Author: Amanda Ahne

Daily Comment (October 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest market-moving deal in the US artificial intelligence industry. We next review several other international and US developments with the potential to affect the financial markets today, including the outlines of a potential US-China trade deal, prospects for a new, market-friendly prime minister in Japan, and the latest on the US government shutdown.

US Artificial Intelligence Industry: Artificial intelligence developer OpenAI and chip designer Advanced Micro Devices (AMD) this morning announced a deal under which Open AI will equip its data centers with gigawatts worth of AMD chips, leading to tens of billions of dollars in new revenue for AMD over the next five years. OpenAI will also get warrants for up to 160 million AMD shares (roughly 10% of the firm) at 1 cent per share, if OpenAI hits certain targets and AMD’s stock price rises.

- The requirement for AMD’s stock to rise doesn’t look like a problem, as its shares are trading approximately 25% richer as of this writing.

- The deal is the latest in a string of AI-related linkups that have further fueled the excitement over AI’s prospects. However, concerns are also rising about excessive exuberance and daisy-chain deals that could ultimately lack economic substance.

China-United States: Bloomberg reported over the weekend that Beijing is pressing the Trump administration to lower national security restrictions on Chinese investment in the US to resolve the current US-China trade war. The proposed deal would involve Chinese firms investing up to $1 trillion in new factories and other industrial facilities in the US. It would also require the US to lower its tariffs on Chinese inputs used in the Chinese-owned facilities built under the deal.

- Other reporting suggests that China is also seeking a commitment from the US to oppose Taiwanese independence under the deal. Such a move would be a fundamental change to the US’s traditional policy of “strategic ambiguity,” under which it doesn’t say how it would respond to a Chinese effort to take control of the island.

- Such a deal might be hard for the US administration to swallow, given that it would likely generate strong opposition from domestic China hawks and could be seen by the public as capitulation to Beijing. It would also pose the risk that massive Chinese investment would allow Beijing to eventually dominate the US economy.

- Still, such a deal could have some positive economic benefits as well. For example, it would likely reduce the risk of a costly, destabilizing war. It could also allow the administration to cut its high tariffs against China and thereby reduce the risk of higher consumer price inflation. It could spur faster re-industrialization in the US. Also, producing more Chinese goods in the US could help rebalance bilateral trade and re-channel Chinese investment from Treasurys into fixed investment.

- If announced, the deal could be a headwind for gold, at least temporarily, while faster US re-industrialization would likely be positive for other commodities. US defense stocks would likely fall in value, but European defense equities would probably be less affected. In any case, such a deal would likely be positive for the broader US and Chinese stock markets.

China-Mexico-United States: Late on Friday, Beijing issued a strong condemnation of Mexico’s 11 on-going anti-dumping investigations against Chinese imports, which it said were masterminded by the US to help crimp China’s economic growth. Importantly, the statement also implicitly threatened to retaliate against Mexico if the probes lead to new tariffs against Chinese goods. Of course, various reports say the US is trying to enlist other countries to constrict Chinese exports. This incident shows how third-party countries can be caught in the crossfire.

Japan: The ruling Liberal Democratic Party on Saturday chose former Economic Security Minister Sanae Takaichi as its new leader, virtually guaranteeing the arch conservative will become Japan’s next prime minister due to the recent resignation of incumbent Shigeru Ishiba. If the Diet approves her as expected, Takaichi would serve out the remainder of Ishiba’s term, which ends in September 2027. Her policies are expected to include being tough on China, supporting big increases in the defense budget, and promoting faster economic growth.

- The prospect that Takaichi would win and return Japan to the pro-market economic policies of former Prime Minister Shinzo Abe has helped boost the country’s stock prices in recent weeks, even though the LDP’s lack of a majority in either house of parliament will make it hard to push through new reforms.

- So far today, Japanese stock prices have surged approximately 4.8%, while the yen (JPY) has weakened about 1.7% to 149.94 per dollar ($0.0067).

