by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment is divided into three sections: 1) Why the BOJ may not change policy anytime soon; 2) How the media narrative may either help or hurt strikers; and 3) Why improved relations with Saudi Arabia and Israel may help the U.S. fend off China.

Yen Under Pressure: One year after the Bank of the Japan surprised markets when it intervened to protect its currency, it is currently on standby to do so again following its recent rate decision.

- The Japanese central bank kept interest rates unchanged at their current levels. Following the Bank of Japan’s decision, central bank governor Kazuo Ueda vowed to maintain negative interest rates as a means to support the economy. Despite Japan’s economy experiencing relatively high inflation, GDP growth has failed to exceed 2.0% for eight consecutive quarters. Although Governor Ueda acknowledged that inflation has consistently exceeded the central bank’s target, he said that policymakers are not yet prepared to change their current monetary stance. He added that the BOJ does not foresee inflation sustainably reaching 2%, due to both downside and upside risks.

- The BOJ’s policy decision comes amid concerns that inflation is getting out of control. Last month, Japan’s core inflation index, which excludes fresh food and energy, rose 4.3% from the previous year. It also surpassed U.S. core inflation for the first time since 2014. Rising inflation has sapped investor confidence in the JPY, sending the real exchange rate to an all-time low against its peers. To avert a potential currency crisis, the Bank of Japan has signaled its willingness to intervene in currency markets and is working closely with the U.S. Treasury to prevent major swings in exchange rates.

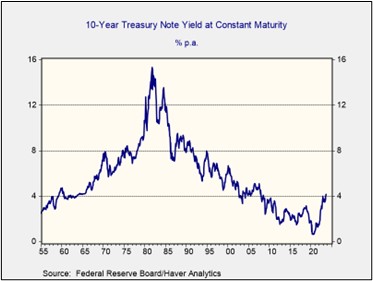

- Although the central bank has maintained its ultra-accommodative monetary policy stance, economists expect it to hike rates starting around March 2024, according to a Reuters poll. This transition is poised to result in a strengthening of the JPY against the U.S. Dollar. Furthermore, this policy shift may exert an influence on yields for long-term U.S. Treasuries. The weaker JPY has benefited Japanese automakers by allowing them to increase car exports to the United States due to improved terms of trade. Japanese automakers’ stocks, such as Mazda (MZDAY, $6.00), Honda (HMC, $35.30), and Toyota (TM, $188.39), have outperformed the market, returning 30.0% in USD over the past six months.

Labor Comeback: One union strike appears to be nearing its end, while another is escalating.

- Hollywood writers are nearing a deal with studios on a new labor contract, after holding marathon talks for 10 hours on Thursday. While a final agreement was not reached, there are rumors that a deal is in sight, and the sides are expected to meet again on Friday. Meanwhile, tensions are rising in the auto worker dispute, after leaked messages from a top aide to UAW president Shawn Fain provided fresh fuel to critics of the union’s strike strategy. The leaked messages reveal that union leaders had long planned a protracted and disruptive dispute with automakers, suggesting that they were not negotiating in good faith.

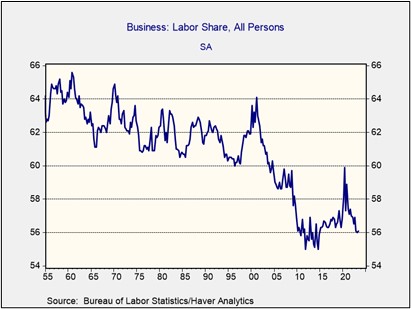

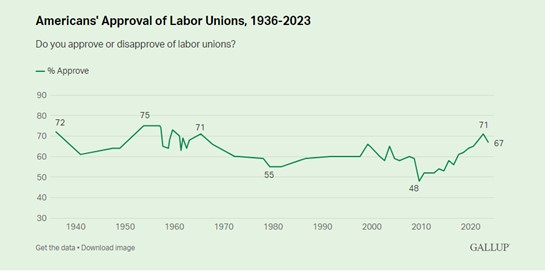

- Labor disputes are often settled in the court of public opinion, rather than behind closed doors. As Robert Schiller points out in his book Narrative Economics, the drop in support in the 1960s and 1970s coincided with the fall of Teamster leader Jimmy Hoffa, who was sent to prison for jury tampering, mail fraud, and bribery. While the current leader, Shawn Fain, might reap the benefits of a resurgence in union support, he could also face heightened scrutiny for quoting controversial civil rights leader Malcolm X. That said, this dispute is far from over as the UAW is considering expanding the strike to Ford’s Chicago assembly plant on Friday.

