by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

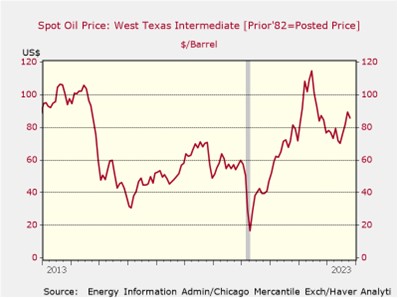

Crude oil prices are breaking down despite OPEC+ efforts to restrain supply.

(Source: Barchart.com)

(Source: Barchart.com)

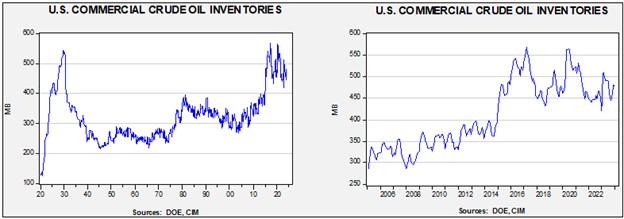

Commercial crude oil inventories fell 4.6 mb compared to forecasts of a 3.0 mb draw. The SPR rose 0.3 mb, which puts the net draw at 4.3 mb.

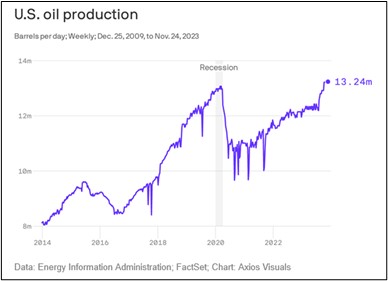

In the details, U.S. crude oil production fell 0.1 mbpd to 13.1 mbpd. Exports fell 0.4 mbpd while imports rose 1.7 mbpd. Refining activity rose 0.7% to 90.5% of capacity. Refinery activity continues to improve on a seasonal basis.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

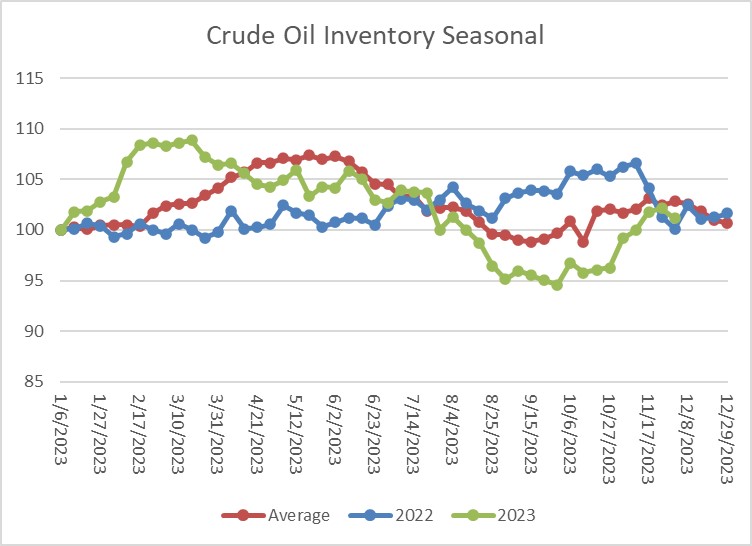

The above chart shows the seasonal pattern for crude oil inventories. Inventories have now risen to seasonal norms.

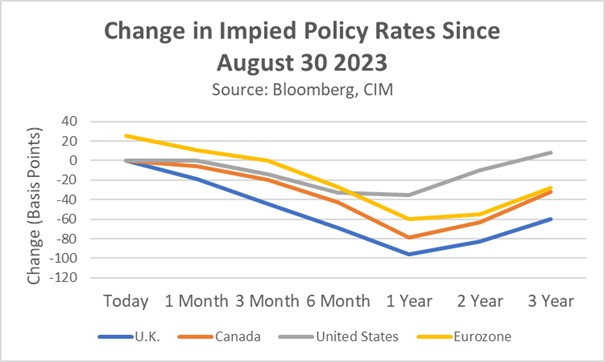

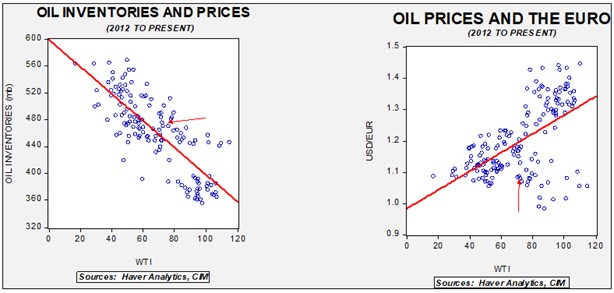

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $65.83. However, given the level of geopolitical risk in the market, we are not surprised that oil prices are above this model’s fair value. However, we note that recent weakness in oil prices has reduced the risk premium.

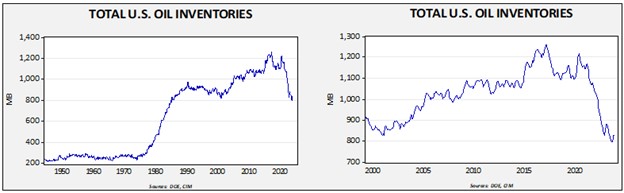

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $89.80.