Philippines: New reports say the wave of coup rumors that have risen in recent weeks in conjunction with mass anti-corruption protests can be traced to loyalists and influencers aligned with former President Rodrigo Duterte, the chief political rival of incumbent President Ferdinand Marcos, Jr. The coup rumors, claims of foreign interference, and accusations of military disloyalty are increasingly seen as destabilizing, and may potentially set the stage for major disruption in a key US ally and major Asia-Pacific economy.

France: Prime Minister Lecornu resigned today after less than a month in office and less than one day after presenting his proposed government. Lecornu’s departure, driven by difficulties in pushing a vital deficit-cutting budget through parliament, makes him the fourth French prime minister to resign in the last year and the shortest-serving prime minister in the Fifth Republic. Since the move is further evidence of the political chaos in one of the European Union’s biggest economies, the news is weighing heavily today on the euro and on EU stocks and bonds.

Czech Republic: In parliamentary elections at the weekend, the Ano party of right-wing billionaire and former prime minister Andrej Babiš came in first, allowing Babiš to try to form a government and become prime minister again. Although the Ano party supports Czech membership in the North Atlantic Treaty Organization, it is more skeptical of the European Union and wants to reduce the country’s aid to Ukraine while it pursues more conservative economic policies. The result could be reduced aid to Kyiv and more friendly relations with Russia.

US Fiscal Policy: The federal government shutdown appears set to continue in the coming days, as Republican and Democratic leaders look committed to their budget positions, meaning Senate votes on a new funding bill continue to fail due to lack of the 60 votes needed for it to pass. However, President Trump is still holding in reserve his threat to use the shutdown to implement mass firings of federal employees — a move that could substantially worsen the economic impact of the shutdown.

US Labor Market: In a little-noticed development amid the federal shutdown, some 100,000 federal employees who had taken the administration’s deferred buyout deal earlier this year dropped off the federal payroll as of October 1. Another 55,000 or so will go off the payroll in the coming weeks. The newly unemployed workers are expected to add to the increased softness in the US labor market, raising the risk of a near-term economic slowdown despite expectations for faster growth in 2026.

Global Oil Market: The Organization of the Petroleum Exporting Countries and its Russia-led partners said eight of their members will boost their oil output by a modest 137,000 barrels per day starting November 1. The move, led by Saudi Arabia, will likely help keep the global oil market well supplied and keep a lid on prices in the near term, especially if slowing economic growth weighs on demand.

Asset Allocation Bi-Weekly – #149 “The AI Arms Race: Navigating the Divide Between Promise and Profit” (Posted 10/6/25)

Asset Allocation Bi-Weekly – The AI Arms Race: Navigating the Divide Between Promise and Profit (October 6, 2025)

by Thomas Wash | PDF

AI is arguably the most exciting investment story of our time, with discussions swirling around its potential to create new businesses, boost productivity, and drive unprecedented revenue growth. This excitement has fueled massive spending as tech firms race to capitalize on the technology’s promise. As the hype has intensified, however, a critical question has emerged: Is AI growing faster than our ability to adapt to it?

A recent MIT report, “The GenAI Divide: State of AI in Business 2025,” suggests this may be the case. The study reveals a staggering 95% of corporate generative AI pilots have failed to deliver a measurable return on investment. This poor performance is fundamentally attributed to “execution failure,” with key issues including a lack of organizational readiness and a disconnect between the technology and day-to-day business workflows. The report also found that firms using consultancy services were more successful, highlighting that effective implementation and user adoption are critical to success.

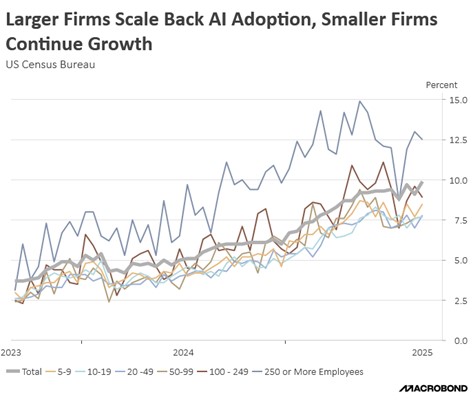

This finding aligns with a separate trend observed in a U.S. Census Bureau survey, which shows that large firms have begun to slow their adoption of AI. This indicates that the initial hype that fueled demand may be giving way to a more cautious, results-driven approach as companies grapple with the practical challenges of integrating AI into their operations.

