Asset Allocation Weekly (March 29, 2018)

by Asset Allocation Committee

After peaking at 2872.87 on January 26, the S&P 500 has been in a corrective phase. The index fell just over 10% and has been range bound ever since, well below the aforementioned high. Here are the primary reasons equities have struggled:

- Valuations became a bit stretched: The P/E, as we calculate it (trailing except for the current quarter, which includes two previous and two forecast quarters), reached 20.8x. This level is at the high end of the dispersion of the multiple for our P/E models and is no way inexpensive. The rally seen after the tax cuts became rather excessive and a pause to consolidate would be normal.

- Trade war fears: The administration, which had put trade policy on the backburner as it tried to overturn the Affordable Care Act and enact the tax bill, has recently turned its attention to trade. Trade impediments and the pullback from globalization would weaken the policy commitment to low inflation that has been in place since the late 1970s.

- Political instability: It is common for the personnel in the White House to change over time. Under normal circumstances, when a party has been out of power for an extended period, a plethora of experienced officials are poised to join the new administration when the party regains power. As time passes and the new president becomes more comfortable in his role, less powerful aides are recruited and the powerful, often with their own agendas, leave the White House. President Trump was enough of an outsider to disrupt this process to some degree. Still, the president did surround himself with some seasoned advisors from the military and business sectors. Although the media probably overstated the case that these figures “corralled” the president’s instinctual management style, it does appear that the White House became less chaotic after Gen. Kelly took over as chief of staff. In the past few weeks, however, there has been a wholesale change in personnel, including Secretary of State, Head of the CIA, and National Security Director. The replacements have hawkish reputations and could bring geopolitical instability. These changes have increased uncertainty and weighed on market sentiment, as have the prospects for political disruption stemming from the upcoming midterm elections.

- Policy tightening: The Federal Reserve is steadily tightening monetary policy. Although current policy has not reached a point where it would be considered restrictive, the direction for interest rates is clear. Monetary policy has tended to support financial asset prices since the 1987 crash, in that declines in equity prices have led Fed chairs to either reduce rates during pullbacks or promise to act if financial conditions deteriorate. However, the new Fed chair, Jerome Powell, made no mention of current market volatility, raising concerns that the “Fed put” may no longer exist.

All these worries have some basis in fact. However, we believe the bearish case is overstated based on what we know now.

- Earnings will be robust: The tax law will shift, in our estimation, about 1.3% of GDP to after-tax profits. If equity prices hold near current levels, valuations will improve in coming months.

- Trade policy: Although we are concerned about the turn toward protectionism, in the short run we have seen initially aggressive positions that have been adjusted to become less onerous. A retreat from globalization is probably underway but it hasn’t progressed enough yet to trigger higher inflation.

- Policy instability: President Trump will likely be considered one of the most unique presidents in history. His extensive use of social media has overturned the Washington order, for better or worse. Future presidents will likely have to decide if they will continue to use microblogging as a way to message the country, unfiltered by the media. At the same time, financial markets rapidly discern signal from noise. If markets determine that a social media rant is not material to market action, the markets will begin to ignore what is coming out of the White House. It is true that this president values flexibility and does not want to be contained. And, a president with such characteristics can make unexpected decisions. At the same time, it should be noted that President Trump’s period of greatest influence is coming to a close. History shows that the bulk of a president’s political capital is exhausted within about 18 months after the election. That’s because, in most cases, the midterms lead to a decline in congressional support and lawmakers realize that the influence of a president wanes once the midterm election season is underway. Simply put, by early summer, President Trump’s ability to make major changes in domestic policy will decline rapidly.

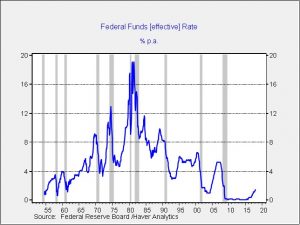

- Monetary policy: The Federal Reserve has engineered three “soft landings” since becoming independent in the early 1950s. Every other tightening cycle generally resulted in a recession. However, the timing from the end of the tightening cycle to the onset of recession can vary widely.

In many cases, especially prior to the 1981-82 recession, the onset of recession coincided with the peak in fed funds. However, in the three recessions since 1982, the peak in rates has preceded the recession by an average of 14 months. If the same pattern holds, we are probably at least 12 to 18 months away from the next recession[1] as policy tightening will likely continue into next year.

In conclusion, although the aforementioned concerns are legitimate, we think they are probably overdone, at least in the short run. In addition, there appears to be ample liquidity to fuel higher equity prices.

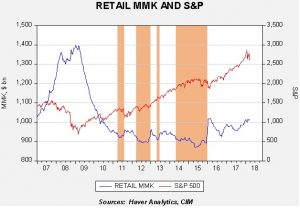

This chart shows the level of retail money market fund holdings along with the S&P 500 Index. The shaded areas show periods when money market funds are at levels of $920 bn or less. These periods tend to coincide with sluggish equity performance. Current fund levels exceed $1.0 trillion; unless investors now view returns on cash as adequate enough to consider it an asset class, we suspect the high levels of liquidity are an indication of caution. If a degree of calm returns to the market environment, it appears there is enough liquidity to at least challenge the previous highs in equities.

[1] Assuming a geopolitical event isn’t responsible for the next downturn.