Weekly Energy Update (May 4, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Recession fears are gripping the oil market, sending prices toward lows last seen in March.

(Source: Barchart.com)

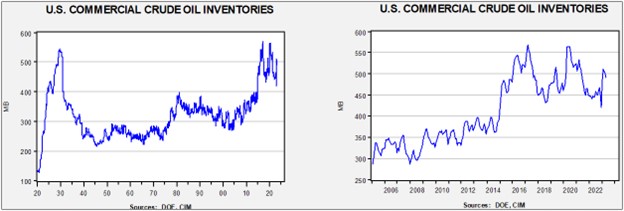

Commercial crude oil inventories fell 1.3 mb compared to the forecast draw of 1.5 mb. The SPR fell 2.0 mb, putting the total draw at 3.3 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.3 mbpd. Exports fell 0.1 mbpd, while imports were unchanged. Refining activity fell 0.6% to 90.7% of capacity.

(Sources: DOE, CIM)

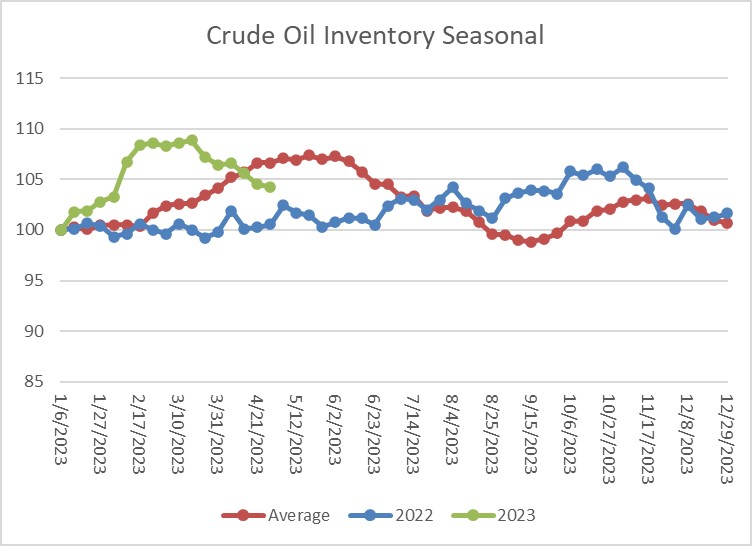

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and have since declined, putting storage levels below seasonal norms.

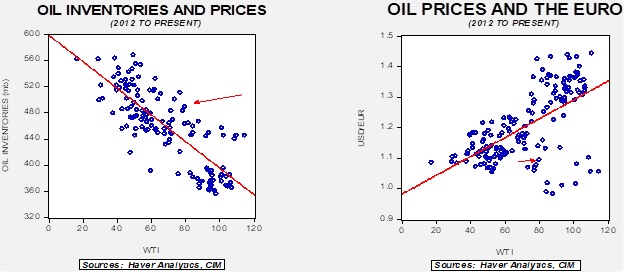

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $58.88. Although OPEC+ is trying to stabilize the market, recession worries are clearly pressuring crude oil prices.

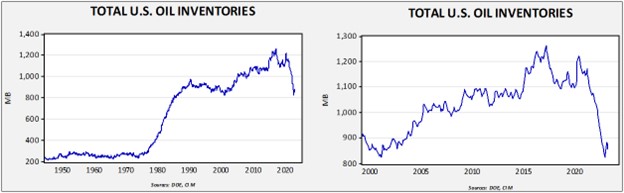

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $95.17.

Market News:

- OPEC+ is warning the IEA that it should be careful about discouraging oil investments as doing so could lead to higher prices and shortages. We are still seeing considerable pressure being put on banks to avoid oil and gas funding.

- China lost its crude oil self-sufficiency in the mid-1990s. Since then, it has become an increasingly important oil importer. As we noted in a recent Bi-Weekly Geopolitical Report, China has been deeply worried about energy security for some time. It has taken numerous steps to address this issue, including building alternative pipelines that avoid the Straits of Malacca, a key chokepoint in Asia, and increasing supplies from Russia and Central Asia. China is also increasing domestic production. Although it seems likely that China will again become self-sufficient, it is clearly taking aggressive steps to reduce supply risk.

