Daily Comment (May 4, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! In the wake of the FOMC, it’s mostly a risk off day so far this morning. Treasury yields were lower overnight, but have reversed higher, the dollar and equities are lower, oil is modestly higher after a hard sell off, and gold is higher.

In today’s Comment, we lead off with a recap of the Fed meeting. The ECB meets today, so we offer our first impressions from that meeting too. The ongoing banking crisis is up next, followed by an update on the debt ceiling situation. In the market section, we cover the changes coming to the southern U.S. border and then close with a look at the world: China, Ukraine, and general international news.

The FOMC Recap: As expected, the Fed raised rates 25 bps and signaled a pause. Here is the official statement and our take:

- The key difference between the May and March statement is the pause signal:

- March: The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

- May: The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

- Note that the bolded sentence from the March statement is missing in the May statement. The committee has left itself some leeway to raise rates if necessary, but the markets are signaling a near certainty of steady policy at the June 14 meeting. Current market projections for the July 26 meeting suggest a near even chance of steady policy or a rate cut. The market is starting to anticipate rate cuts as, even if it’s a bit early, the September 20 meeting is projecting an +80% chance of a rate cut.

- So far, the White House has backed Fed policy tightening, but left-leaning members of Congress are increasing their criticism of monetary policy. A group of Senators and Representatives sent an official letter to Chair Powell, calling on the committee to pause its rate hikes. Although the signers of the missive are not surprising, a case can be made that a slowing economy and stress in the banking system support a cautious approach to policy tightening. The Fed has a dual mandate for price stability and full employment, and the signers of this letter tend to focus on the latter mandate.

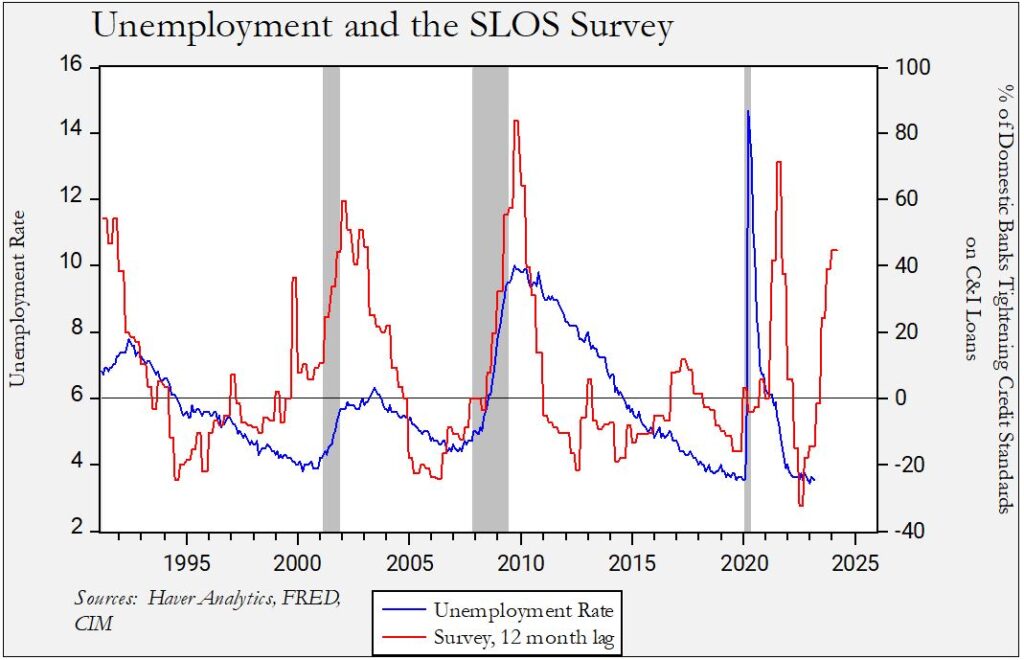

- Surprisingly, the FOMC statement took a rather sanguine view of banking stress. The turmoil we have seen in the banking system has raised fears of restricted credit—the so-called “credit crunch.” In looking at the Senior Loan Officer Survey, which is the current reading regarding commercial and industrial loans for large and medium firms, we are at levels that tend to signal recession over the next year. It also suggests, which shouldn’t be a shock, that unemployment is rising.

This chart shows the survey and the unemployment rate. The lags are not consistent, but it’s rather clear that readings above 40% increase the odds of a recession.

- Market reactions were interesting. The initial reactions suggested the markets took the statements as dovish. For example, the dollar weakened, and gold jumped to $2045 per ounce. Equities rallied and Treasury yields fell. During the press conference, the chair made it clear that a pause was not a signal of easing, notwithstanding expectations noted above. In addition, he said that, in his opinion, he expects inflation to fall slowly. Since he also noted that he doesn’t expect a recession, his outlook on inflation is consistent. FWIW, we think a recession is more likely than the chair does, and thus inflation will also fall much more quickly than he expects. However, on Powell’s comments, the equity market fell off rather sharply, and the other markets mostly moved to areas seen prior to the statement.

