by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

It’s Fed minutes day! Equities are higher this morning, in what we are dubbing the “Seinfeld rally” because it seems to be driven by…nothing! Although there was news overnight (which we discuss below), none of it reasonably explains the rally we are seeing so far. The president won’t be visiting with Denmark’s PM Mette Frederiksen as was previously scheduled because she rebuffed his offer to buy Greenland. Here is what we are watching:

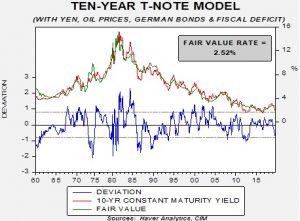

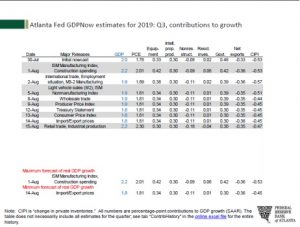

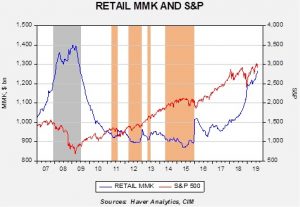

The Fed minutes: The report comes out at midday; the minutes are a heavily sanitized version of the interactions between committee members, with words like “few” or “some” that get scrutinized like scriptural text for meaning. The reality, which is better seen in 2024 when the transcripts come out, often reveals sniping and side comments that show what the members really think. Still, we will work with what we have and the important question we hope to answer from the report is whether Powell can pull the committee along to cut rates faster. We are seeing continued comments from members, the most recent from the San Francisco Fed, that the last rate move was precautionary and not necessarily the start of a more profound cutting cycle. In our view, the breakdown of the committee suggests that Powell will struggle to get more than one more rate cut this year out of the FOMC. Too many members are still working within some form of the Phillips Curve framework and will push back against rate cuts with low unemployment in place. However, there is a growing contingent that wants to conduct policy with an eye on the financial markets, and this group worries that additional stimulus will simply show up in the financial markets as “froth” and create financial instability. At the same time, as we note below, Powell is facing relentless pressure from the White House to cut rates aggressively. The chance of disappointment from the minutes is rather high.

Italy: We thought that, in the end, Salvini would make a deal to keep the government in place. Turns out, we were wrong. Conte, the PM, resigned before the no-confidence vote and now the president is working to figure out if a replacement government can be formed. There are four likely outcomes from this:

- New elections. The timing is bad because the government is in the middle of budget negotiations. Polling suggests the League and associated parties would probably prevail in a new government, sending shockwaves throughout Europe. This would be the equivalent of the AfD taking control of Germany or Le Pen’s National Rally governing France.

- The current coalition could decide to hold together a while longer to get through the budget process. To some extent, this may simply be delaying the inevitable.

- A broad anti-League coalition. A grand coalition of sorts could form a government; however, this would require some elements of the non-League right and the center and populist-left. It might stave off elections, but the coalition would be unstable.

- A narrow anti-League coalition. It would exclude the right-wing but would still require a center-left and populist-left government to form. More stable than option three, but not by a lot.

It appears to us that the most likely outcome is new elections. That’s risky for Salvini because surprises can occur, but the surge of right-wing populism in Europe seems to be strengthening. What we find interesting is that the financial markets have taken the news in stride. In fact, the spread between Italian and German sovereigns actually narrowed with the resignation. Perhaps markets are more comfortable with the League without the Five-Star Movement, or, more likely, it’s hard to get overly concerned about Italian governments simply because they fail with such regularity.

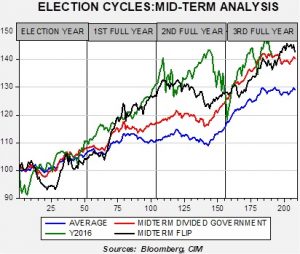

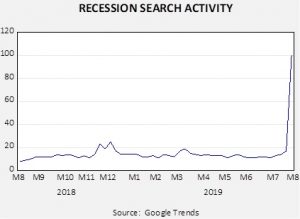

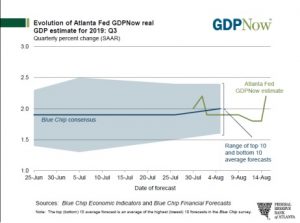

White House recession worries: The White House is clearly concerned about the chances of a recession in the upcoming year. Officials were on various Sunday news shows talking up the economy. As noted above, Fed criticism is continuing. In addition, the administration is considering additional fiscal measures to lift growth. These ideas include a payroll tax cut, indexing capital gains taxes to inflation and perhaps even delaying or removing some tariff measures. As we noted yesterday, measures to boost the economy are common in this year of the election cycle, which is part of the reason why the year before the election tends to be good for equities. However, that trend has been somewhat stunted by trade concerns this year.

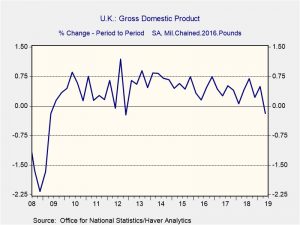

Boris goes to Europe: PM Johnson is on his way to Europe to meet with Chancellor Merkel and President Macron. Johnson’s message to the EU will be clear—the U.K. is leaving on Halloween unless the EU gives ground on the Irish backstop. Johnson is under the impression that opposition to a hard Brexit in Parliament is signaling to the EU that the exit on Halloween is a hollow[1] threat. Johnson seems to think that the EU will break if there is an unmistakable signal that a hard Brexit is imminent. We think he is wrong. When faced with the economic disruption the EU will experience from a hard Brexit, Johnson believes the EU will react; in other words, Britain will be willing to suffer more from a hard break compared to the EU. That calculation might be true; however, we think Johnson might not appreciate how hard it is to get a unanimous position from the EU on any topic. As a result, once established, it takes extraordinary circumstances to reopen negotiations within the EU, which are nearly always tortuous. To some extent, playing “chicken” with the EU is a bit like competing with an opponent whose steering wheel is locked. There may be good reason for the EU to “veer,” but it just can’t.

ISIS on the rise? As the U.S. gets closer to securing an agreement with the Taliban, it appears that elements of ISIS are making themselves more known. Today, top U.S. negotiator Zalmay Khalizad is expected to arrive in Qatar to discuss the remaining parts of a withdrawal agreement. In said agreement, the Taliban would sever its ties with al-Qaeda and assist in counter-terrorism measures. Following the bombing of a wedding that took place on Saturday in Kabul, the effort to secure a deal has been complicated by growing doubts that the Taliban will be able to follow through in countering terrorist threats from ISIS. As a result, this could mean the U.S. withdrawal, which was originally slated to be 5,000 troops, might be lower.

Russia-U.S.: Following the U.S. withdrawal from the Intermediate-Range Nuclear Forces (INF) Treaty, the relationship between the U.S. and Russia has become more tense. Yesterday, Russia showed displeasure that the U.S. has begun testing cruise missiles by stating it believes the U.S. had likely been working on the missile prior to its withdrawal from the INF Treaty. Later that day, President Trump attempted to de-escalate tensions by calling for Russia to be reinstated into the G-7. It appears that despite the president’s attempt to normalize relations between the two countries, the relationship between the U.S. and Russia appears to be in its worst shape since the Cold War. Although we do not expect conflict to arise soon, we do anticipate that both sides will reinforce their military capabilities. Russia will attempt to show the world that it is still a major factor, and the U.S. will likely do so in an attempt to deter perceived threats to its interests in the Pacific.

[1] See what we did there!