Daily Comment (May 10, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an overview of the devastating heatwave in Southeast Asia and the latest on the Russia-Ukraine war. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including political and economic upheavals in key Latin American countries and new reports on the health of the U.S. banking system.

Southeast Asia: Countries including Vietnam, Thailand, Cambodia, and Laos have been suffering from a historic heat wave in recent weeks, leading to melted roadways, school closures, and business disruptions. The new record-high temperatures include 112°F in Vietnam’s northern Tuong Duong district and 110°F in the popular Laotian tourist destination of Luang Prabang. Since the populations in these countries are largely poor and less able to cope, the heat wave and the region’s unusually dry winter will likely have an outsized impact on the affected economies.

Russia-Ukraine War: Russian and Ukrainian officials say that at least one large Russian military unit has been destroyed in the embattled city of Bakhmut, potentially reflecting the Kremlin’s failure to provide enough equipment and ammunition to the Wagner Group mercenaries fighting there. The unit’s destruction, which apparently prompted Russian forces to pull back from part of the city, could also reflect improved resources provided by the West to the Ukrainians ahead of their widely anticipated spring counteroffensive.

- Separately, the U.K. Ministry of Defense estimated that Russia’s total population declined by about two million people more than expected over the last three years because of both COVID-19 and the war in Ukraine. The ministry estimates that about 1.3 million people emigrated from Russia in 2022, including many young, highly educated people in high-value industries. In fact, about 10% of the country’s entire IT workforce left.

- Finally, new reporting discusses how the war has been a boon for small, technology-oriented defense companies around the world.

Turkey: The top opposition candidate in Sunday’s presidential election, Kemal Kılıçdaroğlu, said he will reinvigorate the country’s democratic checks and balances and strengthen its role in the North Atlantic Treaty Organization if he wins. In recent opinion polling, Kılıçdaroğlu has held a slight lead over incumbent President Erdoğan but not necessarily enough to avoid a run-off election later in May.

Colombia: The country’s new finance minister, Ricardo Bonilla, said he and leftist President Gustavo Petro plan to cut Colombia’s reliance on producing mineral commodities and instead nurture basic manufacturing in areas like textiles, fertilizers, metalworking, and pharmaceuticals. Bonilla has also vowed to rein in the country’s budget deficit, but his statement on restructuring the economy suggests Petro’s recent cabinet reshuffle will push Colombian policy leftward, which could be a headwind for Colombian financial markets.

- We would note that Bonilla’s plan to boost domestic manufacturing is also in sync with industrial policy trends in key developed countries, including the U.S., which in recent years has instituted more trade barriers against China and approved hundreds of billions of dollars in subsidies to help boost favored industries such as semiconductors and green technology.

- Bonilla’s plan, therefore, runs counter to free-market ideology. On the other hand, it’s possible to argue that the massive boom in Chinese manufacturing since 2001, driven in part by Beijing’s subsidies and other unfair policies, unfairly short-circuited efforts by Colombia and other emerging markets to develop via manufacturing investment. One could almost say that when the Chinese economy burst onto the world stage, it forced many emerging markets off the road to manufacturing and instead pushed them onto the road of being dependent on commodity production, with all the volatility, environmental damage, and other issues associated with it. It would not be a surprise to see more developing countries adopting policies like Colombia’s in the future.

Ecuador: The national assembly yesterday voted to move ahead with an impeachment trial of President Lasso over charges of corruption. Under the constitution, however, Lasso could first dissolve congress and trigger presidential and legislative elections. In any case, the country is likely to face weeks or months of heightened political uncertainty that will likely weigh on Ecuador’s financial markets and currency.

U.S. Fiscal Policy: President Biden, House Speaker McCarthy, and other congressional leaders met yesterday in an initial effort to resolve the dispute over raising the federal debt limit, but the meeting ended with little apparent progress. After the meeting, Biden reiterated his stance that the politicians should work to cut the budget deficit, but without tying that effort to raising the debt limit. McCarthy expressed his frustration that Biden had not met with him on the issue earlier and reiterated his view that raising the debt ceiling must be accompanied by steep spending cuts. As we mentioned in our Comment yesterday, we expect the discussions, and brinksmanship, to continue in the coming weeks ahead of the June 1 deadline at which time the government may not be able to pay its bills.

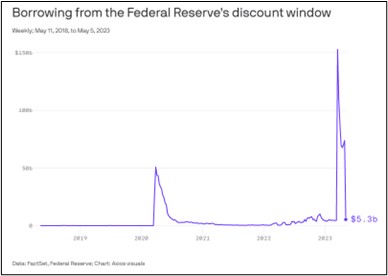

U.S. Banking-Discount Window Borrowing: New data from the Federal Reserve shows that bank borrowing from its discount window plunged to $5.3 billion last week, down from more than $150 billion at the height of the banking crisis in March. The plunge in discount window borrowing last week is a welcome signal that the worst of the banking crisis has passed, although we believe banks will suffer a prolonged period of “disintermediation” as customers gradually pull their deposits to redeploy them to higher-yielding investments such as Treasury bills and money market funds.

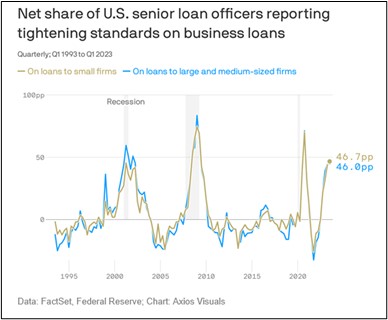

U.S. Banking-Lending Standards: Consistent with the loss of deposits because of disintermediation, the Fed’s latest senior loan officer survey showed banks tightened lending standards for both large and small corporate borrowers in the first quarter. That merely continues a trend of stingier lending that began a year ago, but we note that the tightness is now at the levels often seen in recessions. The data suggests that if the economy isn’t in the expected downturn already, it is rapidly approaching it.