The current spending by major tech companies on AI infrastructure suggests that while AI may be the technology of the future, they are investing as if it’s already a present-day reality. Driven by the immense computational and energy needs of training large AI models, firms like Microsoft, Alphabet, Meta, and Amazon have made the uncharacteristic decision to ramp up capital expenditures.

In 2025 alone, tech companies are projected to spend up to $344 billion on AI infrastructure, including data centers and the hardware required to run complex models. This surge marks a sharp departure from the sector’s traditionally asset-light strategy, which prioritized intellectual property over physical assets to maintain large cash reserves. The current high-stakes environment has led to a massive increase in capital expenditures (capex), often referred to as the AI “arms race,” which is rapidly drawing down the operating free cash flow of many major tech companies.

This capital-intensive trend is expected to continue, significantly aided by the passage of the One Big Beautiful Bill Act (OBBBA) in July. This legislation permanently reinstated a 100% bonus depreciation for qualified property (like computer equipment and servers) acquired after January 19, 2025. It also introduced a new, temporary allowance for 100% expensing of “Qualified Production Property.”

The significant effort to build out AI infrastructure has acted as a healthy indicator of growth across the sector, boosting revenue for numerous suppliers. Nvidia has been the most notable beneficiary, but other firms, including Intel and SAP, have also seen gains. Most recently, Oracle saw its stock jump by nearly 30% after reporting that its first quarter booked revenue included over $455 million in new business related to its cloud infrastructure, signaling strong enterprise demand for AI-enabling services.

While supplier earnings remain robust, the sector faces growing risks of over-dependence. Many key AI technology providers rely on a highly concentrated group of customers — primarily the few cloud giants — for the vast majority of their revenue, raising concerns about the concentration risk inherent in their earnings estimates.

Furthermore, concerns persist that a significant portion of AI funding is circulating within a closed loop of major companies. This occurs when cloud giants invest in smaller AI startups, which then use that capital to purchase cloud infrastructure and compute time from their investors. This circular dynamic risks distorting genuine market demand and may artificially inflate the revenue of the largest players.

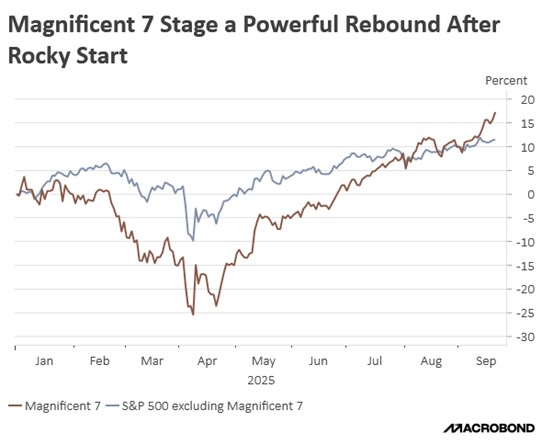

Despite these concerns, we believe the current equity rally has a strong chance of continuing for the foreseeable future. The bull market, which began in October 2022, has historical precedent on its side, with average cycles lasting about five years, suggesting the potential for another two to three years of upside.

However, given the market’s heavy concentration in large cap technology, the risk of a sharp correction in these high-growth stocks is elevated. To mitigate this risk, we recommend maintaining exposure to value stocks, which can provide crucial defensive ballast to a portfolio. Value-oriented sectors typically exhibit lower volatility and have historically demonstrated greater resilience during periods of economic uncertainty or growth stock selloffs.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (October 3, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an analysis of fresh signs of escalating tensions between NATO and Russia. We then pivot to the positive momentum in trade negotiations between the US and China. Further into the report, we delve into the rising hype surrounding Chinese tech stocks, examine a significant new milestone in Italy’s fiscal situation, and detail the emerging signs of trouble within the consumer credit market. We also provide a summary of key economic indicators from the US and global markets.

