Asset Allocation Bi-Weekly – Federal Reserve Policymakers in 2023: Hawks or Doves? (February 27, 2023)

by the Asset Allocation Committee | PDF

The Federal Reserve surprised markets when it raised its benchmark fed funds interest rate by a total of 450 bps in 2022, the most rapid increase in over 40 years. Weighed down by technology stocks, equities had their first annual decline in over a decade. The weak stock performance was mainly due to investors’ beliefs that the Fed was not fully committed to its fight against inflation. Recent trends in the fed funds futures market suggest that investors are just now acquiescing to the idea that the Fed is determined to bring down price pressures. However, our analysis shows that the new committee in 2023 may be more dovish than the market currently realizes.

Based on data collected by InTouch Capital Markets, we have given a score to each of the permanent and rotating members of the Federal Open Market Committee based on their level of perceived policy assertiveness. The scores range from 1 to 5, with 1 being a complete dove and 5 being a complete hawk.

The FOMC has 12 seats total with four of those reserved for presidents of the regional Federal Reserve banks. Those four seats are rotated every year, and in 2023 they will be filled by new members from the Federal Reserve banks of Chicago, Dallas, Minneapolis, and Philadelphia. The new group will lean dovish, with an average score of 2.0 for policy assertiveness. In fact, three of the four new members in 2023 rank in the bottom quartile of assertiveness for all permanent and rotating FOMC members. These new members are significantly more dovish than their predecessors, whose average score is 2.6. Indeed, half of the members rotating out in 2023 ranked in the top quartile for policy assertiveness.

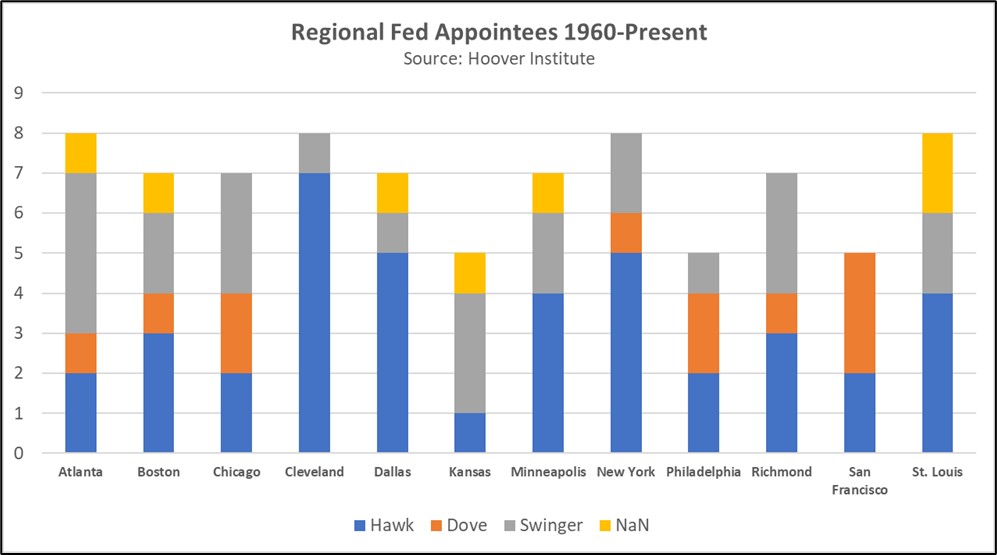

In addition to the rotating seats, President Biden’s selection of Lael Brainard as his top economic advisor has left one of the FOMC’s permanent voting seats vacant. There are 10 potential candidates for the position: Mary Daly, Austan Goolsbee, Susan Collins, Lisa Cook, Betsey Stevenson, Karen Dynan, Christina Romer, Janice Eberly, Brian Sack, and Seth Carpenter. Most of the candidates have ties to the Obama administration or are considered reliable doves, so it is unlikely that Brainard’s replacement will add to the current group’s policy assertiveness score. Currently, Chicago Fed President Austan Goolsbee is considered the front-runner. His selection would leave a vacant regional seat, and the Chicago Fed traditionally chooses doves or dove-hawk “swingers” as its president.

Although our analysis suggests that the Fed will favor accommodative monetary policy, the state of the economy and the level of inflation will also guide rate decisions. With unemployment well below its natural rate and inflation significantly above the Fed’s 2% inflation target, the policymakers are still inclined to tighten policy. Hawkish comments from Fed officials following January’s higher-than-expected CPI report illustrate the committee’s sensitivity to backsliding inflation data. Hence, just because the FOMC members may lean dovish doesn’t mean that they will vote that way.

Historically, Fed officials have not been comfortable with raising rates during a recession. The last time the Fed tightened in a downturn was in 1982. Therefore, if unemployment rises significantly, this current group of FOMC voters will likely stop hiking. However, January’s blockbuster payroll numbers and a near-record-low unemployment rate suggest that a pause is unlikely to happen in the short term. Nevertheless, as the economy heads into recession, which we expect to take place in the second half of the year, we will likely begin to see more Fed officials pushing back against further tightening.

We currently forecast that the approaching downturn will probably be a garden-variety recession, which will downplay the need for aggressive rate cuts. Given the Fed’s dovish tilt we suspect that the committee may pause or make a slight pivot by the end of the year. If we are correct, then this outcome will likely lead to a sharp recovery in equities. However, if inflation increases and the economy continues to expand, the Fed could raise rates again which could weigh on stocks.