- In the wake of the recent approval of the Willow oil project in Alaska, the Biden administration is revisiting a major LNG project also located in Alaska. The drive for energy security conflicts with the president’s coalition that wants to curtail fossil fuel use and production. Most presidents, at some point, are forced to disappoint elements of their coalition. This decision will help with the energy shortfall but could weaken his re-election chances.

- For years, Iraq has wasted associated natural gas from its oil production. The Halfaya oil field is about to begin processing this gas for use in firing the Iraqi electrical grid (and consequently import less electricity from Iran), and perhaps at some point, it can export the natural gas to other parts of the region. French and Chinese oil firms are involved in the project.

- As part of China’s stimulus to recover from COVID-19 lockdowns, it may boost its coal consumption.

- The Biden administration is granting a waiver that will allow refiners to continue to blend ethanol at 15% even though it will violate clean air regulations. Because the evaporation of ethanol speeds up in warm weather, the EPA usually lowers the allowable amount of ethanol to be blended with gasoline in the summer. Keeping the winter standard in place could please the farm belt.

- Although the U.S. hasn’t built a greenfield oil refiner since 1977, the industry has increased capacity through expansions of existing facilities. Exxon (XOM, $108.52) announced that a 250 kbpd expansion of its Beaumont, TX, facility has become operational.

Geopolitical News:

- China may be building military installations, or at least intelligence-gathering platforms, in the UAE. The emirate is home to the Al Dhafra Air Base which is used by the USAF.

- In the debate over the “petrodollar v. petroyuan,” the reserve asset is a key issue. There is an argument that the petroyuan can’t work because China won’t create a reserve asset. If an oil exporter accepts CNY, what will they do with it if they can’t buy Chinese financial assets? One solution is to use the funds for investment. We note that China is building a steel factory in the Kingdom of Saudi Arabia (KSA). The KSA has indicated that it will accept CNY for payment, so using the currency to fund Chinese investment in the country is one solution.

- We also note that TotalEnergies (TTEF.PA, EUR, 54.57) and Sinopec (SNPMF, $0.65) have both bid on a KSA natural gas project.

- Iran seized two oil tankers this week that held crude oil destined for the U.S. One of the tankers is leased by a Chinese shipper but sailed under the flag of the Marshall Islands, and the second carried a Panamanian flag. These actions may have been in retaliation for the U.S. redirecting an Iranian vessel bound for China, which was carrying crude oil.

- A senior Iranian cleric was assassinated, and it is unclear who was behind the killing. Ayatollah Abbas Ali Soleimani was a former envoy to the troubled region of Baluchistan. The assassination of religious figures is not common in Iran, but unrest has been elevated recently over hijab rules.

- Iran has not released inflation data for two months, likely because it doesn’t want to reveal bad news.

- Indian and Iranian officials met this week, and Tehran is encouraging India to use local currencies in the oil trade to reduce contact with the U.S. dollar system. India should welcome that development.

- Russia considers Armenia and Azerbaijan to be included in its sphere of influence. These two powers have been in some sort of conflict for decades, however, which complicates matters for Moscow. In an interesting twist, the U.S. is holding talks between the two nations to moderate tensions, a move that will be seen by the Kremlin as meddling. We note that the natural gas supply line from Russia to Armenia has been temporarily suspended for repairs just as the discussions appear to be getting underway.

- In a recent Bi-Weekly Geopolitical Report, we noted that the KSA has indicated what it would require in order to normalize relations with Israel. Reports suggest the U.S. is considering its options.

- Iranian officials fleeing the violence in Sudan were evacuated by the KSA military. These officials arrived in Jeddah this week. The news adds to evidence of the thaw between the KSA and Iran.

- The impact of sanctions has mostly been to disrupt oil flows. Although Russia is still exporting significant levels of oil and natural gas, it is earning less due to the increased cost of transportation. India, it appears, is a prime beneficiary since it is taking Russian crude oil and processing it into products to be sold to Europe.

- Resource nationalism is becoming increasingly common. Last week, we noted that Chile has moved to nationalize its lithium industry. We discuss this in further detail in the Alternative Energy section below.

- We continue to monitor updates on the Nord Stream I and II attacks. Denmark reports that Russian vessels that carry small submarines were seen in the area just before the blast.