Rising NATO-Russia Tensions: The possibility of a direct conflict between NATO and Russia continues to intensify as the US weighs a significant policy shift. Specifically, the White House is reportedly considering providing Ukraine with intelligence for its deployment of Tomahawk missiles and drones to strike Russian energy infrastructure. This assertive step, though unconfirmed, is seen as a strategic lever designed to compel Moscow to the negotiating table, given its continued attempts to stall talks in order to gain more territory in Ukraine.

- While Moscow has downplayed the development by stating that the US was already sharing intelligence, it has concurrently expressed strong frustration with NATO’s increased assistance with strikes on Russian territory. These strikes, which have targeted at least 15 Russian oil refineries, have been highly effective, forcing refinery throughput to below five million barrels per day. This drop is a significant financial blow, directly undermining the oil revenue Moscow relies on to finance its military campaign.

- In response, Russia continues to test NATO’s resolve through repeated airspace violations. The most recent incident occurred late on Thursday when Munich Airport in Germany was forced to temporarily suspend all flight operations due to multiple drone sightings in its airspace, affecting approximately 3,000 passengers. These incursions prompt calls for the drones to be shot down, an action Russia could deem a declaration of war.

- This standoff has devolved into a dangerous game of chicken, with Washington and Moscow each betting the other will yield to prevent a major conflict. This geopolitical brinkmanship is inherently hazardous, as it increases the potential for miscalculation and accidental escalation. Although the likelihood of direct military confrontation remains low, we believe the risk is greater than current market sentiment would suggest.

China Trade Progress: The White House has announced a potential breakthrough in trade talks with China. Treasury Secretary Scott Bessent suggested that the two nations could be nearing an agreement during their fifth round of talks, which are being held in South Korea. The secretary’s comments underscored the ongoing US effort to persuade China to resume purchases of American agricultural products and lift restrictions on the export of rare earth minerals. A potential trade deal could open the door for a new phase in the two countries’ complicated relationship.

- The US is believed to be using trade talks as a way to convince China to pivot away from an export-driven model toward one powered by domestic demand. Yet, Beijing has reframed the dialogue, shifting the focus from economics to also include geopolitics. China is demanding both the removal of US tariffs and an explicit US denial of Taiwan’s sovereignty. While the US has denied agreeing to a change in its stance, these discussions show how China plans to use talks to achieve its aims beyond trade.

- However, while trade tensions show signs of cooling, the geopolitical rivalry is clearly heating up. Earlier this week, a senior Chinese diplomat expressed displeasure with the newly appointed US consul general to Hong Kong, warning her not to collude with “anti-China forces.” This warning is particularly pointed since under the previous administration, US officials were photographed conversing with student leaders in Hong Kong.

- A trade deal between the US and China would be highly supportive of equities in both countries, as their economies remain strongly linked despite efforts to decouple. That said, even as commercial uncertainty dissipates, we anticipate that the strategic competition for influence will continue as both nations pursue the development of their respective global spheres of influence.

Japan Elections: Following a series of electoral setbacks, Japan’s ruling Liberal Democratic Party will choose its new leader on Saturday. Five candidates are in the running, with Shinjirō Koizumi and Sanae Takaichi being the clear favorites to win and subsequently become the next prime minister in mid-October. This incoming leader faces an immediate and difficult agenda consisting of handling cost-of-living discontent, managing US trade and security tensions, and tackling increasingly urgent immigration concerns.

China AI Hype: The global AI rally is broadening, propelling Chinese tech companies into focus. Alibaba’s deep commitment to AI, which aligns with China’s policy push for technological self-reliance, is seen as a primary driver for the recent surge in returns. Investors are also attracted to the stark valuation gap where the Hang Seng Index carries a P/E ratio of approximately 26.4×, which is dramatically lower than the NASDAQ Composite’s multiple of about 57.1×, according to Bloomberg data.

