Daily Comment (February 17, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with our thoughts about the mixed signals coming from central bank policymakers concerning future rate decisions. Next, we explain how the transition away from COVID policies and restrictions will affect the West and China differently. Finally, we discuss how potential talks between the U.S. and China could impact the eventual disentanglement of the two economies.

Rate Hike Uncertainty: Future central bank policy is becoming harder to predict as policymakers and investors disagree on the best path forward.

- Monetary policymakers around the world are becoming more hawkish. Regional Fed Presidents James Bullard and Loretta Mester are entertaining the possibility of future 50 bps hikes. Although neither Fed member has a vote on the Federal Open Market Committee, investors have adjusted their estimate for a new peak in the Fed’s target range of its benchmark rate. Investors now expect rates to hit 5.2% by July, up from 4.9% two weeks ago. The S&P 500 fell 1.4% on Thursday following the comments as investors offloaded risk assets.

- European policymakers are sending conflicting messages about their potential policy path after their March meeting. Chief Economist Philip Lane, a noted dove, urged fellow policymakers to bear in mind that the increase in inflation has yet to be felt throughout the economy. Meanwhile, European Central Bank hawk Joachim Nagel insists that borrowing costs have not yet risen to a level that would injure the economy. The ECB is expected to raise interest rates by 50 bps in March and will then discuss future rate increases on a meeting-by-meeting basis. The rate uncertainty led to a 1% decline in the Stoxx Europe 600 and a 1.1% decline in the German DAX on Thursday.

- There is growing angst concerning when the Bank of Japan will pivot. With inflation above the central bank’s 2% target, the market anticipates that the BOJ will tighten policy this year. Newly nominated central bank governor Kazuo Ueda has publicly stated that he would like to maintain the bank’s ultra-accommodative policy. However, investors are betting that the BOJ will wind down its yield curve control by April or mid-July at the latest. In anticipation of the policy change, the JPY has rallied against the USD to start the year.

- The bank plans to launch a pilot of its central bank digital currency beginning in April. The transition will give the central bank more flexibility when making policy decisions.

Pandemic Past: Countries are ending the last vestiges of COVID-19 policies as the pandemic enters a new phase.

- China has declared a “decisive victory” over the virus as the country continues to pivot away from its controversial Zero-COVID policies. Beijing claims, without supporting evidence, that the country’s death toll has dropped to the lowest in the world since the government ended many of its COVID restrictions. Officials cautioned that although the situation is improving, the virus is still circulating. Therefore, China still plans to continue its vaccination program. The self-proclaimed victory is another example of how the country is attempting to control the narrative surrounding its controversial policies as its moves to reopen its economy.

- In the U.S., Johns Hopkins University has ended its COVID tracker program. The initiative provided users with a simple and understandable interface for information on the pandemic. It was designed to make the data from the Centers for Disease Control and Prevention accessible and transparent to the masses. It was one of the most widely cited pandemic databases in the country, and thus, its end reflects how far the country has come since the pandemic began.

- Policy differences between the West and China will affect how they each transition toward a post-pandemic normal. An exodus of older workers has contributed to labor shortages in the U.S. and Europe, while the extensive COVID measures have led to a growing distrust of the government. These challenges have impacted fiscal and monetary decisions as government officials look to return their countries to the pre-pandemic normal. A tight labor market in the West has allowed central banks to maintain hawkish monetary policy to bring down inflation caused by the pandemic. China, on the other hand, has ramped up fiscal stimulus to help boost consumer confidence, which is near an all-time low.

- The differences may mean that in the long run China may have an inflation problem, but until then, its markets should benefit. That said, hawkish policy in the West should make equity markets more resilient after inflation is under control.

Another Attempt: Chinese and U.S. officials are scheduled to meet again as the two countries look to move past their row over spy balloons.

- Secretary of State Antony Blinken and his Chinese counterpart Wang Li will both attend the Munich Security Conference. Although there has been no formal announcement, there is speculation that the two will meet at the conference. The potential encounter would be the first high-level meeting between the two countries since the discovery of the spy balloon. Before that incident, the officials were scheduled to work on a thaw in relations between the two countries. Tensions between the major powers have simmered over the last two years due to concerns regarding Taiwan, Russia, and technology restrictions. A major breakthrough is not likely to take place, but we do believe that the meeting could lay the groundwork for future talks.

- The mutual antagonism will probably persist. The Pentagon announced that its top China defense minister arrived in Taiwan on Friday. The move will likely upset Beijing, which views military contact with Taipei as undermining the “One China Policy.” Moreover, China plans to respond to U.S. restrictions on semiconductors by limiting the U.S.’s access to its clean energy technology. China’s new technology czar acknowledged that his country might not be able to bypass U.S. controls on key chip technology but could still flex its muscles in other ways. Beijing’s decision to review the CATL-Ford deal to ensure that critical battery technology isn’t transferred is a prime example of the czar’s new strategy.

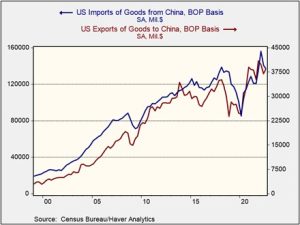

- The decoupling between the major powers will not be a smooth process. Trade ties between the two sides remain as strong as ever despite their growing mistrust. U.S. exports and imports with China remain near an all-time high, even as the countries attempt to reduce their dependence on one another. In other words, the talk has been cheap about a potential split over the last few years. What isn’t cheap, though, is the political landscape. There is a growing animosity among lawmakers within these countries. We suspect that the spy balloon may have been sent by Chinese officials to prevent a possible thaw in U.S.-China relations. Therefore, we believe the two are still on the path to divorce.