by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] Financial markets breathed a great sigh of relief as the first round of the French presidential election went about as expected. Macron and Le Pen will square off on May 7th to decide the presidency. Current polls show Macron with a commanding lead, generally 20 points or more. Although we have seen electoral surprises recently, they have all been within the margin of error. For Le Pen to make up 20 to 25 points would require a significant event, e.g., major terrorist attack, political scandal of epic proportions or campaign error that seriously undermines Macron’s character.[1] Although we do expect Macron to win, we also expect a tighter vote than the current polls suggest. Macron has no real party and so he will not have the usual “get out the vote” apparatus in place. It’s important to note that nearly 40% of the first round votes went center-right and far-left; it isn’t inconceivable that turnout could be low. Current polling suggests that Le Pen will only gather a small part of Mélenchon’s 19%, with the majority going with Macron and a rather large number spoiling their ballots by abstaining. Most of Fillon’s voters will end up with Macron as well.

Although Macron will keep France in the EU and the Eurozone, which is a market-friendly outcome compared to Le Pen, he is far from an ideal candidate. First, he has no party; there is no framework in the Fifth Republic for when a president has no representation in the Assembly. He will be forced to select a PM that will be acceptable to whichever party wins in the June legislative elections. Thus far, we haven’t seen any reliable polling for the legislative elections but, given the collapse of the center-left in this election, the most likely outcome will be a center-right domination of the Assembly. Macron can probably function with that outcome. Second, Macron is a political novice. French voters wanted change in this election, something we saw in the U.S. (arguably since 2008) and with Brexit. Assuming a Macron win, it is simply unknown whether France is in competent hands.

Therefore, we believe the worst outcome has been avoided but this outcome isn’t necessarily good for financial markets because it is further evidence that the center-left and center-right coalitions that have mostly ruled the West since WWII are struggling to maintain their hold on power. The strong rally we are seeing in equities (with one exception, discussed below) along with the drop in gold, the JPY and Treasuries is consistent with “risk on.” However, much of this rally is probably due to investors reversing positions designed to protect themselves from a negative outcome in these elections. If that is all it is, the rise should mostly be contained within the next few days.

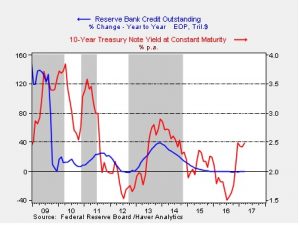

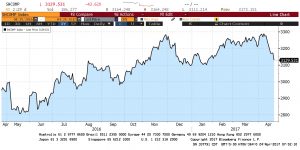

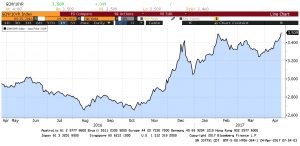

The one interesting divergence from the global equity rally is China. The Shanghai Composite has been stumbling recently in what seems to be caused by growing worries of rising interest rates.

Note that Chinese equities have been coming under pressure over the past two weeks. The drop coincides with rising interest rates.

The Xi government is worried about the high levels of Chinese debt and reports of rising non-performing loans. As the PBOC clamps down on lending, rates are rising which appears to be pressuring equities lower. The Xi government is working to maintain stability and growth as the CPC conference that will elect him to a second term convenes in October. Thus, we don’t expect the regime to allow for a major market drop or a financial crisis to develop…at least if it can control such things. So far, the drop in Chinese equities appears to be nothing more than a normal market retracement, but more significant declines may be forthcoming if we break the 3100 level on the Shanghai Composite.

Finally, President Trump surprised his aides by indicating that a tax proposal will be outlined on Wednesday. We don’t expect anything other than the broadest of brush strokes but this announcement does suggest he is trying to make a splash around his first 100-day mark. We also don’t expect a government shutdown on Saturday, although we have to say that negotiations don’t seem to be going well. The opposition isn’t planning on voting for a border wall and the GOP may reduce funding for the ACA’s subsidies so the potential for a closure is in place. We believe the president doesn’t want a shutdown this early on his watch so he will likely stand down, but anything is possible given the mercurial nature of Mr. Trump. We continue to watch the markets but clearly today there are no concerns about a government closure.

_____________________________________

[1] https://www.youtube.com/watch?v=yTO5AYl1zCs