Daily Comment (May 2, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

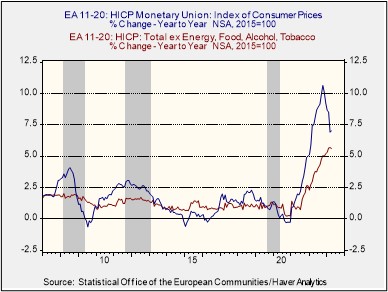

Our Comment today opens with a report showing an acceleration in the Eurozone’s consumer price inflation. While the acceleration was modest, it could still encourage a more aggressive interest-rate hike by the European Central Bank at its policy meeting on Thursday. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including an unexpected resumption of rate hikes in Australia and a warning by U.S. Treasury Secretary Yellen that the federal government could be unable to pay its bills by June 1 if Congress doesn’t act to raise the federal debt limit.

Eurozone: The April consumer price index was up 7.0% from the same month one year earlier, dashing expectations that annual inflation would be unchanged at 6.9%. The acceleration in headline price growth could encourage the European Central Bank to again hike its benchmark short-term interest rate aggressively at its policy meeting on Thursday. That’s especially the case given that a separate key measure of inflation also remains worrying. Excluding the volatile components of food and energy and the government-influenced prices for alcohol and tobacco, the April core CPI was up 5.6% on the year. That marks somewhat cooler core inflation than in March, when the core CPI was up 5.7%, but it was no cooler than the 5.6% increase in the year to February.

Italy: The right-wing populist government of Prime Minister Meloni has issued a decree aimed at making it easier for companies to hire new workers. The decree will reduce the country’s “basic income” support for people who can work and ease regulations to make it easier to hire short-term workers. In a modest effort to encourage more births, the policy also includes a cut in payroll and benefit taxes for workers with children. None of the changes are revolutionary, but they could have a small impact on Italy’s labor market, and they could signal further, more substantial moves by Meloni later, despite opposition by labor groups.

Russia-Ukraine War: The U.S. released a new, unclassified estimate that Russian forces fighting in Ukraine have suffered approximately 100,000 total casualties since December, including about 20,000 killed in action. According to the report, about half the fatalities were members of the Wagner mercenary group with half of those being prisoners who had been enticed to join up in return for their freedom if they survived a six-month tour of duty. The enormous losses show how the Russians’ strategy has caused a depletion in their combat strength just as the Ukrainians look set to launch a new counteroffensive.

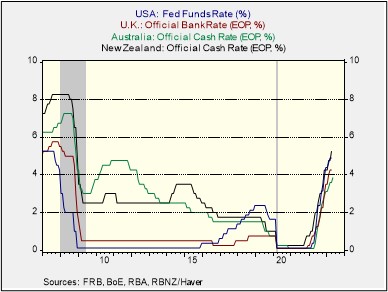

Australia: The Reserve Bank of Australia (RBA) unexpectedly resumed its monetary tightening cycle by boosting its benchmark short-term rate 0.25% to 3.85% to help bring consumer price inflation back down to target. The hike by the RBA was its first since a similarly sized increase in March.

- The RBA’s rate hike underscores that many major central banks remain committed to monetary tightening despite nascent signs that inflation is cooling. The rate hike is a signal that investors should be prepared for the possibility that rates could go higher than anticipated, and possibly stay there, in key countries around the world.

- As a result of the RBA hike today, Australian bonds have sold off, boosting the yield on 10-year government obligations to 3.456%. In contrast, the Australian dollar (AUD) has jumped 1.01% to $0.6697.

Canada: The Canadian government and its main public-employee union yesterday reached an agreement on a new labor contract that will end the workers’ strike. Under the deal, the government will boost wage rates by 12% over four years and provide a one-time, lump-sum payment equal to 3.7% of annual pay. The agreement hewed close to what the unions initially demanded, reflecting the bargaining power they had amid the country’s tight labor market.

U.S. Labor Market: As we warned in our Comment yesterday, Hollywood screen writers failed to strike a deal for a new labor contract last night with the major networks and studios, prompting them to announce a strike. As the 11,500 members of the Writers Guild of America walk off the job, late-night and variety shows are likely to be the first affected. The strike reflects both concerns about the impact of streaming technology on writers, and the increased bargaining power workers have in today’s tight labor market.

U.S. Monetary Policy: The Fed’s policy making committee will begin its latest meeting today, with its decision due tomorrow afternoon at 2:00 pm ET. The policymakers are widely expected to hike their benchmark fed funds interest rate by another 0.25%, to a 16-year high of 5.00% to 5.25%. However, as we mentioned in our Comment yesterday, the focus for investors will likely be on the post-meeting statement and comments by Fed Chair Powell to see if they provide any hints that the rate hikes are finished.

- Given the damage inflicted on the economy from the current rate-hiking cycle, any hint of a pause could give a boost to equities.

- Also, any strong signal of a pause in U.S. interest rates would likely be a further negative for the dollar. Factors such as slowing U.S. economic growth and the prospect of continued interest-rate hikes abroad have now pushed the greenback lower by 8.6% from its most recent peak last September.

U.S. Fiscal Policy: Yesterday, Treasury Secretary Yellen warned that the federal government could be unable to pay all its obligations, including Treasury debt service, as early as June 1 if Congress doesn’t raise the debt limit. In addition, the bipartisan Congressional Budget Office brought forward its deadline of when the government could default, saying lower-than-expected tax receipts this spring could leave the government unable to pay its bills by early June.

- The new forecasts raise the risk of a near-term default on government debt, which would likely be a significant negative for U.S. asset values.

- President Biden later invited the Republican and Democratic leaders of Congress to meet next week to discuss a way forward.

U.S. Bank Regulation: Responding to the recent U.S. bank failures, the Federal Deposit Insurance Corporation yesterday recommended a boost in the business deposit amount that would be insured as one way to help prevent bank runs. According to the FDIC, a targeted rise in deposit insurance for businesses’ everyday operating accounts would be more cost-effective and less likely to promote risky behavior by bank bosses than just eliminating the $250,000 cap in place on deposit insurance.

- The FDIC didn’t specify how much the coverage cap should be raised for business transaction accounts.

- However, it did calculate that raising the insurance cap to $2.5 million would likely cover what most small and medium-sized companies need to keep in their accounts to cover payroll.

- In any case, any such change in the deposit amount covered by insurance would require approval by Congress.

U.S. Defense Industry: As major U.S. defense contractors released their quarterly reports over the last couple of weeks, some company officials said on their earnings calls that they are facing far fewer supply chain problems than they did over the last two years. Greg Hayes, the CEO of Raytheon (RTX, $100.33), even gushed that, “It’s getting a hell of a lot better.”

- The officials noted that defense supply chains are still not back to normal, but the situation is far better than it was, and revenue growth now looks set to accelerate sharply.

- We continue to believe that increasing geopolitical tensions will drive military budgets higher around the world. Due to issues like bureaucratic lethargy, labor shortages, and supply chain disruptions, the expected growth in revenues and profits will probably only become notable in the next couple of years.