Daily Comment (May 3, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a word on global oil supplies and prices, where a new tanker seizure by Iran would seemingly boost crude oil prices but growing concerns over recession have pushed those prices sharply lower so far today. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including an apparent Ukrainian drone strike against the Kremlin and a preview of today’s Federal Reserve decision on U.S. interest rates.

Global Oil Market – Iran: The U.S. Navy announced that Iran has again seized an oil tanker in the Persian Gulf region, marking the second such incident in a week. Tehran has justified the harassment by saying the tankers violated maritime regulations, but the real reason is likely to retaliate for the ongoing U.S. sanctions against Iran and to undermine the U.S. security presence.

- If they continue, the tanker seizures could boost crude oil prices beyond what they otherwise would be.

- All the same, global prices for oil and other key commodities are trading sharply lower today on increasing concerns about the impending recession in the U.S. Front-month futures prices for WTI are currently down 3.0% to $69.57, while prices for Brent are down 2.7% to $73.29.

Russia-Ukraine War: Russia is dealing with another wave of what appear to be Ukrainian drone attacks today. In one key incident, two Ukrainian drones were downed by Russian electronic warfare systems and crashed into the Kremlin in central Moscow, prompting Russian accusations that Ukraine was trying to assassinate President Putin. The Russians also threatened to retaliate in kind against the Ukrainian government, but we would note that Ukraine may have been emboldened to launch the strike against the Kremlin because the capital of Kyiv is now protected by sophisticated air defense systems like U.S. Patriot missiles. Other attacks apparently made by Ukraine today included a strike against a major fuel depot, a strike on an airport, and the derailment of a fuel train in southern Russia. By disrupting Russian logistics, these attacks could signal that Ukraine is nearly finished preparing for its expected counteroffensive.

- Separately, the Turkish government announced that the deputy defense ministers of Turkey, Russia, and Ukraine will meet on Friday to discuss extending the agreement that unblocked some of Ukraine’s Black Sea grain exports last year.

- Russia has signaled that it expects sanctions relief before it would agree to extend the deal.

- If the deal isn’t extended and Ukrainian grain exports are again shut in, it could lead to another round of higher global food inflation.

- There is also new information on the explosions last September that damaged the Nord Stream 1 and 2 natural gas pipelines that run from Russia to Western Europe. Four Nordic media outlets have discovered that several Russian military ships, including a tug capable of launching mini-submarines, were spotted in the area just days before the explosions. Indeed, the Russians could have had several motives for the attack. They may have meant to punish the European countries for lending support to Ukraine or to test the West’s security for undersea infrastructure in the region.

European Union: The EU’s single-market commissioner, Thierry Breton, will announce his plan to ramp up the bloc’s production of ammunition and missiles in response to Russia’s aggression against Ukraine. Breton’s “Act in Support of Ammunition Production” (ASAP) would pour some €500 million from the EU budget into European defense industry factories to boost weapons manufacturing. The plan is the third leg of the EU’s program to boost its defense capabilities after many years of muted efforts.

Chile: Leftist President Gabriel Boric is making good on his plan for the government to take at least a 51% stake in key lithium-mining operations. In an interview with the Financial Times, the official charged with negotiating for the stakes revealed that he wants to complete the purchases by the end of this year. The process has spooked investors and driven down the value of Chilean mining firms. The move is also expected to shift investment toward other producers such as Australia, Argentina, and Africa.

U.S. Monetary Policy: The Fed’s policy making committee will wrap up its latest meeting today, with its decision due to be announced at 2:00 PM EDT. The policymakers are widely expected to hike their benchmark fed funds interest rate by another 0.25%, to a 16-year high of 5.00% to 5.25%. However, the focus for investors will likely be the post-meeting statement and comments by Fed Chair Powell to see if they provide any hints that the rate hikes are finished. Given the damage inflicted on the economy from the current rate-hiking cycle, we continue to believe that any hint of a pause could give a boost to equities.

U.S. Fiscal Policy: Democrats in the House of Representatives launched a “discharge petition” aimed at bringing a vote to the floor for a “clean” bill which would raise the federal debt limit with no associated spending cuts. The discharge petition would require the support of five Republicans, so it’s considered a longshot, but it does suggest at least some in Congress are increasingly concerned about the economic damage that could be caused by brinksmanship around the debt limit or an outright default.

U.S. Artificial Intelligence: Arvind Krishna, the chief executive of IBM (IBM, $125.16), said in an interview that his company will pause all hiring of back-office positions that could be done with artificial intelligence. Going forward, Krishna suggested that about 7,800 positions at the company could eventually be replaced by AI and automation. The statement will likely fuel concerns that the rapid rollout of AI could boost unemployment.

- In another example of AI disruption, education technology firm Chegg (CHGG, $9.08) yesterday warned that popular AI chatbot ChatGPT is already starting to hurt its sales of on-line study guides.

- Chegg’s stock plunged 48.4% on the news.

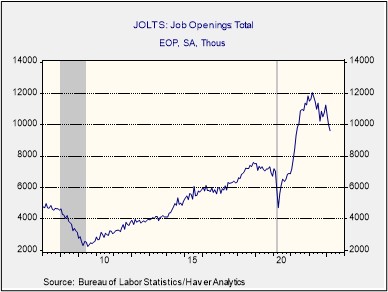

U.S. Labor Market: In yesterday’s JOLTS report on the labor market, total job openings fell in March to a seasonally adjusted 9.59 million, marking their lowest level in almost two years. In addition, March layoffs rose to 1.81 million, reaching their highest level in over two years. The figures point to a worse-than-expected softening in labor demand and add to other recent evidence that the economy could be slipping into recession even now, although we still think the recession will hit a bit later in the year. In any case, the weak JOLTS report helped push equities and other risk assets sharply lower yesterday.