- The rise in labor union popularity is related to a shift in economic preferences away from efficiency and towards equality. This shift will benefit workers through stronger wage increases and better working conditions, but it is likely to come at the expense of higher inflation, as firms may be encouraged to cut back production or increase prices. The transition to a more equitable economy will not be fast or smooth, and it will probably face many hurdles. However, firms with monopoly power may prosper from this shift, as they are likely to be better positioned to make adjustments in the changing landscape.

Saudi Arabia-Israel Normalization: Diplomatic normalization talks between the two major Middle Eastern powers are gaining momentum.

- Saudi Arabia’s Crown Prince Mohammed bin Salman (MBS) has expressed optimism that his country and Israel can overcome their differences and build a more cooperative relationship. This potential breakthrough comes on the heels of a visit to Washington by Israeli President Benjamin Netanyahu, where he mended ties with his American counterpart, Joe Biden. The potential arrangement between Saudi Arabia and Israel includes a possible security guarantee similar to the one between Japan and South Korea, a show of support by Israel for the development of a Saudi uranium enrichment program, and concessions to the Palestinians. The arrangement will be a major win for Biden but is far from certain.

- Lawmakers are likely to be hesitant to accept the proposed terms of the Saudi-Israeli peace deal for a number of reasons. Democrats have long raised concerns about Saudi Arabia’s human rights record, especially following the 2018 killing of Washington Post journalist Jamal Khashoggi. Meanwhile, the Republican Party remains divided on the issue of security guarantees for other countries, with some conservatives advocating for a more Jeffersonian approach to foreign policy, in which the military is less involved in the affairs of other countries. The contentious nature of the proposed Saudi-Israeli peace deal could complicate negotiations and make a final agreement less certain.

(Source: Chinamed.it)

(Source: Chinamed.it)

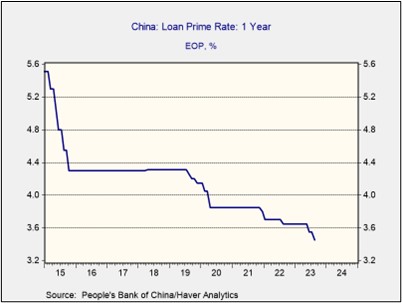

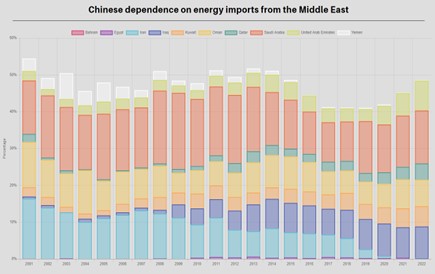

- The potential security guarantee between the U.S. and Saudi Arabia could undermine China’s efforts to draw Saudi Arabia into its sphere of influence.

- A diplomatic relationship between Saudi Arabia and Israel would benefit the United States in its competition with China for influence in the Middle East. While China often uses its economic clout to win friends, it is less willing than the United States to make security commitments. Therefore, the deal would likely prevent Saudi Arabia from completely aligning itself with China, as some feared following Riyadh’s talks with Beijing regarding a petroyuan and its invitation to the BRICS group. Additionally, it could provide a blueprint for how the United States plans to win over emerging countries without offering access to its consumer base.

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Barchart.com)

(Source: Barchart.com)

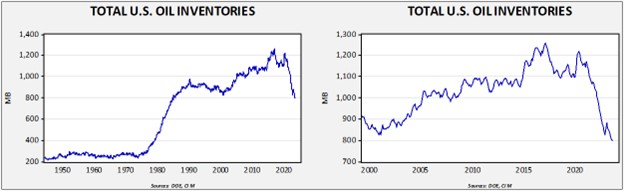

(Sources: DOE, CIM)

(Sources: DOE, CIM)