed’s new policy tools will be tested as the central bank ramps its balance sheet reduction and rate hikes over the next few months. Quantitative tightening is expected to cause financial strain as traders struggle to get deals done. The Bloomberg U.S. Government Securities Liquidity Index, a gauge of deviations in yield compared to a fair value model, dropped to its lowest level since March 2020. The deterioration in the index suggests that traders find it more challenging to exchange treasuries for cash and vice versa. If the problem worsens, the Fed will be forced to intervene. Although the financial system is withstanding monetary tightening now, we are still not sure that a financial mishap will not take place in the future. In the event of a blowup in the financial system, we expect the Fed to become more accommodative in its rate policy. As a result, we believe that the Fed could pause or cut rates by mid-2023 if financial conditions deteriorate significantly.

The West Needs a Break: The European Union and the U.S. are exploring ways to prevent further inflation within their respective regions.

- Vice President of the European Central Bank Luis de Guindos wants to anchor inflation expectations. In a speech to EU ministers, Guindos urged the central bank to prioritize price stability over growth. His comments are another example that the central bank could look to slow GDP growth in Europe to tame inflation. Higher European interest rates increase the likelihood that the region will fall into recession, leading to further fragmentation throughout the bloc. That said, a decline in gas prices could provide a tailwind for Europe, but we are not optimistic about that happening anytime soon.

- As energy woes continue in Europe, EU countries rolled out plans designed to protect households from big jumps in their utility bills. France plans to cap energy price increases at 15% for next year. Meanwhile, Germany is considering purchasing a controlling stake in gas import company Uniper (UNPRF, $4.08) to ensure the company does not fall into bankruptcy. These extreme actions by countries demonstrate the growing angst over energy security.

- Italy might not be as vulnerable as initially thought. Energy company CEO Claudio Descalzi claimed that Italy could make it through the winter without Russia’s gas, assuming the temperatures are mild. Last year, the country imported nearly 40% of its gas from Russia.

- On the other hand, Germany may not be so lucky. The country’s head energy regulator warned that Germany would run into gas shortages if the winter is gruesome.

- The U.S. rail workers reached a tentative agreement with rail companies to avert a strike on Wednesday. At the last minute, White House officials intervened on a deal that secured better pay and improved working conditions for workers. A shutdown would have prevented almost 30% of cargo shipments by weight from shipping in the U.S., potentially adding to already elevated inflationary pressure. The agreement ended a two-year negotiation and will be welcomed by markets.

Ukraine War and Russian Sanctions Update: As Ukrainian troops continue to progress in their counteroffensive, the West looks for new ways to punish Russia for the invasion.

- The West wants Turkey to stop helping Russia avoid sanctions. Although a NATO ally, Turkey has tried to remain neutral in the Ukraine conflict. It has supplied Ukraine with sophisticated military drones to help in its war efforts while deepening its trade ties with Russia. Turkey has received limited pushback from the U.S. and Europe up to this point. However, this may change soon. The West is considering slapping sanctions on Turkish banks that are integrated into Russia’s domestic payment system, known as MIR. The crackdown from the West suggests that it will become less conciliatory toward neutral countries that aid Russia in averting sanctions.

- Chinese President Xi and Russian President Putin met in Uzbekistan on Thursday at the Shanghai Cooperation Organization Summit. The two countries will discuss the ongoing war in Ukraine, with Russia hoping for additional support from China. Despite the two’s agreement that their relationship has no limits, Beijing has implicitly shown that it is unwilling to run afoul of U.S. sanctions. China’s position is unlikely to change as Russia’s inability to secure a quick invasion, as it initially promised, has made it look weak in the eyes of many within the Chinese leadership. Moreover, China’s lack of military support will likely make Russia’s losses from the war even greater.

- Although there is some speculation that U.S. actions in Taiwan could lead China to ramp up its support for Russia, we are not so sure. In our view, Russia’s vulnerabilities may have encouraged the U.S. to take a greater interest in Taiwan as the sovereign island has much more geopolitical significance than Ukraine. Thus, there are likely factions within the Chinese Communist Party that are less inclined to support the additional backing to Russia.