- To a great extent, we are now at a critical crossroads. If the economy heads into recession, inflation will fall and the FOMC will cut rates. This is what the financial markets appear to be discounting. Powell may genuinely believe that a recession isn’t likely, despite the fact that his staff expects one. Or it may simply not be politically possible for the chair to signal that a recession is likely; after all, if that is what the FOMC members expect, they should be cutting now. Paradoxically, if the political problem is why Powell doesn’t expect a recession, his position’s impact on markets raises the odds that we will have a recession.

The ECB: As expected, the ECB raised rates by 25 bps. This was widely expected, but the tone of the statement was rather hawkish. The bank indicated that policy would remain tight because inflation remains sticky. Similar to what we are seeing in the U.S., European banks are tightening credit. And, as we are seeing in the U.S., corporate market power is boosting inflation as firms pass along higher costs to consumers to maintain their profit margins. The press conference was underway as we were writing this report, but market reaction appears to suggest that market participants were wanting more aggressive tightening; we are seeing the EUR weaken in the aftermath of the release.

The Banking Crisis continues: As the coronation of King Charles III looms, in deference to another Queen, yet another regional bank looks like it’s in deep trouble. After the Powell press conference yesterday, PacWest Bank (PACW, $6.42) announced it was in talks with investors about strategic alternatives, which likely means it will need to be sold. Its shares plunged in afterhours trading. Overall, mid-sized banks continue to lose ground.

- As we note above, the FOMC seems rather unconcerned about the banking situation. We believe this is because they think that stopping the bank run was sufficient. As we have stated on numerous occasions, the problem isn’t just the bank run situation, it’s disintermediation. Banks can’t offer market yields on deposits since their assets were purchased in the ZIRP era and doing so would lead to insolvency. This situation is very similar to the S&L problems of the 1980s. There is probably only one solution to this problem—the Fed must lower rates to protect the asset bases of these banks.

- Meanwhile, we are starting to see increasing evidence of a credit crunch. Bank lending fell towards the end of March and it’s likely the slump will continue. Slowing lending will act as a brake on the economy and increase the odds of recession.

- Adding to problems was the announcement that Toronto-Dominion Bank (TD, $59.76) was terminating an agreement to purchase First Horizon Bank (FHN, $15.05), citing regulatory constraints. Toronto-Dominion Bank will pay First Horizon around $225 million for ending the deal. First Horizon shares fell sharply overnight.

The Debt Ceiling: Treasury Secretary Yellen’s recent signal that the Treasury would “run out of cash” by as early as June 1 has increased the tension on Congress to avoid a debt default or a government shutdown. Speaker McCarthy is expected to meet President Biden on May 9, but there is little evidence that either the president or speaker are prepared to make concessions. The president simply wants an increase in the debt ceiling—a “clean bill.” McCarthy, fresh off his budget vote, wants to use his legislation as the basis for negotiations. We doubt these meetings will accomplish much. Meanwhile, there are various tactics and ideas being considered.

- Democrats are crafting a discharge petition, which would force a vote on increasing or suspending the debt ceiling. The petition would put the bill on the floor for a vote over the Speaker’s objections, and given the narrow GOP majority, only a few defections could lead to a clean debt ceiling resolution, which would likely pass the Senate. If five GOP reps defect, this bill could reach the floor. However, getting five will still be difficult.

- Whenever the debt ceiling becomes a problem, the argument emerges that the 14th Amendment makes defaulting unconstitutional. The key clause is as follows:

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned…

This clause was designed to prevent Southern Congressmen from attempting to repudiate the Federal debt accumulated to fight the Civil War. The fear was that the southern states, with voter rolls bolstered by free slaves, could legislate to avoid servicing the war debt. The 14th Amendment was designed to prevent that outcome. Some legal scholars believe the clause could be used to skirt the debt ceiling issue. Of course, this clause conflicts with Congress’s “power of the purse,” so a unilateral action by the executive branch to keep spending and borrowing would eventually be decided by the courts. However, it should be noted that it is unclear who exactly could sue. The Supreme Court ruled in 1997 that individual lawmakers lack standing, but Congress as a whole might. Given the risks involved, previous administrations have avoided this outcome. But, it is being considered, apparently.

- Another possibility is Congress could agree to extend the deadline by either raising the debt ceiling by an amount estimated by legislators to be a few week’s or month’s worth in order to negotiate further or suspend the limit while negotiations are going on. This idea may be gaining some traction. It should be noted that, due to recesses scheduled in both houses, the House is only in session 12 days and the Senate 15 days this month. Complicating matters further, President Biden will be out of the country this month, visiting Japan and Australia. At the same time, “kicking the can” doesn’t really resolve the issue and without the deadline looming, it’s unlikely progress will be made.