Italy Deficit Improves: Italy’s improving fiscal health is set to give its government crucial political flexibility, with the budget deficit projected to drop below 3% by 2026. Achieving this would bring Italy into compliance with EU rules for the first time since 2019 and would likely lead to its exit from the EU infringement procedure. This timing is opportune, as the freedom from restrictive EU oversight could immediately open the door for new government initiatives, including significant defense spending increases and substantial tax relief.

AI Integration: Walmart is increasing its investment in AI to optimize supply chain management, signaling a strategic shift to reduce its dependence on manual labor for specific tasks. This move is expected to boost profitability, especially as the company adapts its business model to navigate challenges like tariffs. While AI adoption is becoming widespread across industries, its integration will be a gradual process. The most immediate impact will likely be seen in a reduced pace of hiring for roles susceptible to automation.

Credit Problems? Despite the economy’s overall resilience, significant vulnerabilities are surfacing in the consumer credit market. The collapse of subprime auto lender Tricolor Holdings, combined with weak earnings from CarMax and the bankruptcy of First Brands Group, points to an intensifying credit crunch in the subprime auto sector. This distress is a key indicator that, beneath strong macroeconomic headlines, a segment of the population is increasingly burning through savings and accumulating debt to sustain their standard of living.

Daily Comment (October 2, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an update on Stargate’s latest ventures. We then shift our focus to global developments, including stricter EU tariffs on Chinese steel and Beijing’s strategy to counter potential isolation from the West. Further analysis covers the decline in ADP private payrolls, the US defense pledge to Qatar, and the latest on the government shutdown. We also provide a summary of key economic indicators from the US and global markets.

Stargate Deals: Market optimism remains underpinned by the public-private AI infrastructure push. On Wednesday, OpenAI solidified this trend by securing key agreements with Samsung Electronics and SK Hynix for its ambitious Stargate projects. Crucially, the deal involves both the supply of next-generation chips and a commitment to jointly build AI data centers in Seoul. This strategic expansion is a clear indicator of the effort by the US-led AI ecosystem to diversify its computation capacity and deepen alliances with key global hardware partners.

- Stargate’s deal with a South Korean tech company forms part of its broader strategy for international growth. This follows closely on the heels of a similar infrastructure agreement with the UAE as well as with the UK, demonstrating a coordinated push to establish a global footprint that spans both advanced technology and critical data center capacity.

- The US push to develop AI infrastructure is a key component of a broader strategy to solidify its position as the global epicenter of artificial intelligence. The administration’s approach appears to be one of expanding US influence through technological supremacy, while simultaneously reducing the rest of the world’s reliance on international trade.

- The central challenge to watch for is the US’s ability to compete with China as both nations expand their AI reach abroad. US success hinges on convincing more countries to adopt US-based AI infrastructure and technology over Chinese alternatives. Successfully winning these build-out contracts will directly increase US market share, making it significantly easier for US tech companies to justify their aggressive, high-growth valuations.

EU Trade Restrictions: The EU has proposed doubling tariffs on imported steel to 50% in an effort to shield its domestic industry from dumping by China and other Asian nations. This new rate is designed to align with the US tariff level, a move intended to prevent steel exports that are being diverted by US policies from flooding the European market. Although the EU has steel import quotas in place already, this new plan is far more granular, introducing specific quotas based on individual product types and originating countries.

- The global move to restrict imports reflects a concerted effort to economically isolate China, as US trade policy is prompting a worldwide realignment. In response, key US partners and regional powers — including Canada, Mexico, Japan, and India — have enacted new anti-dumping measures targeting Chinese goods.

- Concurrently, efforts are underway to counter China’s potential to weaponize its own imports in retaliation. Last month, G-7 members began talks to establish price floors for rare earths. This strategy aims to incentivize investment in alternative production and reduce collective reliance on China. The group is also considering targeted tariffs on Chinese exports of these critical minerals.

