by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Note: After a long hiatus, we have resumed podcasting. Our new series, titled The Confluence of Ideas, begins with an overview of “Hegemonic Stability Theory” (the program title links to our podcast page). Our plan is to record a new episode about every 10 days, or three per month. We hope you enjoy them—let us know what you think!

Happy Monday! An update on Brexit, and our thoughts on the drug cartels in Mexico. Unrest is springing up all over the world and so are elections. Here are the details:

Brexit: The anticipated vote didn’t happen on Saturday. Instead, Parliament passed a measure that forces PM Johnson to ask for an extension. He sent an unsigned letter to Donald Tusk asking for the action. Initially, this vote looked like a major blow for Johnson but, in reality, it appears the vote was to ensure that a hard Brexit won’t occur on Halloween. Johnson intends to bring his bill up again this week and estimates of votes suggest he will get the 320 needed to pass.[1] In other words, a slim majority has decided this is the best deal they are going to get and favor Johnson’s plan; they didn’t vote for it on Saturday, opting for the other measure, in order to prevent a hard Brexit.

That being said, there is still a good bit of uncertainty. Labour may attach a call for a second referendum, this time on Johnson’s bill. This position might gain favor even if Johnson’s bill passes if the majority is narrow. If a second referendum is held, there is a rising possibility that the U.K. stays in the EU. Why? Because of demographics. Older voters support Brexit; younger voters don’t. Over the past 30 months since Brexit started, older voters have died and more young people have become eligible to vote. The GBP continues to swing based on sentiment toward Brexit; as the odds of a hard Brexit fade, the currency has been appreciating.

Mexico: Last week, in the city of Culiacan, there was a firefight between Mexican troops and gunmen associated with Joaquin Guzman, the son of “El Chapo,” the notorious drug lord. After capturing the young Guzman, authorities returned him to his “associates” following the cartel’s threats to assassinate Federal officers in their control. This situation is quite disturbing. Harkening back to Thomas Hobbes, we give the state a monopoly on violence to protect us from lawlessness. A monopoly on violence, according to Max Weber, is one of the hallmarks of a nation. The fact that drug cartels control much of Mexico weakens the government’s claim on sovereignty. Although this doesn’t necessarily prevent investors from considering Mexico as a destination for funds, the tenuous nature of state control does have to be taken into account.

Unrest spreading: We are seeing civil unrest spreading around the world. There was another round of protests in Hong Kong on Sunday. Protestors across the political spectrum came out against corruption in Lebanon. Meanwhile, in Chile, protests against a fare hike for public transportation are expanding rapidly. The Pinera government has rescinded the hike but unrest has continued, enough to trigger state-of-emergency declarations. Eight people have reportedly been killed in the rioting. Protests have emerged in other South American nations, including Argentina and Ecuador. The common themes in these protests are opposition to corruption and a reaction against austerity. We are continuing to monitor Hong Kong, although we suspect that, in the end, Beijing will bring things under control. The unrest in Chile is escalating and the government’s reaction has been rather harsh. Chile has been one of the most stable nations in the region, so civil disorder there does raise concerns. Lebanon is divided, therefore small protests can spin into big ones relatively quickly.

Elections: The Swiss held elections over the weekend, in which the Greens had the best showing. The center-right will continue to dominate the government. Vote counting continues in Bolivia. It appears the vote will be inconclusive and a run-off will be necessary, although the fact that election officials stopped updating results has raised concerns of a “fix.” Canadians go to the polls today in a race that is too close to call. Argentina will hold its elections next week.

Germany: The Bundesbank said the country’s economy may have contracted in the third quarter. If so, it would mean Germany has entered its first recession in six years. That confirms the view of most analysts, and it suggests continued weakness in the overall Eurozone economy and strong headwinds for Eurozone stocks.

Global fiscal policy: At the annual meetings of the IMF and World Bank over the last week, multiple finance ministers and central bankers suggested the threat of further slowing in the global economy calls for increased fiscal stimulus. The officials specifically noted that easy monetary policy is now probably at the limit of what it can do to support the economy.

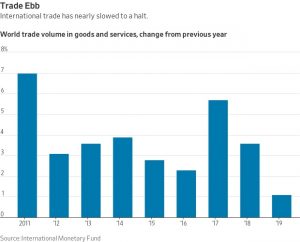

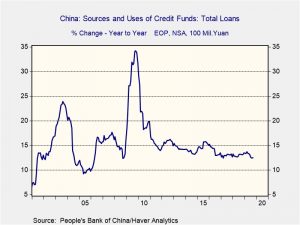

China trade: There was some optimism expressed by China on the progress of trade talks. However, there were no details offered. The optimism is helping equities this morning.

Syria: U.S. troops are decamping for western Iraq, although the administration is considering leaving a small contingent in Syria. Kurdish forces have withdrawn from the border as part of the ceasefire agreement.

Odds and ends: JP Morgan (JPM, 120.56) is announcing a new plan to reintroduce those with criminal backgrounds into the workforce. Some of this is likely part of recent announcements by the Business Roundtable to move beyond mere shareholder interest in setting policy, but it is also possible that tight labor markets are prompting the move. Although fears have eased, there are still worries about financial market liquidity. One of the characteristics of cyberwar is that it can be difficult to determine the source of the attack. Russia has taken this a step further, instigating attacks and making it appear that Iran was behind them. It’s getting so hard to find financing in the shale oil patch that some firms are turning to directly securitizing wells. This action effectively turns ownership of the well over to a special purpose vehicle which pays out production revenue to bondholders. These bonds could have some interesting characteristics; rising oil prices might actually boost the value. At the same time, it would shift a number of risks to bondholders, including faster decline rates and regulatory changes. Mario Draghi presides over his last ECB meeting on Thursday.

[1] Although there are 650 seats in Parliament, the Commons Speaker and his three deputies don’t vote. And, Sinn Fein has seven seats in Parliament but refuses to sit in the House of Commons. That means there are effectively 639 seats, so 320 will pass a measure.