Market News:

- The OPEC+ meeting ended with a set of voluntary cuts. The market sold off after the news. Our take is that these meetings are designed to be like summit meetings where all the participants decide in advance on a plan and the formal meeting is designed to make it official. The fact that the meeting was delayed and then followed by “voluntary” cuts means that either (a) nothing was decided before the meeting, or (b) whatever was decided didn’t hold up once the meeting was underway. The Kingdom of Saudi Arabia (KSA) continues to talk the market higher. The reality is, though, that the excess capacity of OPEC+ is growing and without a lift in demand soon, it will be hard for prices to hold up because the excess capacity will act to prevent traders from taking aggressive long positions.

- OPEC+ has added a new member — Brazil joined the group. However, we will be surprised if the country ever participates in production cuts.

- Thwarting OPEC+ efforts is record U.S. oil production. Interestingly enough, the Biden administration is avoiding taking credit for this increase due to the environmental wing of the Democratic Party.

- The Biden administration has pledged to refill the Strategic Petroleum Reserve but is finding that years of underinvestment in the salt dome facilities that house the oil are hampering rebuilding efforts. We also note that the government has extended the grace period of borrowed barrels by oil companies. We suspect that the administration wants to avoid reducing supplies, which has led to the extended supply terms.

Geopolitical News:

- Although piped natural gas exports from Russia to Europe have mostly stopped, Russian LNG sales are increasing to record levels. Several factors are causing this situation to occur with one being that low water levels in the Panama Canal have redirected Russian shipments away from Asia and over to Europe. LNG is not sanctioned by the West, so European buyers can purchase the gas without penalty. We will be watching to see if the U.S. tries to sanction this gas at some point.

- Over 70% of Russian overseas oil sales are occurring via a “shadow fleet” of obscurely registered vessels.

- Venezuela’s threats to Guyana continue. In the wake of a referendum over the weekend in Venezuela, President Maduro issued a series of edicts creating a bureaucracy to control about half of Guyana. He has also ordered oil drilling in Guyana’s territory. Brazil has ordered a military mobilization; there is a gap in the jungle on the Guyana/Brazil/ Venezuela frontier. The Brazilian military is there to prevent Venezuelan troops from using that gap to invade Guyana. Guyana is poised to become a major oil producer.

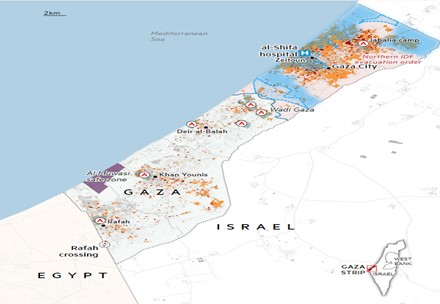

- A series of missile and drone strikes have targeted shipping off the Yemeni coast of the Red Sea. We strongly suspect the Houthis are involved and are showing support for Hamas. U.S. warships have responded to the attacks. The U.S. is considering a naval task force to protect Red Sea shipping.

- Less than 10% of Russian oil is being sold using USD. This outcome is positive for buyers, but as we noted last week, not so favorable for Russia.

- President Putin made a rare trip outside Russia in a visit to the UAE and Saudi Arabia.

- Russia has taken control of the Eridu oil field in Iraq.

Alternative Energy/Policy News:

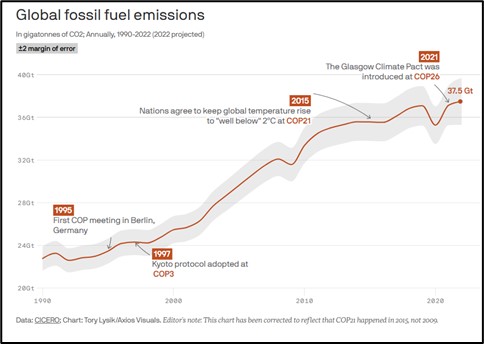

- One of the outcomes of the COP28 meetings was a strong pledge to boost nuclear power. Although rarely touted by environmentalists, nuclear power is emissions free and reliable. Although Western nations made pledges to return to nuclear, most of the actual building of reactors is occurring in Asia and especially in China. Uranium prices have been strong lately, as consumers are trying to secure supplies. Prices have been depressed for years, which has discouraged mining activity. But now, with renewed interest in nuclear power (to say nothing about nuclear weapons proliferation), this market has turned up.

- As China increases its exports of EVs, the demand for ocean car carriers is heating up.

- U.S. EV and hybrid auto sales are expanding.

- The U.S. is leaning toward excluding Chinese EV batteries from the U.S. supply chain.

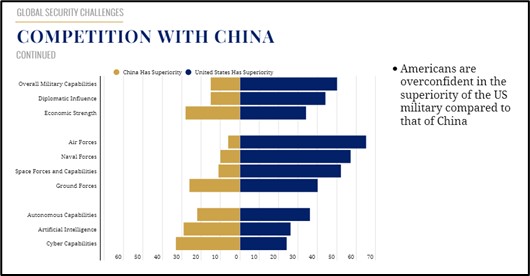

(Source: Ronald Reagan Institute, 2023)

(Source: Ronald Reagan Institute, 2023)