- Other more arcane solutions have come up in these debates. A favorite of Joe Wiesenthal of Bloomberg (and co-host of the Odd Lots podcast) is the $1.0 trillion platinum coin.

- Another odd twist to the deadline is that the IRS has improved its efficiency in sending refund checks. Because it is sending checks faster, the Treasury General Account is draining faster too.

Markets, Economics and Policy: The strike in Hollywood continues, and the border crisis is increasing.

- The writers have gone on strike in Hollywood. Late night talk shows tend to be affected first, as the hosts lose their joke pipeline. Taped shows are usually done a few weeks in advance, so it may be a month or so before TV dramas and sitcoms go to reruns. Usually, we wouldn’t see this issue as market moving. But the decision to strike, the first in 15 years, is due to the accelerating shift away from broadcasting to streaming. Writers are finding that the new environment is turning them into “gig” workers with little job security. Often, the streaming firms make content that is short-term in nature and is hiring writers for short term projects. The network broadcast model was designed to put a team of writers on a drama or sitcom which generated steady work. Breaking work into small segments and hiring workers for only those jobs is a factor across the economy; organized labor is trying to respond. We note this is a factor in the delivery industry as well.

- Title 42, which has allowed immigration officials to turn away potential immigrants and asylum seekers due to the pandemic, will expire on May 11. The government is moving 1500 troops to assist processers and help secure the border. The expiry is expected to increase flows to the border and is not just a political problem for the White House, but it will also affect the southwestern border states as they cope with the increased flow.

- Drought is reducing the water levels of the Panama Canal, forcing vessels to reduce their cargo to transverse the waterway.

China News: We are monitoring recent changes to China’s national security laws which are affecting Western firms. And Florida is joining other states in restricting the foreign purchasing of real estate.

- Governments have multiple policy goals. In particular, there can be a tension between economic growth and national security which is especially evident in foreign investment. In our Weekly Energy Update, we have regularly reported on such tensions rising as Chinese EV battery firms look to make investments in the U.S. Given China’s lead in this area, it makes economic sense to use their technology. However, given national security concerns, we should avoid such endeavors. Recently, China issued a new national security law, effective July 1, which is so broad and vague that just about anything (perhaps even reporting on the economy) could be seen as violating the law. We will have more to say on this in the coming weeks, but in the meantime, there are reports suggesting that incoming foreign direct investment into China is waning and this decline may be tied to these new regulations.

- When a nation runs current account deficits, it must fund them via a capital account surplus. The dollar’s reserve currency status essentially requires the U.S. to run a current account deficit, which means foreigners have dollars they need to invest in the U.S. Most of the time, those dollars flow into Treasuries,[1] but, foreigners sometimes prefer other investments. Real estate is popular for numerous reasons. Wealthy foreigners may want a place in the U.S. if they need to move quickly. U.S. farmland has attracted foreign buyers.[2] Florida has introduced legislation to restrict and regulate “hostile nations” from purchasing real estate in the Sunshine State. Florida has been a popular destination for foreign capital flight, especially from South America. There are concerns the legislation may to too broad and introduce unnecessary restrictions.

International News: We update the Ukraine War, we have a new head of the World Bank, and England holds local elections.

- The day after an apparent drone attack on the Kremlin, we still aren’t sure who is responsible. Russia is blaming Ukraine for the attack, calling it an assassination attempt. President Zelensky denies the claim. If Ukraine was behind the attack, it didn’t signal the action to the U.S. If Ukraine was responsible, it was ill-advised as it is unlikely that such an attack would be successful, and it would open the possibility for Russia to retaliate in kind. This is why some analysts are arguing it was a “false flag” operation, made by the Russians themselves. Or, it could have been elements within Russia, either trying to eliminate Putin, or making the feeble attack to trigger a massive, and perhaps unconventional response. We will continue to monitor the situation, but we do doubt it was a Ukrainian operation.

- NATO is warning members that Russia may be targeting undersea pipelines and cables. Intelligence officials say Russia is actively mapping these assets.

- An op-ed in the Atlantic makes the case for overwhelming support of the upcoming Ukraine offensive. We note the U.S. announced additional support.

- Zelensky is visiting the Hague

- Ajay Banga has been confirmed as the president of the World Bank.

- England holds local elections today, the first major test for PM Sunak.

- The civil conflict in Sudan is clearly a tragedy. Wars often expose wider vulnerabilities. It turns out that the country is the world’s primary supplier of gum arabic, which is used as a thickener and stabilizer in numerous food products. Currently, suppliers are using current inventories but if the conflict continues, it could become a problem.

[1] Which is one of the reasons why a debt ceiling default is so risky.

[2] Chinese buyers of Missouri farmland has been a “hot button” issue, for example.