Daily Comment (February 21, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with more evidence that the European economy is growing much better than expected. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including new tensions between the West and both Russia and China. We also include a discussion of why investors should consider not just the central banks’ monetary policy but also the broader mix of economic policies when assessing the outlook for inflation.

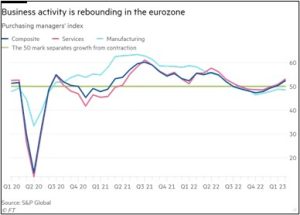

Eurozone: S&P Global reported that its flash composite Purchasing Managers’ Index for February jumped to 52.3, smashing both the expected reading of 50.6 and the final January reading of 50.3. The unexpectedly strong reading in February mostly reflected a jump in the PMI for the services industries, since the PMI for manufacturing plateaued at just below 50. As with most major PMIs, readings above 50 indicate expanding activity, so today’s report suggests the Eurozone’s economy has now expanded for two straight months and is currently growing at its best rate in nine months.

- On a related note, S&P Global said its flash composite PMI for the U.K. jumped to an eight-month high of 53.0 from 48.5 in the previous month.

- The reports are likely to be positive for European equities and currencies, although they will also probably encourage the major European central banks to keep hiking their benchmark interest rates aggressively.

Russia-Ukraine War: President Biden made an unannounced visit yesterday to see Ukrainian President Zelensky in Kyiv and to signal the U.S.’s continuing support for the country as it fights to resist the Russian invasion. Meanwhile, U.S. Secretary of State Blinken over the weekend said that he has evidence showing the Chinese government is preparing to expand its support for Russia to include lethal equipment. Chinese officials have denied any such intention, but reports indicate that the U.S. administration has warned China that taking such a step would cross a red line and result in negative consequences for the U.S.-China relationship. Ironically, Chinese Foreign Policy Chief Wang Yi said China would soon offer its own peace proposal to end the war. European officials seem to be quite wary of the prospect.

Russia-United States: In a speech to the national legislature today, President Putin stated that Russia will suspend its participation in the New START arms control treaty with the U.S., which limits the number of strategic nuclear weapons each side is allowed to deploy.

- The U.S. State Department had already formally notified Congress last month that Russia violated the treaty by refusing to allow on-site inspections and rebuffing Washington’s requests to discuss its compliance concerns. Putin’s announcement, therefore, breaks little new ground regarding the treaty’s operational effect.

- On the other hand, as China ramps up its inventory of nuclear weapons with no arms control constraints, the formal or informal demise of New START could free the U.S. to expand its nuclear forces to meet the new challenge of deterring both China and Russia simultaneously. Of course, that would likely entail a dangerous new nuclear arms race.

Iran: Diplomatic sources say the International Atomic Energy Agency has detected that Iran has been enriching uranium to a purity of 84%, near the weapons-grade level of 90% and far above the 3.67% level it was capped at under the now-defunct limitation agreement of 2015. If confirmed, the advancement could prompt a sharp reprisal from the international community and potentially lead to a military attack on Iran by Israel.

China-South Pacific Islands: Illustrating its focus on building influence in the South Pacific region, the Chinese government named its first permanent special envoy to the region last week. The new envoy will be Qian Bo, who has been China’s ambassador to Fiji since 2018. The naming of the special envoy will likely cause alarm in the U.S. government and will serve to worsen the U.S.-China geopolitical rivalry, which we believe has the potential to hurt investors.

United States-China: On the sidelines of the Munich Security Conference over the weekend, U.S. Secretary of State Blinken met with Chinese Foreign Policy Chief Wang and warned him that Beijing must “never again” repeat its “unacceptable” deployment of a surveillance balloon through U.S. airspace as it did late last month. In its statement on the meeting, the Chinese government countered that the U.S. would “bear all the consequences” if Washington escalated the controversy.

- Overall, the Blinken-Wang meeting gave each side a chance to present their views on the balloon incident, and communication is probably a good thing.

- On the other hand, it is clear that the U.S. and China have diametrically opposed views of key world issues, and those differences are likely to keep U.S.-China tensions high and ensure that investors remain at risk as the relationship deteriorates.

U.S. Monetary Policy: With the minutes from the Fed’s last policy meeting due to be released tomorrow, investors are worried that the U.S.’s recent strong economic data could push policymakers to hike interest rates even further and hold them there for a prolonged period. We agree that it is a significant risk, and it is also a key reason why we continue to think that a recession will take hold later this year and that stock prices could fall substantially further before turning upward again. However, it’s important to remember that such a scenario doesn’t depend on economic trends and monetary policymaking alone. Another thing to keep in mind is the importance of policy coordination, or how monetary policy affects, and is affected by, other areas of economic policy. Some strategists and investors should consider that the Fed’s rate hikes to tackle inflation may need to be more aggressive if they aren’t matched by anti-inflation measures in fiscal policy (including both tax policy and spending policy), regulatory policy, industrial policy, and perhaps even social policy (such as education and workforce policies).

- The Fed’s current rate-hiking program is clearly aimed at dampening demand to bring it back into balance with supply. That may get easier as supply chains continue to recover from the COVID-19 pandemic, but factors such as high wage growth and pandemic-era savings balances are still pushing up prices.

- Many other policies could also weaken demand and help boost supply. For example, tax hikes and government spending cuts can decrease demand. Deregulation that reduces the cost of doing business can boost supply, and the same can be said for industrial policies that help expand particular industries so that they more quickly achieve economies of scale. Education and workforce policies could boost the effective labor supply.

- The successful fight against U.S. inflation at the beginning of the 1980s illustrates how strategists and investors sometimes lose sight of the importance of policy coordination. The Fed and many other observers continue to believe that it was simply tight monetary policy that finally broke inflation’s back at the time. In reality, we believe that deregulation and globalization were probably just as instrumental in bringing inflation down and re-establishing the dollar’s value.

- Looking out at the coming years, we expect inflation to moderate significantly, but we continue to believe it will settle at average rates that are higher than in the decades before the pandemic, in large part due to the type of policy mix we expect to hold sway. Regardless of the Fed’s monetary policy, supply is likely to be constrained and made more expensive by deglobalization (a form of re-regulation that cuts off efficiency gains from international trade) and near-shoring (a form of industrial policy that builds relatively more expensive, resilient supply networks closer to home). Meanwhile, our read of political trends suggests there is no great move toward social policies that might significantly expand the labor force. Populist tax policies might be targeted toward the wealthy, reducing their ability to invest to expand productive capacity, while the growth in Social Security and Medicare spending as the population ages will help keep demand higher than it otherwise would be. In sum, investors may need to pay more attention to the thrust of the overall economic policy mix and policy coordination in order to understand where future inflation and interest rates are likely to end up.

U.S. Auto Loan Market: New data indicates the share of subprime auto loans that were at least 30 days late reached 9.3% at the end of 2022, marking their highest delinquency rate since 2010. The report suggests that even though the labor market remains strong, a significant number of consumers has been put into financial stress by last year’s spike in auto prices and high inflation for essential household goods.

- Many lower-income families will also soon face the end of their pandemic bump in food stamp benefits. Food stamp recipients in 35 states will lose at least $95 per month in benefits beginning in March.

- That’s consistent with our view, as we noted above, that the economy is still likely to fall into recession later this year.

U.S. Commercial Real Estate Loan Market: On a related note, data provider Trepp reported that the delinquency rate for loans backed by office buildings in commercial mortgage-backed securities last month jumped to 1.83% from 1.58% previously. Other reports point to higher delinquency rates and outright defaults for office building loans due to persistently high vacancies and rising interest rates.