Daily Comment (February 23, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning. Today’s Comment begins with our thoughts about the minutes from the latest Federal Open Market Committee meeting. Next, we discuss changes and challenges in the tech sector and what they signal for investors. The report concludes with a discussion about the rising tensions between the U.S.-led and China-led blocs.

Hawkish Minutes: The market has done away with bets for a pivot in June and now expects the Fed to raise rates at least until the start of the third quarter.

- According to a Fed statement, the overwhelming majority of Fed members supported slowing the pace of rate hikes. The latest meeting minutes showed that almost all participants favored a 25 bps hike in February, with few participants signaling a preference for a 50 bps hike. Despite the moderation in tightening, the minutes also revealed that all participants agreed that ongoing increases would be needed to help contain inflation. Although the committee acknowledged that inflation was on a downward trend, members insisted that there is still insufficient evidence that inflation is on a sustainable path toward the central bank’s 2% target.

- The minutes reinforced concerns from the market that the Fed was not yet prepared to end its hiking cycle. The S&P 500 closed down 0.2% on Wednesday as equity holders weighed the potential for further tightening. Meanwhile, the yield curve was only slightly affected as fixed-income investors had largely priced in the potential for more hikes. The yield on the 10-year Treasury fell 3 bps, while the 2-year yield was relatively unchanged.

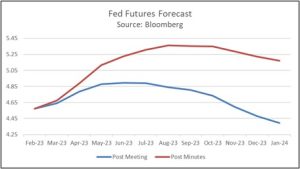

- The market reaction indicates that investors have accepted that the Fed will at least meet the target rate outlined in its dot plot chart. Following the FOMC policy meeting on February 1, investors had assumed that the Fed was almost done hiking rates. However, this sentiment changed leading up to the release of the minutes as investors weighed hawkish comments from Fed officials. As the chart below shows, investors have drastically revised their expectations of future Fed rates. The change is similar to the level of St. Louis Fed President Bullard’s policy rate outlook. The increase in expectations suggests that financial conditions will likely get tighter throughout the year, and thus, could increase the likelihood of a severe recession.

Down But Not Out: Tech may have taken a beating as of late, but recent changes may make the sector more attractive down the road.

- FAANG stocks are down 6.6% over the last five days, despite starting the year strong. The underperformance of the high-tech growth sector is related to concerns that higher interest rates will continue to weigh on earnings. As a result, many of these firms will have to continue focusing on becoming more profitable and managing their expenses to bring more value to their investors. The pivot from tech firms partially explains why the market rallied at the beginning of the year when investors believed the Fed was set to end its hiking cycle.

- Tech firms have tightened their bootstraps over the last few months to offset rising interest rate costs. So far, much of the cost-cutting has come from layoffs. For example, Meta (META, $171.12), which fired 13% of its work staff in November, now plans to cut thousands more jobs across the company. Assuming that the job cuts in tech are mostly of inefficient workers, the trimming of the workforce should lead to more productivity and a boost to bottom lines. Therefore, the sector could be positioned for a strong rally when the Fed decides to cut rates.

- That said, the tech sector is also facing a litany of challenges that could prevent it from rallying to its full potential. Lawmakers have grown suspicious of the influence big tech firms have over the populace and would like to regulate their ability to collect and sell data. Advancements in artificial intelligence could be impacted as government officials fear that the technology will be misused. AI is an area that both Microsoft (MSFT, $251.51 ) and Amazon (AMZN, $95.79) view as having great revenue-generating potential, but it is also very expensive. Thus, attempts to restrict its use could slow investment in the area.

- Similarly, some U.S. tech firms may face bans in other countries as foreign governments look to promote their own companies. For instance, China plans to restrict access to OpenAI’s ChatGPT service.

Taking Sides: Other countries continue to get caught in the middle of the major power struggle between the U.S. and China.

- Tensions between the U.S.-led and China-led blocs continue to ratchet up. Washington insists that Beijing is considering supplying lethal aid to help Russia with the war in Ukraine. The accusation has led to fresh tension between the two largest economies as such actions from China could open the country up to Western sanctions. Additionally, the U.S. plans to ramp up the number of troops it has deployed to Taiwan in the coming months. The move is designed to deter China from invading the autonomous island. Posturing from the U.S. suggests that a thaw in tensions between the two rivals is less likely to happen.

- On a separate but related note, Russian, Chinese, and South African navies will participate in naval exercises off the South African coast later this week. The joint exercises show the growing military ties between Russia and China.

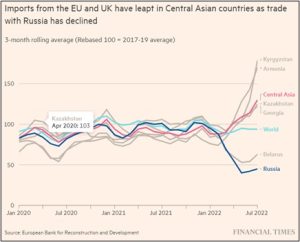

- The competition between the two powers has forced smaller countries to choose sides. Western governments are investigating whether a surge of exports from Central Asia included products under sanctions. If these countries are found to have aided Russia with sanctioned goods, they could be hit with penalties from the West. Meanwhile, G-20 host India does not want the word “war” used in any joint statement when referring to the conflict in Ukraine. The country considers itself to be a neutral party in the conflict and does not want the event to be stained by the bickering between rival diplomats. Although India remains a geopolitical ally of the U.S., the country wants to maintain ties with Moscow to preserve its access to Russian mineral resources.

- Rising geopolitical frictions between the U.S.-led and China-led blocs remain a prevalent risk for investors. The deep trade ties between the countries mean that any potential unraveling could be felt throughout the world. In the long-term, the decoupling should benefit countries along the periphery of the U.S. as near-shoring should lead to increased capital investment. However, this process will be costly and may force firms to push the adjustment onto consumers. If true, this will likely pose a long-term risk to inflation as less supply-chain diversification will make it more difficult for companies to rely on the lowest-cost producer to manufacture goods.