Daily Comment (October 3, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] Equity markets are mostly flat this morning after two sharp down days. Johnson has a new Brexit plan. The WTO approves U.S. retaliatory tariffs against the EU. Here is what we are watching this morning:

Equity worries: Equity markets have taken a bruising in the first two days of the quarter. Worries about global growth are front and center, but other issues are important as well. First, with Chinese negotiators coming to Washington next week, there is hope that at least a truce will emerge. In fact, a narrative is developing that suggests President Trump will make a deal with China because he needs equities to rally and he needs a “win” amidst impeachment investigations and slowing growth. Perhaps. However, the president has suggested on numerous occasions that he views the trade conflict with China as politically supportive; in addition, there is growing support for confronting China in Congress. Thus, if the administration takes a partial deal it might backfire. Another point to consider is what China wants. There is no doubt a trade war hurts both sides. The issue isn’t who suffers the most but who has the greater ability to absorb pain. China probably can win on this one; Xi runs a surveillance state and has much more control over his media. China probably won’t accept anything other than a full removal of tariffs, something we doubt the U.S. will accept. If the meetings next week don’t offer something to the markets, and tariffs are applied as scheduled, further weakness is likely.

Second, there is a worry that the Fed may react too slowly to problems in the economy, as it did in 2007. We note recent speakers have struck an optimistic tone on the economy, which may make it more difficult to cut rates quickly. It is hard for an institution that has relied on the Phillips Curve for decades to cut rates when unemployment is this low. History shows, unfortunately, that policymakers tend to wait until the evidence is abundant to support easier policy. Usually by that point, it’s too late.

EU tariffs: The WTO has confirmed that Airbus (EADSY, 31.34) received illegal subsidies and gave the U.S. permission to apply $7.5 bn of retaliatory tariffs against EU products. The USTR has drawn up a list of products he recommends to be taxed.[1] In addition to these tariffs, President Trump will decide by November 13 if he will place tariffs on autos and parts that could be worth up to $100 bn. EU leaders are quietly begging Congress to prevent this from happening. Even though talks with China loom large, the potential that the trade conflict could shift to Europe doesn’t appear to have been discounted by the market; otherwise, we would likely see a much weaker EUR.

On the other hand: All isn’t lost on trade. Despite the impeachment proceedings, Congress does appear to be making progress on USMCA. Getting that deal done would likely be positive for Canada and Mexico.

Johnson’s plan: PM Johnson released his Brexit plan. It’s rather convoluted, involving a customs border and a separate regulatory border. So far, the EU has reacted cautiously, not because it thinks the plan has merit but because it fears Johnson will use rejection to argue that the EU will never agree to an acceptable plan and a hard Brexit is the real goal. In our opinion, Johnson’s goal is to get new elections. He would prefer not to have a hard Brexit but feels that is a better outcome than constantly extending the deadline. What Johnson seems to want is Brexit followed by elections; if the U.K. is out of the EU, then the Brexit Party has no reason for existence and the Liberal-Democrats have no issue to run on. Labour is hopelessly split and the Tories will likely romp to victory. There is only one problem with this plan—if a hard Brexit proves to be the economic disaster that many have warned against, it’s hard to see how Johnson can win an election. Whether or not these dire forecasts are correct is an empirical question, but therein lies the risk of where Johnson seems to be heading. Of course, if everything breaks his way, an even better outcome is that the EU caves and accepts his plan, he pulls the U.K. out of the EU on time and is the conquering hero. But, the aforementioned “Plan B” of leaving without a deal is also acceptable.

Hong Kong: The city’s cabinet will meet Friday to approve using a colonial-era emergency powers law to get control over the ongoing anti-China protests. One measure being considered would be a ban on publicly wearing the masks that protestors use to protect themselves from tear gas. We suspect the government’s further clampdown will likely spawn more, not less, protests.

Turkey: U.S. national security officials say Turkey seems to be preparing to send troops into northeastern Syria to attack the U.S.-allied Kurdish forces battling ISIS there. If a large attack transpires, the officials say the U.S. may have to pull its remaining 1,000 or so troops out of Syria, potentially allowing ISIS to regroup.

Ukraine: While President Zelensky may be in hot water over the U.S. impeachment inquiry, that shouldn’t detract from his success in easing tensions with the pro-Russia separatists in eastern Ukraine. This week, his government signed a deal with the separatists, Russia and EU monitors for a limited troop withdrawal and local elections in separatist-controlled areas as soon as Kiev gets control over its border with Russia.

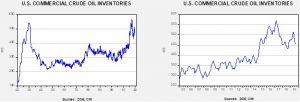

Energy update: Crude oil inventories rose 2.4 mb compared to an expected draw of 0.6 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.4 mbpd. Exports and imports both fell 0.1 mbpd. The rise in stockpiles was mostly due to falling refinery demand (see below).

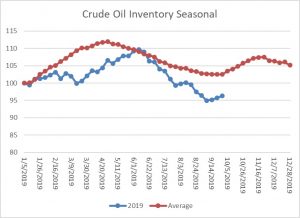

This chart shows the annual seasonal pattern for crude oil inventories. This week usually signals the beginning of the autumn build season. We have already troughed stocks but expect them to rise into early December.

The most important information from this week’s data is that we are now well into the autumn refinery maintenance season.

The decline in refinery utilization will likely continue for the next two weeks and should begin to rise by mid-October. During this period, inventories usually rise. However, the extent of the rise will depend on Saudi production.

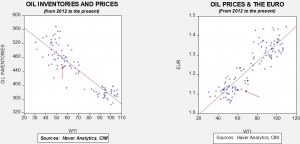

Based on our oil inventory/price model, fair value is $66.51; using the euro/price model, fair value is $47.84. The combined model, a broader analysis of oil prices, generates a fair value of $53.63. We are seeing a clear divergence between the impact of the dollar and oil inventories. Given that we are into the maintenance season, we would normally expect inventories to rise. Reports that the KSA has lifted output to pre-attack levels has put further pressure on oil prices. We also note that Iraqi PM Mahdi has imposed a 24-hour curfew in response to two days of large demonstrations against government corruption and high unemployment that have killed 18 people.

[1] Front and center are single-malt Irish and Scotch whiskies.