- As Western nations toughen their stance, China is expected to deepen its ties with the Global South to reduce its own economic dependencies. This shift is already visible, with Chinese exports being increasingly redirected to Africa and Latin America, leveraging existing investment partnerships. We can expect this trend to accelerate as China works to establish an alternative trading bloc.

Cook Safe for Now? The Supreme Court will hear arguments in January on the president’s authority to fire Federal Reserve Governor Lisa Cook, a case that will define the limits of presidential power over independent agencies. The delayed hearing has, for now, secured Cook’s position on the FOMC. However, her eventual removal could undermine confidence in the Fed’s independence, potentially weighing on the US dollar.

ADP Payrolls: Private sector payrolls recorded their steepest decline since 2023, falling by 32,000 jobs in a fresh sign of a cooling labor market. The downturn appears broader than initially thought, as the prior month’s data was revised down from a gain of 51,000 to a loss of 4,000. Although the ADP report and official government data can differ, they typically move in tandem, offering a critical glimpse into the labor market while the federal government’s release is suspended.

China Soybean Purchases: The White House is preparing to confront China over its halted purchases of American soybeans, a critical point in the ongoing trade negotiations. China’s shifting of its massive agricultural orders to competitors like Brazil and Argentina has damaged the US farm sector. While a resumption of Chinese buying would offer significant relief, the agreement hinges on unspecified concessions that Beijing is expected to demand. The two nations face a November deadline, after which previously suspended tariffs are slated to be reinstated.

Qatar Protection: The White House has pledged to defend Qatar in the event of an attack, a move aimed at securing the country’s continued participation in the Abraham Accords. This assurance comes in response to a recent Israeli airstrike on Qatari soil targeting Hamas leaders — an act Israel has since apologized for but was seen as a severe breach of trust. By extending US protection, the Trump administration hopes to reassure Qatar that such an incident will not be repeated.

Federal Job Cuts: The White House is considering permanent layoffs to pressure Democratic lawmakers into ending the government shutdown. This escalation comes as the two parties remain deadlocked over a spending agreement to fund the government. While the threat of layoffs suggests the stalemate could persist longer than expected, there are indications that both sides remain willing to negotiate a deal.

Daily Comment (October 1, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment starts with an analysis of the government shutdown and the evolving strategy of the White House in restructuring US healthcare to fight chronic disease. We then pivot to global topics, including the UK’s move to establish a regulatory framework for stablecoin, the dynamics driving the Argentine peso’s current pressure, and Saudi Arabia’s massive $55 billion acquisition of Electronic Arts as part of its gaming push. Finally, we provide a summary of recent economic indicators from the US and global markets.

Government Shutdown: A government shutdown began at midnight as a deep political divide prevented Democrats and Republicans from agreeing on a stopgap spending bill. The breakdown occurred when lawmakers failed to reconcile the Democratic demand to extend Affordable Care Act subsidies with Republican opposition to tying that provision to ongoing government funding. While there is some hope that the government shutdown will be limited, there are some signs that each side is willing to hold out to prevent the other side from gaining an edge.

- While a government shutdown can cause significant public inconvenience, its economic impact is typically minimal, especially when it lasts for only a few days. For instance, the longest shutdown on record, which ran for 35 days, was estimated to have reduced that year’s GDP by only 0.4%, meaning it had a rough economic cost of 0.15% per week that it was in effect.

- A major concern for financial markets regarding a government shutdown is the potential delay in the release of critical economic data. For instance, the shutdown would halt the publication of the Bureau of Labor Statistics’ (BLS) jobs report, leaving the underlying health of the labor market in doubt. This delay is particularly problematic because Federal Reserve officials have stated that future interest rate cuts likely hinge on the outlook for employment.

- We believe a potential government shutdown is unlikely to derail market sentiment. Although it would deprive investors of crucial economic data, the market has looked past this risk so far, positioning for a positive outcome that should mitigate near-term downside. In the absence of official reports, however, market participants will likely assign greater weight to private data sources like the ADP employment report.

