by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It was a mostly quiet overnight session. Here is what we are watching this morning:

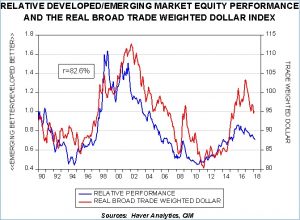

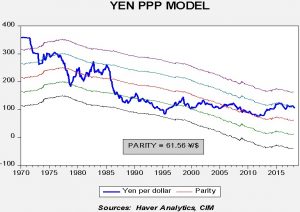

Policy talk boosts greenback: Dovish comments from the ECB and BOE have lifted the dollar this morning. The ECB is considering delaying the path of tapering due to recent economic weakness and BOE Governor Carney made similar statements as well. We have been bearish the dollar based on valuation issues; using inflation parity, the dollar remains overvalued, although the degree of overvaluation has been reduced. Monetary policy, under conditions of overvaluation, is usually not all that important. However, the dollar has been range-bound in recent months and we suspect that condition will remain in place for a few more weeks before the dollar’s decline resumes.

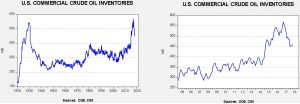

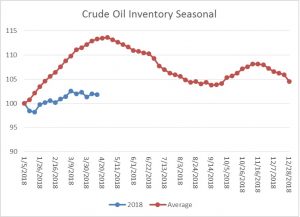

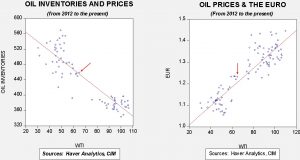

Trump and OPEC: The president tweeted this morning that OPEC is “at it again” artificially boosting prices. Oil prices dropped sharply on his comments. He argued that there are “record amounts of oil all over the place.” This is clearly wrong. As we detailed yesterday, oil inventories are well off their peak and we have not seen the usual seasonal build in stockpiles that typically occurs in the first four months of the year. The president suggested “this will not be accepted.” There are two things the president could do to bring down oil prices. First, he could authorize a release of oil from the Strategic Petroleum Reserve (SPR). Although the government plans to sell oil out of the reserve in the coming years for budgetary reasons, there is still ample oil available in the reserve. This action would be improper—the SPR is designed for emergencies, not for guiding prices. However, other presidents have used the reserve in this way; President Clinton did so in the late 1990s (although officially this release was related to heating oil). The second action he could take would be to recommend legislation to stop oil exports. This would lower U.S. oil prices relative to the world and give OPEC + Russia what it really wants, which is an end to the supply threat from shale oil. We remain bullish oil; the president could affect oil supplies but, in reality, this morning’s tweeting is simply jawboning. However, politically, his comments make sense; high gasoline prices are never popular with the public and calling out OPEC is one way to react to higher gasoline prices.

In related news, Saudi Arabia and Russia will begin talks over the weekend “on sending a signal on what they will do beyond next year.”[1] Saudi Arabia needs Brent around $75 per barrel to meet its fiscal obligations. Russia can balance its budget with $53 oil. The two must decide if they will continue their program to reduce supplies or begin to retake market share. Although we are bullish crude oil, any news that OPEC is boosting supplies will be bearish for prices, at least in the short term. Longer term, if the Iran deal ends or the conflict in Syria spreads, oil prices would likely rise.

North Korea: Media reports indicate that North Korea will not have preconditions for upcoming talks. Although there is concern about strategic ambiguity (the U.S. and the DPRK say the same thing but mean something different), it does appear that Kim wants a deal of some sort. The talks are a high-stakes gamble. If negotiations are successful they could bring peace to a troubled part of the world and give President Trump an historic breakthrough. If they fail, it’s hard to see how war doesn’t follow.

[1] https://www.wsj.com/articles/an-oil-deal-between-saudi-and-russia-worked-now-what-1524130200