Daily Comment (February 24, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with our thoughts about the potential for a bond rally in 2023. Next, we discuss how revisions to economic data may impact our timeline for a recession in both the U.S. and Europe. We end the report with our views on whether the U.S.-led bloc can remain united against Russia and China.

Will the Rally Return? Expectations of higher policy rates have called a potential rally in global bonds into question.

- Investors were convinced that a steady decline in inflation and an increased risk of a global recession would force major central banks to moderate their policy stance in 2023. After falling 16.2% in 2022, the Bloomberg EuroAgg Index, which tracks government and corporate bonds within the EU, has climbed 2.2% in the first month of the year. Meanwhile, the Vanguard Total Bond Market ETF, which tracks U.S. fixed-income assets, rose 4.1% in January after falling 13.4% the previous year. These assumptions were turned on their head after a relatively warm January led to stronger-than-expected economic data, and China’s reopening led to upward revisions for global growth.

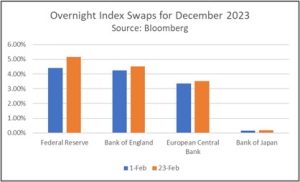

- Hawkish comments from central bankers have led investors to ratchet up their interest rate expectations. Members of the Federal Reserve and the European Central Bank’s Governing Council have argued that strong January data provides evidence that central banks can raise policy rates further. A similar view is shared among members of the Bank of England’s Monetary Policy Committee. Meanwhile, there is speculation that the Bank of Japan is engaging in stealth tightening. Traders have not ignored these changes to central bank sentiment. Overnight index swap rates of four major banks have increased throughout February, suggesting that the market expects global financial conditions to tighten throughout the year.

- However, there is still a good chance that bonds could rally this year. Last year’s decline was so deep that any reversal in policy rates could lead to a disproportionate jump in bond demand. The market’s sensitivity to changes in interest rates can partially explain why the U.S. Treasury yield curve has remained inverted for so long. Investors don’t believe that the Fed will keep rates high for long enough to warrant a change in long-run borrowing costs. As a result, fixed-income assets, such as investment grade and government securities, will likely look more attractive as the central bank approaches the end of its hiking cycle.

Recession Fears Are Back: New economic data suggests that Gross Domestic Product growth was slower than investors initially thought in the final quarter of 2022.

- Revised figures showed that consumption was less robust than originally estimated, and fixed investment spending continued to be a drag on growth. Although the U.S. economy remained in expansion territory in Q4 2022, revisions have shown that Germany’s economy contracted toward the end of the year. The downward revision in the data suggests that businesses and households had been less active in the economy than sentiment surveys had indicated. Therefore, the risk of a hard landing is now elevated in the U.S. and Europe

- That said, all hope isn’t lost for central banks to navigate a soft landing. Governments have attempted to offset some of the negative impacts that rising energy prices and interest rates have had on the economy. In December, the German government approved gas and power subsidies to mitigate the impact of a potential energy crisis for households and firms. Meanwhile, the U.S. is looking at ways to reduce the cost of owning a home. The Biden administration plans to boost homebuying by reducing mortgage insurance costs for some new homeowners. These measures alone may not be enough to prevent a downturn, but they could help delay and/or moderate a future one.

- The U.S. and European economies are not deteriorating at the same pace. Downward revisions have not changed our forecast for when a potential U.S. recession could take place. We still suspect a downturn could happen in the second half of the year. A European recession could occur sooner, though, since the region’s higher inflation has caused a greater pullback in consumer spending, and it will be difficult for Europe to stimulate growth while also fighting inflation. It is too soon to tell whether central bank officials will factor in the slower growth in their next policy meetings; however, tighter monetary conditions may raise the likelihood of a deeper recession.

Anniversary of the War in Ukraine: The next year will offer a new durability test for the Western alliance.

- The coalition between the U.S. and Europe has held up much better than both Russia and China had anticipated. At the beginning of the war, there was much skepticism about whether the West could remain a united front against Moscow. Russian President Vladimir Putin believed that Europe’s dependency on Russian energy was a key vulnerability of the Western alliance. A multitude of sanctions and billions of dollars’ worth of military equipment proved his thesis wrong. The sanctions may have left much to be desired, but the weapons and equipment sent to Ukraine were critical in slowing Moscow’s territorial ambitions.

- China is still the elephant in the room. Although Europe has been willing to sever ties with Russia, they have been less willing to do the same with China. This is not only seen with Germany’s wooing of Beijing last year but also in the reluctance of Dutch chipmaker AMSL($638.09) to participate in U.S.-led export controls against China. Additionally, the reopening of the world’s second-largest economy has provided a major tailwind for Europe. China has noticed this weakness within the alliance and has been trying to play up its role as a peacekeeper to curry additional favor with Europe. Hence, we suspect the U.S. will have a difficult time convincing Europe to clamp down on Beijing without hard evidence of China’s involvement in the war in Ukraine.

- Make no mistake about it, there are major divisions within the U.S.-led bloc. However, these differences have not been able to prevent countries from working together to prevent Russia’s advancement in Ukraine. Confronting China will likely provide fresh challenges as the country remains a major export market for European countries. As a result, the U.S. may need to provide Europe with additional assistance if it wants to ensure that the Western alliance remains intact. We are confident that Europe offers many opportunities for investors looking for international exposure. However, this outlook may change if China supplies Russia with lethal weapons.