Healthcare: The White House has unveiled a new initiative aimed at lowering healthcare costs. On Tuesday, the president announced an agreement with Pfizer to cut certain drug prices by up to 85%, facilitated by tariff reductions. The administration expects other major pharmaceutical companies to follow suit. In a separate move, the president directed $50 million toward AI research to advance pediatric cancer treatments, signaling a strategic shift to leverage technology for more efficient medical breakthroughs.

- These drug price cuts are part of a larger administration strategy to incentivize the pharmaceutical industry to reshore its manufacturing base. This follows the president’s threats earlier this year to impose higher tariffs on companies that refuse. Despite some willingness from players like Eli Lilly, significant cost concerns remain a primary barrier for a sector facing thin profit margins. In this context, reduced drug prices seem to be a concession offered to secure industry cooperation on reshoring.

- Additionally, a longer-term goal appears to be shifting reliance from university-led research toward tech companies. The White House believes that leveraging technology could make achieving breakthrough research more cost-effective than relying on academic institutions.

- Overall, we view the government’s increased economic involvement as a potential stabilizer for equity markets, offering crucial support during downturns and funding for long-term development. The primary risk, however, is a reduction in corporate autonomy, which could lead to market inefficiencies. Consequently, we believe this environment favors a more active investment management approach to hedge against these potential risks.

Stablecoin Future: In a clear sign of a shifting regulatory landscape, Bank of England Governor Andrew Bailey endorsed stablecoins as a tool to reduce commercial lending reliance. This move aligns with a wider Western effort to catch up to the United States, which has taken a lead with its pro-digital asset legislation. As part of this race, both the UK and EU are exploring the development of their own stablecoins. Despite this accelerating acceptance, the fundamental concern that stablecoins could threaten financial stability remains unresolved.

Hybrid War? The prime minister of Denmark has warned that NATO must do more to counter Russian aggression. She argued that last week’s drone incursions, which led to the shutdown of Denmark’s main airport, appear to be part of a broader strategy by Moscow to divide Europe and represent a form of hybrid warfare. In her remarks, she advocated for increased supplies of defense equipment to shore up regional defenses. While we believe the risk of direct conflict remains low, this risk is currently underpriced by financial markets.

Argentine Bailout: The Argentine central bank intervened on Tuesday to defend the peso after a sharp sell-off. This was triggered by market fears that the US may be unable to follow through on its pledge of support, especially with a looming government shutdown. These concerns were ignited by a lack of detail from US Treasury Secretary Scott Bessent, who had vowed to do “whatever it takes” to bolster confidence after weak regional election results.

Basel Talks: The US is pushing for changes to the Basel framework that would no longer treat the EU as a single market for regulatory purposes. This move is likely to cause significant friction with EU regulators and institutions, as it would increase the risk weighting for many banks in the region and undermine the fundamental EU principle of a unified single market. This push for a rule change exemplifies the increasingly frosty state of transatlantic relations.

The EA Takeover: The game maker went private following the largest leveraged buyout in history. The $55 billion takeover was backed by the investment fund Silver Lake and Saudi Arabia’s Public Investment Fund (PIF). This acquisition serves as a potent reminder of the growing economic ties between the United States and Saudi Arabia, as the oil exporter seeks to diversify away from hydrocarbons and into technology. The move signals that Riyadh is poised to expand its global reach by adding more major companies to its investment portfolio.

Daily Comment (September 30, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a note on the high likelihood of a federal government shutdown starting tonight. We next review several other international and US developments with the potential to affect the financial markets today, including a US-Swiss deal that should allow Switzerland to keep intervening in the currency market to hold down the value of the franc and new Chinese retaliatory measures against the US’s new port fees targeting Chinese ships.

US Fiscal Policy: Yesterday’s meeting between President Trump and the top Republicans and Democrats in Congress broke up with no deal on a short-term funding bill to avert a partial federal government shutdown starting Wednesday. Democrats continue to push for restoring billions of dollars of healthcare spending. Republicans say they’re willing to discuss the issue, but not under the pressure of a deadline. If it happens, a shutdown could potentially disrupt financial markets and would likely postpone the monthly labor report due Friday.