- Turkmenistan has started exporting natural gas to Pakistan for its eventual sale to Afghanistan. Turkmenistan wants to build pipelines to South Asia to boost its exports but is finding it hard to secure routes through Afghanistan.

- A German firm’s investment in Siberian natural gas fields may be supporting Russia’s war effort.

- Iran is looking to swap oil for Chinese cars.

- Cuba was unable to hold May Day parades due to a lack of fuel.

Alternative Energy/Policy News:

- Every so often, we come across something that we didn’t expect. Oliver Stone, the movie director, has produced a documentary that makes the case that the only way to address decarbonization is through nuclear power. Although we agree with this position, it’s still a shock to see someone who generally leans “left” come out so strongly in support of nuclear power. Here is the movie trailer.

- China is expected to have the world’s largest installed nuclear power capacity by 2030. Currently, the U.S. has the world’s largest.

- California has unveiled new rules on trucking that will force the industry into zero-emissions vehicles, but there are numerous loopholes that will give the industry some leeway. We do note that the state can’t implement the rule without EPA approval, although it is expected to get it. These new rules are coming at a time when the industry is struggling.

- Apparently, other states are also looking to eliminate internal combustion engine (ICE) vehicles.

- At the same time, the Supreme Court is looking at cases that may restrict the power of regulatory bodies. This concept has been a concern of conservatives who worry that regulators could become overly powerful. Specifically, the court will hear litigation surrounding the “Chevron (CVX, $158.65) deference,” which gives regulators leeway when legislation isn’t clear. We expect the court to impose limits on this deference.

- New York is looking to ban natural gas heating and stoves. Germany wants to ban all gas and oil home heating.

- One of the major hurdles to alternative energy is scalability. Vaclav Smil’s work on energy concentration raises strong objections to alternatives. The history of modern society is one where energy sources become increasingly concentrated, e.g., coal had more embedded power than wood, petroleum more than coal, uranium more than petroleum, etc. Although it is possible to get energy from sun, wind, and biofuels, the scale required to match current consumption isn’t yet possible. This op-ed discusses the issue with great clarity.

- Pumped storage is making a comeback. This process pumps water uphill to a reservoir when electricity demand is low (and cheap) and allows it to run downhill through turbines when demand is higher (and prices are, too). Although this “battery” is somewhat limited by geography, there are apparently enough sites to trigger an expansion of the method.

- Chile’s decision to nationalize its lithium industry is roiling the market and sending shares of Chilean companies lower while lifting shares of those that produce the metal outside of Chile. Still, Chile is the world’s largest producer, and state interference will almost certainly lift prices.

- There is growing concern that other mining nations may take similar steps. Mexico has passed legislation that shortens mining concessions, tightens regulations on mining waste, and requires that local areas share in the profits. The Obrador administration has not approved any new concessions since he took office. It is unclear if (a) he will approve new projects with this new law, and (b) if mining firms will be interested in investing.

- Although there will be environmental concerns, Germany is reopening mines to secure important minerals.

- We note that EU “rewilding laws” are starting to conflict with wind and solar farms.

- Although the Biden administration continues to claim it doesn’t want to “decouple” from China, and instead wants to “de-risk,” it may be a distinction without a difference. However, if the U.S. tries to avoid China in the solar energy market, it may find it difficult to overcome China’s dominance.

- India and China want to avoid “hard targets” for cutting carbon emissions.

- EVs are much heavier than ICE cars. The battery is the issue, and the overall vehicle weight is becoming a problem for traffic safety.

- Ford’s (F, $11.92) earnings this week highlighted the large investment costs needed to transition to EVs. The electric division reported losses of $722 million.

- Occidental Petroleum (OXY, $61.17) hopes to sell the CO2 it captures for industrial use.

- Geothermal projects are being developed in Africa.

- Researchers are testing to see if aquifers can be used for long-term energy storage.

- The EPA will allow companies in Louisiana to begin storing CO2 in injection wells. Notwithstanding the scaling issue, having a place for the gas is necessary if carbon capture has any hope of working.

- Major banks are increasing their support for carbon capture projects.

- There are a number of “clean ammonia” projects underway which will need a place to store the CO2 generated during the process.