US Artificial Intelligence: Fortune magazine today released its first-ever “AIQ 50” list, which ranks Fortune 500 companies generating significant and measurable impact with AI. In a surprise, many of the firms on the list aren’t in technology at all, but they have been at the forefront of implementing and leveraging AI in their financial, manufacturing, mining, or retailing operations. The top 10 companies on the list are:

- Alphabet

- Visa

- JPMorgan Chase

- Nvidia

- Mastercard

- Coca-Cola

- ExxonMobil

- Amazon

- Ecolab

- Wesco International

United States-Switzerland: The US and Swiss governments yesterday signed an agreement not to “target exchange rates for competitive purposes,” although the document also recognizes that market interventions are a valid tool for addressing currency volatility or “disorderly” moves in exchange rates. The deal is being taken as a green light for Switzerland to keep intervening in the currency markets to hold down the value of the franc against the dollar.

United States-China: The Commerce Department yesterday said its “entity list” of foreign firms subject to export controls would be expanded to include the subsidiaries of any named entities. The entity list isn’t focused only on China, but Chinese entities make up a large share of it. Therefore, the move will probably be a further source of tension in the US-China relationship and could potentially invite Chinese retaliation against US firms.

Australia: The Reserve Bank of Australia today held its benchmark short-term interest rate unchanged at 3.60%, as widely expected. The central bank has cut rates three times since February, but it said rebounding economic activity and an uncertain outlook justified holding rates steady today. In response, the Australian dollar has appreciated about 0.5% so far today, reaching $0.6611 and continuing its upward trajectory that started in January.

China: The official purchasing managers’ index for manufacturing rose to a seasonally adjusted 49.8 in September, beating expectations and rising from 49.4 in August. Like most major PMIs, the official China indicator is designed so that readings over 50.0 signify expanding activity, so the latest reading suggests Chinese factory activity is now basically stagnant or declining only slightly. The modest improvement suggests the manufacturing sector is seeing some improvement from government stimulus and relative stability in the US-China trade war.

China-United States: Beijing yesterday released new measures to retaliate against the US’s new port fees for Chinese-owned and Chinese-operated ships calling at US ports. The new Chinese measures will allow Beijing to impose special fees or restrictions on US-connected ships trying to access Chinese ports. The US isn’t a shipping power, so the number of affected vessels could be small. However, the rules may allow Beijing to take an expansive view of what US-connected ships could be targeted, potentially making this a more important issue for shippers.

Bi-Weekly Geopolitical Report – US Influence on the Wane: New Evidence (September 29, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

World history goes through phases, not as a cycle of recurring situations but as a series of “regimes” or broad sets of trends and relationships. Each regime is complex, since it encompasses issues such as the political landscape in various countries, the dominant global approach to economic policy and trade relationships, the structure and operation of security alliances, and even cultural norms. The most recent regime was the post-Cold War period of globalization that ended around 2008. Since each regime is so complex, and its elements or facets can change at a different pace, it can be hard to know for sure that a transition is taking place. It can be even harder to know what the new, following regime will look like.

Importantly, several major developments over the last few months have confirmed that the world is still transitioning away from the Globalization period. These developments have also provided added evidence about what to expect during the incoming regime of Global Fracturing or, potentially, Chinese Hegemony. As shown in this report, one key message is that the US continues to lose influence in international affairs as it steps back from its traditional role as global hegemon. Recent evidence of this includes the latest United States-China trade talks, the Russian drone incursions in Poland and Romania, and Israel’s attack on Hamas officials in Qatar. These developments are in line with other examples in recent years, such as the Obama administration’s decision not to enforce its “red line” against Syria’s use of chemical weapons in its civil war and the Biden administration’s chaotic withdrawal of US forces from Afghanistan. In this report, we discuss the latest developments and outline how they might affect financial markets going forward.